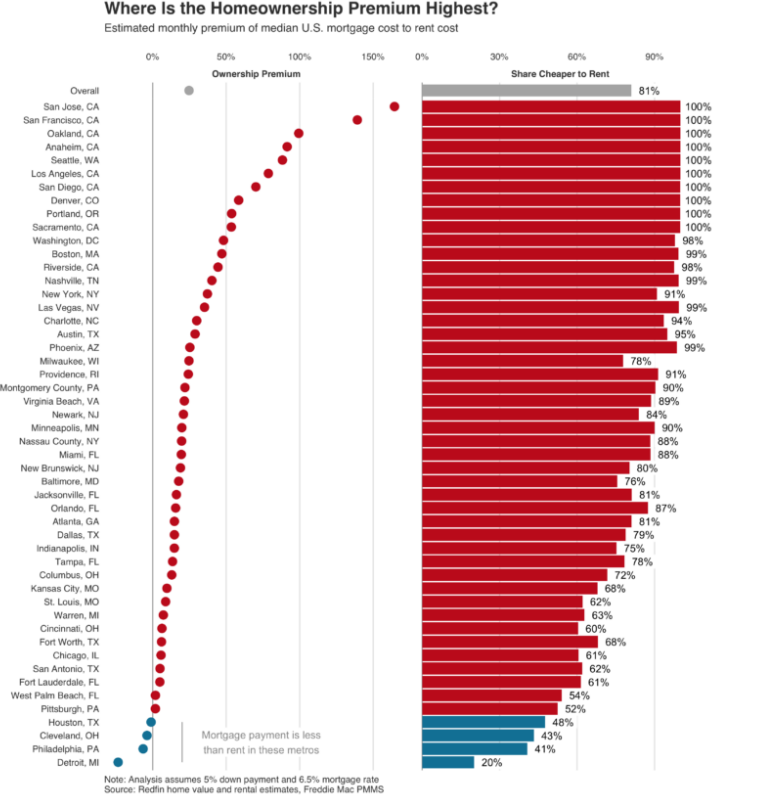

Renting vs. buying a house in the Bay Area.

Renting vs. buying a house in the Bay Area.

On today’s show, we discuss:

– Future Proof

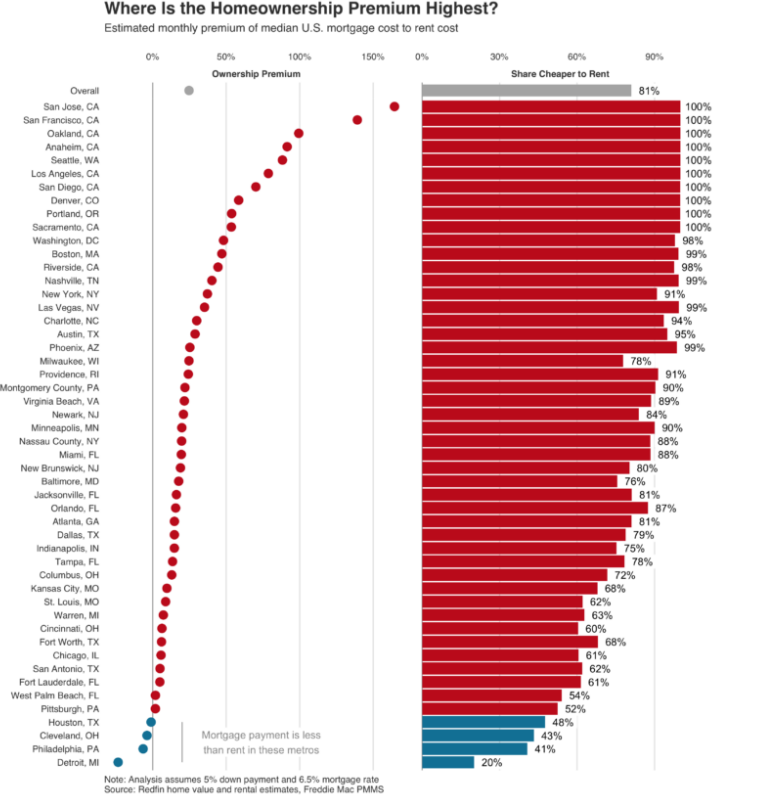

– How markets have changed over the past 70 years

– Why allocations to stocks are higher than they were in the past

– Small caps vs. large caps

– Trading options vs. gambling on sports

– Why people spend more money then they earn

– Why the vibes are off in the economy

– Starter homes, and much more!

