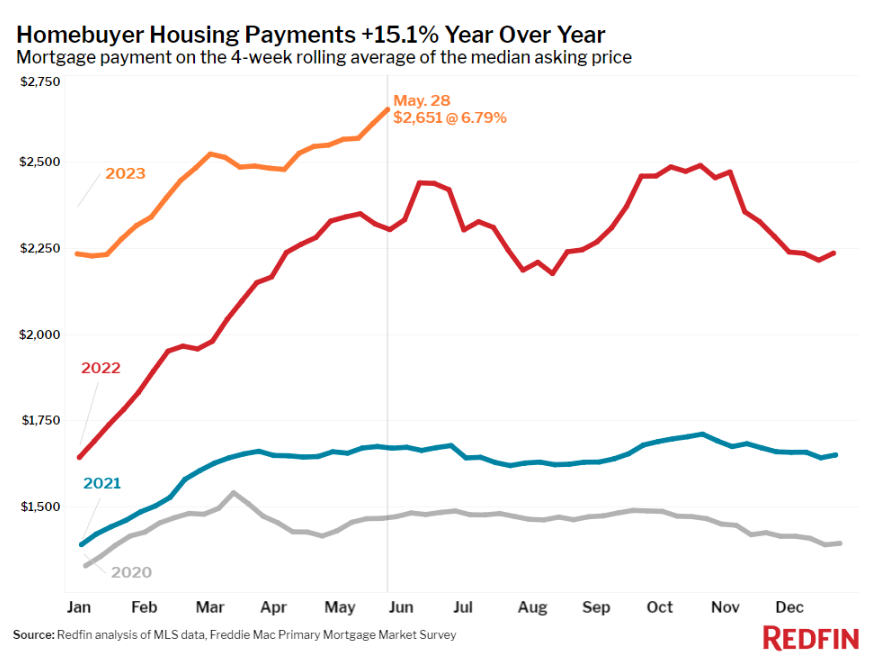

Each week Redfin puts out a housing market update full of valuable data and nice-looking charts of trends on sales prices, asking prices, new listings, housing supply and more.

This one has to be painful for anyone who’s in the market for a house right now:

The year-over-year numbers up 15% are bad enough being but just look at how much more affordable things were as recently as 2020 and 2021.

This is part of the reason the housing affordability issue is that much more excruciating now — the pace of the increases happened so quickly.

We’ve simply never seen prices and rates rise this fast in such a short period of time.

The I-can’t-believe-I-missed-it factor has to be off the charts right now.

