Why diversification is important even if you have all of your money in stocks.

Why diversification is important even if you have all of your money in stocks.

On today’s show, we discuss:

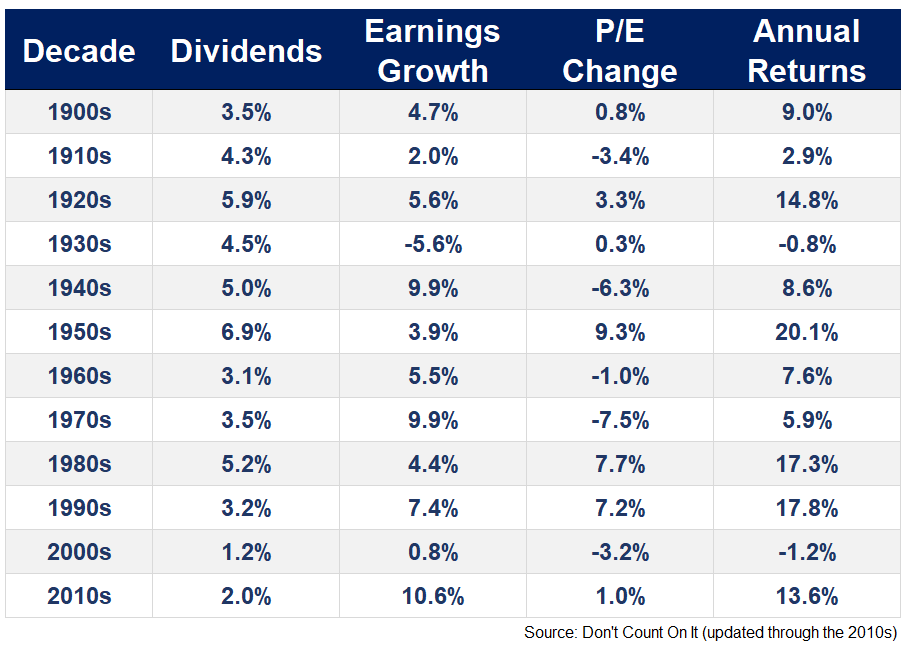

– When to get bullish in the long run

– How to use sell side stock research

– What’s wrong with Disney

– Cruises are underrated

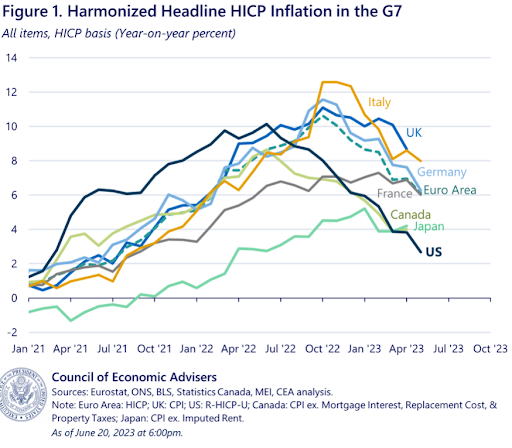

– How the pandemic messed up historical economic relationships

– 8% mortgage rates and 3% mortgage rates

– Why housing prices are still going up, and much more!

Why eff you money is overrated.

