The most popular retirement plan for people in the early-20th century and before was simple — you died.

No saving your entire career and moving to Florida or Arizona to golf your days away for the next 2-3 decades. No gold watch ceremonies when you hung it up at the office.

Most people simply worked until they dropped dead because a life of leisure in retirement wasn’t a thing for most people.

In 1900, 75% of men aged 75 or older were still in the labor force. From 1920 to 1960 the number of senior citizens in the workforce dropped from 60% to 30%.

That number is now below 10%.

So what changed?

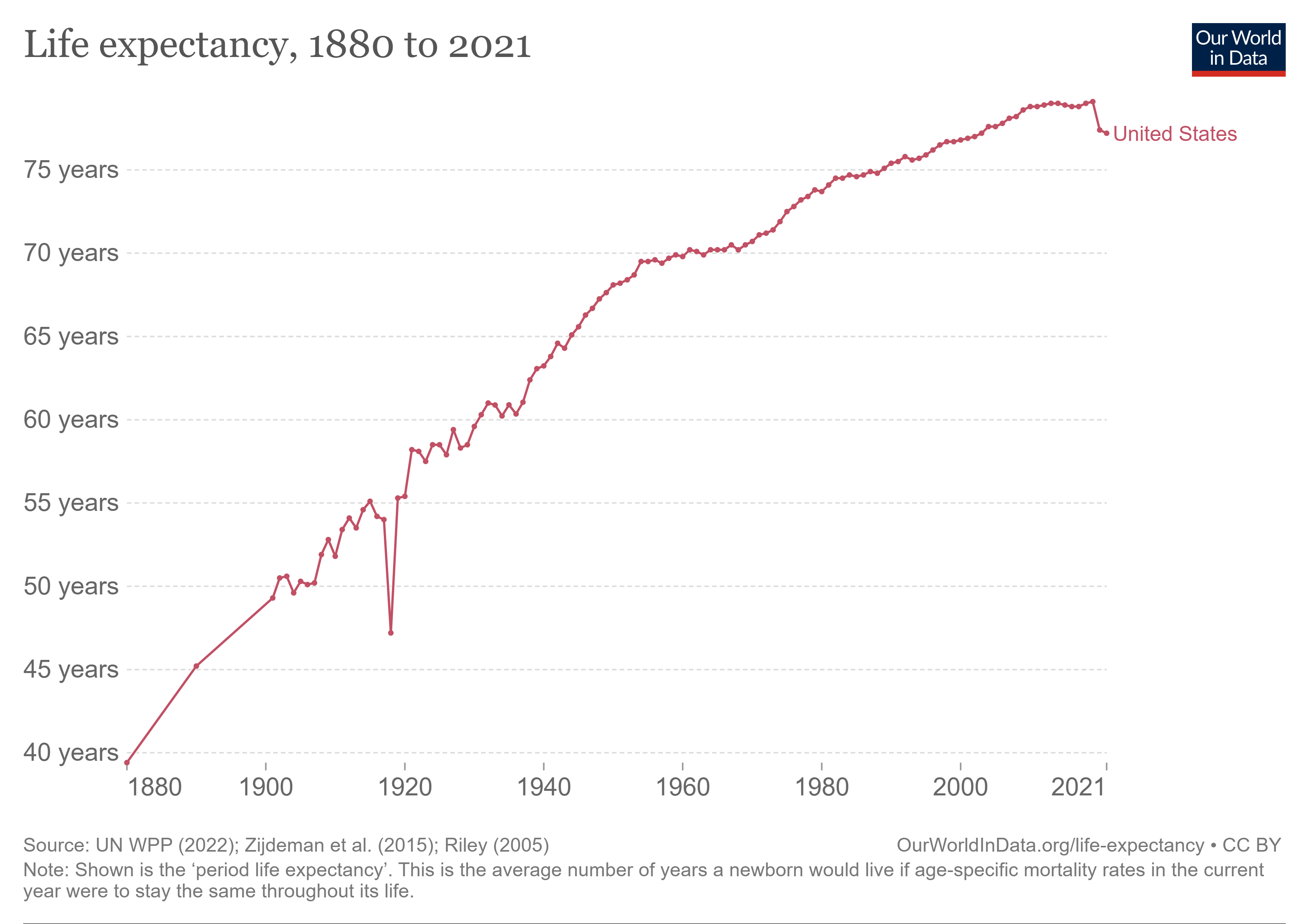

Well first of all people started living longer.

More wealth combined with more longevity made retirement a possibility for more people.

The biggest retirement-altering event in history is likely the Great Depression.

There was no safety net, for anyone, in the worst economic and stock market crash in the history of the United States. No unemployment insurance. No retirement plans in place. Household finances were decimated.

This led to the Social Security Act of 1935.

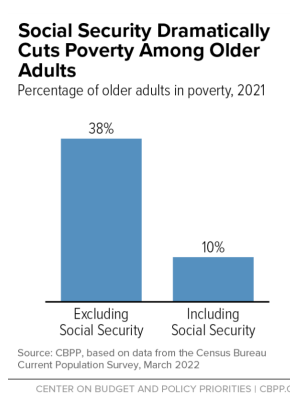

The retirement savings rates for many people in the United States leaves a lot to be desired. Things would be A LOT worse if we didn’t have Social Security as a backstop.

