Whenever there’s a huge run-up in prices in any financial asset there is usually more than one reason for it.

Take housing as an example.

Prices are going crazy because of demographics, low rates, the pandemic and a lack of supply of homes on the market.

There’s nothing we can do about demographics right now, interest rates are what they are and the pandemic panic buying should subside at some point so there’s really nothing that can be done to fix these housing issues.

But we could build more houses. We should build more houses.

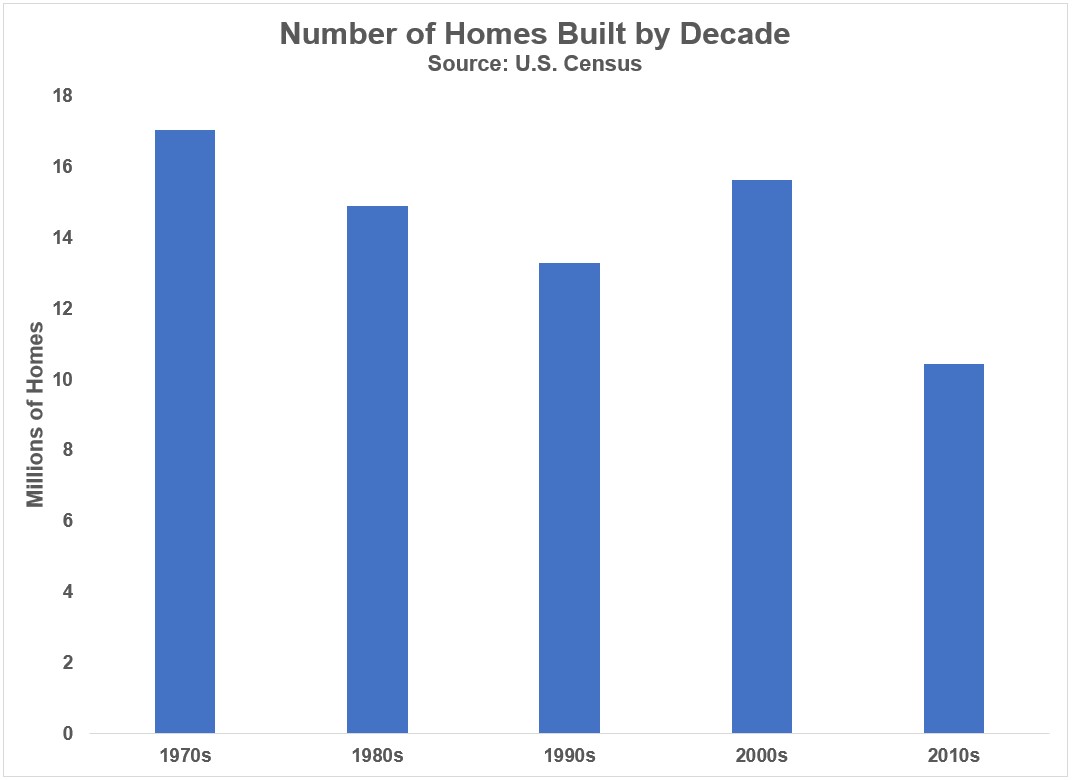

The U.S. Census keeps track of the number of new privately-owned housing units completed each year going back to the late-1960s. Here are those numbers broken out by the previous five decades:

There were 17 million homes finished in the 1970s, 15 million in the 1980s, 13 million in the 1990s, 16 million in the 2000s and then just 10 million in the 2010s. We simple didn’t build enough houses following the Great Financial Crisis.