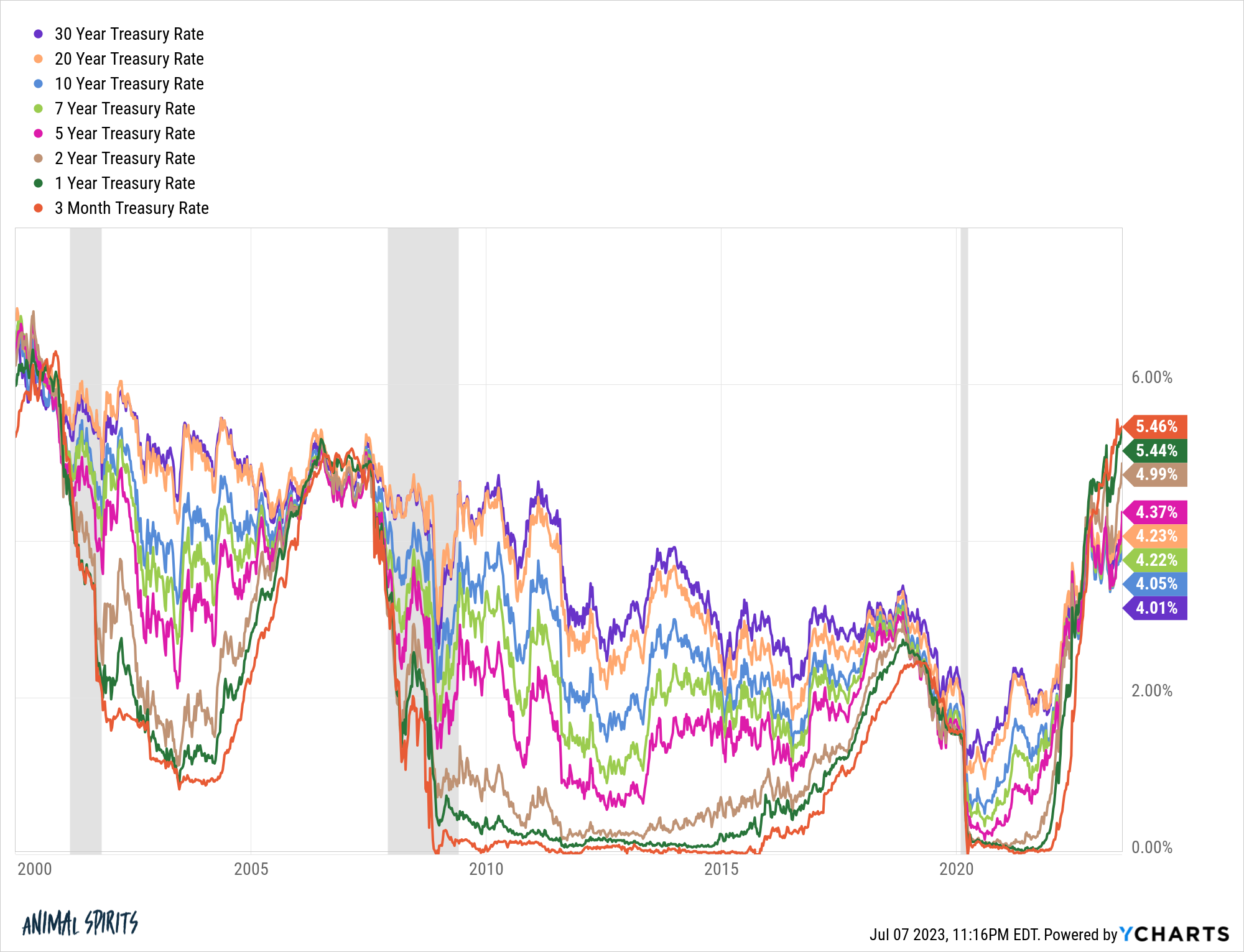

Why aren’t higher interest rates having a bigger impact yet?

Don’t fight the Fed (except when you do).

