Here’s an email that came to our Animal Spirits inbox this week:

A lot of people are wondering the same thing.

The overall price level is up more than 20% this decade. Wages have more or less kept up but that’s on aggregate. Those who have seen their wages rise faster than average are offset by those whose incomes haven’t kept pace.

Technology will help bring down the prices of certain goods. Just think about how much cheaper flat-screen TVs have gotten over time.

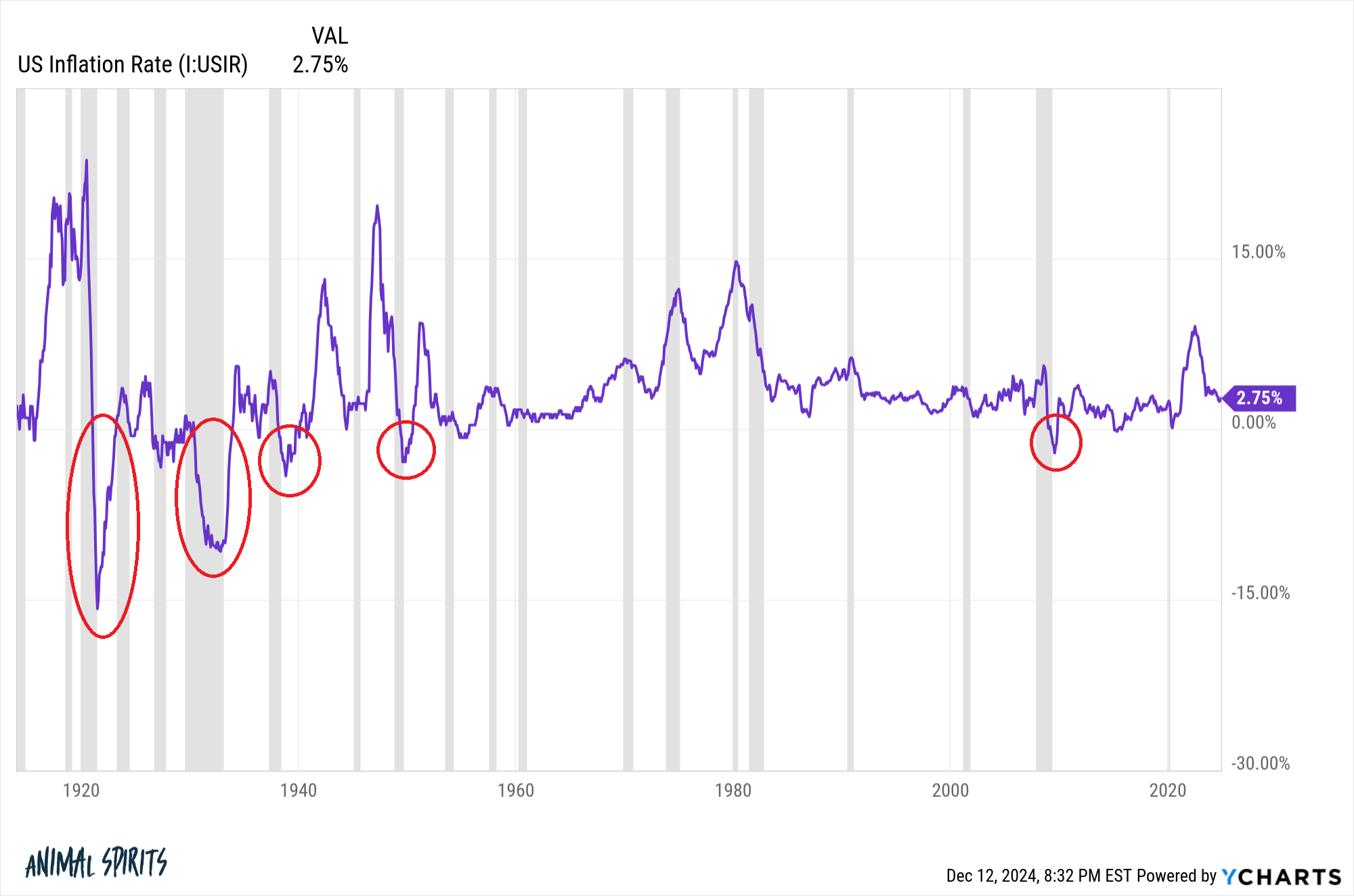

But the only way we are likely to experience broad-based price declines is during a terrible economy with heavy job losses.

Even then it might not be as much relief as some would like. During the Great Financial Crisis the largest year-over-year deflation was -2.1%:

Prior to that short bout of deflation you have to go back to post-WWII days to see an extended period of falling prices. The last severe deflation in the United States occurred because of the Great Depression and Depression of 1920-1921.

The recurring theme here is downright awful economic environments are the cause of falling prices. Deflation is bad for the economy because businesses and households delay consumption since people expect prices to be lower tomorrow than they are today.

Lower consumption. Lower revenues. Fewer jobs. Lower growth. Not fun.

Be careful what you wish for.

This is not to say inflation is a good thing, just the lesser of two evils.

So you hedge against inflation to the best of your abilities.

Here are Ben’s three best inflation hedges:

1. A good job. Inflation statistics are helpful in understanding trends in the overall economy but are imperfect measures for households.

Your household inflation rate is personal. It depends on where you live, how you live, how much you spend, what you spend your money on and, most importantly your job.

Wage growth is personal just like the inflation rate. No one’s income trajectory matches these averages:

The ability to grow your income in the face of rising prices is your best hedge against inflation. The best career advice I’ve ever received is to become indispensable to whoever I work for.

Easier said than done but that helps ensure you’re paid a fair wage and have the ability to negotiate a higher salary.

