My general theory about the internet is nothing is properly rated anymore because there are so many opinions out there today.1

The same is true when it comes to personal finance. Everything is probably over- or underrated.

Here are 3 financial concepts I think are overrated:

1. Eff-you money. Having enough money to do whatever you want whenever you want is the dream. Eff you money sounds wonderful…in theory.

The problem is most of the people who have enough money to do whatever they want whenever they want don’t do that. The reason they have eff you money in the first place prevents them from ever using it as such.

They become a slave to money and power. They work too much, they travel all the time, they fight online with other billionaires, and they have terrible relationships with their spouses or children.

The following comes from a New York Times profile of Elon Musk:

He said he had been working up to 120 hours a week recently — echoing the reason he cited in a recent public apology to an analyst whom he had berated. In the interview, Mr. Musk said he had not taken more than a week off since 2001, when he was bedridden with malaria.

“There were times when I didn’t leave the factory for three or four days — days when I didn’t go outside,” he said. “This has really come at the expense of seeing my kids. And seeing friends.”

The person with the most eff you money in the world sounds miserable to me.

I don’t have billions of dollars but I just took a week off work to spend time with my family on the lake. I have the time to coach my kids’ sports teams, go to their games and take part in school functions. I’m home in time for dinner every night.

Money is great and all but it can become so all-consuming that it defeats the purpose.

You don’t need millions of dollars to manage your time more efficiently. Having eff you money doesn’t make much of a difference if you don’t have your priorities straight.

2. A house is your best investment. Real estate can be a wonderful investment. You have the inherent leverage involved, the potential tax breaks and the long-term nature of the asset.

But for most people, owning a home is just a place to live that more or less keeps up with inflation after accounting for all of the costs involved. Housing is as much a form of consumption as it is a financial asset.

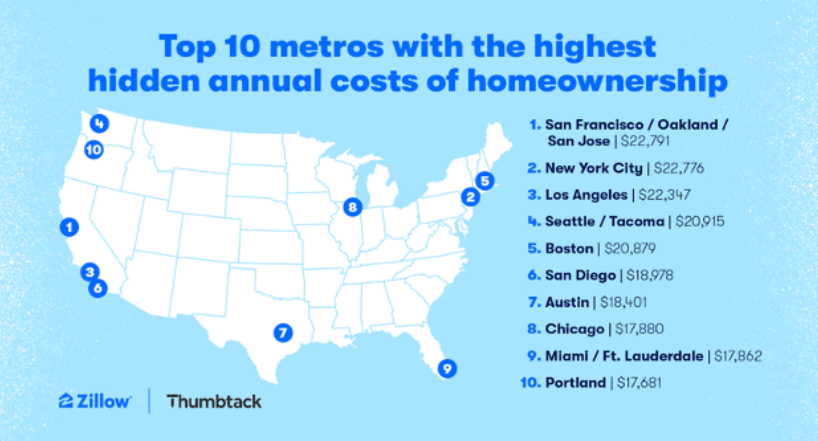

Zillow recently released a new report on the hidden costs of homeownership. They estimate the average ancillary homeownership costs — utilities, insurance, maintenance, property taxes, etc. — to be more than $14,100 a year. That’s an additional $1,100 a month on top of your mortgage.

And those numbers are even higher in most metro areas:

When you add in things like lawn care, furniture and all of the other stuff you have to buy to fill up your house, these numbers are probably on the low side.2

My point here is not that you should avoid buying a house. A house is still a worthwhile investment for most people. But the biggest return you get from owning a home mainly comes from the psychic income you receive from choosing your neighborhood and making a house your own.

The past few years have been a historical anomaly in terms of house price gains.

Owning a home is not a great investment for the simple fact that most people have no idea what their true rate of return is since no one really keeps track of all the costs involved in the process.

3. Paying off your mortgage early. I understand the psychological boost you can get from being debt-free. Some people simply cannot stand owing other people money.

Still, I don’t get paying off your mortgage early.

Sure, it gets you out of monthly housing payments along with the mortgage interest but that freedom comes at a cost.

First, you have the opportunity cost of that money that could be invested elsewhere, not in the illiquid roof over your head. Once that money is in your house you can’t really get it out unless you borrow money against your home or sell it.

Plus, a mortgage is tax-advantaged debt. Over a 30 year long period inflation will eat into a huge chunk of that debt. A house is already a pretty decent hedge against inflation but with a fixed-rate mortgage, all the better.

And the leverage allows you to not put all of your eggs into one basket when it comes to your investments.

That money also means a lot more to you when you are young and have the ability to allow compound interest to do the heavy lifting for you in the stock market.

I like the idea of having your mortgage paid off by the time you retire. That makes all the sense in the world.

Paying it off early makes zero sense to me.

Further Reading:

Why I Might Never Pay Off My Mortgage

1The other thing is the internet has simply revealed there are always people out there with different tastes than you…and that’s OK. There is a huge difference between “the best” and “my favorite.”

2Plus you have all of the frictions involved with buying and selling a home like realtor fees, closing costs, appraisals, moving expenses, etc.