After what the stock market went through in March, it feels like we’ve all been given a mulligan.

Losses have been erased. Stocks are rocking back to all-time highs.

This is a crude example, but if you started out the year with a $1 million portfolio invested exclusively in the U.S. stock market, your balance would have fallen to less than $700,000 by March 23, 2020. As of the close on Friday your portfolio would now be worth close to $1.2 million.

This type of volatility is one of the main reasons you can earn a premium in the stock market over “safer” assets such as bonds and cash.

But this volatility can also become a cause for concern among many investors who have a sizable nest egg. It’s never easy to experience portfolio drawdowns but when your portfolio balance is higher, seeing the actual dollar amounts evaporate, even when they don’t last, can be too much for some investors to stomach.

This is especially true for retirees or those approaching retirement age.

I’ve had a handful of conversations in recent months with investors in this stage of their lifecycle who are considering using this mulligan to reposition their portfolio. Many have come to the conclusion that they now have enough money in their portfolio to survive. They’ve already won and simply don’t want to screw things up or see their money fluctuate so much.

This is true even for those investors who aren’t fully invested in stocks but even have a more conservative portfolio in the 50/50 or 60/40 range. While the S&P 500 fell roughly 34% by late- March, a 60/40 portfolio was down more than 20%.

Some people have the risk appetite to handle those types of losses. Others don’t.

What if you don’t have the need or desire to grow your wealth any longer by having your portfolio dominated by the stock market?

There is no perfect portfolio no matter what stage you’re in. But this situation is especially precarious for those who are more worried about capital preservation than the growth of their money because interest rates are so low at the moment.

Let’s look at some candidates for a shift to a more conservative portfolio along with some of the pros and cons for each:

Bonds. Bonds can still have a place in your portfolio but don’t expect to earn much in the form of yield at the moment. The Vanguard Total Bond Market Index Fund currently yields around 1.15%. After inflation you’re not left with much in the form of returns here.

You can go out further on the risk curve to earn higher yields but it will cost you in the form of larger drawdowns and higher volatility.

