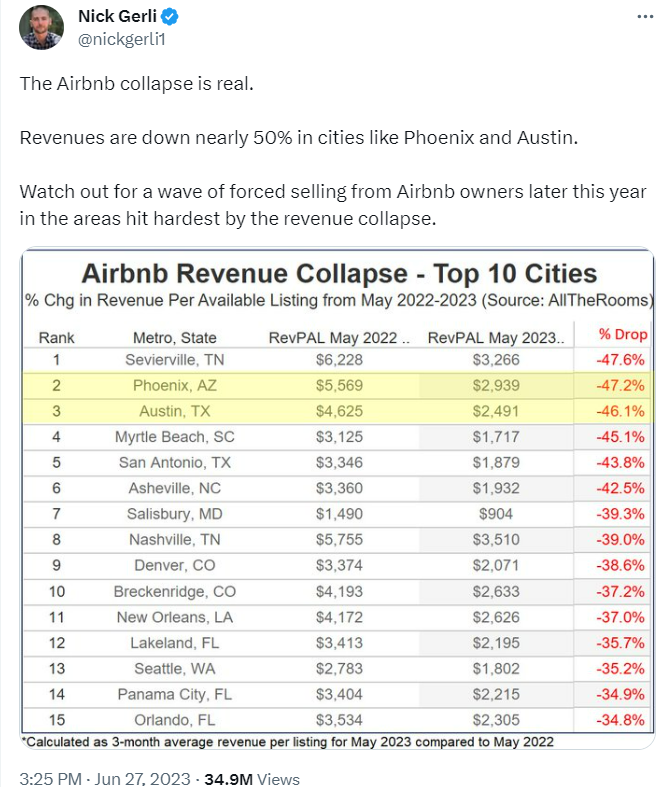

There was a viral post on Twitter last week about an Airbnb revenue collapse:

Sounds scary.

According to Elon Musk’s money pit of a company, this tweet had millions of views. A lot of people wanted this to be true because it would show how fragile the housing market is these days.

A crash at last!

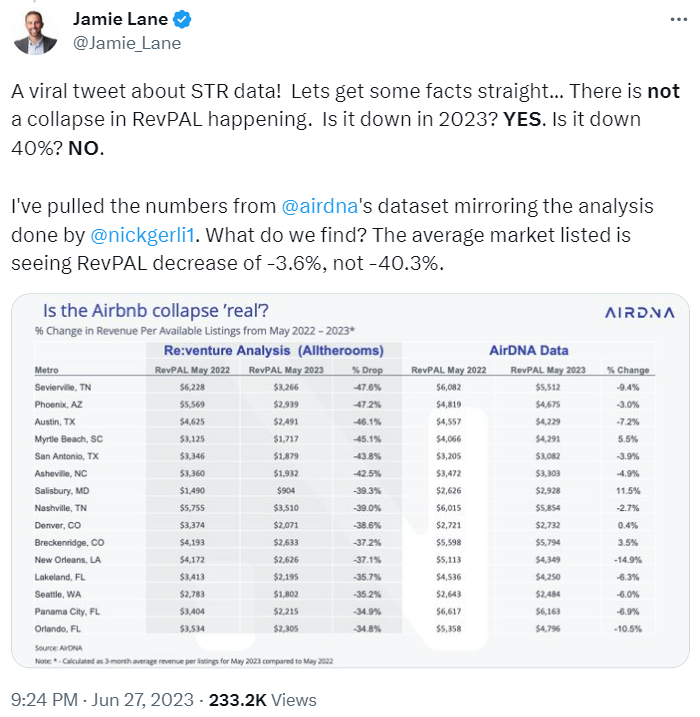

Alas, there was a follow-up fact-check tweet that called into question the veracity of the Airbnb collapse:

I’ve stayed at a few Airbnbs in my day but I’m not an expert on this stuff.

Maybe this collapse thing is real. Or maybe it’s a made-up number to scare people on social media.

One way or another, the data will be your North Star here.