How IRAs changed the markets forever.

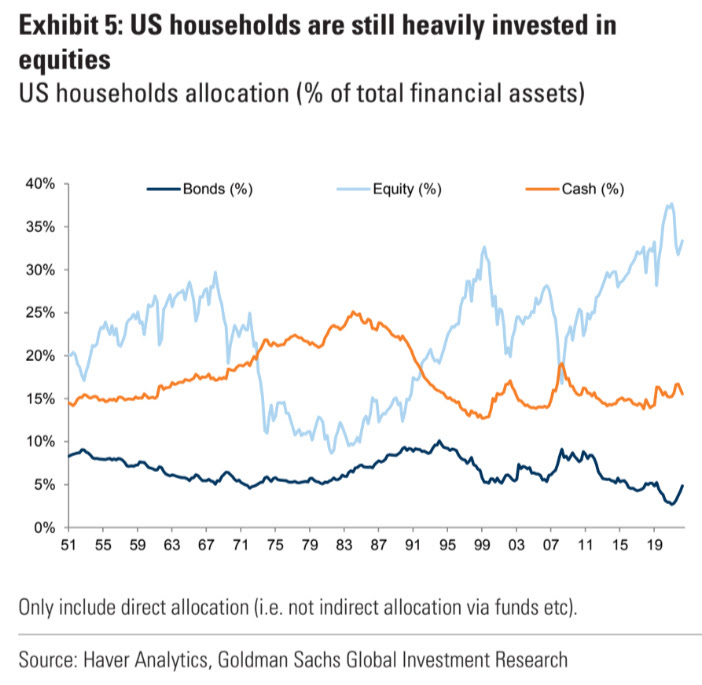

On today’s show, we are joined again by Brett Hillard, CIO of GLASfunds to discuss:

– Wealth managers vs. institutions investing in alternatives

– How advisors are utilizing GLASfunds

– Investing in alts in a rising-rate environment

– How private investments could be improved, and much more!

