Similarities between the current crisis and past economic environments following wars.

Similarities between the current crisis and past economic environments following wars.

Don’t blame the Fed for bailing out corporations. Blame the government.

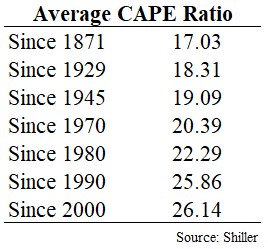

At the lows, the S&P 500 was off roughly 34% from its highs. From those lows it’s now up almost 25%. This is confusing to many investors for a number of reasons: The economy is still effectively shut down for the foreseeable future The unemployment numbers continue to worsen as jobless claims in the past…

Michael and Ben discuss more wild days during the crisis.

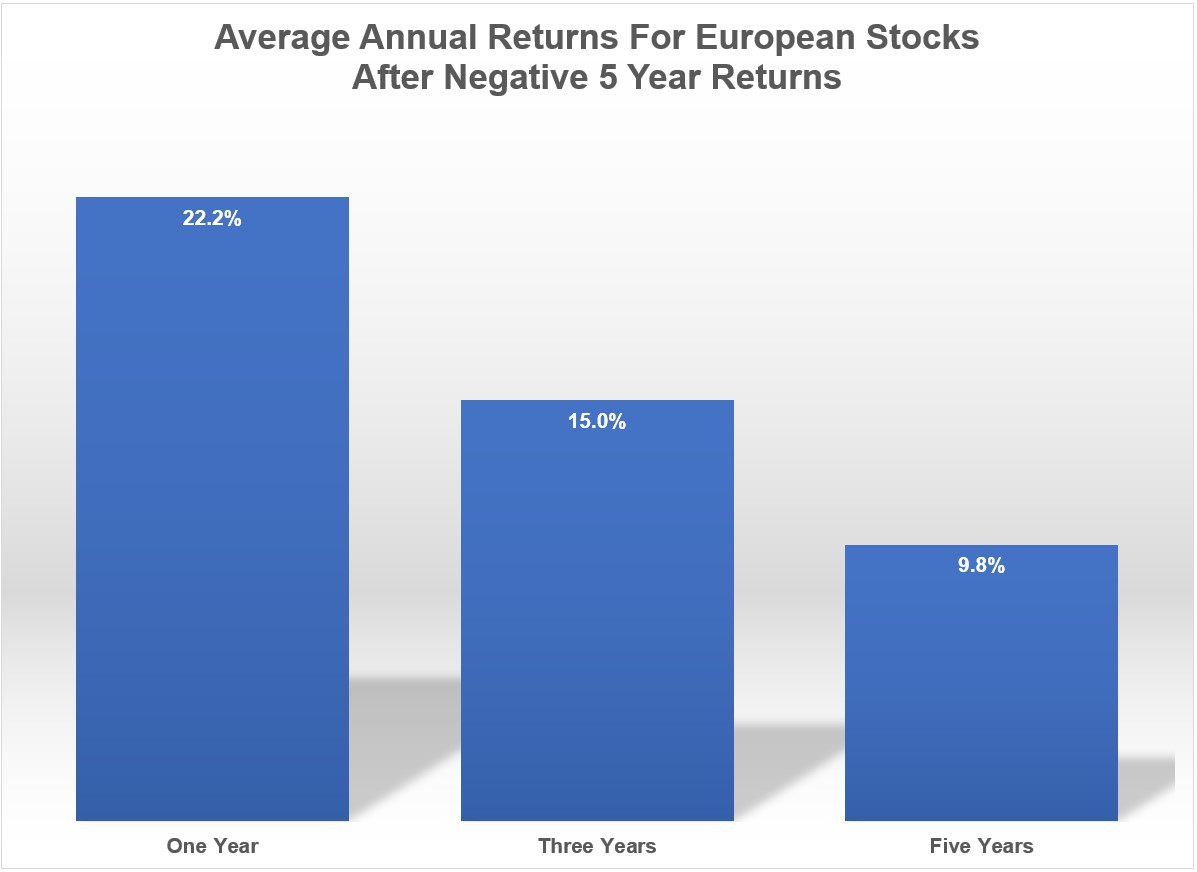

What happens to European stocks after a 5 year run with negative returns?

The importance of understanding market history when investing.

