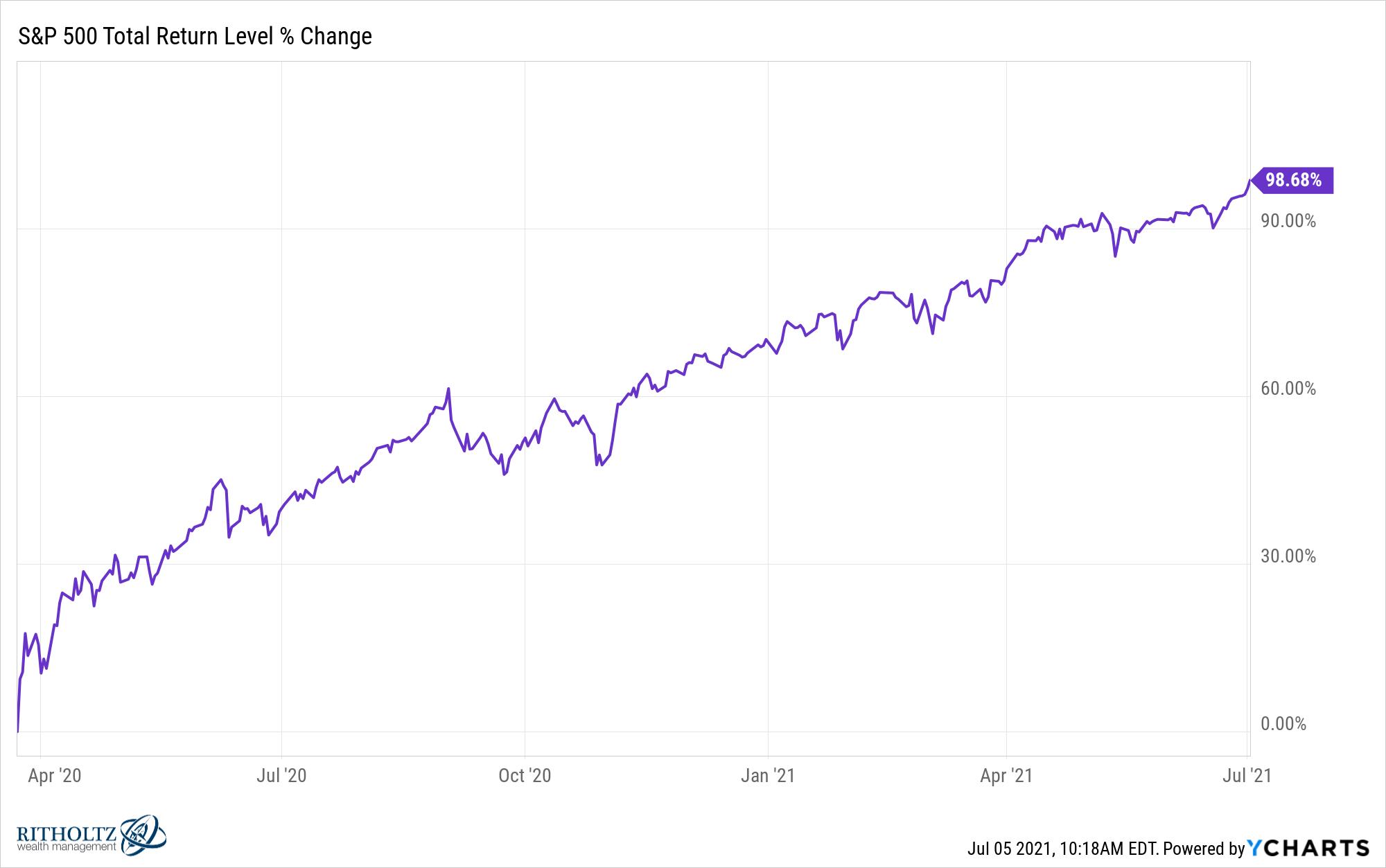

From the pandemic-induced lows of March 23, 2020, the S&P 500 is now up just a shade under 99%:

For the sake of this blog post, let’s round it up and call it a clean 100% gain. The stock market has now doubled in a little more than 15 months.

As it turns out, investing during a market crash can be lucrative.

To some investors, this feels way too far way too fast. To other investors, this gain may feel quaint, especially relative to some of the enormous returns we’ve seen in other securities and asset classes.

I’m in the camp that this is still kind of a big deal.

This is a huge return in such a short period of time for a market that’s measured in the tens of trillions of dollars.