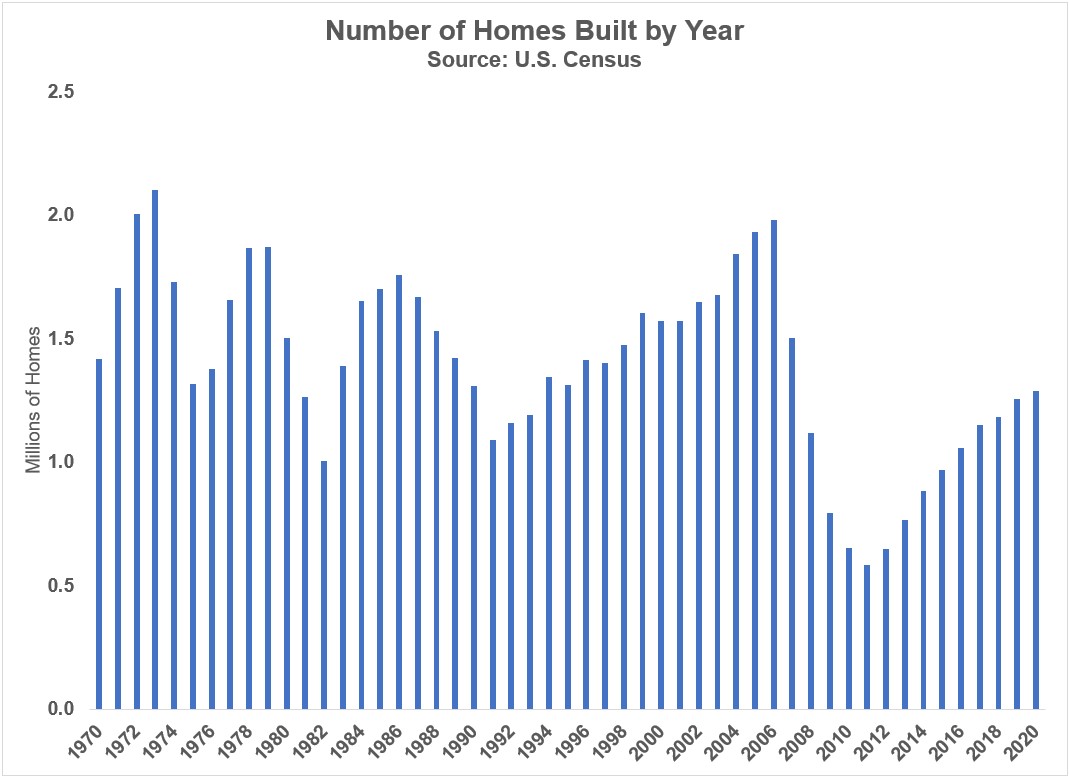

This trend becomes even more apparent when looking at the annual data:

You can see there were dips in the number of houses built following previous recessions in the mid-1970s, the early-1980s and the early-1990s but nothing as drastic as what occurred following the real estate crash that led to the 2008 financial crisis.

Those numbers are slowly but surely working back up to the long-term averages but these numbers are even worse than they appear once you factor in population growth in this time.

