Today’s Animal Spirits is brought to you by YCharts and CME Group:

See here for 20% off your initial YCharts professional subscription

See here for more information on adding futures to your portfolio with CME Group

Listen here:

On today’s show, we discuss:

- Berkshire Hathaway’s cash fortress tops $300 billion as Buffett sells more stock, freezes buybacks

- Week 44

- 1999 vs. 2024

- What Does a Once-in-a-Generation Investment Opportunity Look like?

- The Trump-Betting Whale Speaks Out: ‘I Have Absolutely No Political Agenda’

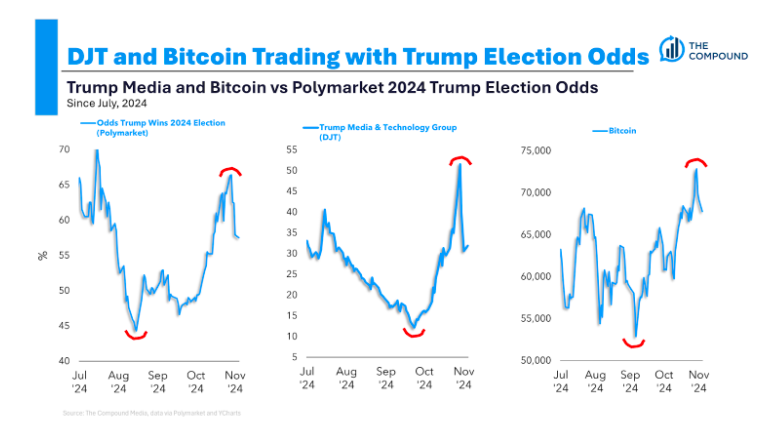

- Wall Street Bets on Trump 2.0

- Don’t Mix Your Politics With Your Portfolio

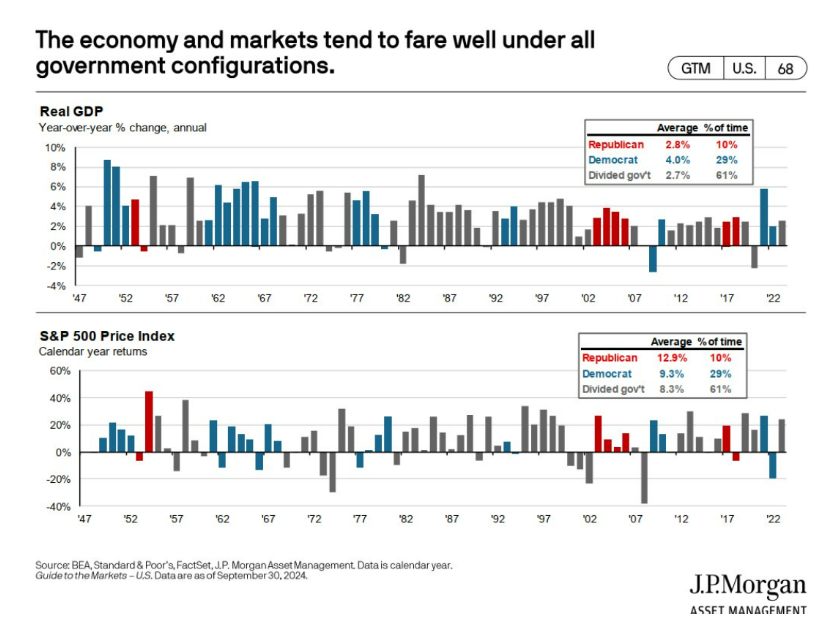

- Presidential Terms & Market Cycles

- Would the Stock Market Crash if Elizabeth Warren Became President?

- Would the Market Care if the President Was Impeached?

- Does the Stock Market Have a Say in the Presidential Election?

- Does the Stock Market Care Who the President Is?

