“The stock market is detached from fundamentals” is something people in the investment industry like to say (and they’ve been saying this a lot lately).

“We believe the market is fully valued right now” is another crowd favorite.

Then there’s, “The market is trading at fair value.”

I enjoy a good valuation debate as much as the next pundit but valuations require a ton of context and can’t always be taken at face value.

You have to consider different accounting methods, how those methods have changed over time, the composition of the market in question, how companies have changed over time, the fundamental(s) you’re measuring (earnings, sales, cash flows, book value, etc.), how you calculate your measurements, interest rates, inflation, economic regimes and a whole host of other issues.

Fundamentals are more complex than they seem.

One of the simplest, yet most overlooked, stock market fundamentals is the dividend yield. Dividends are actual cash flows being paid out by corporations into the hands of investors.

You can’t fake, manipulate or fudge a dividend payment by hiring a talented CPA.

Dividends also happen to be one of the most resilient features of the stock market over the long-term.

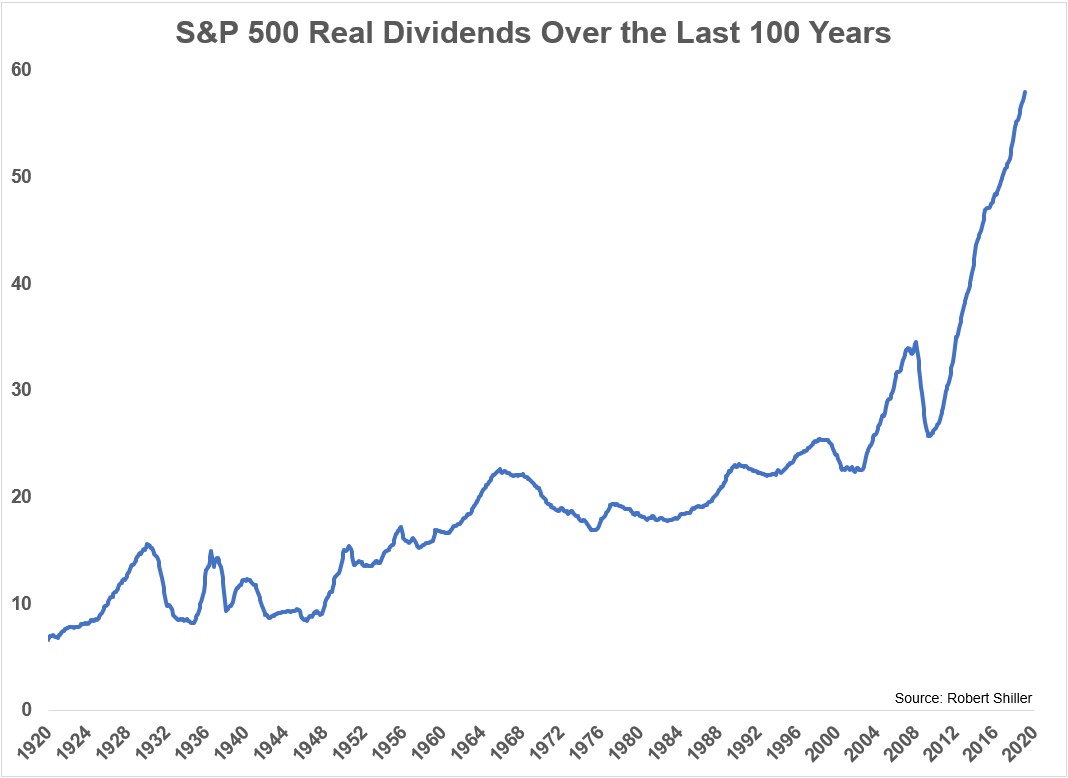

This is a look at dividends after accounting for inflation from 1920-2019:

A little bumpy at times but the real growth rate of 2.1% over the rate of inflation over the last 100 years is impressive.

That doesn’t sound like much but the inflation rate over this time frame was just shy of 3%. So nominal dividends have grown at an annual rate of roughly 5% since 1920.

This is one of the more underrated parts of investing in the stock market. What other forms of income grow at a rate higher than inflation over the long-term?

Of course, that growth doesn’t always come in a straight line. Dividends are not immune to economic downturns.

Disney announced in recent weeks the company would be cutting their dividend to save money. They’re not alone.

According to Morgan Stanley, the market is currently pricing in a 15% haircut this year (and Morgan Stanley thinks the actual number will be better than this). This makes sense but dividends aren’t expected to fall as much as one would assume what with the onset of a depression.

Considering the market fell 35% and profits will likely fall dramatically more in the quarters ahead, this doesn’t sound all that bad to me.