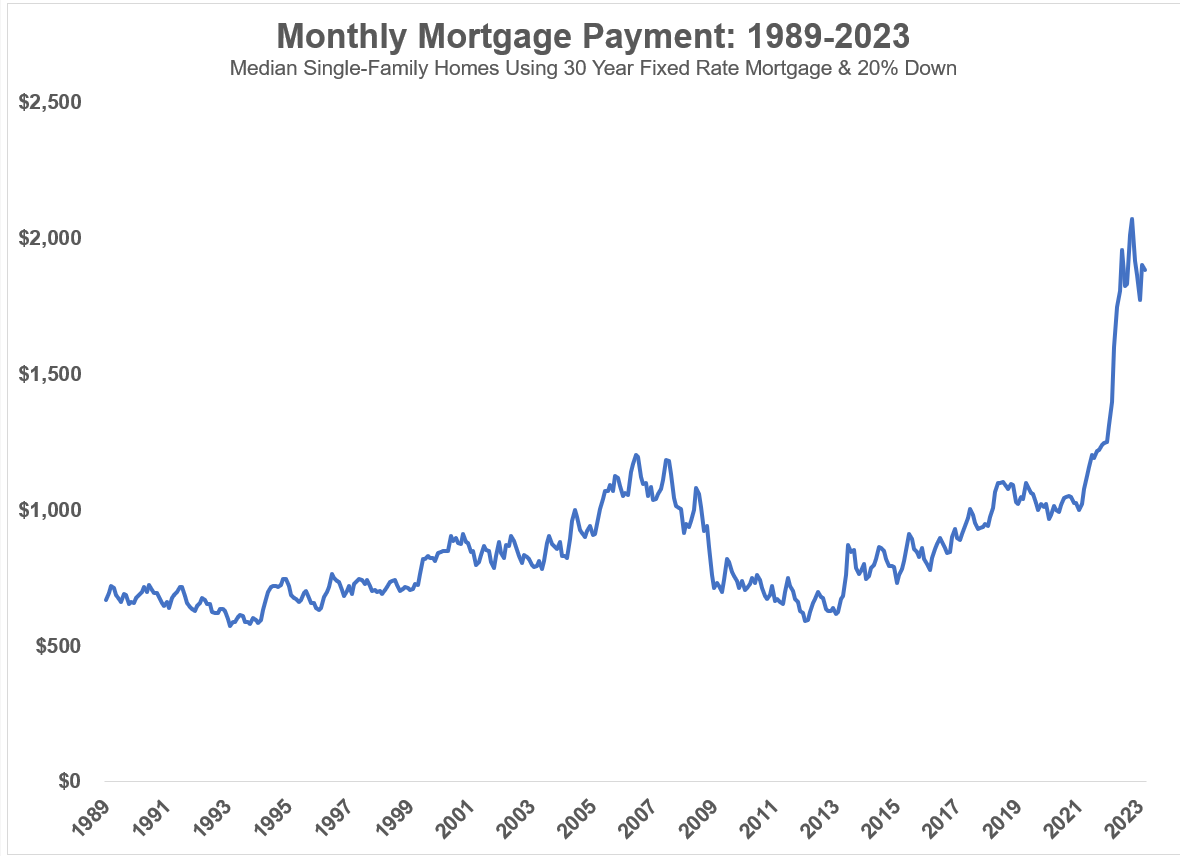

I occasionally update a chart of average monthly mortgage payments over the past three-plus decades using median existing home sale prices, 30 year mortgage rates and the assumption of a 20% down payment:

See if you can spot the run-up in prices and mortgage rates.