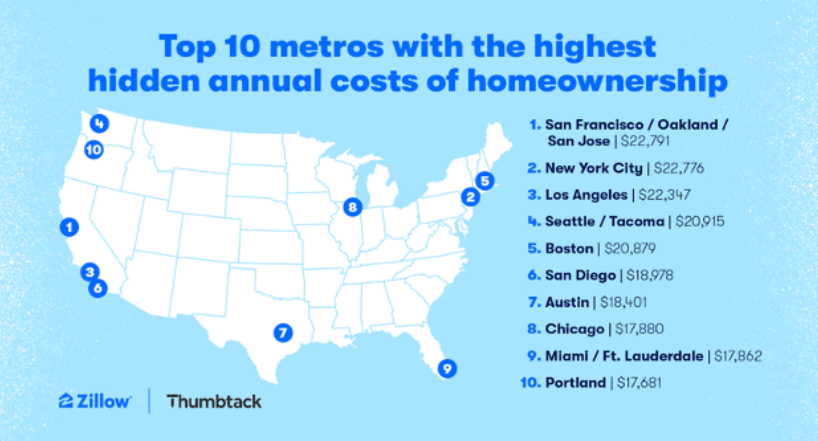

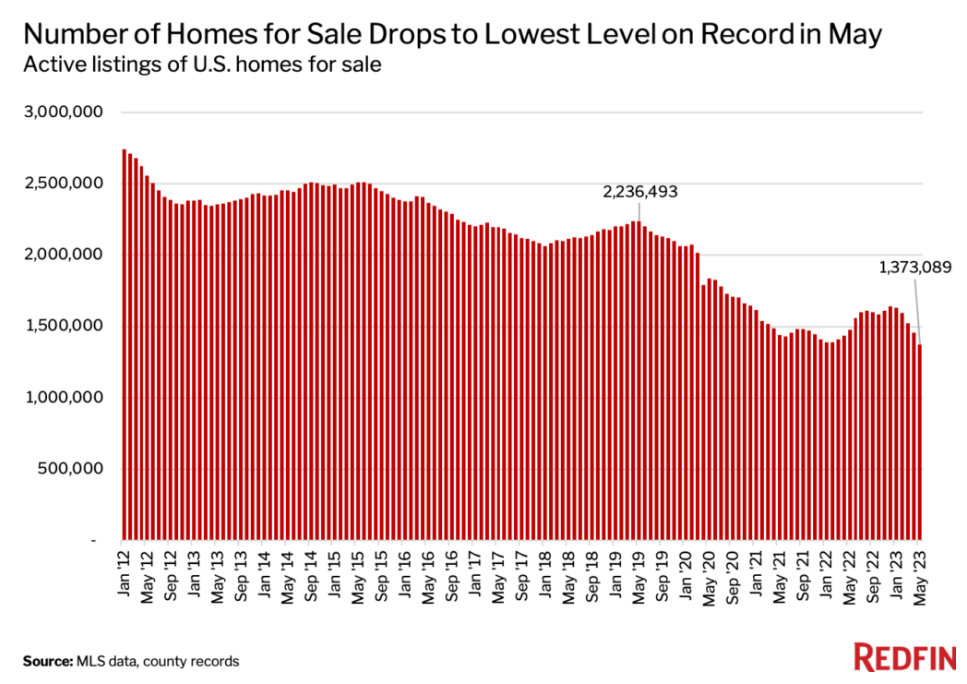

What if the housing market correction is basically over before it started?

On today’s show, we discuss:

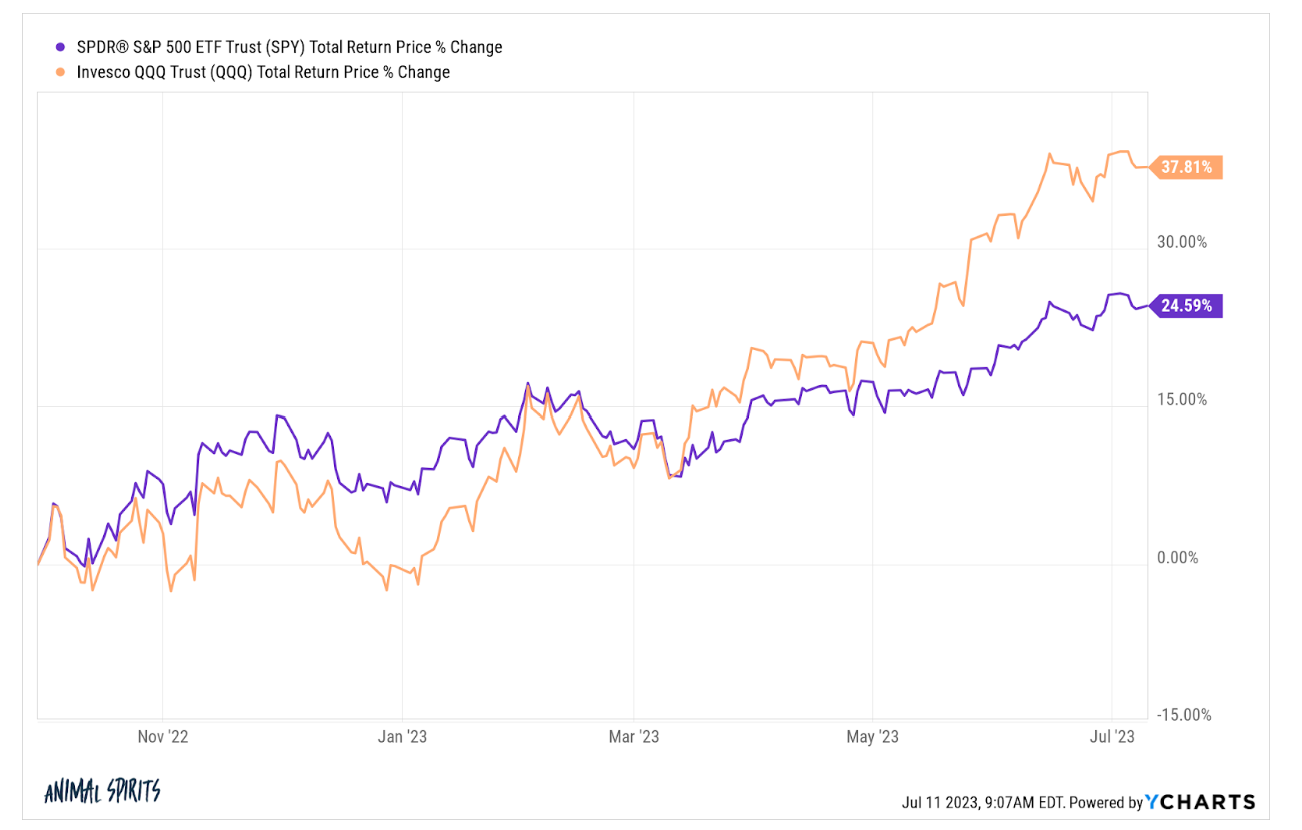

– The stock market fighting the Fed

– The power of index fund flows

– The most trustworthy source of financial advice

– An economic miracle in the United States

– How to pick a bottom in stocks

– People are desperate for a housing market crash

– Some thoughts on fireworks, and much more!

Why balance in all things is so important, yet difficult to pull off.

On today’s show, we are joined by Chris Hutchins, Host of All The Hacks Podcast to discuss:

– Credit card point devaluation

– The best credit cards to optimize spending

– Where to book flights

– Transferring points

– Hacking family trips, and much more!

