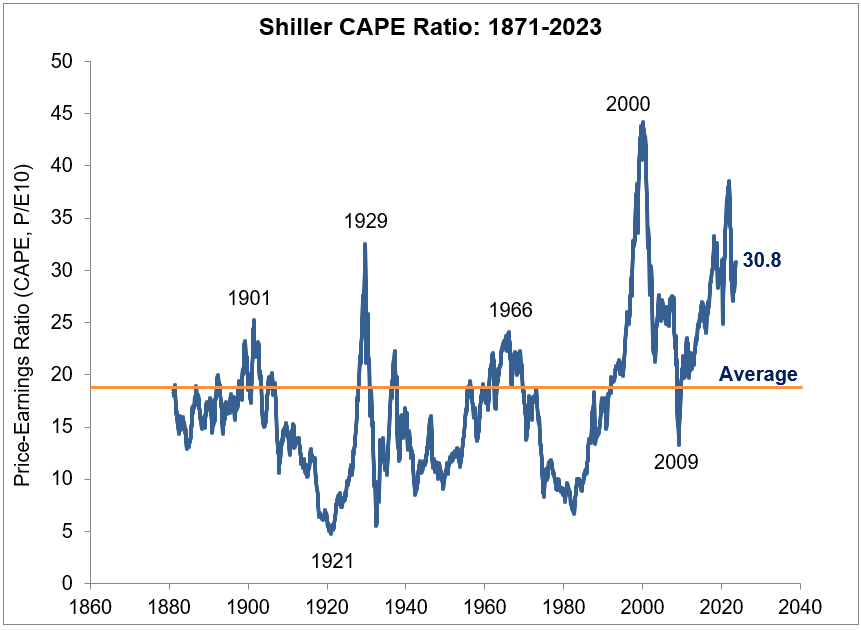

How expensive are stocks relative to bonds?

How expensive are stocks relative to bonds?

We are joined by Francisco Bido, Senior Portfolio Manager for the Integrated Alpha group of F/m Investments to discuss:

– Screening out companies

– Growth vs value investing

– Investing in Apple

– Avoiding Tesla, and much more!

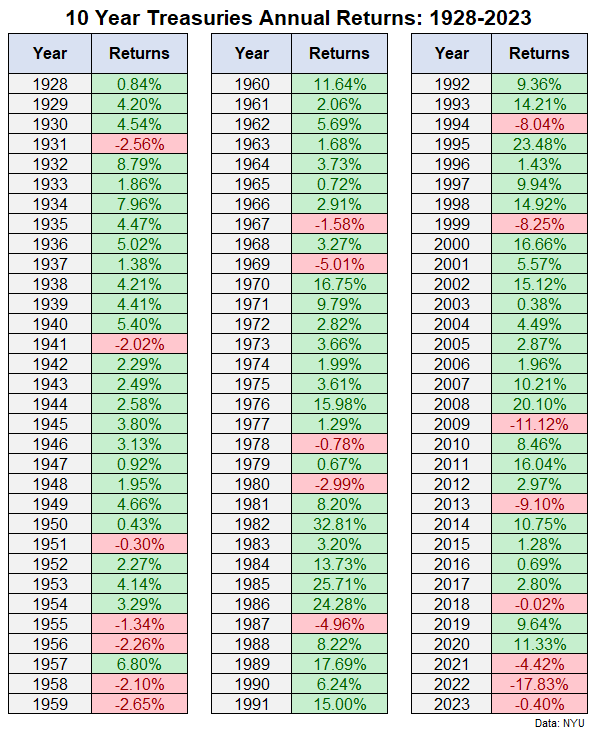

Why inflation is good and bad at the same time.