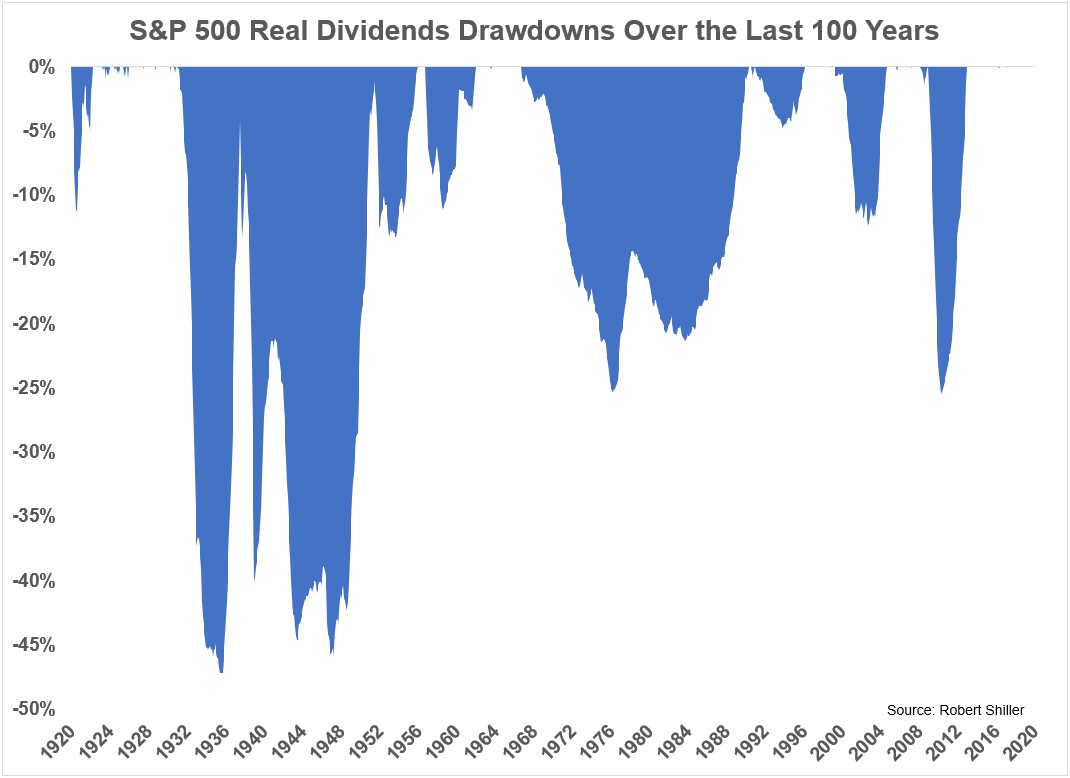

Here’s a look at how much dividends have fallen throughout the past 100 years on an inflation-adjusted basis in the S&P 500:

On a real basis, dividends have never fallen more than 50% over the past 100 years despite the stock market getting cut in half on 5 occasions.

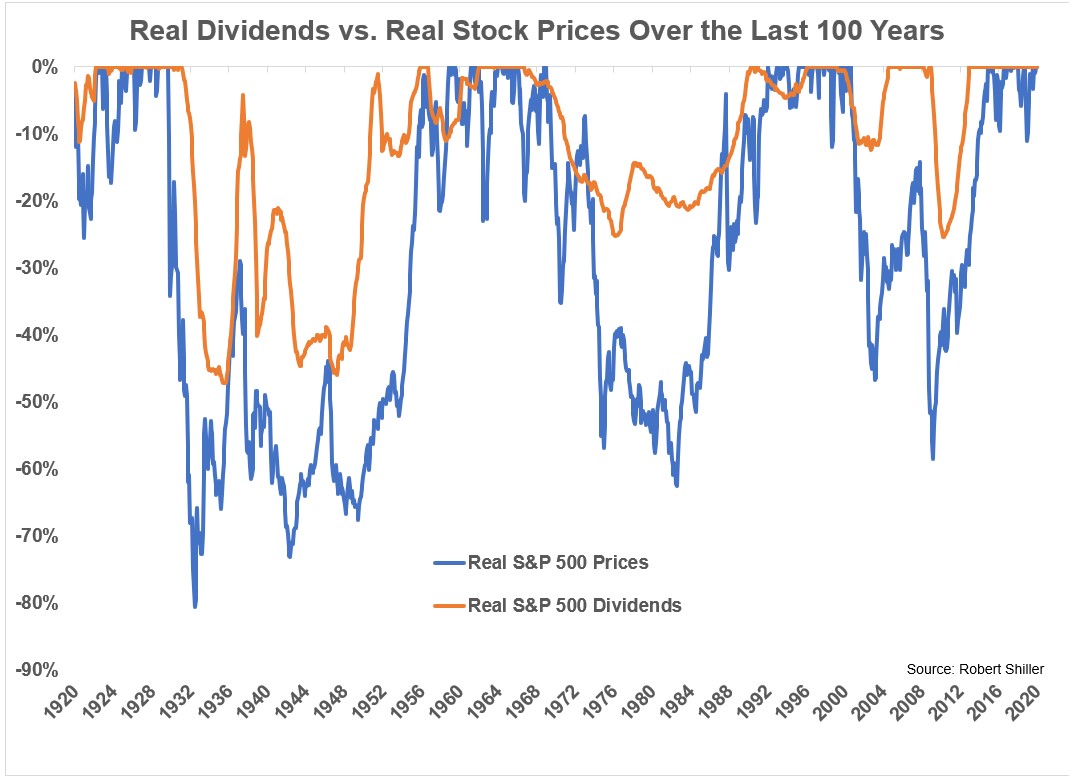

You can get a better sense of this relationship when viewing real drawdowns in dividends versus real drawdowns in the S&P 500 itself over this time:

Even during the Great Depression when the stock market fell more than 80% on a real basis, dividends fell “only” 47% or so. Dividends snapped back much quicker than the market after that period as well (it nearly round-tripped before stocks fell an additional 50% in 1937-1938).

