Michael and I empty our inbox to answer listener questions.

Michael and I empty our inbox to answer listener questions.

Some reminders on my investment philosophy.

Michael and I discuss the red hot real estate market, chasing performance in tail-risk funds and more.

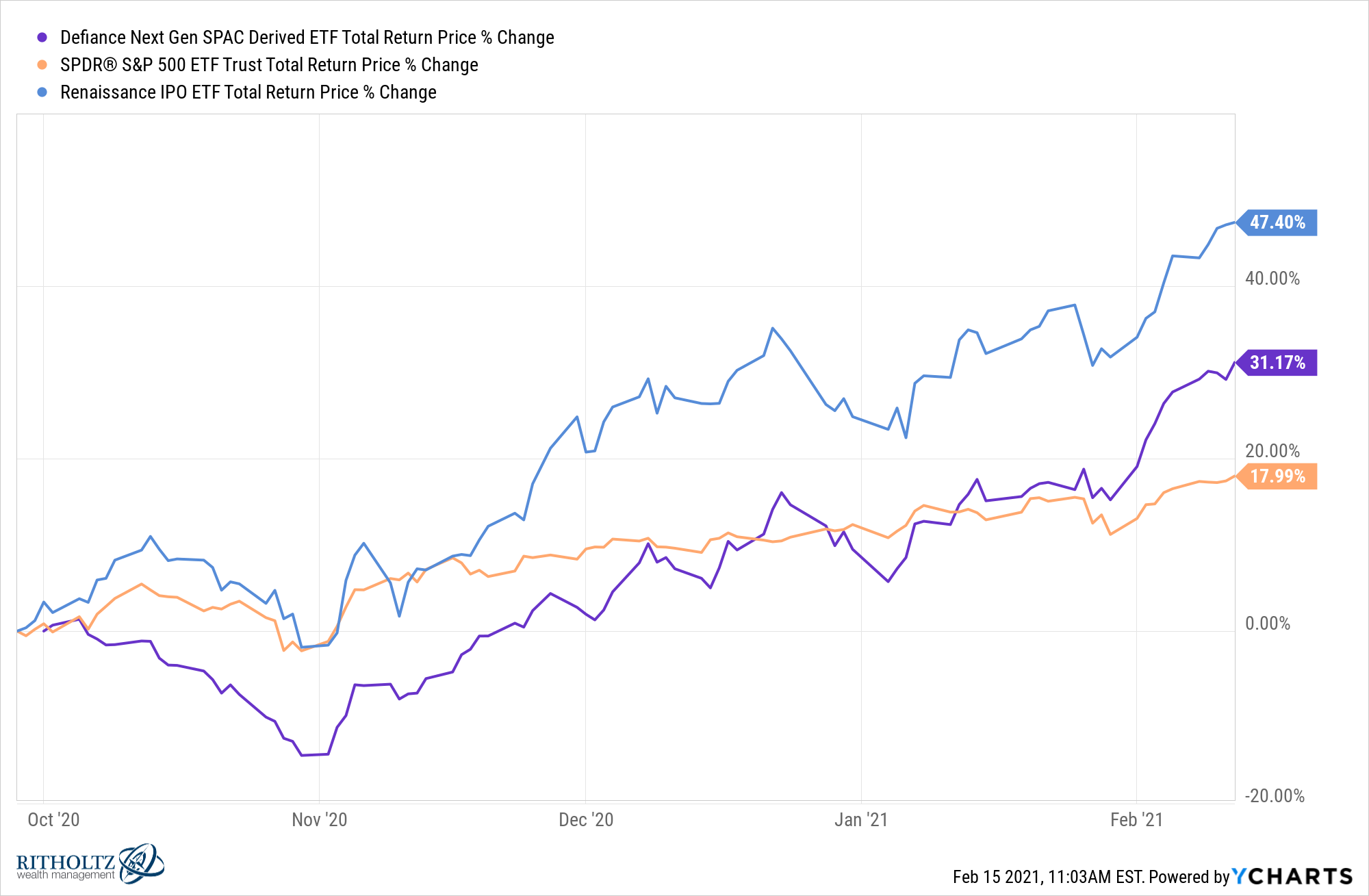

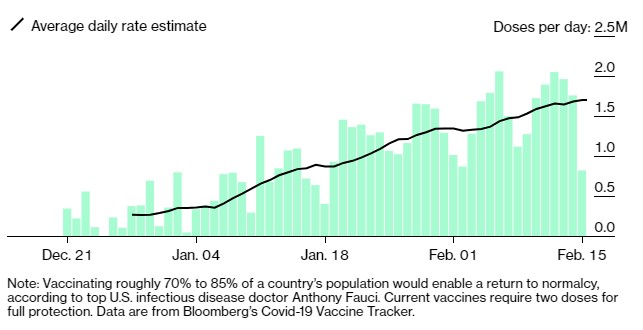

Weighing the pros and cons of an extremely strange market environment.

