As someone who lives in the relatively inexpensive Midwest, I’ve always wondered how so many people could afford living in California.

After visiting the Golden State a number of times over the past decade or I can see why people are willing to pay up.

The weather is amazing. Great beaches. And the views are spectacular.

Here’s a look from a rooftop bar this past week at Future Proof:

As I was taking an Uber into Huntington Beach for our event this past week I was enjoying the scenic drive along the coast until this monstrosity came into view:

I don’t know if it’s a water treatment plant or a power plant or what but it just seemed odd to me where it was located. I’m sure they had reasons for putting it there but it’s bizarre to me how people in the past didn’t seem to put a premium on things like nice views.

Apparently it used to be even worse.

My colleague Gary Pulford, who lives in California, shared these pictures with us to show how much the coastline in Huntington Beach has changed:

This was in 1969! That’s not that long ago!

It looks like an apocalyptic nightmare. Developers and government officials likely realized it would be a tad more inviting if they cleaned up the coastline. Surprise — people like housing, restaurants, parks and businesses along the water with nice views.

Who knew?

It wasn’t just California either.

They used to build these huge factories on bodies of water all over the United States and then just dispose of their waste in the lakes, rivers and oceans.

Obviously, they didn’t know any better but it would be mind-boggling if they did such things today.

I grew up in beautiful Traverse City, a small town in Northern Michigan, nestled on a lovely bay that’s part of Lake Michigan. The waters look Caribbean-like in the summer.

Yet for years the city had a power plant smack-dab on the water on the most prime real estate in town. This is what it looked like in the 1940s:

They cleaned it up a little bit but it still looked like this for my entire childhood all the way through graduating college:

They finally demolished it in 2005.

Now look at the Open Space:

Just a little nicer.

Over the past couple of decades, I’ve seen this same thing happen to coastline cities up and down Lake Michigan.

It’s like people in the past didn’t think about real estate in the same way.

Some of it is we are wealthier as a society. We have more information. Tastes and preferences have changed. Building materials have improved.

I’ve been thinking a lot about how these changes have impacted the housing market these past few decades.

I laughed at this House Hunters 1989 skit on TikTok but it also does a nice job of showing how choices and desires have changed when it comes to housing over time:

Lol House Hunters 1989 pic.twitter.com/8b3OAByb4b

— Stinson Dean🌲 (@LumberTrading) August 25, 2023

Ironically, it was around 1990 that real estate prices in this country experienced a sea change.

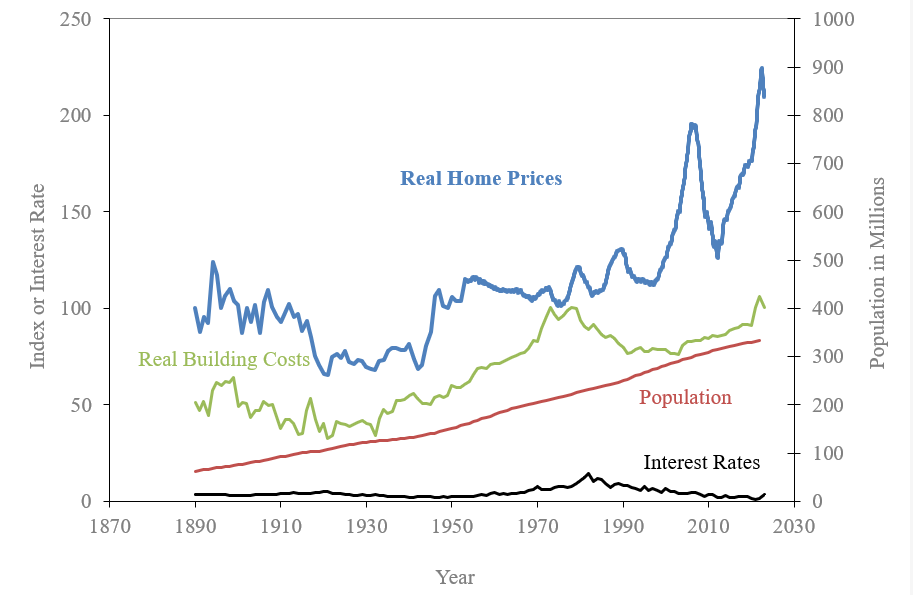

Robert Shiller has data on real housing prices, real building costs, population, and interest rates going back to the late-19th century:

Inflation-adjusted housing prices didn’t really go anywhere for almost 100 years then they took off like a rocketship starting in 1990 or so.

Interest rates and demographics certainly played a role here. The pandemic supercharged prices as well.

But my theory is at least some part of these gains have been driven by increased information and attention on the housing market. People didn’t care about home offices, open floor plans, entertaining spaces, granite countertops, tile backsplashes, hardwood floors, luxurious bathrooms and mud rooms in the past.

The advent of the internet, HGTV, Zillow, online listings and social media have made us all more aware of housing trends, designs and tips.

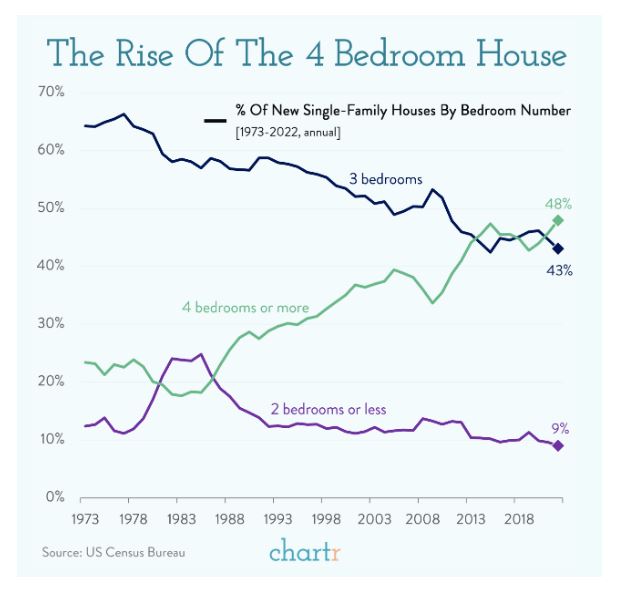

Just look at the rise of bigger homes over time even though the average size of families is getting smaller:

Housing prices have risen because of supply and demand dynamics but also because they’re bigger, nicer and higher quality.

And the fact that so many people are paying attention to desirable locations and amenities means we are placing a higher premium on housing than past generations did.

Michael and I talked about housing affordability and so much more on a live episode of Animal Spirits from Future Proof:

Thanks to everyone who came out for the show. We had so much fun.

Further Reading:

How the Housing Market Has Changed America

Now here’s what I’ve been reading lately (all books):