Dividends fell just over 20% in the nasty 1973-1974 bear market that witnessed stocks fall more than 50% real.

Real corporate payouts fell just 12% when the stock market got cut in half from 2000-2002 while the Great Recession saw dividends fall 25% when the market fell well over 50%.

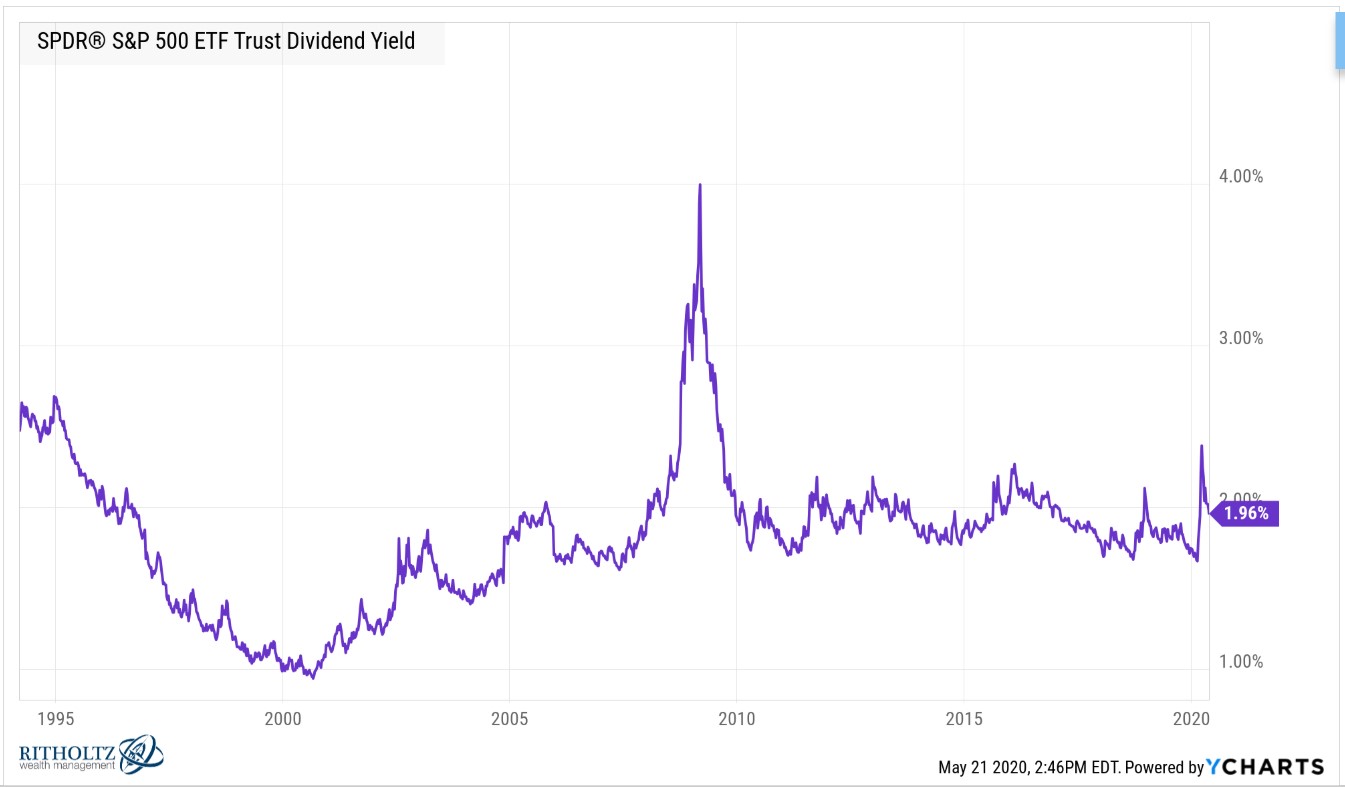

The S&P 500 yields just shy of 2% at the moment:

That doesn’t sound so juicy until you realize:

- it grows over the long-term at a rate higher than inflation

- the 30 year treasury yields just 1.4% at the moment

- the income paid out by corporations is far less volatile than the prices of those corporations

This last bullet point is another reason market valuations are so difficult to put into practice as a timing indicator. Stock prices tend to overshoot their fundamentals. That’s why prices fall more than dividend payments during a bear market.

The stock market or even high dividend-paying stocks themselves are no substitute for fixed income. The volatility and loss profiles for stocks and bonds are completely different, even with such low bond yields.

But investors underestimate how helpful the income portion of stock market can be over the long haul.

Stocks may be one of the best sources of income of any asset class. And that income may be more important than ever with bond yields on the floor.

Further Reading:

The Relationship Between Earnings & Bear Markets