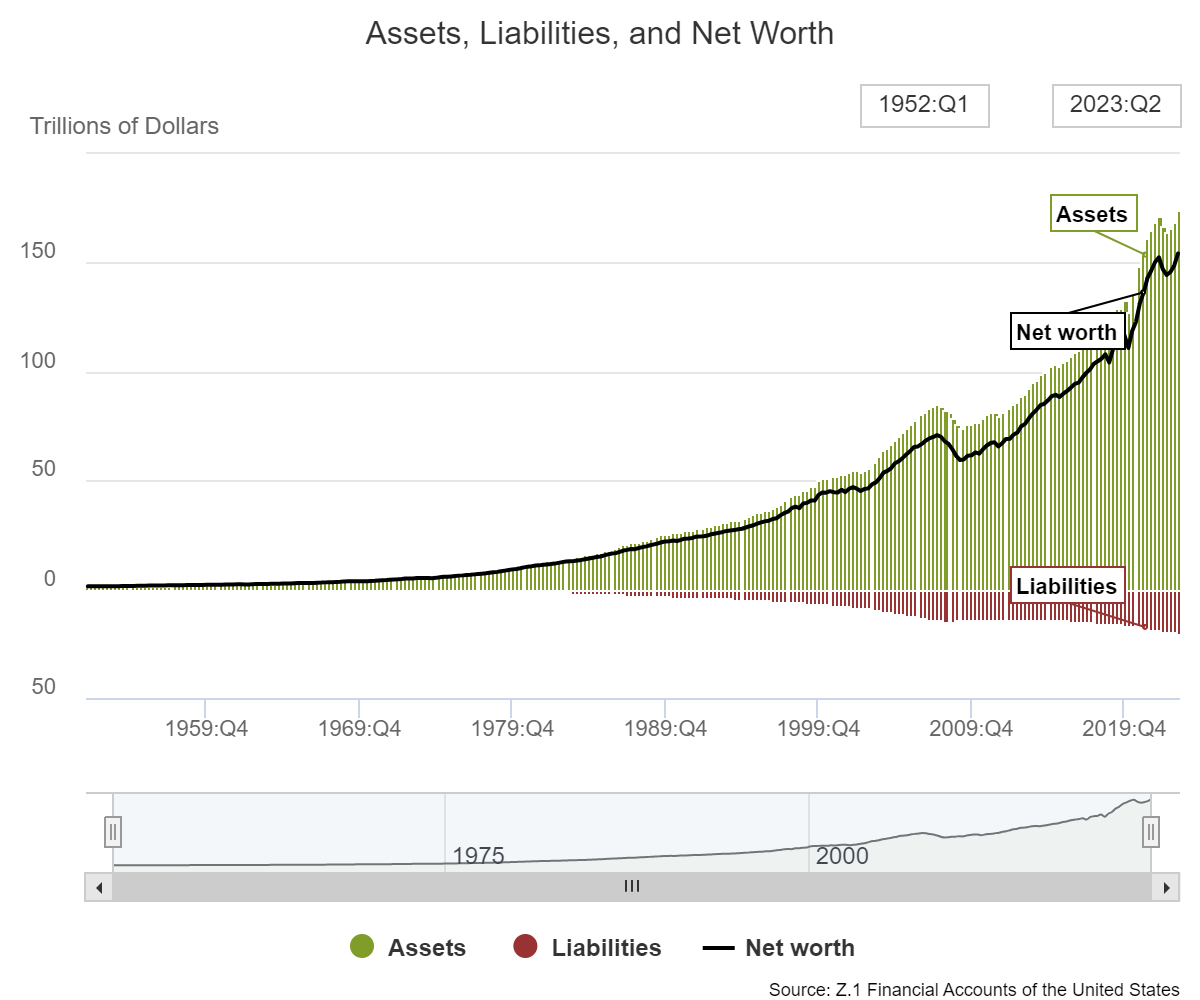

A detailed look at hosuehold balance sheets from assets to liabilities.

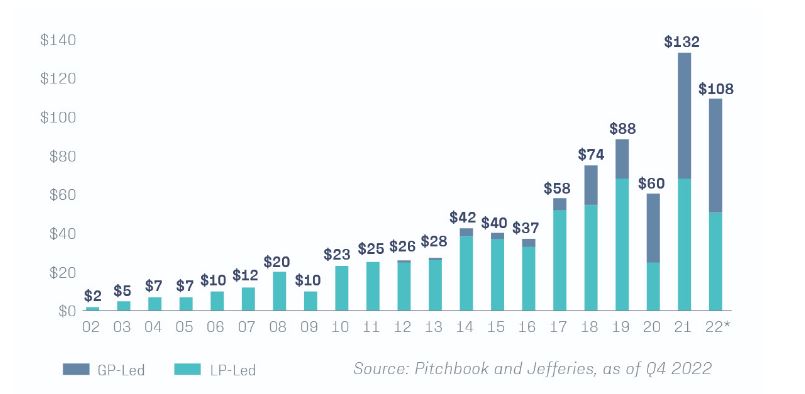

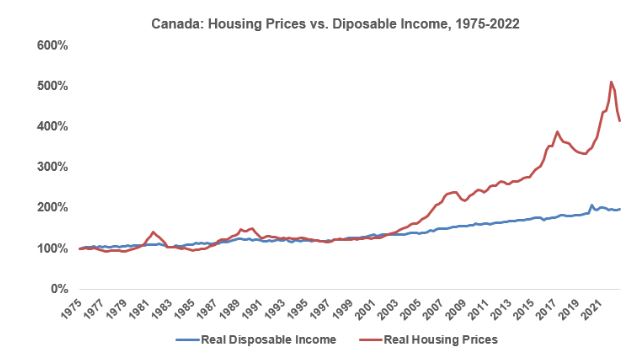

Another reason housing prices have been going up for 3 decades.

