Thursday was another wild day in market-related news and we taped just after it all came out.

We discuss:

- More bad news on the unemployment front

- The Fed is not messing around

- Is the Fed impacting price discovery? Does it matter?

- Why markets are so confusing right now

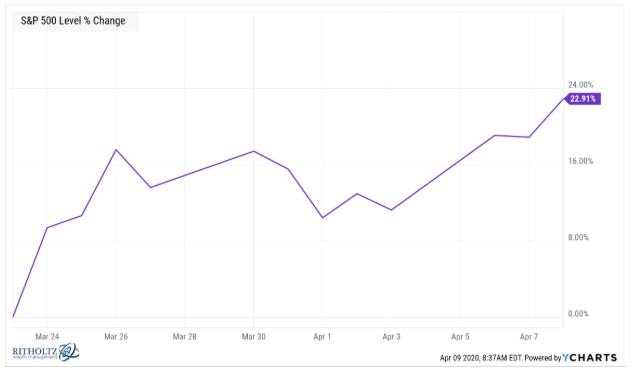

- What if this isn’t a bear market rally? What if that was THE bottom?

- My new theory about the future of stock market returns

- What does a contact tracing world with the coronavirus look like?

- What will change the most following this crisis? What will stay the same?

- Vanguard investors bought the dip and millennials sold it

- Why markets are so hard to figure out

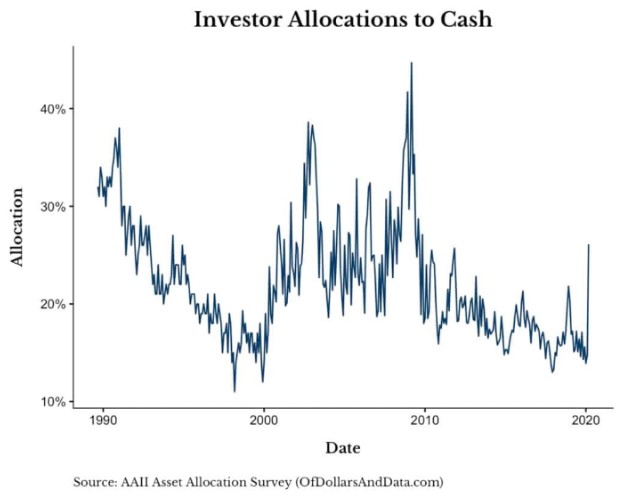

- How many people went to cash last month?

- A tail risk fund that worked really well

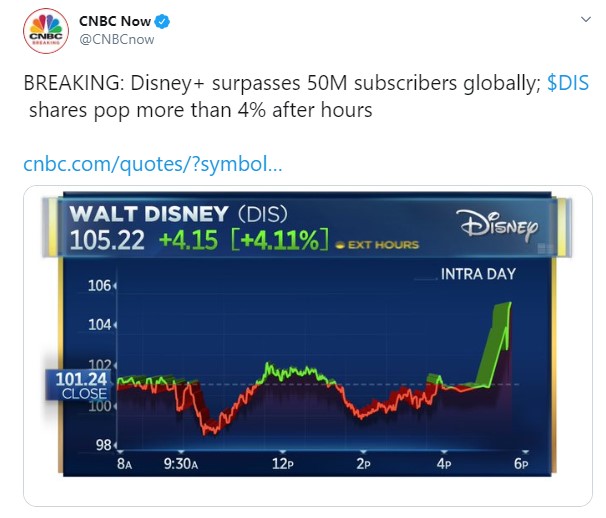

- Disney+ is a beast

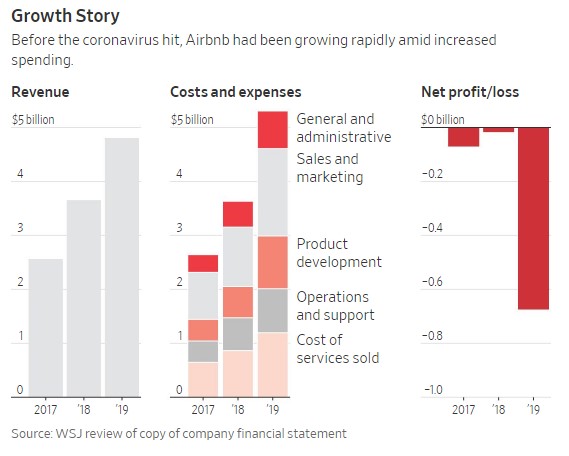

- What’s going to happen to Airbnb?

- Who is buying cruise ship bonds right now?

- What happens to all the zombie companies?

- Inequality and the art market

Listen here:

Stories mentioned:

- Just a bear market rally

- The technology that could free America from quarantine

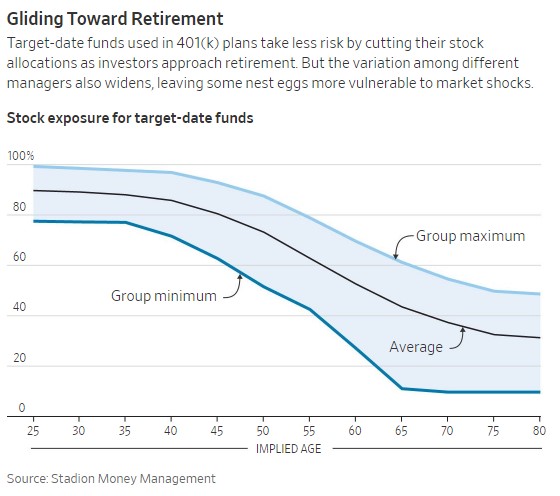

- What the market sell-off revealed about targetdate funds

- The flight to safety

- Tail risk fund returned 3600% in March

- Millennials fled when stocks fell

- Nearly a third of U.S. apartment renters didn’t pay rent in April

- Airbnb revenue could fall by half this year

- Airbnb’s coronavirus crisis

- Disney+ subscriptions hit 50 million

- Why cruise ship backed bonds drew $17 billion of demand

- A corporate debt reckoning

- Stocks’ rightful owners

Books mentioned:

Charts mentioned:

Contact us at animalspiritspod@gmail.com with any questions, comments, feedback or recommendations.

Follow us on Facebook, Instagram and YouTube.

Find transcripts of every show on Shuffle.

Check out our t-shirts, coffee mugs, stickers and other assorted swag here.

Subscribe here: