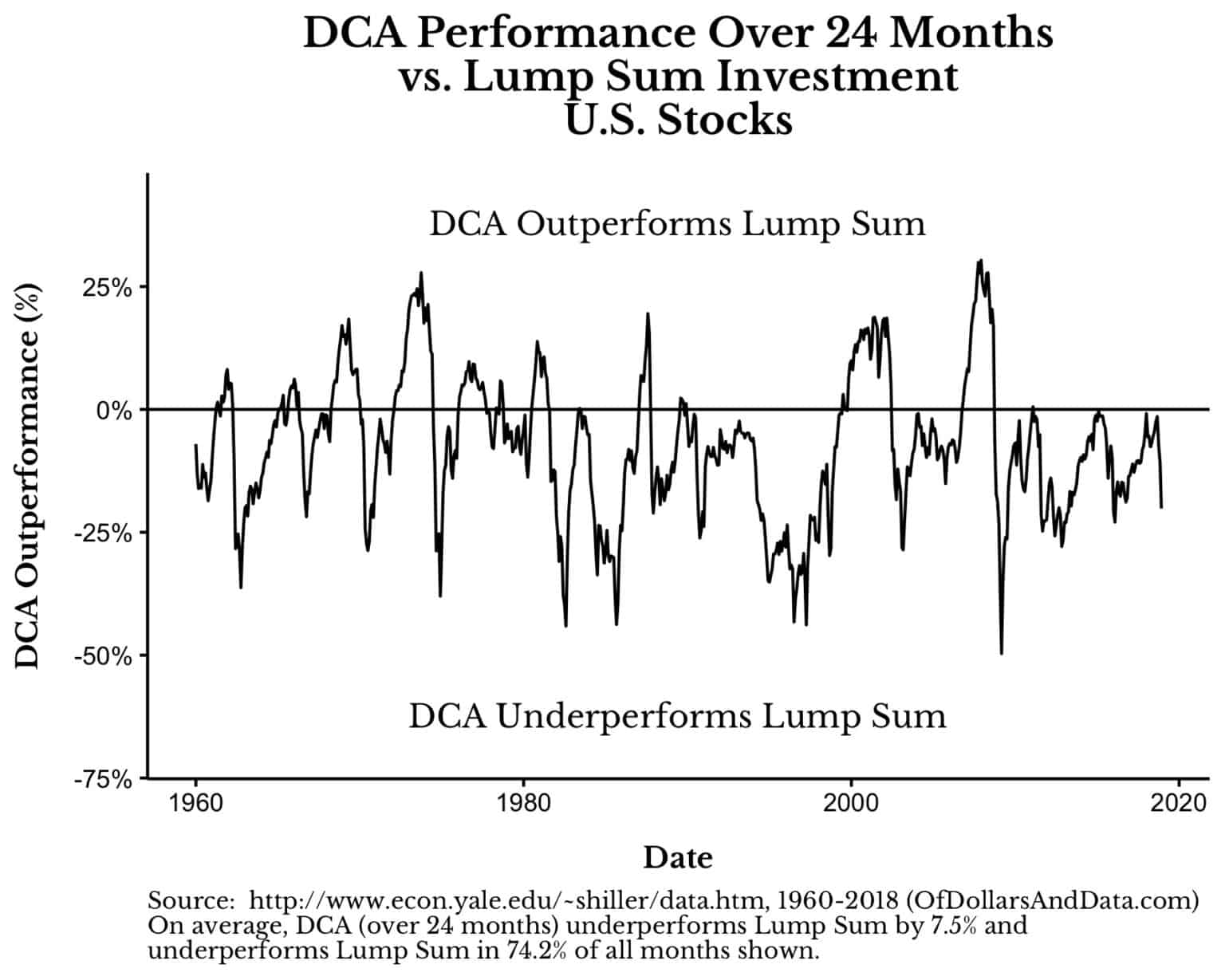

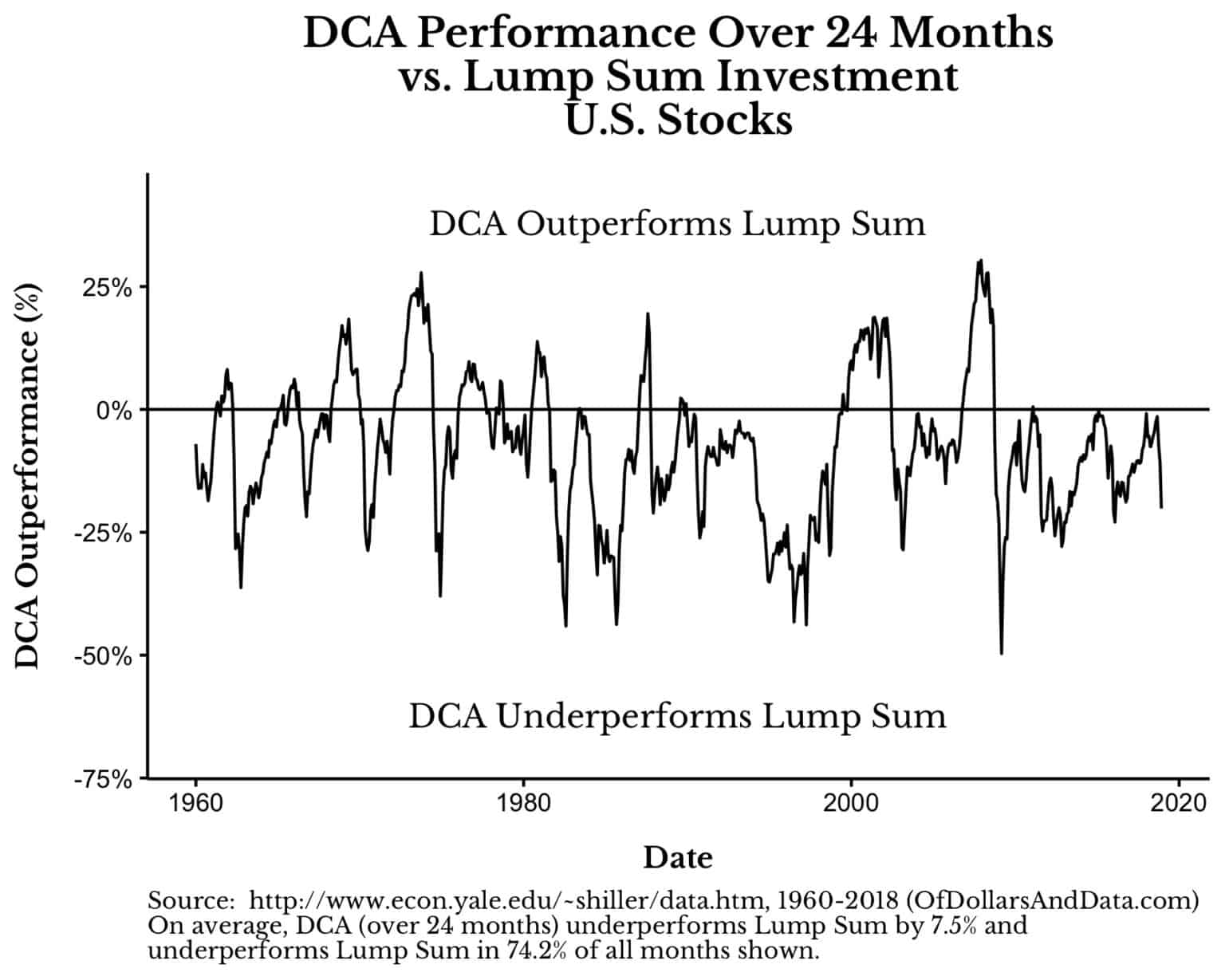

Lump sum vs. dollar cost averaging in a bear market.

Lump sum vs. dollar cost averaging in a bear market.

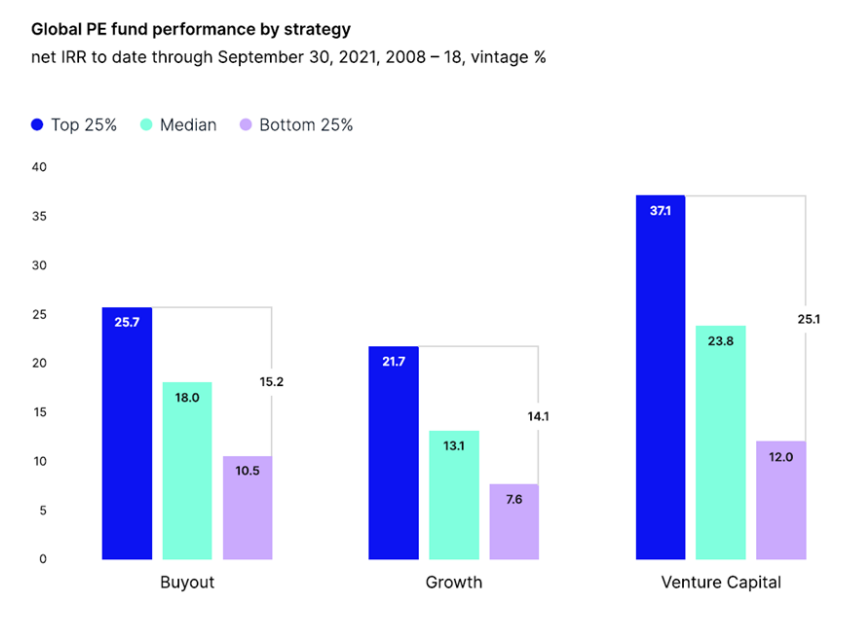

On today’s show, we discuss similarities between the late 90s and today, how tough it is to get VC exposure, current market dynamics within the private markets, and much more.

What if GDP contracts for two quarters but we don’t technically go into a recession?

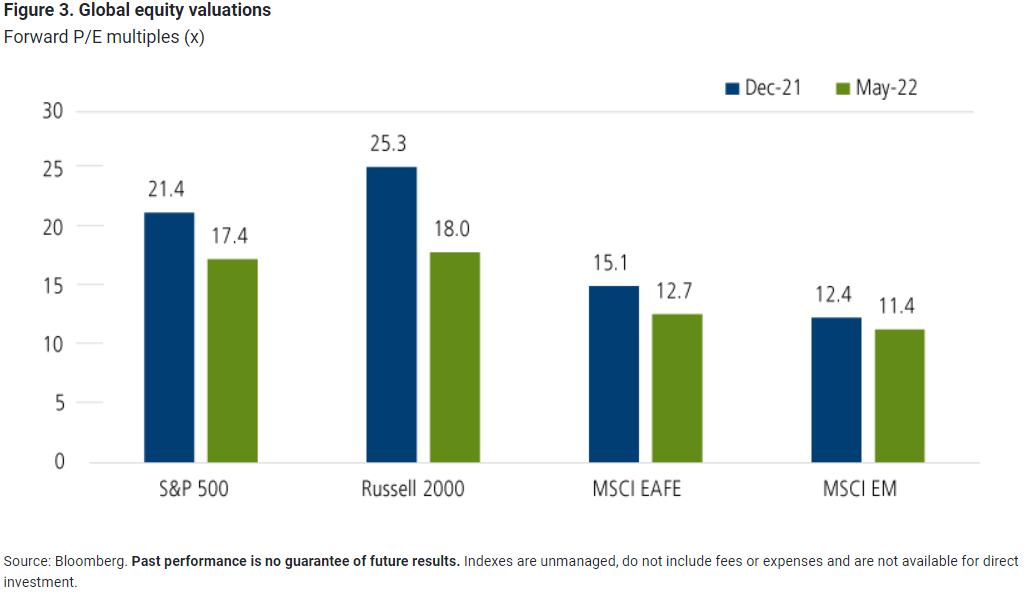

Why diversification matters even more during bear markets.