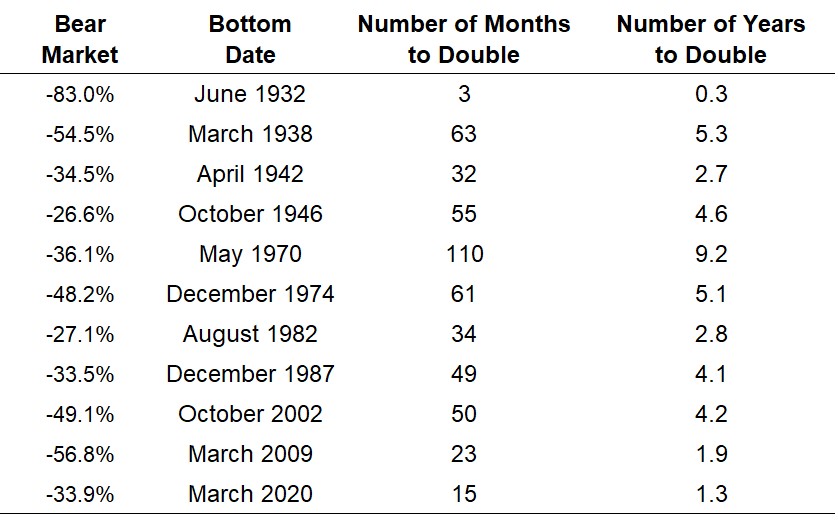

To put this number into perspective, I looked back at how long it took from the bottom of previous brutal bear markets for the S&P 500 to double up.

After the Great Financial Crisis caused the market to fall 56%, the S&P bottomed on March 9, 2009.1 The market snapped back in a hurry, surging nearly 70% from those lows through the end of the year.

A 16% correction in 2010, set things back a little (remember all the double-dip recession talk?) but by the end of January 2011, the market was up 100% from the lows. That would be around 23 months or just shy of 2 years for a double from the lows of the GFC.

Following the dot-com bubble, the S&P 500 fell 50% from the spring of 2000 through the fall of 2002, a period that also included the Enron scandal and 9/11.

The S&P 500 was twice as high as the October 2002 lows by January 2007. So that was roughly 50 months or more than 4 years for a 100% gain off the bottom.

The October 1987 Black Monday crash saw the market lose more than 30% of its value in less than a week. The S&P didn’t technically bottom until December of that year.

Returns for the market were strong in both 1988 and 1989, up 17% and 31%, respectively but there were two separate double-digit corrections in 1990 of -10.2% and -19.9% (which included a recession). The S&P 500 didn’t hit 100% returns from the 1987 lows until December 1991, 49 months later.

I did this same exercise for the bear markets of 1973-1974, 1968-1970, 1946, 1940-1942 and 1937-1938 as well. None of the recoveries from these market crash scenarios saw the stock market double in 15 months or less like the current situation.

The only historical precedent I could find to the current bounce from the bottom of a bear market was the aftermath of the Great Depression.

The stock market bottomed on June 1, 1932 following the bone-crushing 80%+ crash that began in 1929. Stocks were basically flat for the remainder of the month but then took off like a rocketship, rising a cool 92% in July and August of 1932.

By the first week of September 1932, the stock market was up more than 100%, which happened in a little more than 3 months. I guess you could say the stock market was a tad oversold from the worst crash in history.

It’s fitting the Great Depression was the fastest double off a bear market bottom since a depression was on the table from the onset of the pandemic in the spring of 2020 before governments around the globe sprung to action and flooded the system with money.

Here’s the full list of how long it has taken for a 100% return off the lows from some of history’s biggest bear markets:

Interestingly enough the past two bear markets are in 2nd and 3rd place all-time for fastest doubles. This bodes well for my theory that market cycles are speeding up, especially during and following big sell-offs.

So one takeaway here would be markets can get away from you in a hurry if you happen to be positioned wrong, as many bearish investors who went to cash in March 2020 discovered.

This was as close to a blink-and-you-missed-it moment as we’ve seen in the stock market.

The other side of this argument would be periods such as the late-1930s and 1970s when stocks took much longer to recover.

This is a risk today’s investors haven’t experienced in some time.

For now, enjoy the gains.

I wish I knew what comes next but it appears we are in uncharted territory, as always.

Further Reading:

The Future of Bear Markets

1The S&P is now up nearly 730% from those March 2009 lows. Buying index funds throughout the crash of 2008 will be the best investments of my lifetime.