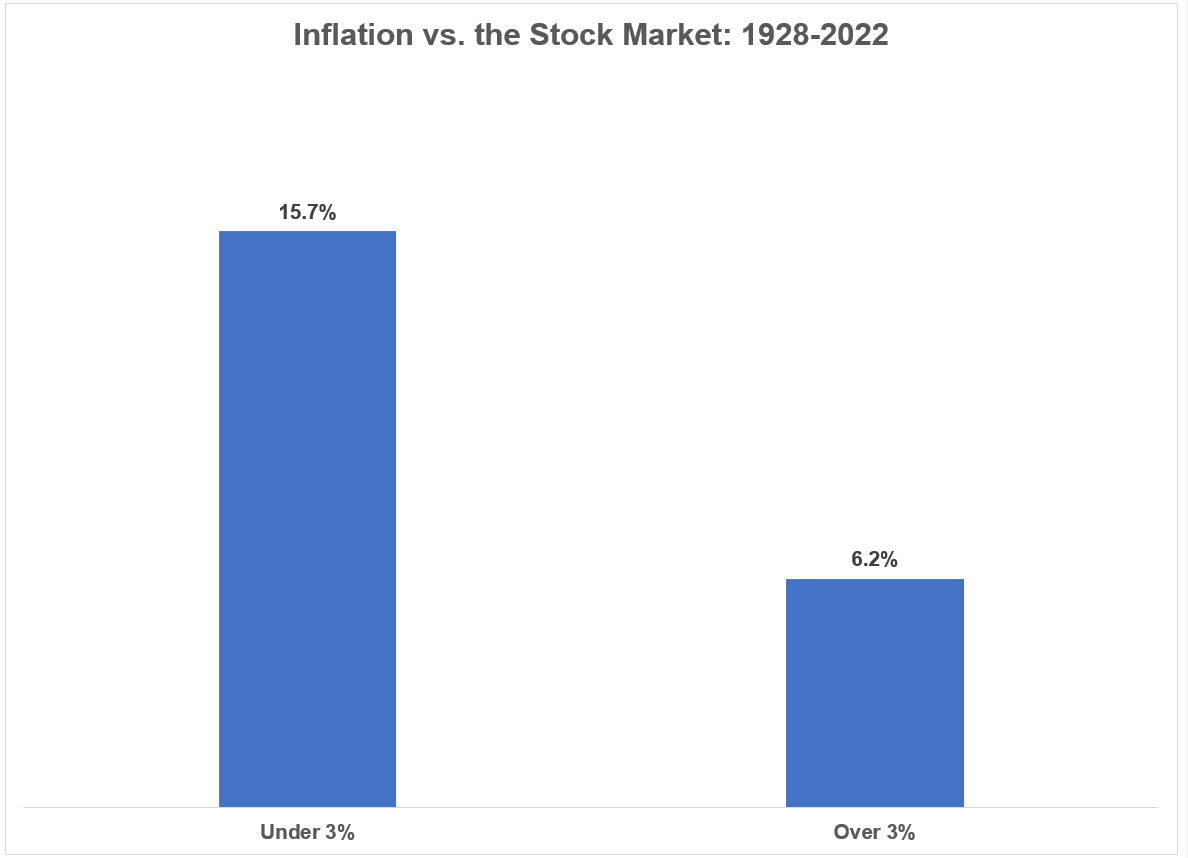

Robert Shiller has a free online database of historical stock market data I’ve been using for years. Going back to 1871, Shiller has data on historical interest rates, dividends, earnings, inflation and valuations. His preferred valuation measure is the cyclically-adjusted price to earnings (CAPE) ratio The average CAPE ratio going back to 1871 is 17.4x…

How to deal with a large increase in your income in a short period of time.

On today’s show, we discuss:

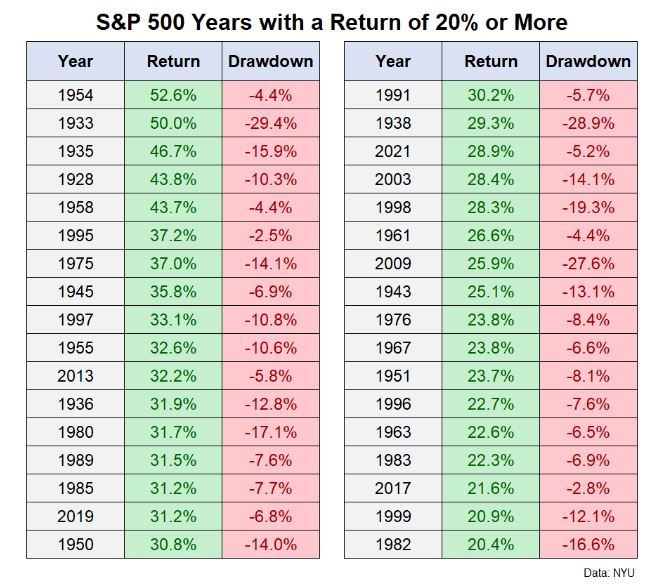

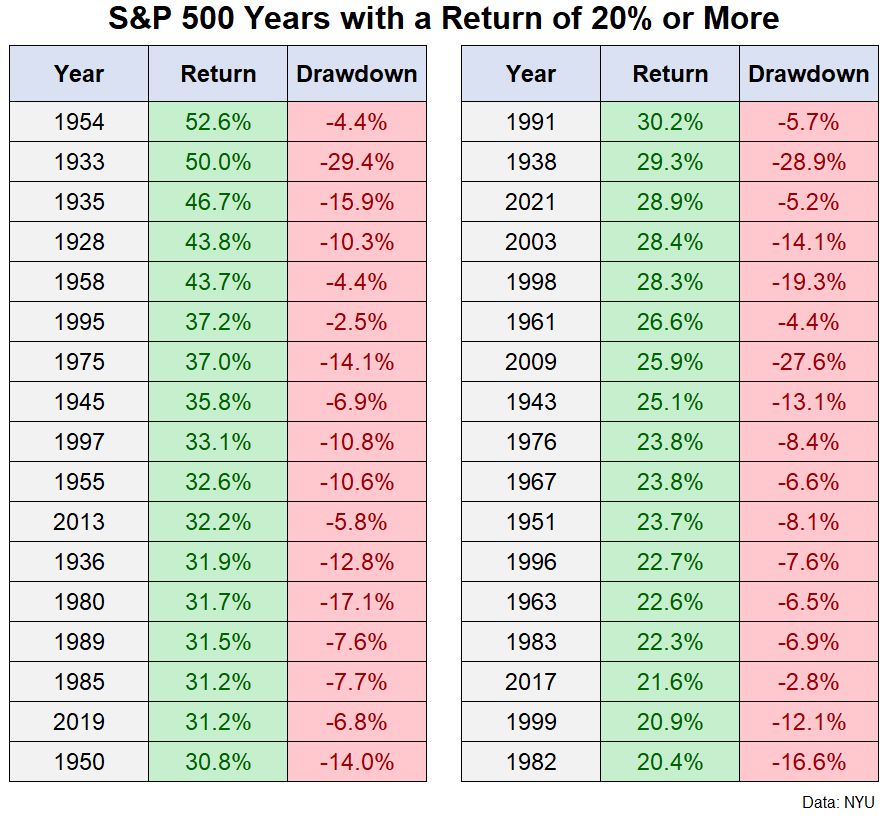

– Bull market corrections

– Why valuations don’t matter all that much

– Why people were so wrong about the stock market

– Why we haven’t gotten a recession yet

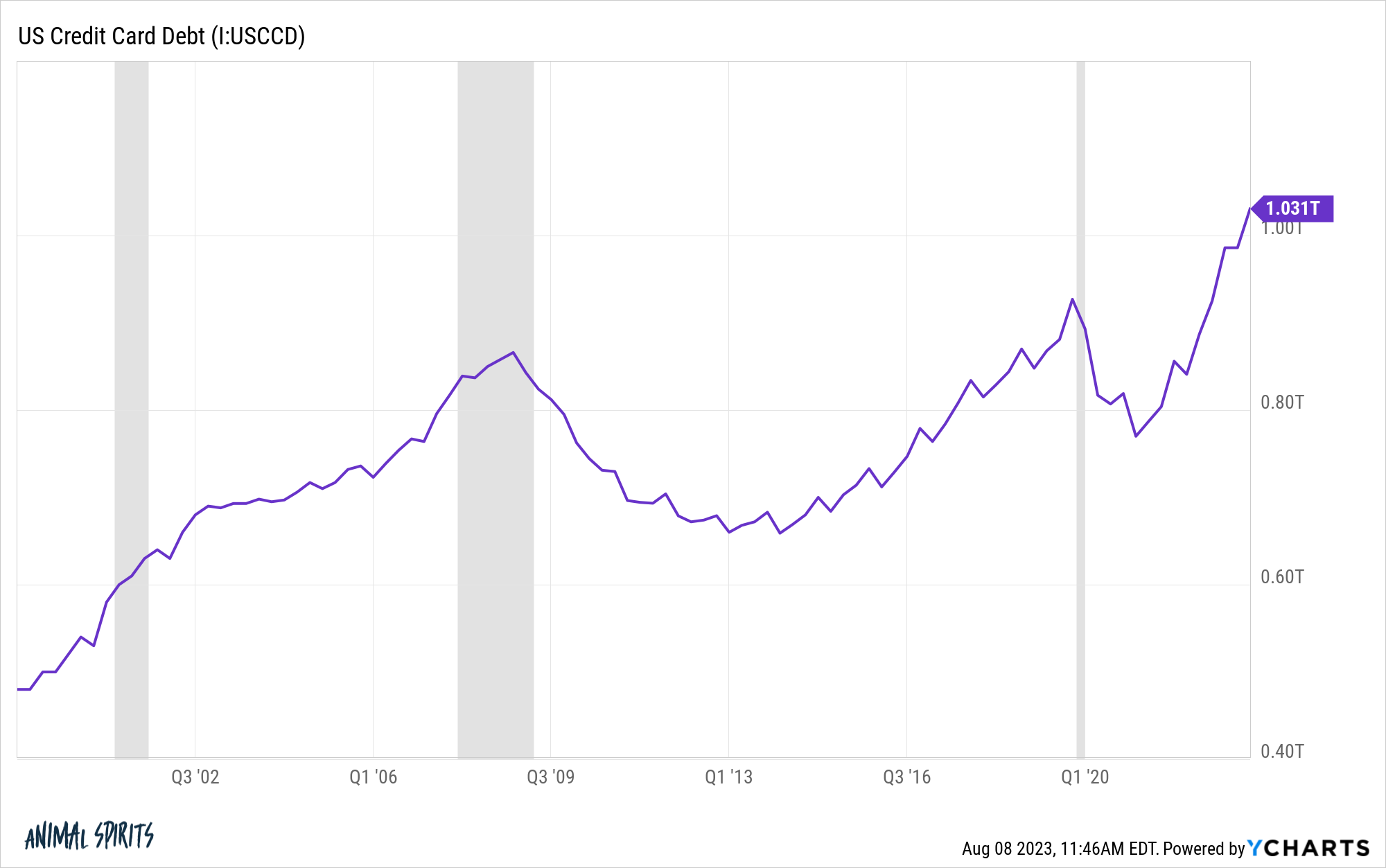

– $1 trillion in credit card debt

– Robinhood’s results

– Tipping at a hotel, and much more!