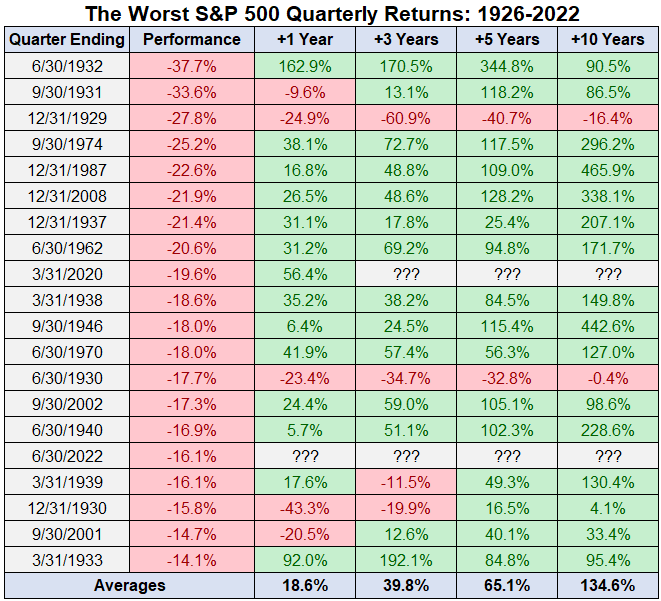

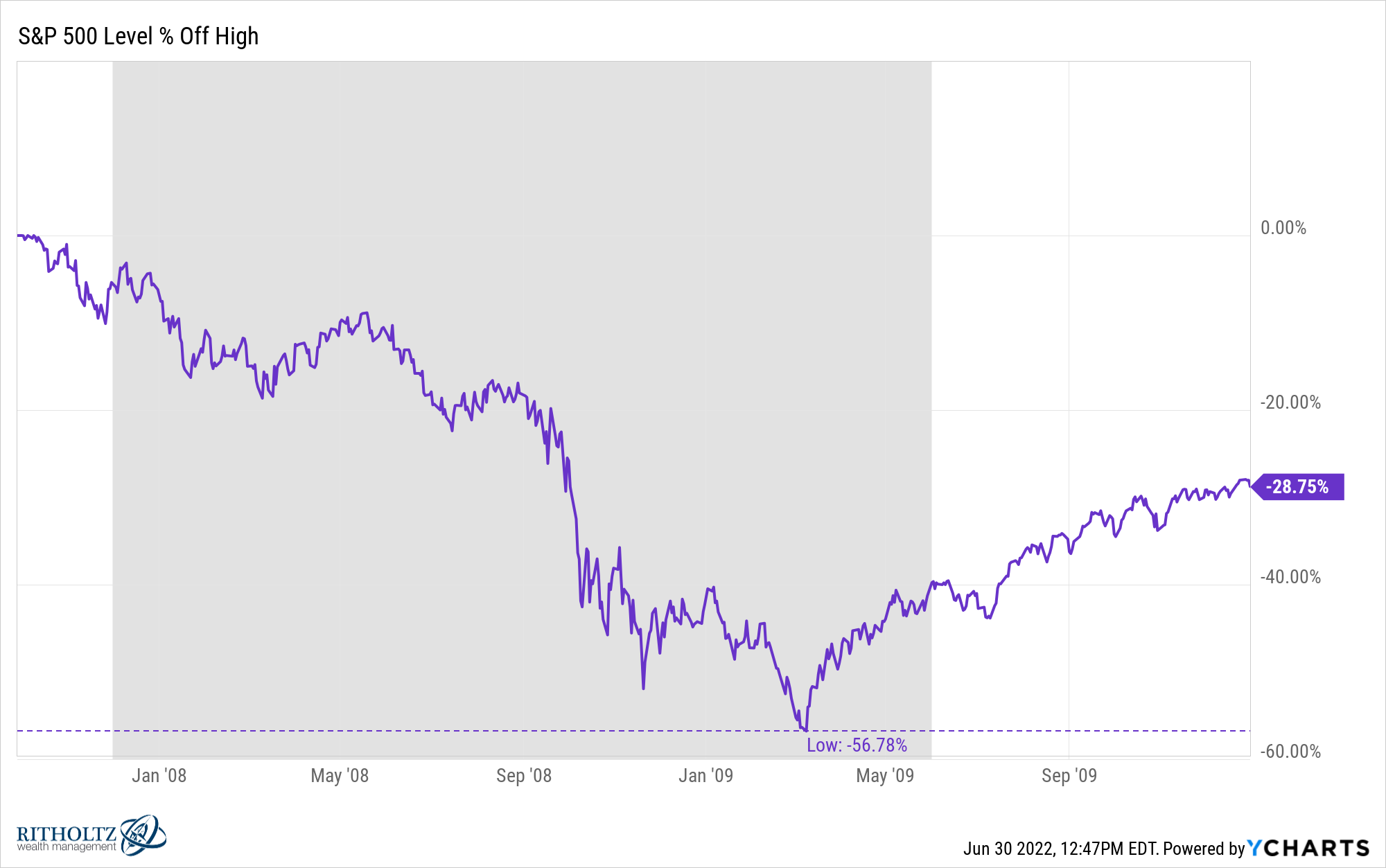

What happens after the worst quarterly returns in stock market history?