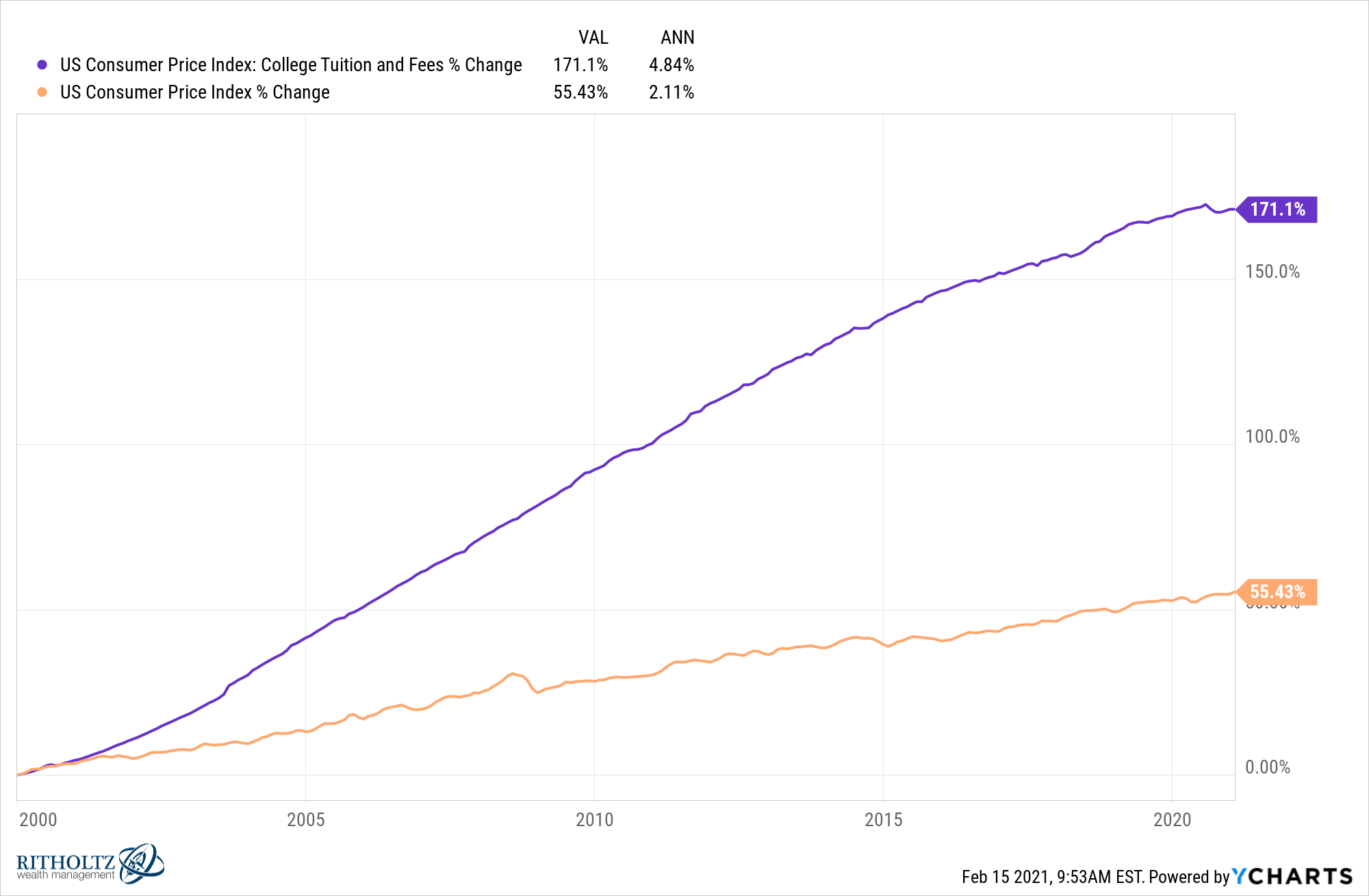

What if college tuition isn’t as expensive as it seems?