Four out of every 10 older Americans would be below the poverty line if it wasn’t for Social Security:

Instead, that number is one in 10.

Social Security is the largest source of retirement income for a large number of retirees in this country. The program provides at least 50% of income for 40% of beneficiaries. One out of every 7 people who receive Social Security rely on it to provide at least 90% of their income.

The Congressional Budget Office estimated Social Security will replace around 40% of income for the median worker at retirement.

Public pension plans began to gain traction in the post-war boom in the 1950s as well.

According to the Employee Benefit Research Institute, the number of people covered by private pension plans went from less than 4 million in 1940 to almost 20 million by 1960. That was 30% of the labor force.

By 1975, 40 million people were covered, more than 40% of the labor force.

There are two ways to look at these numbers:

(1) Pensions were far more prevalent for the first generation of retirement savers, making their lives much easier in terms of saving and planning.

(2) It’s a myth that “everyone” was covered by a pension plan back in the day.

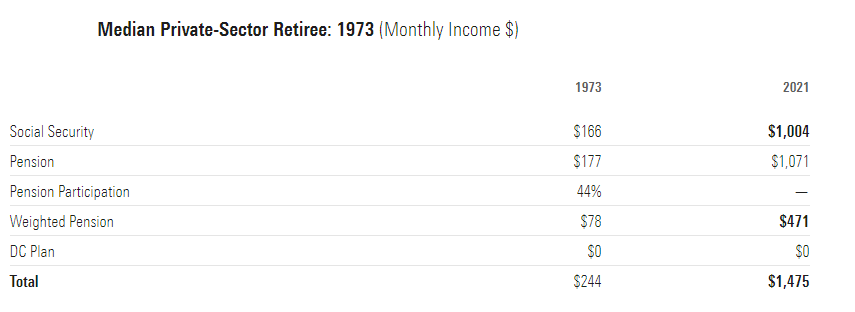

Morningstar’s John Rekanthaler ran the numbers on the difference between what many consider the golden age of retirement in the days of more pension plans in the 1970s and how things stack up today.

Here are the 1973 numbers translated into today’s dollars:

You can see just 44% of people received pension income in 1973 while the average Social Security payout was nearly as much as the pension income. Plus, there were no 401ks, IRAs, Roth accounts or any other tax-deferred retirement plans back then for the simple reason that they didn’t exist.

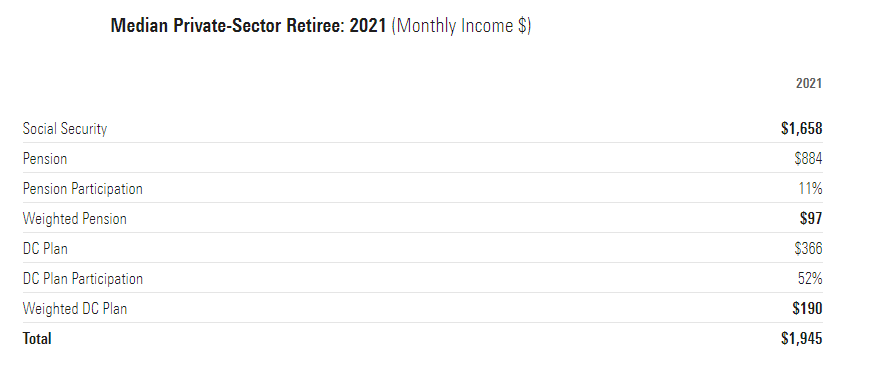

Now here are the numbers for today’s retirees:

Obviously, pensions are much lower, covering just 11% of the retired population with a lower payout after adjusting for inflation. But look at the Social Security number. It’s 65% higher today than it was in 1973.

The reason Social Security is higher is because it tracks real incomes and real incomes have risen over the past 50 years.

I wish I could tell you today’s retirees are better off than previous generations because they save and plan more than their parent’s generation. That could be the case (these numbers don’t include taxable accounts).

But it is true that retirees on the whole are better off today than they were in the past and a big reason for that is Social Security.

Most pension plans don’t increase with the rate of inflation and it’s a retirement myth that every worker used to have their retirement covered by their employer.

Social Security is only going to become more expensive as people live longer and the baby boomer generation retires en masse.

But this program has been a lifesaver for a lot of people. Even if they have to make some changes to the program going forward to make it more viable financially, Social Security has been one of the most important government programs ever created.

We would have an even bigger retirement crisis if it wasn’t for Social Security.

Michael and I talked about retirement planning, Social Security and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Everything You Need to Know About Retirement

Now here’s what I’ve been reading this week:

- An oral history of The Fugitive (Rolling Stone)

- Hedge funds (JL Collins)

- If this economy is bad tell me what a good economy would look like? (Noah Smith)

- The Fed is no longer punishing savers (Irrelevant Investor)

- What determines happiness? (A Teachable Moment)

Books:

- A Piece of the Action: How the Middle Class Joined the Money Class (Joe Nocera)