A short history of consumer borrowing and credit card debt in America.

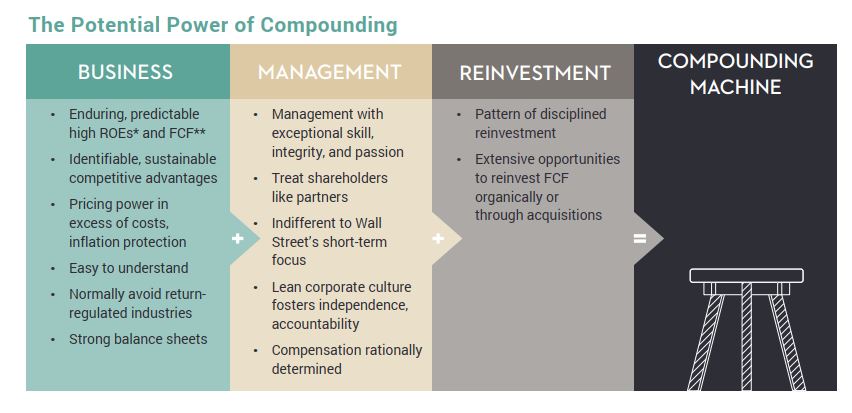

On today’s show, we are joined by John Neff, Partner and Portfolio Manager of AKRE Capital Management to discuss:

– The AI investing craze

– The creation of fundamental analysis

– Compounding returns with Warren Buffett

– Running a highly concentrated portfolio, and much more!