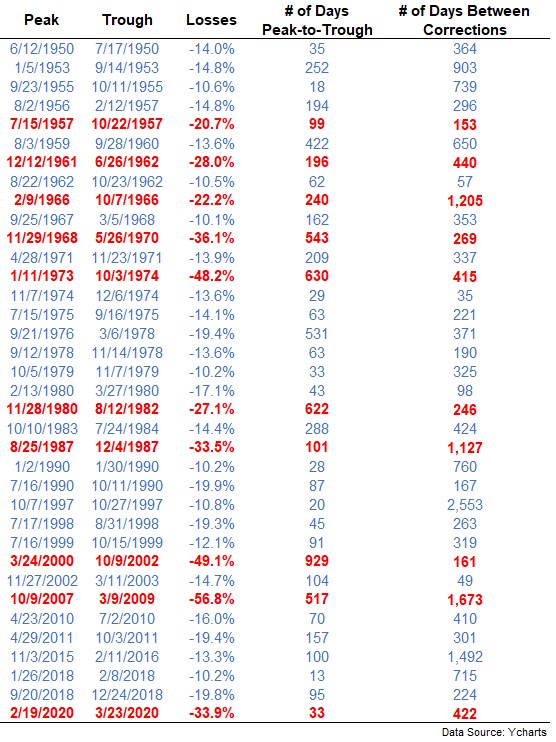

Every correction and bear market for the S&P 500 since 1950.

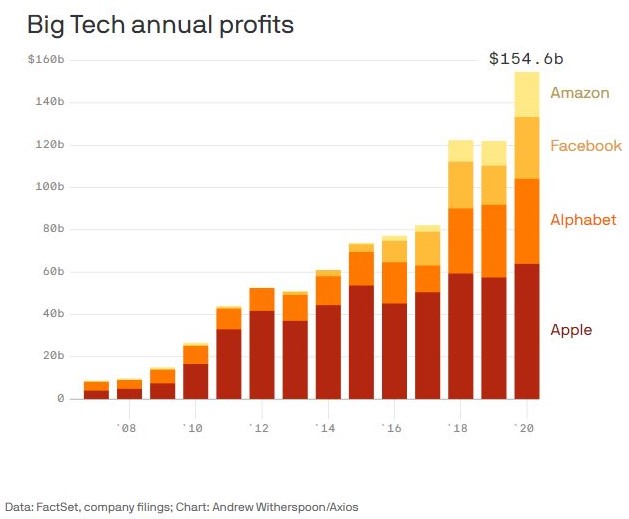

How big tech is impacting the stock market and why a huge crash is unlikely.

Michael and I spoke with behavioral psychology expert Daniel Crosby.