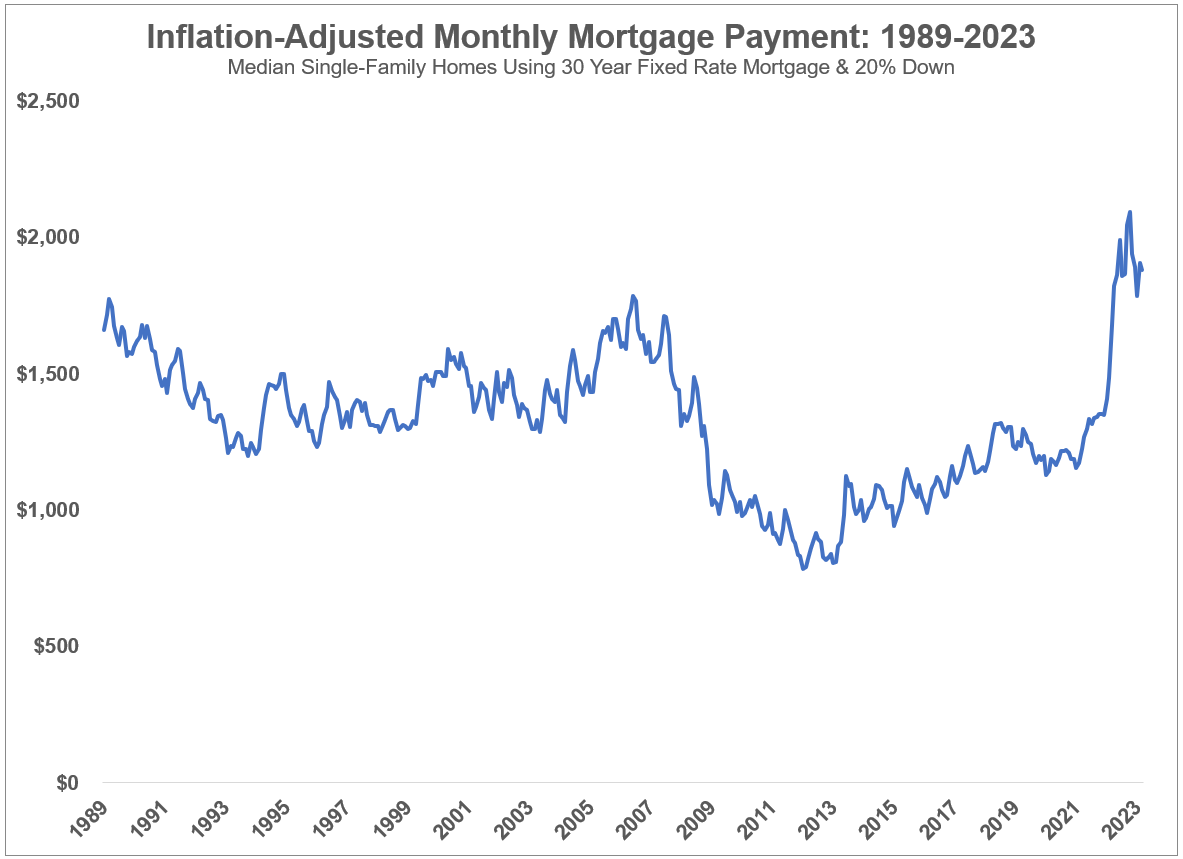

Even when adjusting for inflation to even things out a bit, housing prices are precarious at the moment for anyone taking on a new mortgage payment:

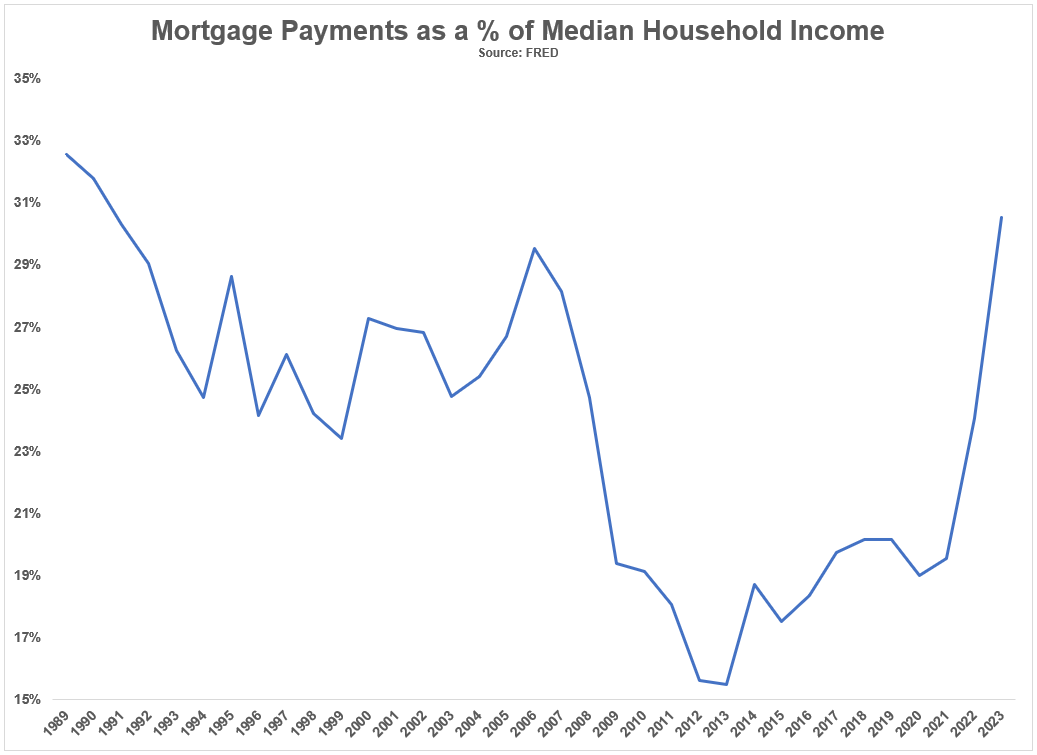

There is a personal finance rule of thumb that goes something like this — spend somewhere in the range of 28-30% of your income on housing.

These things are not written in stone but that’s probably not a bad starting point with the usual caveats that it depends on your circumstances, where you live, how much you save, yada, yada, yada.

Using the same median price data for existing homes in the United States, I compared the monthly payment over time to the median household income going back to 1989:

This is just monthly mortgage payments and does not include things like insurance, property taxes or upkeep so this isn’t all-encompassing in that 28-30% spending rule.

But this does a nice job of putting current mortgage payments into context. Shockingly, mortgage payments were higher as a percentage of median household income back in the late-1980s and early-1990s.

The good news is real incomes have increased over time while rates were falling. That helped.

The bad news is rates and prices rose so quickly that we’ve erased affordability overnight.