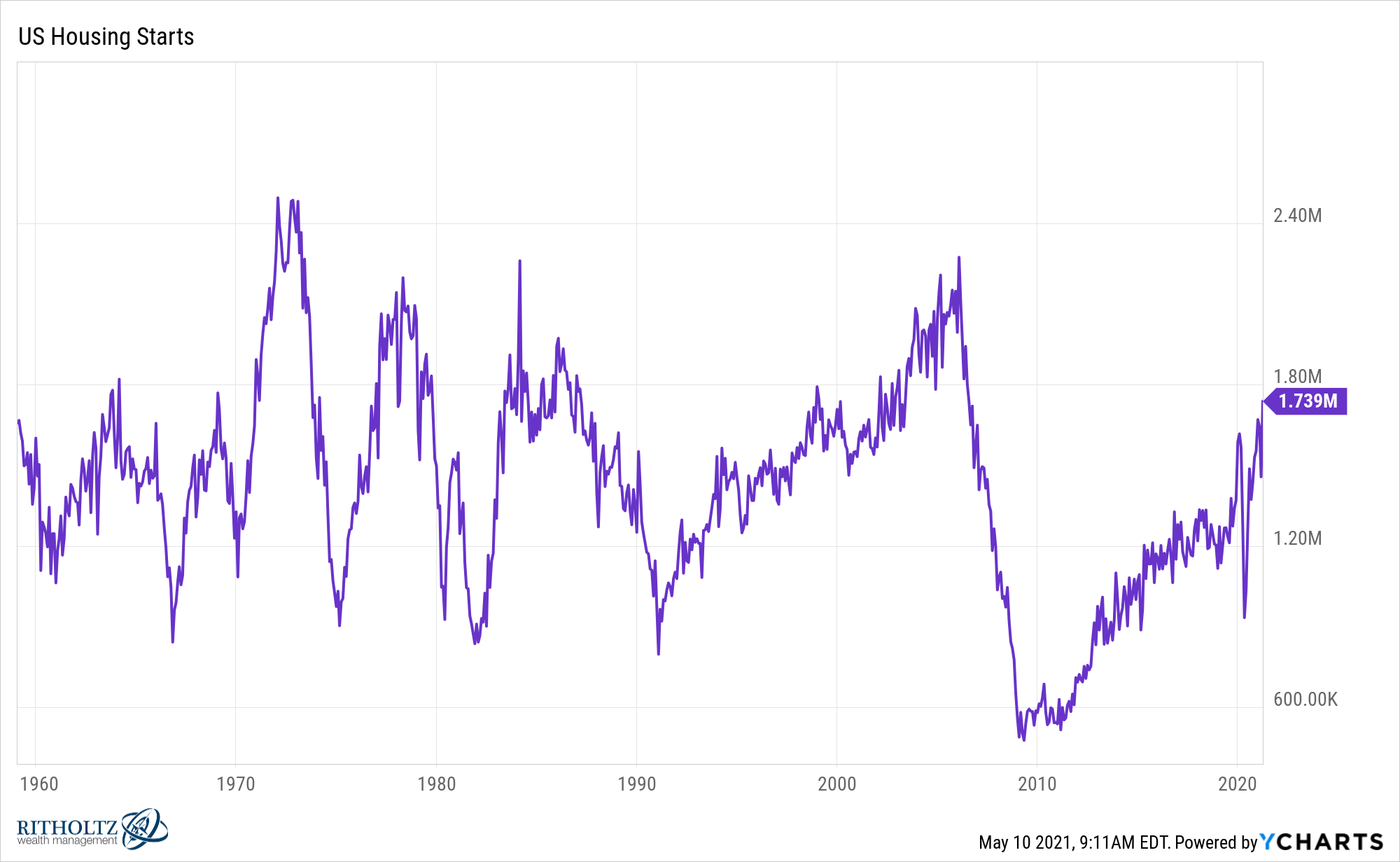

Here are new housing starts going back to 1959:

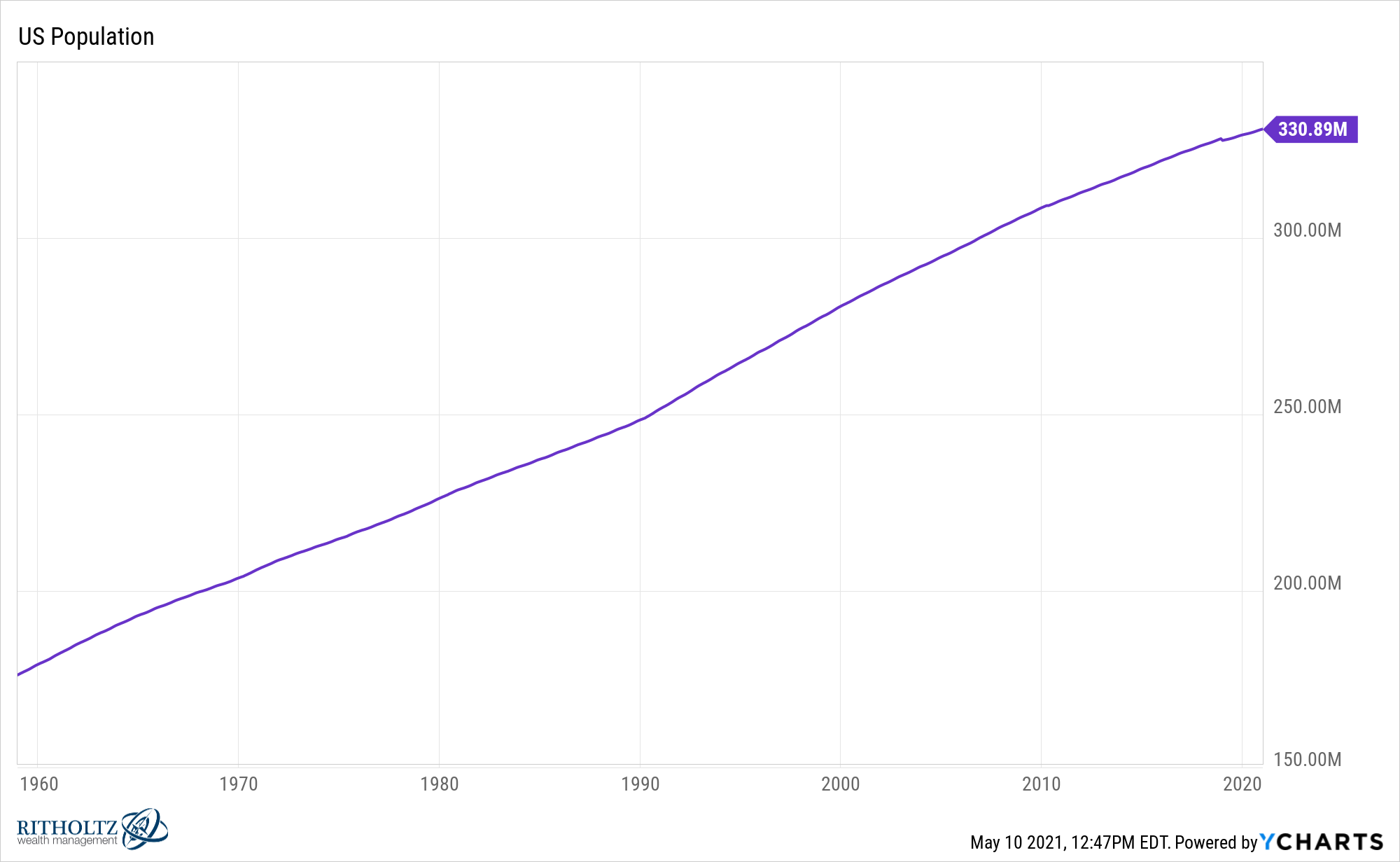

Even though these numbers are improving it’s important to remember there are now far more people in the United States than there were before. Look at the population growth in America in this time:

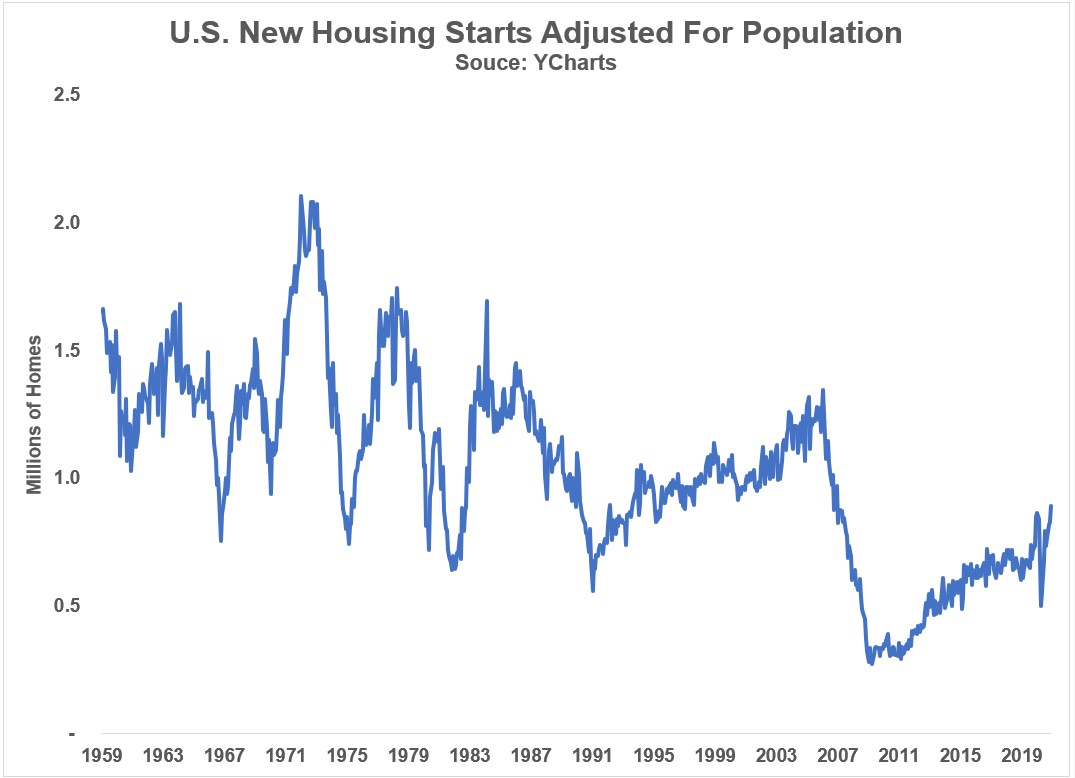

Putting it all together, let’s adjust new housing starts for population going back to 1959:

There were roughly 210 million people in the United States in the early-1970s and they were building more than 2 million houses a year. There are now 330 million people and last year there were less than 1.3 million houses completed.

We really need to build more houses in this country.

And it’s not like we haven’t done this before. It can be done.

The combination of the Great Depression and WWII crushed the U.S. housing market in the 1930s. New housing starts fell from one million a year in the late-1920s boom to fewer than 100k a year by the mid-1940s.

Following WWII, an economic boom ensued, the middle class was born and the GI Bill helped turn owning a home into the American dream. David Halberstam explains in his book The Fifties:

A federal housing bill was rushed through that contained very little in the way of controls, and a great deal in the way of federal insurance to protect builders by means of federal mortgage guarantees. “The real estate boys read the bill, looked at one another in happy amazement, and the dry rasping noise they made rubbing their hands together could have been heard as far as Tawi Tawi,” a writer named John Keats noted of the moment. The stored-up energy of two decades was unleashed. In 1944 there had been only 114,000 new single houses started; by 1946 that figure had jumped to 937,000: to 1,118,000 in 1948; and 1.7 million in 1950.

Much like today, there was also a migration from cities to the suburbs:

Starting in 1950 and continuing for the next thirty years, eighteen of the nation’s twenty-five top cities lost population. At the same time, the suburbs gained 60 million people. Some 83 percent of the nation’s growth was to take place in the suburbs. By 1970, for the first time there were more people living in suburbs than in cities.

All over America, subdivisions were advertising that buyers could come in for no down payment and others were asking, “one dollar down.”

Obviously, the government was far more accommodating to the housing market back in the 1950s. It would take a strong policy initiative to get so many new homes built today since the homebuilders are still gun-shy from the last housing crash.

The housing market could certainly cool off if rates rise or prices become too unsustainably high.

But it would be a far healthier market if we just built more homes.

Further Reading:

World War II: The Economic Anomaly