What if your advisor’s performance stinks?

On today’s show, we are live at Future Proof to discuss:

– Duncan spilling a Miami Vice

– What we actually do at RWM

– If Apple is the next IBM

– Canadian real estate

– Issues at ESPN

– Traveling to California, and much more!

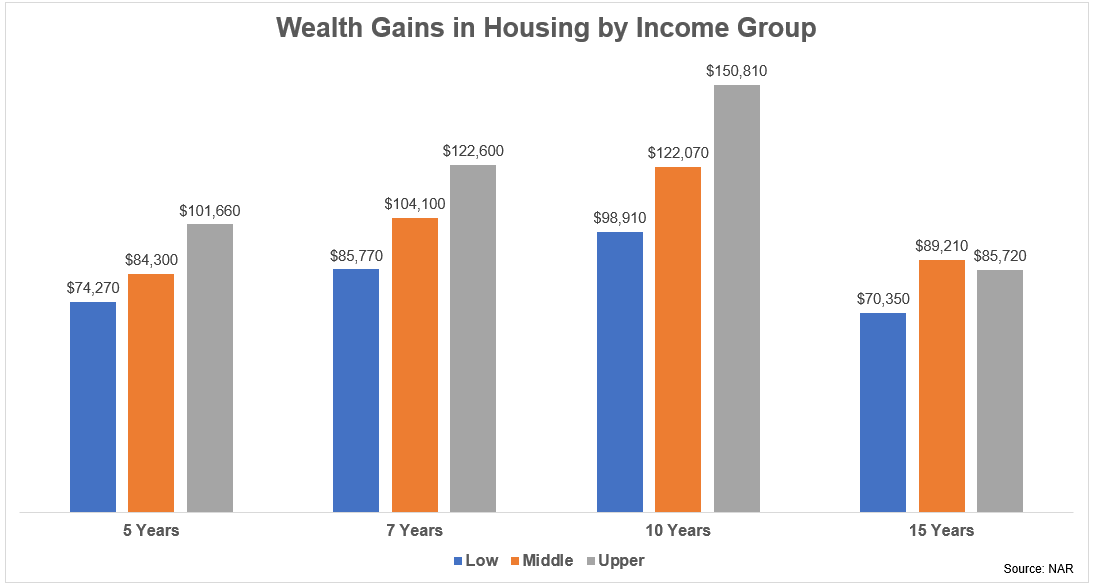

According to the National Association of Realtors, the median price of a house in the United States is worth $190,000 more than it was a decade ago. If you’ve owned a house for more than 3 years or so, you’re likely sitting on some nice gains. Those gains were not evenly distributed but across the various…

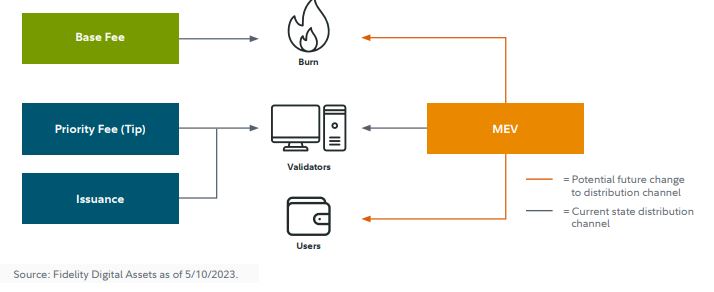

On today’s show, we are joined by Jack Neureuter, Senior Research Analyst at Fidelity Digital Assets, and Ramine Bigdeliazari, Director of Product at Fidelity Digital Assets to discuss:

– What the SEC ruling means for digital assets

– How an ETF may affect the crypto ecosystem

– The migration of talent within crypto

– Macro changes and digital asset reactions, and much more!