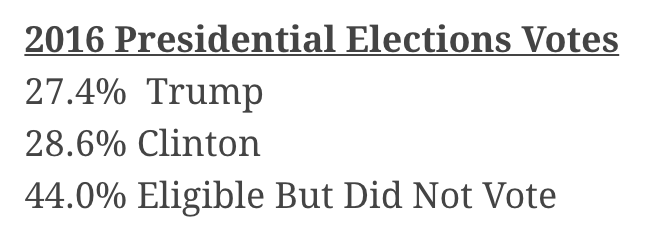

It’s estimated 44% of eligible voters didn’t fill out a ballot for the 2016 elections.

That amount of people vastly outnumbered those who voted for Trump, Clinton or any of the third party candidates. Here’s the data courtesy of The Big Picture:

Trump and Clinton were both in the 60 million range while the number of people who didn’t vote was estimated at 100 million.

Data also showed the proportion of young people who voted was dwarfed by the proportion of the older generation who voted. It’s estimated less than 50% of millennials showed up at the polls while nearly 70% of boomers voted.

The question many people wonder is this: How can we get more young people to show up to vote?

You could make the argument for performing your civic duty by guilting people into voting by posting your “I Voted” sticker on social media but that doesn’t seem to work.

My theory on this is the best way to increase voter turnout would be giving people the option to vote online.1 If you want people to do something and logic doesn’t change their behavior, try making it easier for them.

There are obviously security concerns in terms of hacking but this option would also decrease the costs associated with voting since the overhead would be drastically reduced.

But maybe I’m wrong about this one based on what happened in Switzerland.

Switzerland introduced a mail-in voting option for the country with the aim of increasing voter turnout through a combination of lower costs and increased convenience to vote. In theory, this makes sense from the perspective of an economist.

Unfortunately, people’s actions don’t always live up to rational economic theories because of unintended consequences.

In Switzerland, every citizen 18 and over is automatically registered to vote and can have the documents sent to their home prior to the elections. All they have to do is fill it out and drop it in the nearest mailbox to vote.

Researchers in Europe studied the voter turnout between 1971 and 2003. They then looked at the impact of an optional mail-in vote. Surprisingly, the addition of a mail-in option didn’t have much of an impact on voter turnout at all.

The results were twofold:

(1) Adding a low-cost voting option didn’t increase voter turnout in a meaningful way.

(2) The size of the community involved had a big impact on the behavior of voters when this was introduced. In larger communities, there was an increase in the number of voters while there was actually a decrease in turnout for smaller communities.

The researchers posited social pressure was the determining factor in these results. In smaller communities, many of which have just one voting station, social pressures exist to be seen showing up to vote. Once that constraint was taken away, fewer people felt the need to prove to others in their community that they voted.

On the other hand, the convenience of not going to a crowded voting station led to an increase for the more populous communities. But the end result was basically a wash in terms of overall voter turnout.

I’m not holding my breath for an Internet voting option in the U.S. anytime soon but based on this research the end result from this idea would potentially be a change in the composition of voters but maybe not the overall number of voters.

So one party would likely benefit more than the other which is why this will probably be unfeasible for the foreseeable future.

*******

This idea of social pressure in the voting booth got me thinking about how our financial decisions can be impacted by societal norms. Here are a few that came to mind:

- Once you get out of school you should buy a house. Buying a house can be a good financial decision but it’s not for everyone, especially young people who should crave flexibility as they figure things out.

- Buying a house is always better than renting. Renting is just throwing away your money and paying for someone else’s mortgage, right? This choice is situation-dependent and the financial implications of buying a home are often highly underestimated.

- Young investors should have all of their money in stocks. This is another one that works well in theory but fails to take into account the human element of seeing your savings get chopped in half on occasion.

- Keeping up with the Joneses. Researchers at the Federal Reserve found the neighbors of lottery winners are more likely to borrow money, spend money on conspicuous goods, speculate with their investments, and eventually declare bankruptcy.

Further Reading;

Social Proof in the Markets

1The other lay-up idea here is to make election day a national holiday to make it easier to vote for those who work during the day. And while we’re at it let’s make the first two days of March Madness holidays as well.