Preparing yourself for different moves in the stock market.

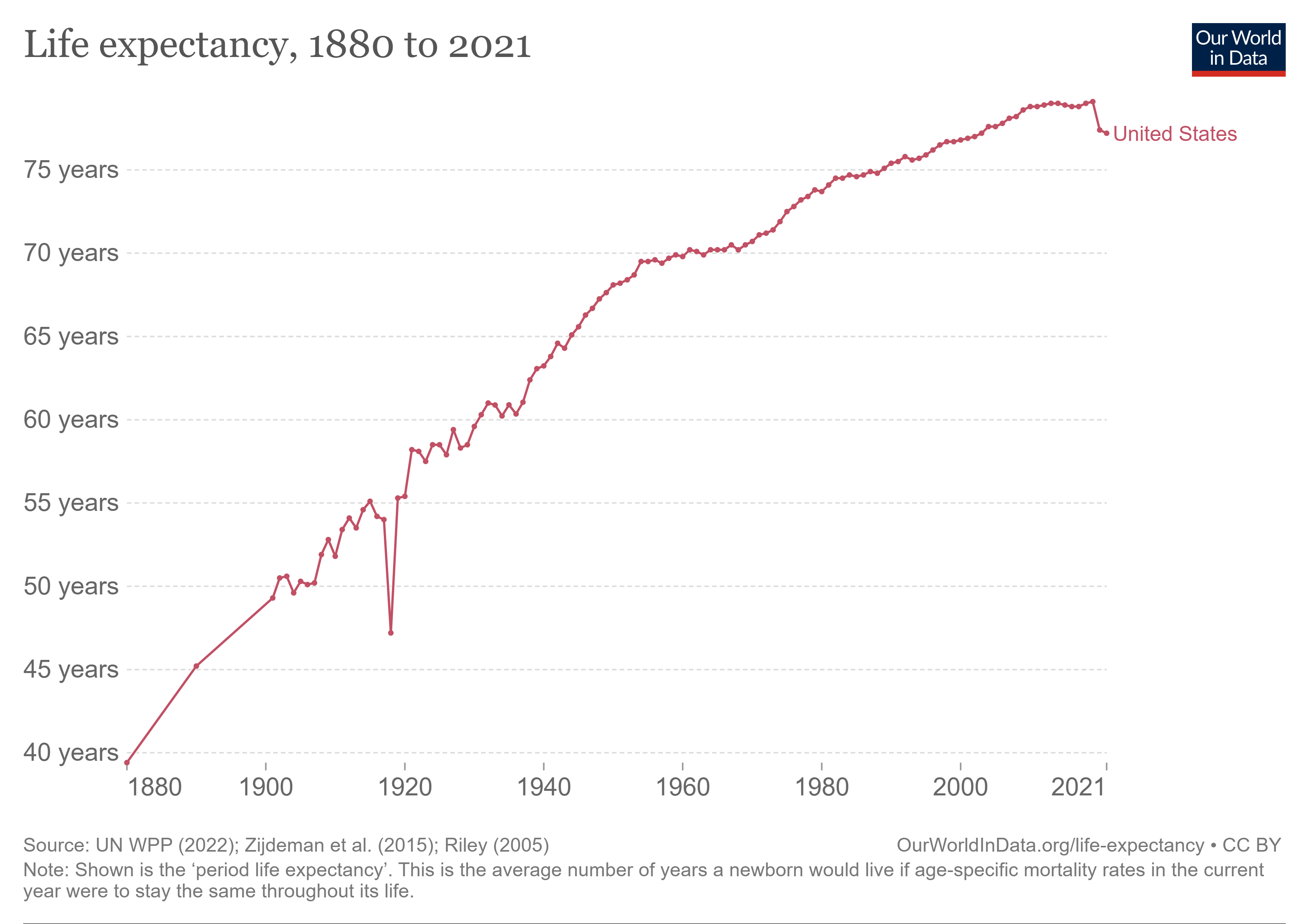

A short history of how retirement has evolved over the past 200 years.