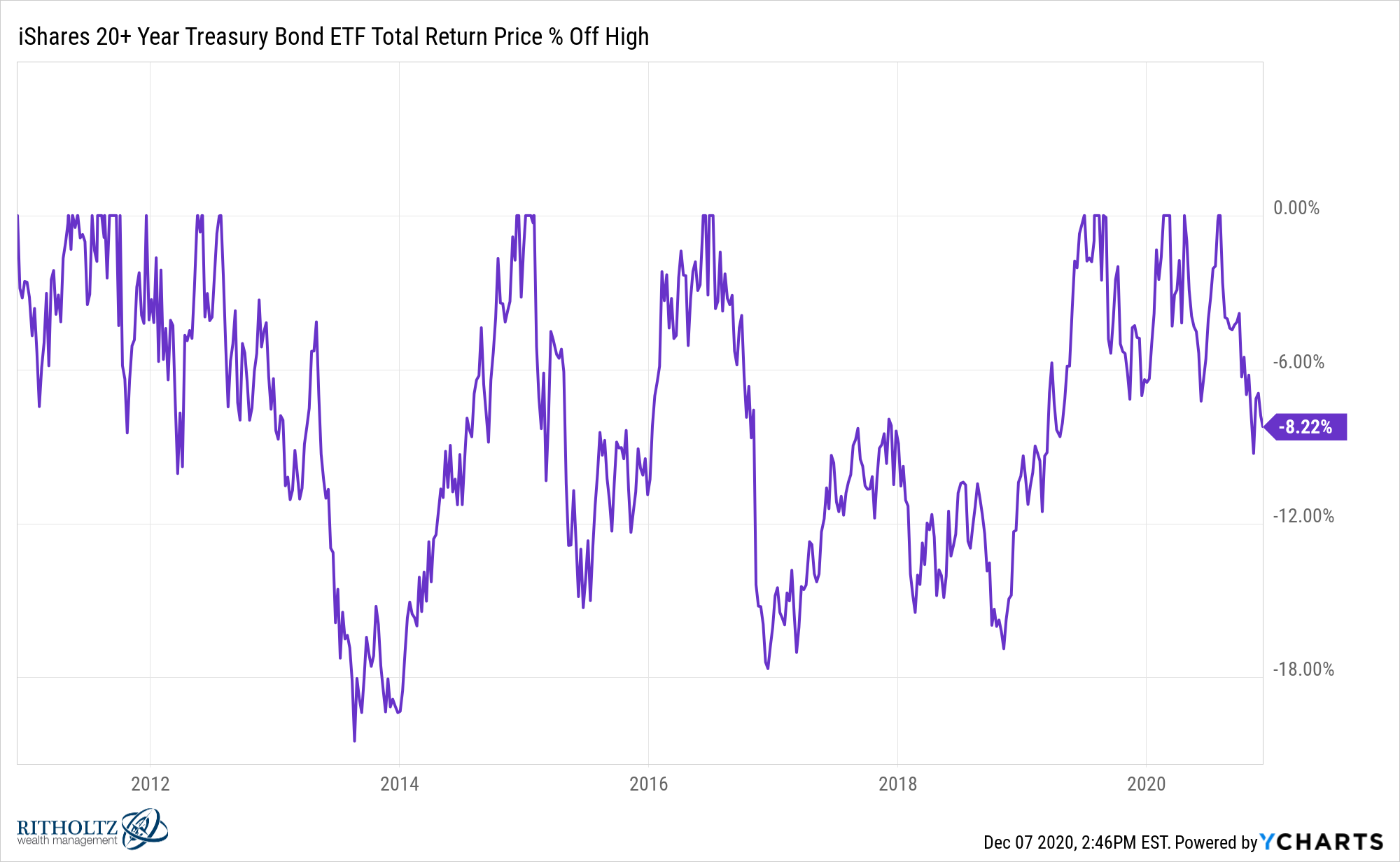

For example, if you can’t handle the volatility of the stock market, long-term bonds are probably not going to make you feel much more comfortable sleeping at night. Look at the drawdowns in long-term government bonds (TLT) in recent years:

There are multiple double-digit drawdowns and this is during a period where rates have generally fallen. Can you imagine how much worse things could get if/when rates actually rise for a sustainable period?

So if you want more stability it makes sense to keep your duration short in terms of owning bonds.

Treasury Inflation-Protected Securities. Your biggest risk as a fixed income investor is not necessarily rising interest rates1 but inflation. Inflation erodes your purchasing power over time, making your fixed income payments worth less as prices rise.

TIPS are one of the most unique assets in all of investing because they provide near-perfect protection against inflation. Unlike regular bonds that pay a nominal interest rate, TIPS pay investors based on a real yield.

The way this works is the principal value of your bonds is adjusted by the rate of inflation. If inflation goes us, your principal goes up in lockstep with the inflation rate. TIPS are your friend as a fixed income investor during an inflationary environment.

Unfortunately, in a low rate environment, you’re not getting compensated in terms of yield to hold these bonds.