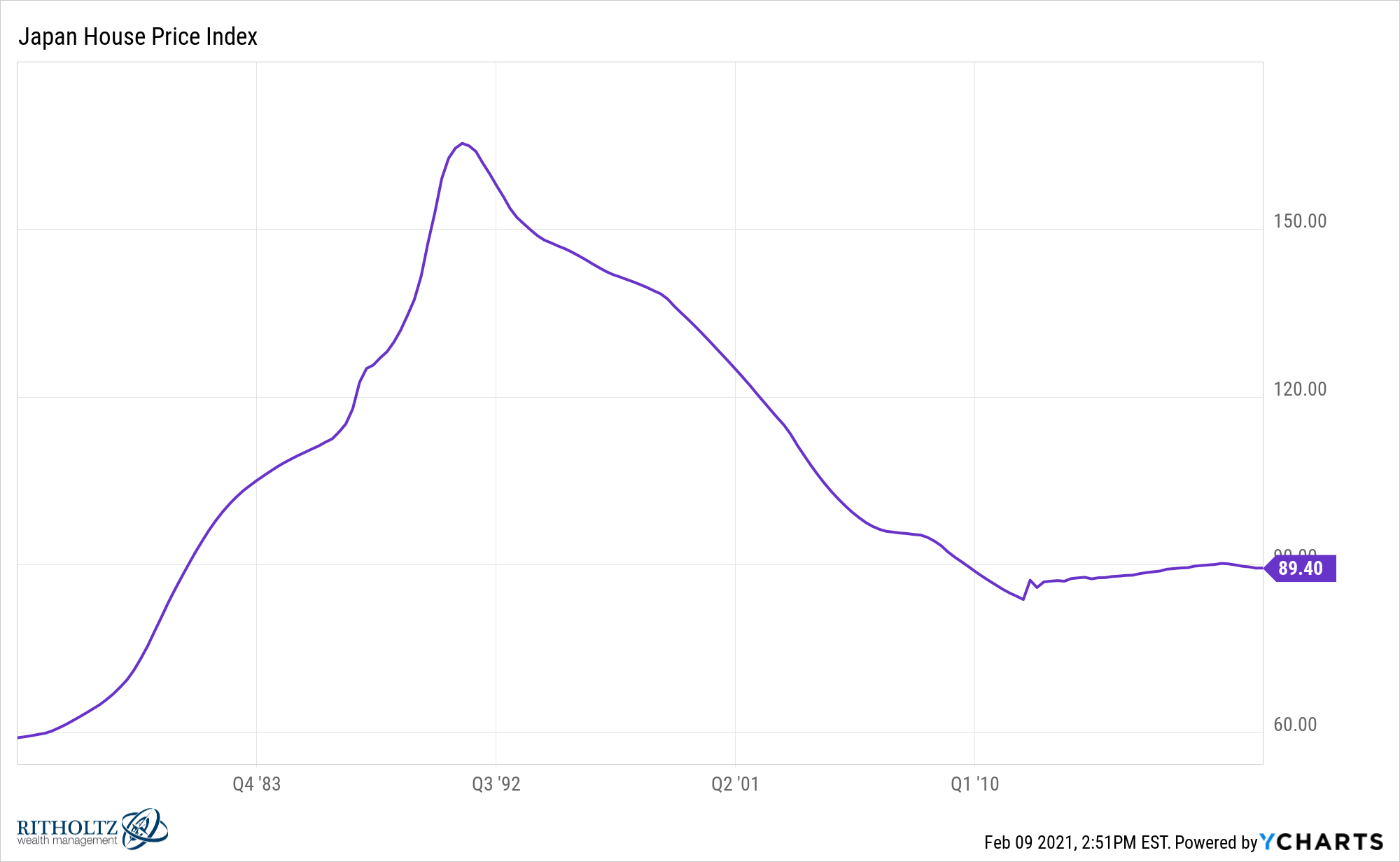

The Japanese property bubble of the 1980s might be the greatest asset bubble of all-time.

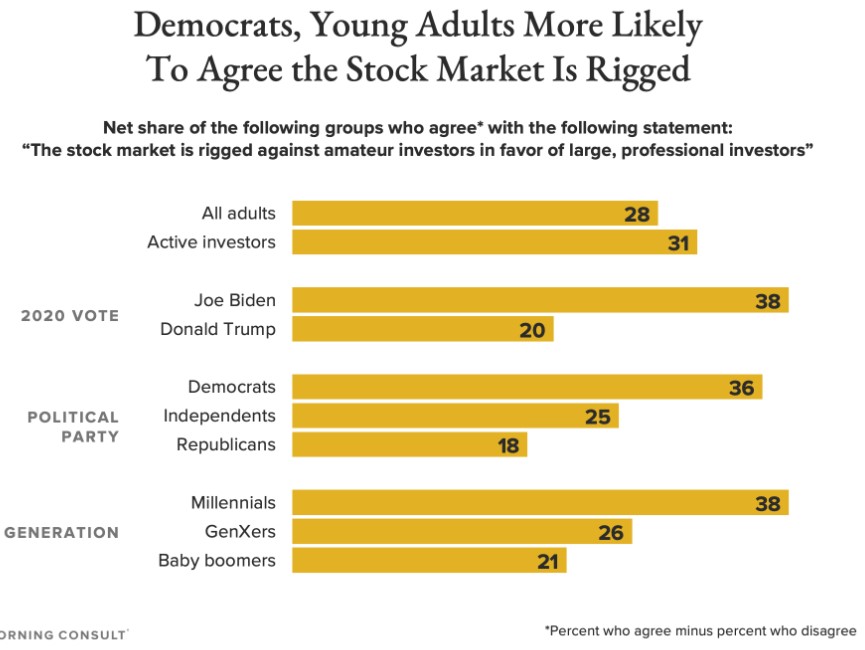

Michael and I discuss rigged markets, putting guardrails on your investments and tapping equity in your home.