It’s probably not helpful to those in the market for a house today, but with the benefit of hindsight, the 2008-2017-ish range looks like a generational buying opportunity in residential real estate.

If you purchased a home in that time frame, consider yourself lucky. I do.

So what are your options if you’re in the market for a house right now?

You could wait. Housing prices have come down a bit but not nearly enough to make up for the change in rates and enormous gains we’ve seen in recent years.

With mortgage rates back to nearly 7% one would expect prices to continue correcting. I could see mortgage rates staying in the 6-7% range IF the economy keeps humming along and IF the Fed doesn’t throw us into a recession.

Higher for longer mortgage rates could certainly be a headwind for the housing market.

However, that’s not a guarantee because of the supply-demand imbalance we have.

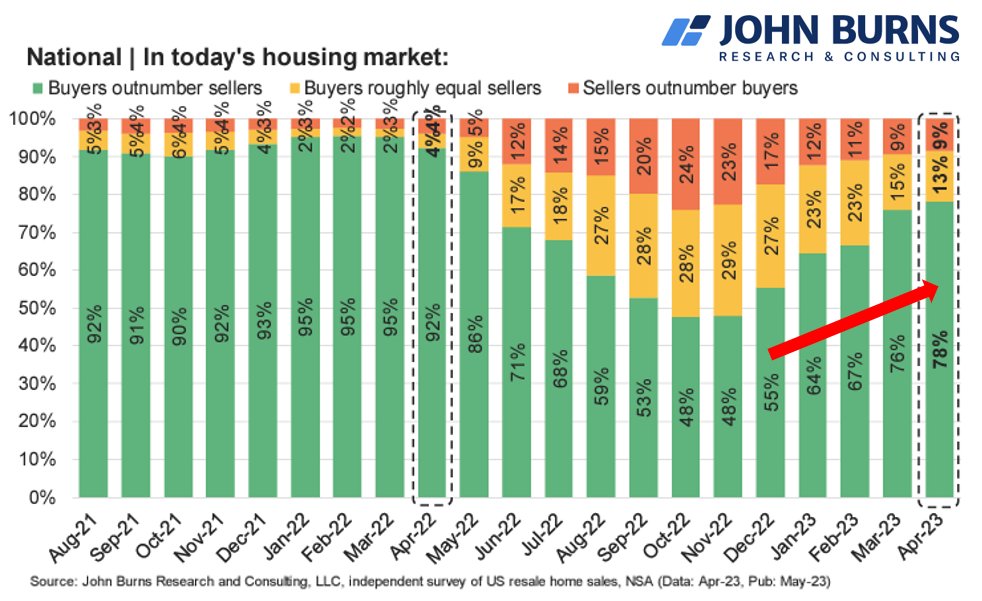

John Burns Research shows buyers still outnumber sellers by a wide margin in today’s market:

The other problem with waiting is housing is more of a personal asset than a financial one. The finances of it obviously matter but most people move because of life reasons, not investment reasons.

You could buy and hope. Finance people love to say that hope is not a strategy. It’s a good saying but most big financial decisions have to incorporate some element of hope in them.

Let’s work through the different levels of hope you’d be baking into buying a house right now, even at these price and mortgage rate levels:

- You hope you can grow into your payment over time. The best part about a fixed rate mortgage is your payment is, well, fixed and your income will likely grow over time. This is one of the reasons housing is such a good inflation hedge.

- You hope mortgage rates will go down. If we do go into a recession or inflation falls even more or both you would expect interest rates to go down which would in turn mean mortgage rates would fall. That average $2,651 monthly payment at 6.79% would fall to $2,062 at 4.5%. I can’t promise the ability to refinance at those rates in the coming years but it would make buying at current levels make more sense if it happens.

- You hope the housing market doesn’t roll over. It wouldn’t be much fun to make one of the biggest purchases of your life only to see it fall in value immediately after buying. I understand this worry but it matters much more if you’re a short-term homeowner. I don’t like the idea of buying a house if you’re not going to own it for a minimum of 7-10 years, which would help lessen the importance of the current price point.

Here’s the thing — no matter what type of housing market we’re in, the only variable that matters is this: can you afford the monthly payment and ancillary costs that come with owning a home?

For some people right now that answer is a resounding NO.

Others will plug their nose and continue buying right now because they want or need to own a home, prices and mortgage rates be damned.

Further Reading:

The Housing Market Lottery