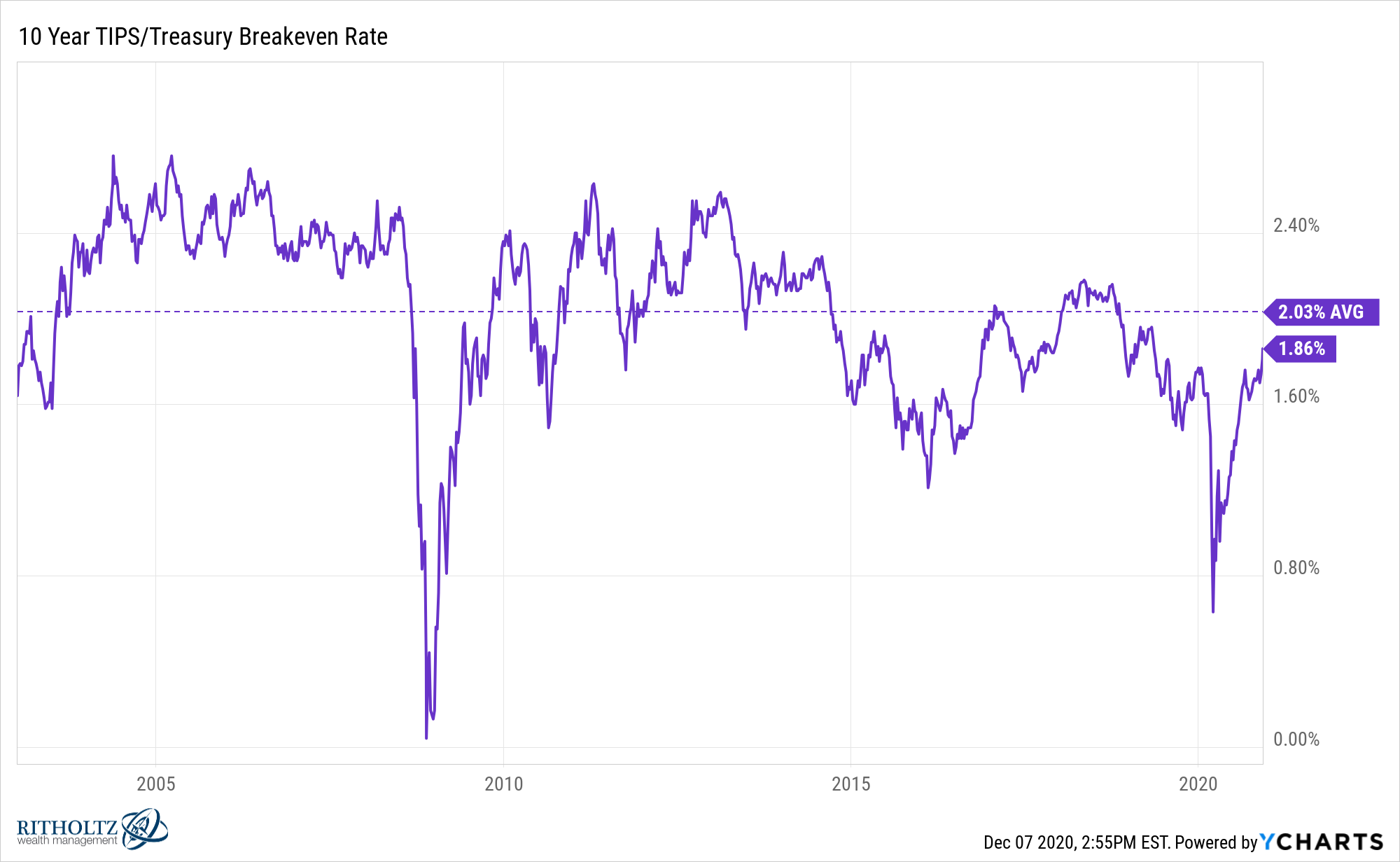

The breakeven rate shows the difference between the 10 year treasury rate (currently just under 1%) and the 10 year TIPS yield:

This number gives us an approximation of investor expectations for the inflation rate in the future.

It’s important to point out TIPS protect against unexpected inflation. The expected inflation is baked into the current yield of both treasuries and TIPS.

Cash. Holding more money in cash — money markets, savings accounts, t-bills, etc. — will not protect you against inflation. Cash is one of the worst hedges against inflation. But it can protect you better than bonds against rising interest rates.

That’s precisely what happened in the 1970s. One month t-bills were up 6.3% per year in the 70s while long-term government bonds gained 5.5% per year.2

The reason for this is because investing in a short-term cash-like vehicle allows you to see an immediate increase in yield when rates rise. When rates rise, there is no loss of value (on a nominal basis) for money held in your savings account. But bonds can experience short-term losses of principal when rates rise because your current fixed income securities are now less attractive on a relative basis.

Cash equivalents don’t pay much at the moment but holding cash still allows you to fund current spending needs and protects against rising interest rates.

Annuities. Annuities make a lot of sense in theory for people who are averse to risk or don’t want to invest in the stock market with all or a portion of their portfolio.

They offer lifetime protection against longevity risk, meaning you won’t run out of money because they typically offer a regular stream of income until death. By pooling your risk with other holders of annuities, the people who don’t live long lives essentially subsidize those who do. That’s why annuities are insurance products sold by insurance companies.

There are downsides to these products though.

They can be extremely complicated if you don’t know who you are buying them from or how they work. Many annuities also come with high costs and don’t allow you to withdraw your money in the event of an emergency.

You’re also giving up control of your money so your options are severely reduced if your plans change in terms of what you want to do with your money. Finally, you’re making a bet on the insurance company surviving the duration of your contract with them.

Stocks. I’m writing this piece for investors who completely want out of the stock market but let me make the case for holding at least a small piece of your portfolio in stocks, even for those who are extremely risk-averse.

Most people invest in stocks for their growth potential but one of the most impressive long-term benefits of owning stocks is the fact that the collective dividend stream of corporations tends to rise at a rate that’s higher than inflation. The real growth rate of dividends has compounded at more than 2% above the rate of inflation for the past 100 years or so in the U.S. stock market.

If you’re squeamish about investing in stocks you could favor dividend-paying stocks, low volatility stocks, high-quality stocks or some combination of the three.

Even a small allocation to the stock market could provide diversification benefits to a fixed income heavy portfolio.

Reducing risk in your portfolio is likely going to be driven more by your emotions than the financial aspects of this decision. You have to prepare yourself for the fact that you could be missing out on further gains in the stock market.

So this is a decision that has to be made for the management of risk, not the management of returns.

Further Reading:

The Best Source of Investment Income?

1Over the long-term rising rates help fixed income investors because eventually, you’re investing in securities that have those higher rates.

2They both underperformed the inflation rate which came in at 7.4% for the decade.