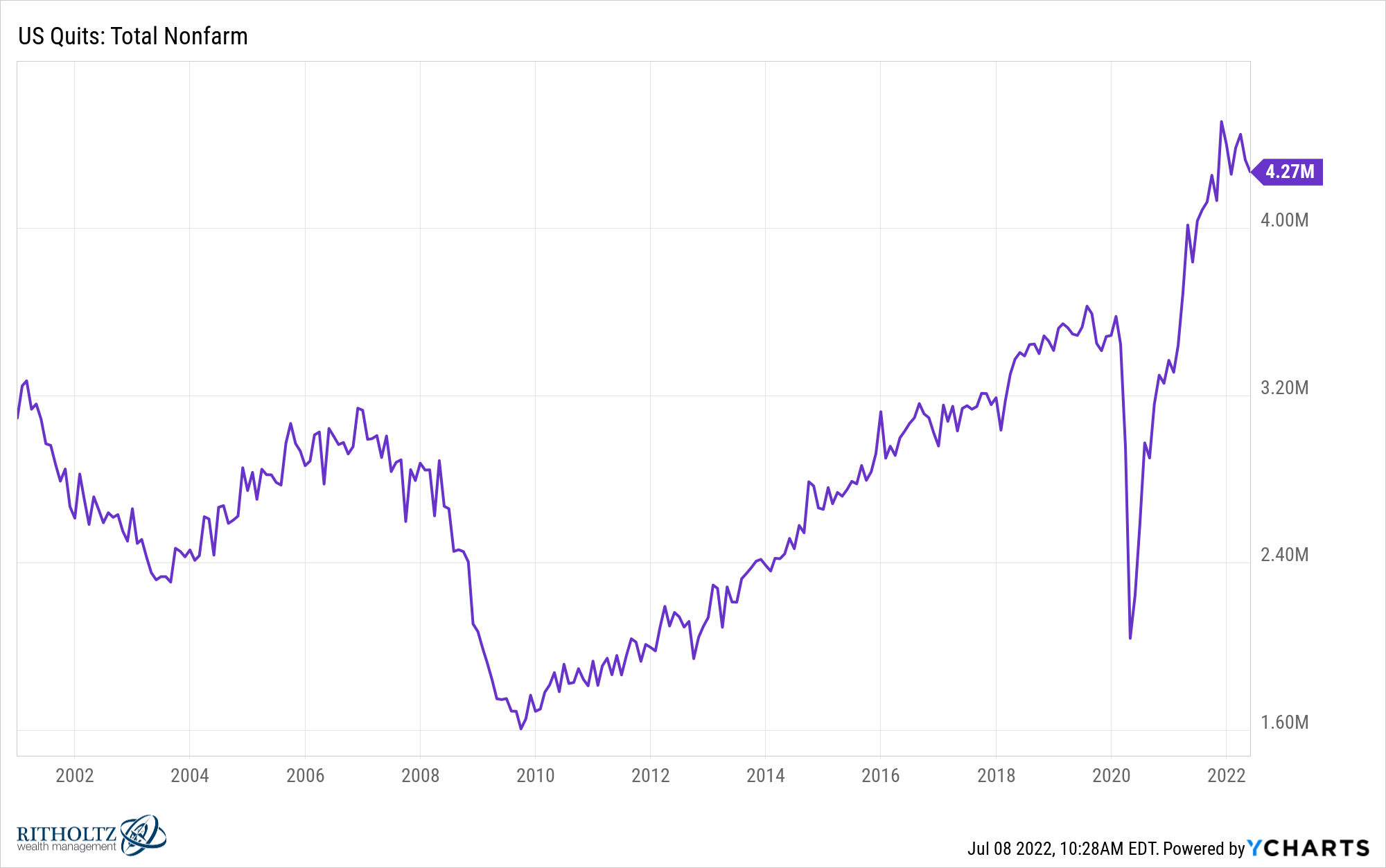

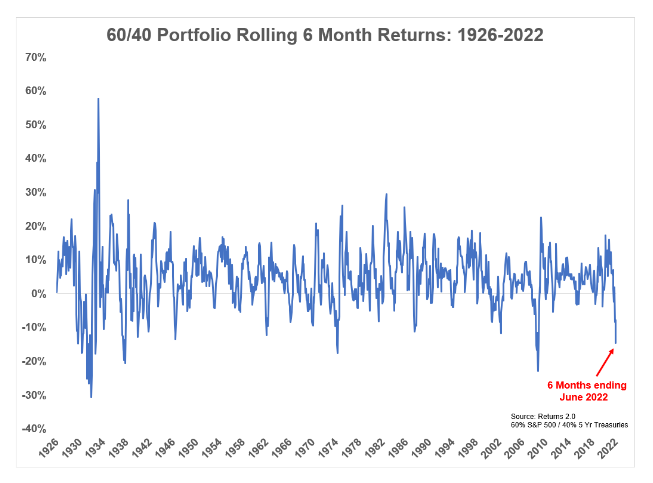

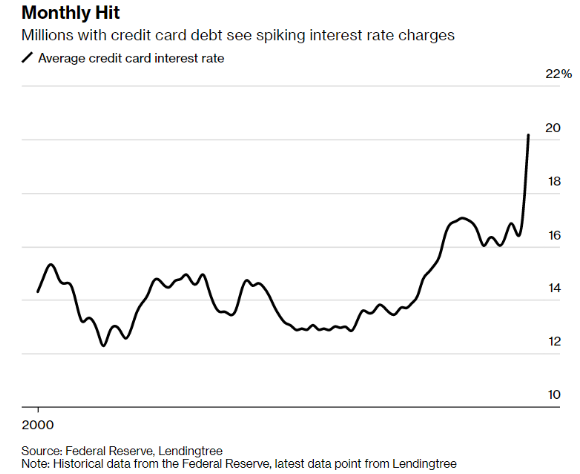

On today’s show, we talk about why the first 6 months of the year were one of the worst ever for financial markets, why it’s so difficult to gauge the economy right now, what’s priced into the stock market, the worst earnings call ever, the psychology behind inflation and much more.

On today’s Talk Your Book, we spoke with Michael Grant of Calamos about today’s macro-environment, how the Fed can guide us to a soft landing, short selling the past 18 months, and much more.

