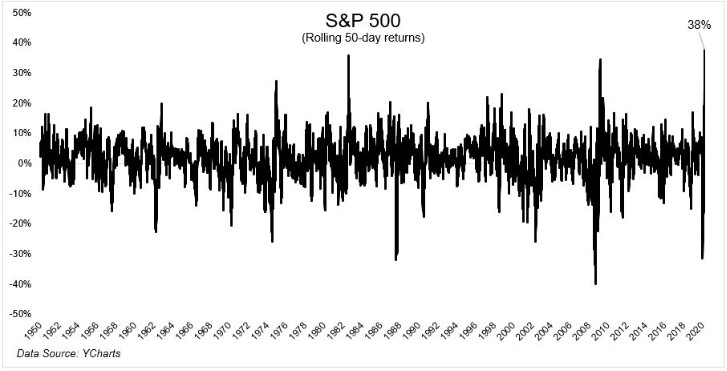

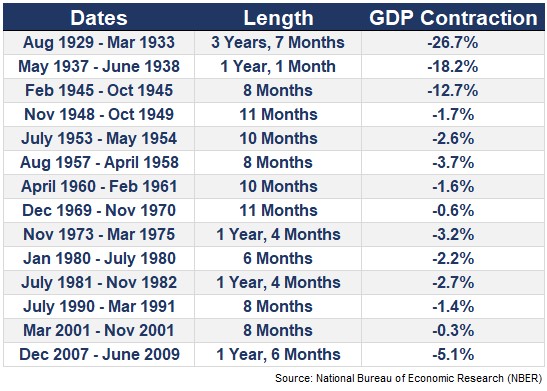

According to the National Bureau of Economic Research, the U.S. economy peaked in February and officially entered a recession in March. This is a newsflash to exactly zero people. When the pandemic hit and the economy was put in the freezer, it was immediately obvious the longest economic expansion in this country’s history came to…