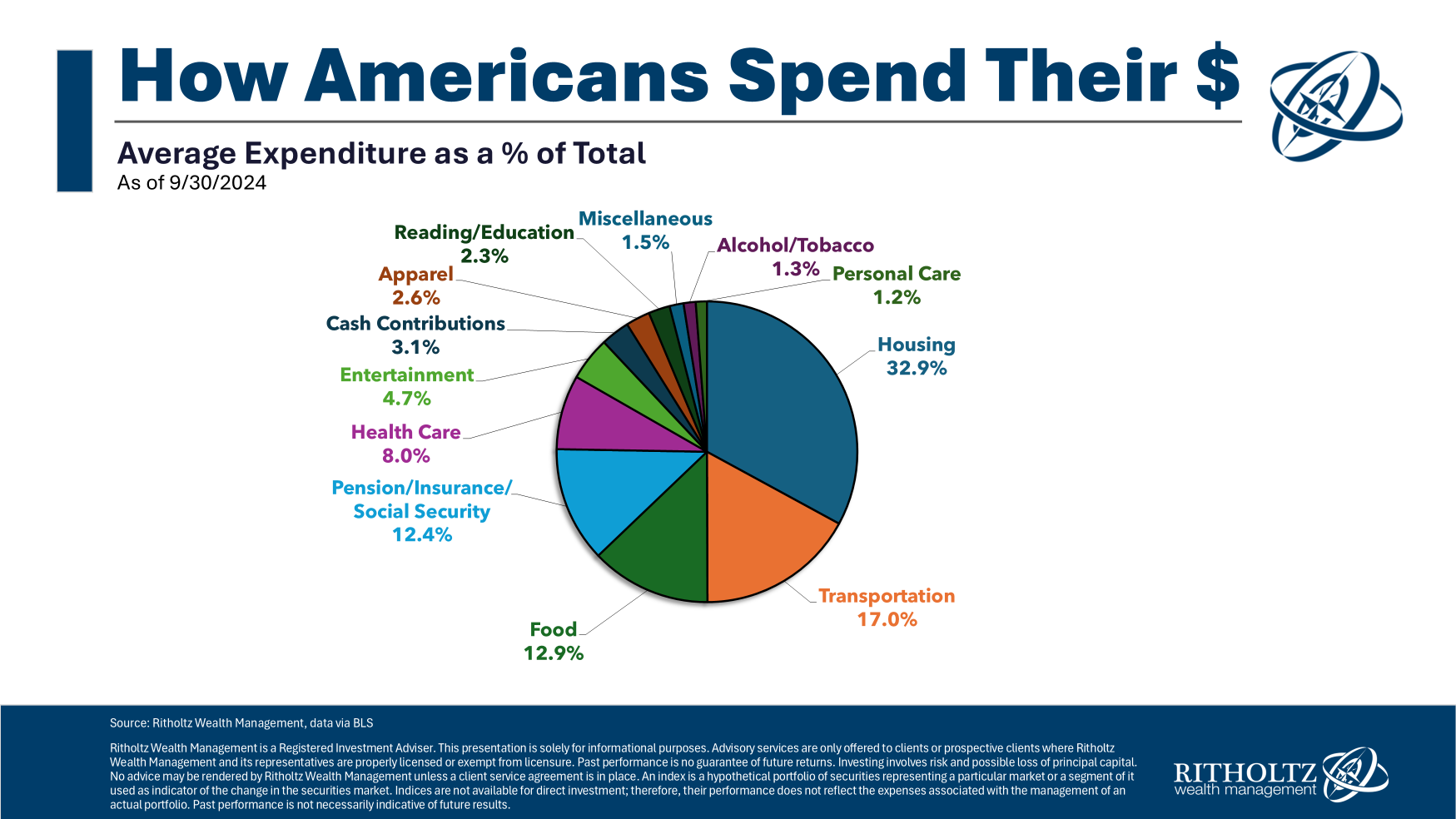

2. A fixed-rate mortgage. People focus on the price of eggs, gas and bacon but the two biggest spending categories by far are housing and transportation:

These two categories alone make up half of all household consumption.1 This is why a fixed rate mortgage is such a good deal.

To paraphrase Wooderson from Dazed and Confused, “That’s what I love about these fixed rate mortgages, man, I make more money, the payment stays the same.”

You earn more money as you progress in your career. That makes the fixed payment easier to stomach from a budgeting perspective over time. You can also write off the interest you pay on the loan as a deduction for tax purposes. Plus, inflation eats into the value of your payment slowly but surely over time.

Housing prices generally go up but tend to do even better than other asset classes when inflation surges as the cost of building new homes increases (higher wages, higher material costs, etc.).

3. Stocks for the long run. Sometimes the stock market struggles with a burst of inflation over the short to intermediate-term but stocks for the long run are still your best investment hedge against the silent killer of inflation.

Over the past 100 years or so the U.S. stock market has beaten the inflation rate by nearly 7% per year. Dividends have grown more than 2% faster than the annual inflation rate. Inflation-adjusted earnings growth has come in at around 3% per year.

Cash-like investments can help when inflation and rates are rising in the short-term but the stock market remains your best bet for beating inflation over the long-term.

Michael and I talked about this email and some thoughts on inflation on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Inflation is the Lesser of Two Evils

Now here’s what I’ve been reading lately:

- The 4 phases of saving & investing for retirement (Kitces)

- More basketball teams should press (The New Yorker)

- Retire without regrets (HBR)

- Nick’s favorite investment writing of 2024 (Of Dollars & Data)

- Manufacturing is a war now (Noahpinion)

- Taking a news vacation (Range Widely)

- Why retail traders underperform (Klement on Investing)

- 8 marketing moves for financial advisors (Advisor Unlock)

Books:

1It’s also worth noting a vehicle is a terrible hedge against inflation. It goes down in value immediately.