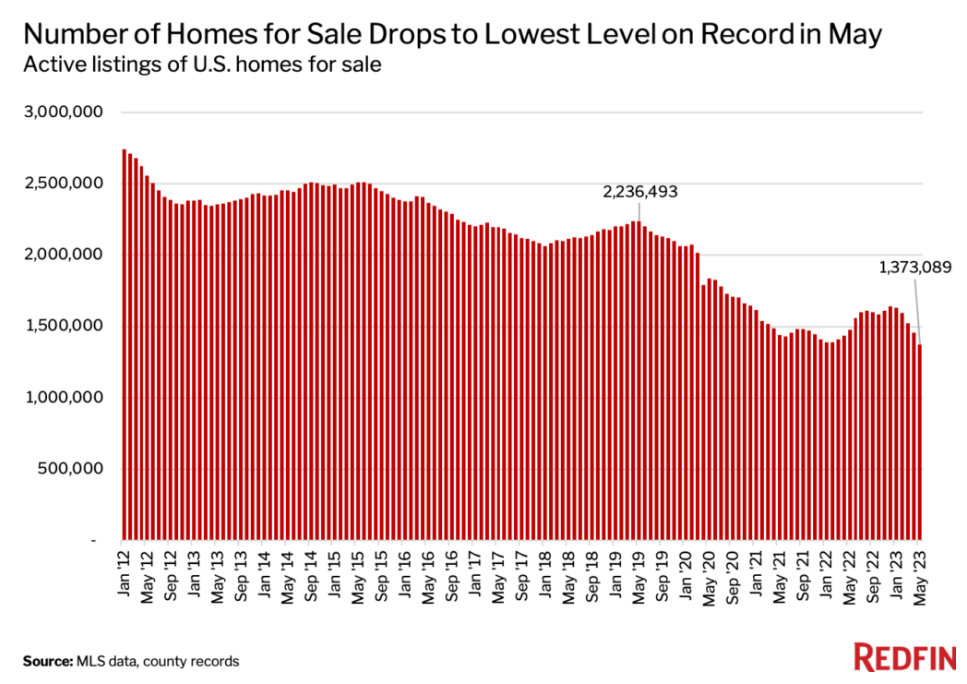

If this collapse in Airbnb revenue is real, you’ll see a wave of forced selling from buyers who got in over their heads.

As of now it’s certainly not showing up in the data. According to Redfin, the supply of houses for sale is as low as it’s ever been on record:

Maybe that scary tweet will be proven right someday.

Anything is possible.

But the reason that tweet has millions of views while the fact-check one has a fraction of that is because so many people want the housing market to crash.

Housing prices went up 50% during the pandemic.

Mortgage rates went from 3% to 7% seemingly overnight.

How could the housing market not crash?!