- The 11th Commandment

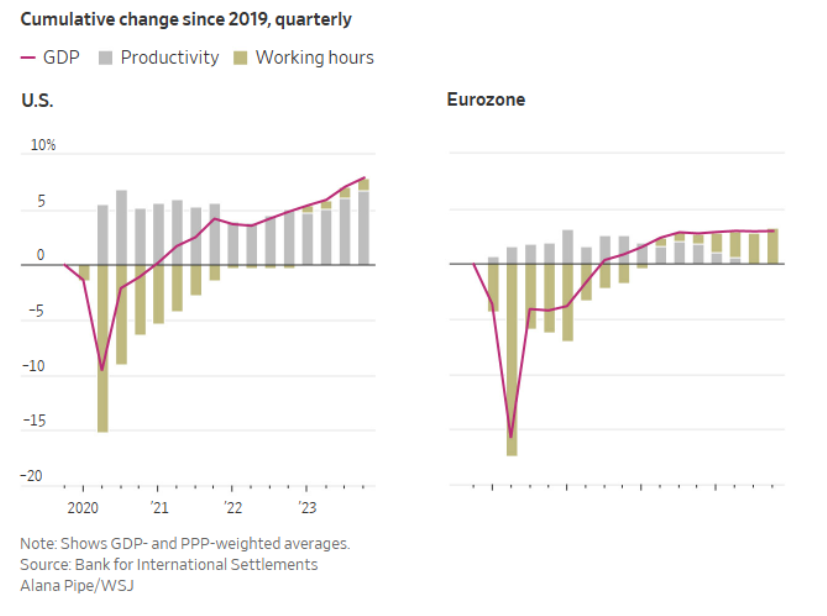

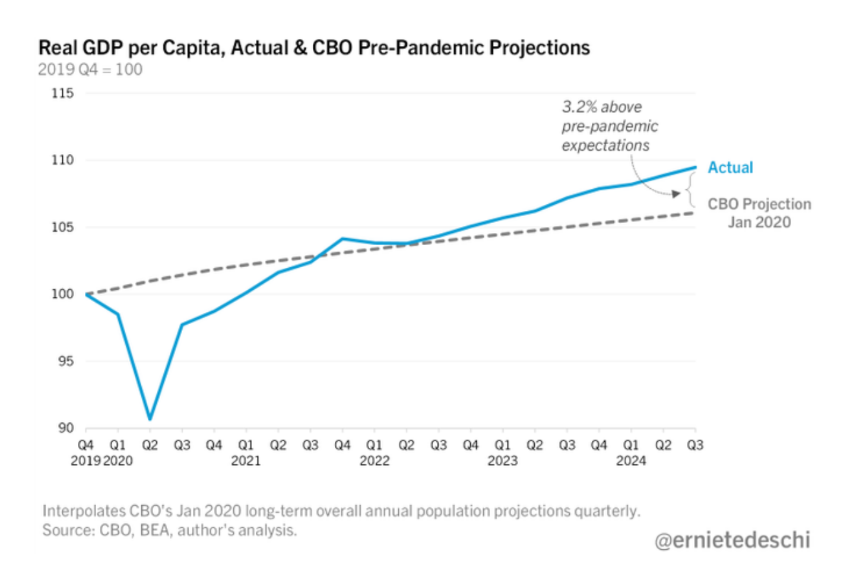

- The Next President Inherits a Remarkable Economy

- The cost of college is quietly going down

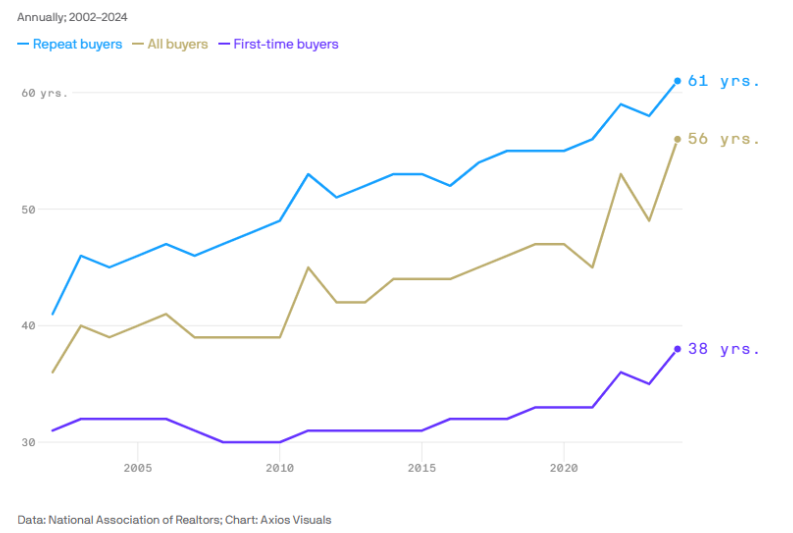

- America’s homebuyers are older than ever

- KKR sets its sights on 401(k) plans via target-date funds

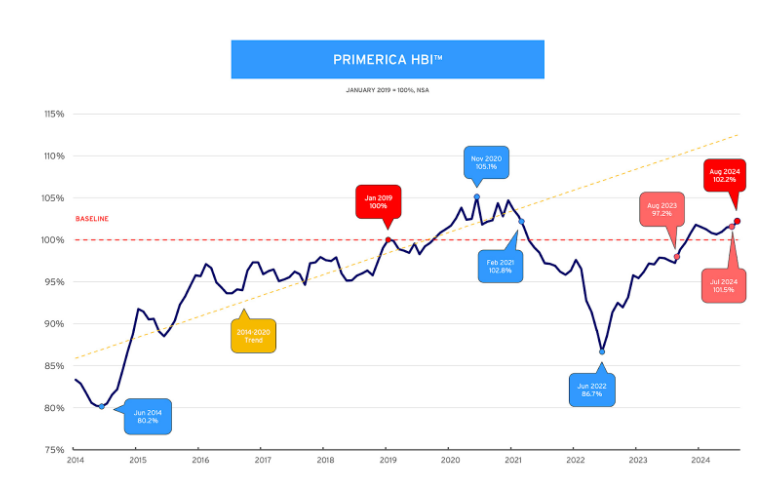

- Primerica Household Budget Index™ – Purchasing Power for Middle-Income Families Increased Over Previous Month

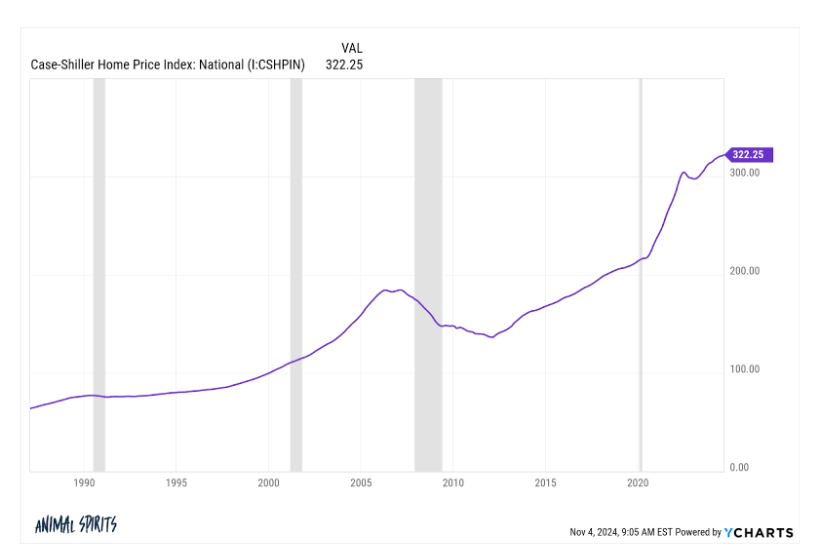

- Weekly home check

Recommendations:

- Disclaimer

- A League of Their Own

- Anora

- The great horror renaissance: Jason Blum on how Blumhouse is still scaring up big profits at the box office

Charts:

Tweets:

Free Cash Flow (cap weighted) French data July 1951 to August 2024.

Lo 10 (Expensive) v Hi 10 (Value) relative performance in gray.

Lo 10 (Expensive) v Hi 10 (Value) relative underperformance in gold.

Value has outperformed Expensive by 20x over the full set (gray) but has… pic.twitter.com/UfpyqwuSHo

— Tobias Carlisle (@Greenbackd) October 30, 2024

Same idea, a few more decades added – that puts the pandemic inflation into perspective (instead of just comparing to the lowest inflation decade). pic.twitter.com/fG4aeKUI4m

— Bill McBride (@calculatedrisk) October 29, 2024

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound, Inc., an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.