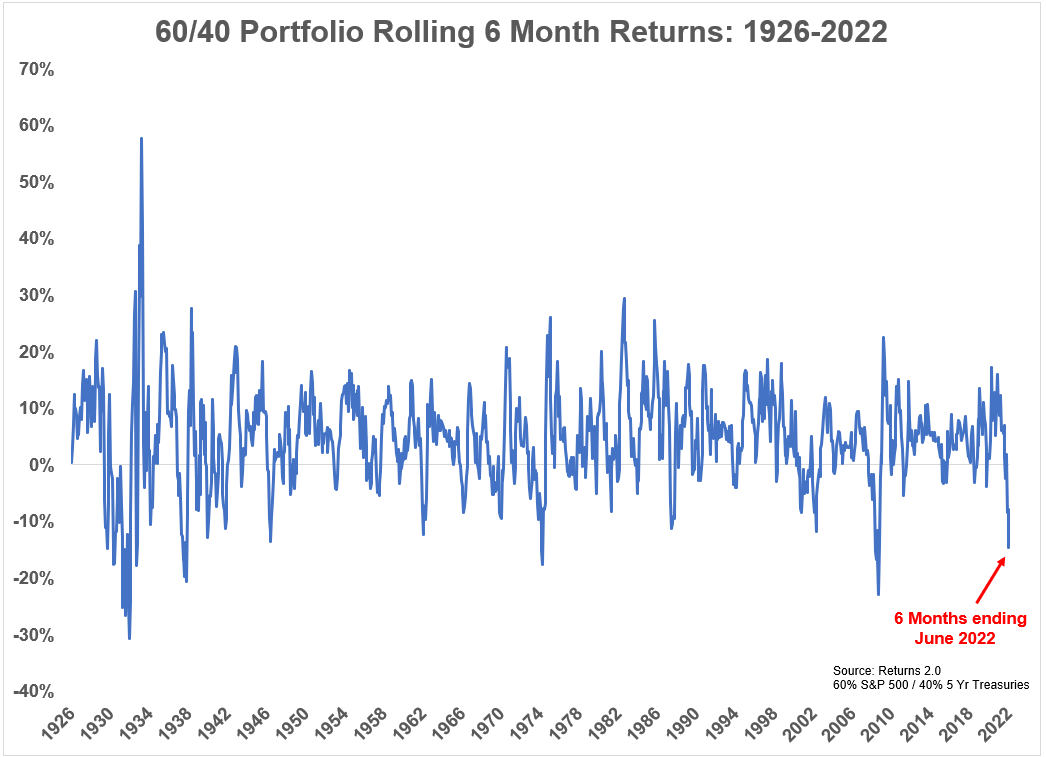

The first 6 months of 2022 were dreadful for financial markets. In fact, you could argue we just lived through one of the worst 6 month periods EVER for stocks and bonds. This isn’t hyperbole. The data backs it up. Here’s a look at the rolling six month returns1 for the S&P 500 going back…

Can the stock market predict a recession?

Answering questions about credit card rewards points, airlines, spending and more.