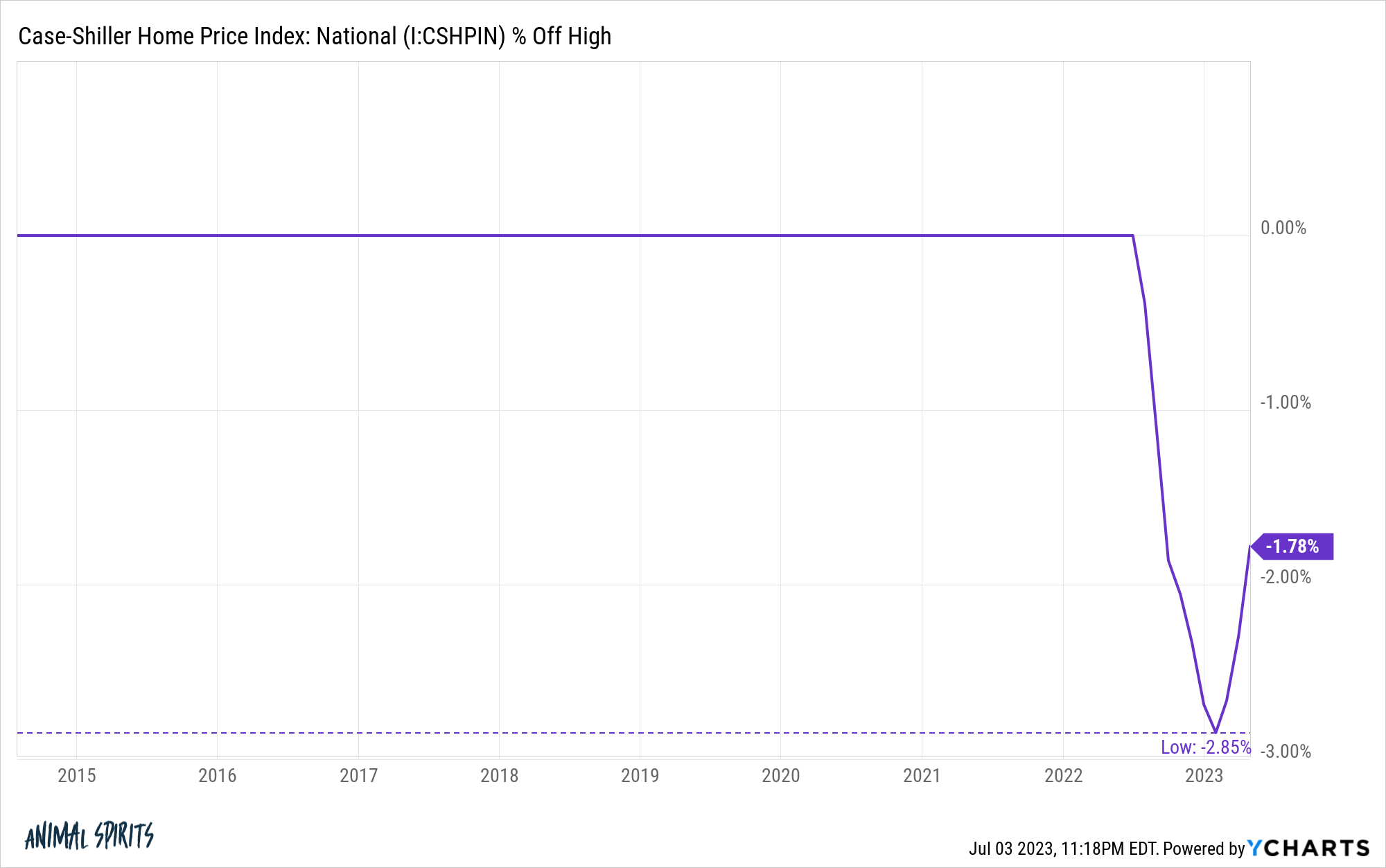

Not only have housing prices avoided a crash thus far, but it’s also possible the mild correction in prices might already be over.

Here’s the latest data from Yahoo Finance:

Home prices grew for the third straight month in April, potentially cementing a recovery in values and reflecting a housing market that is sorely undersupplied.

The S&P CoreLogic Case-Shiller US National Home price index increased by 0.5% in April on a seasonally adjusted basis compared with the previous month, according to data released Tuesday. The index that tracks housing prices in the 20 biggest metros showed prices in April rose 0.9% on a seasonally adjusted basis over March, better than the 0.35% gain expected by economists surveyed by Bloomberg.

Similarly, the Federal Housing Finance Agency reported Tuesday that average US home prices grew 0.7% month over month in April on a seasonally adjusted basis.

Far from crashing, housing prices are actually rising nationally.

Here’s a look at the drawdown profile for the Case-Shiller National Housing Index:

Housing prices fell a little less than 3% at the nadir of this cycle. Now that prices are rising we’re less than 2% from all-time highs in housing prices.

Maybe this is simply a minor reprieve. It’s possible housing prices could roll over again if mortgage rates stay at 7% for the foreseeable future.

Logic says housing prices should fall more than they did.

But a lack of housing supply, 70+ million millennials, people with 3% mortgages and the fact that we didn’t build enough houses in this country following the last housing bust could end up overriding that logic.

If you would have told me 18 months ago that inflation would hit 9%, the Fed would go on one of their most aggressive rate hiking binges in history and mortgage rates would more than double, I would have figured a 10-15% correction in housing prices would be on the table.

That might have been my baseline assumption.

Plenty of people would like to see prices fall even more than that.

It’s looking more and more likely that’s simply not going to happen.

Michael and I talked about the housing and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

The Worst Housing Affordability Ever?