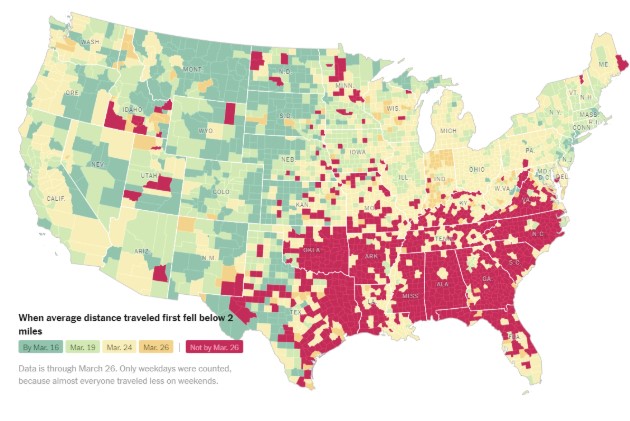

We discuss: Some good news out of NYC Why this is more like war than the Great Depression Can we really return to normal until we get a vaccine? Social distancing is working? Why the ability to stay home is a luxury When will we all be wearing masks everywhere? The government finally did something…

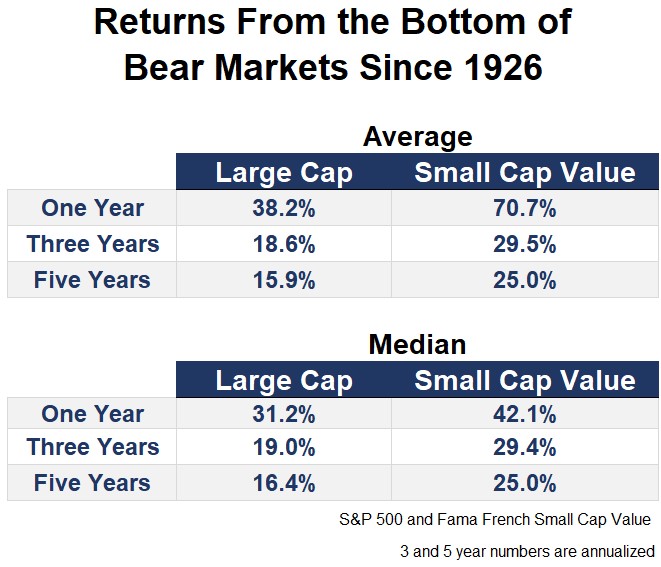

A history of small cap value performance following a bear market.

The double-edged sword of experience during a bear market.

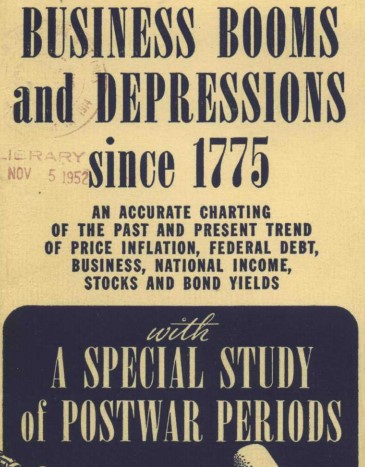

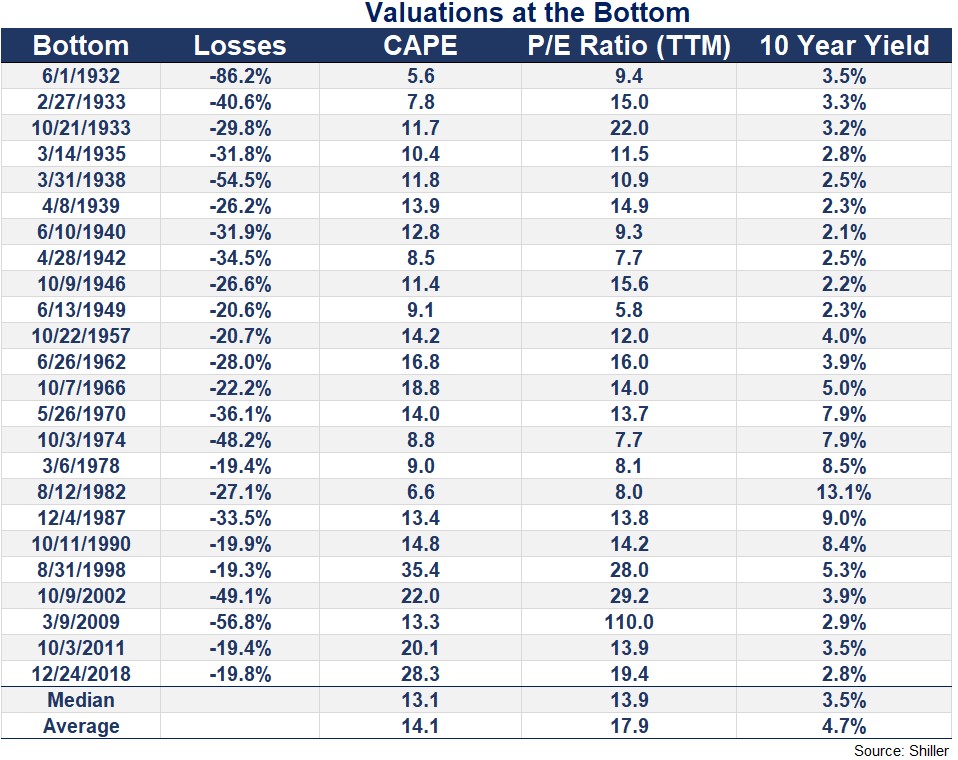

What if valuations don’t give investors an all-clear signal?