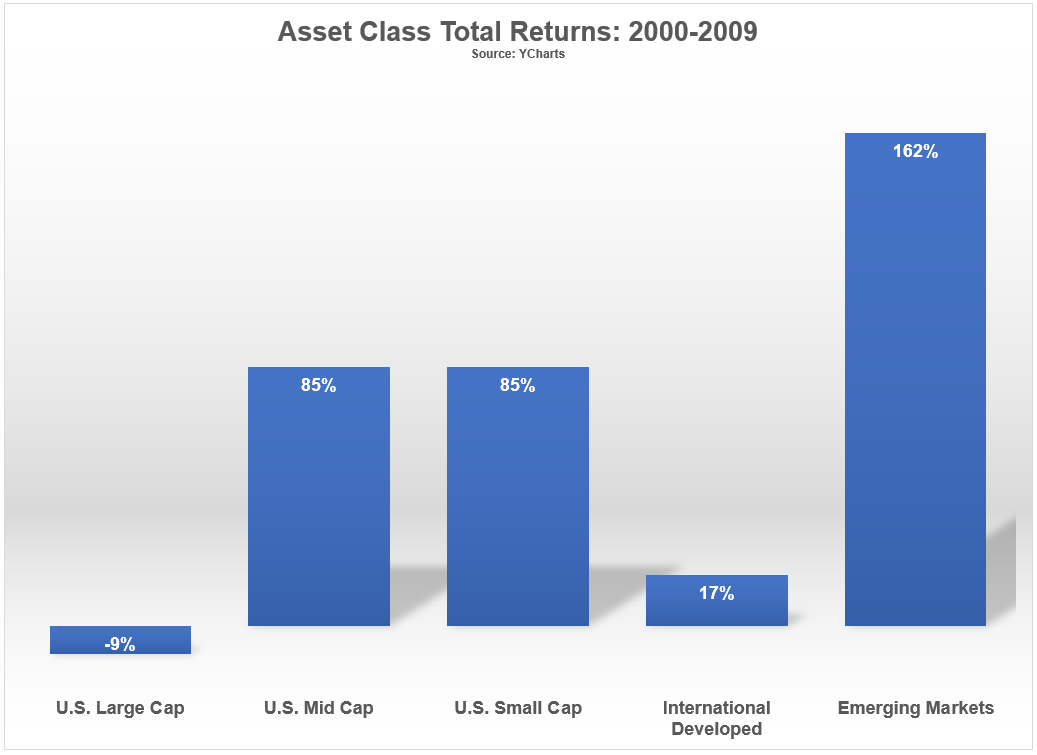

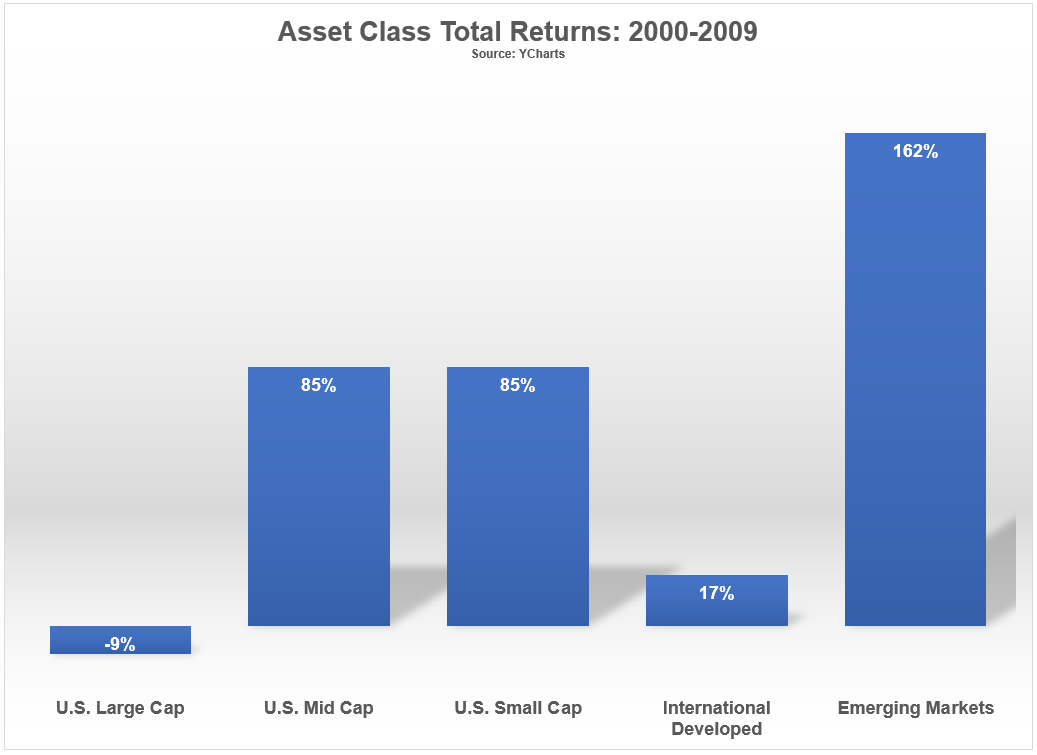

I have a hot take that’s been pre-heating in the oven for a while that goes like this: The Big Short by Michael Lewis has lost investors more money than the last 3 bear markets combined. Allow me to explain. We’ve all read (or watched the movie) about the band of misfits who made a…