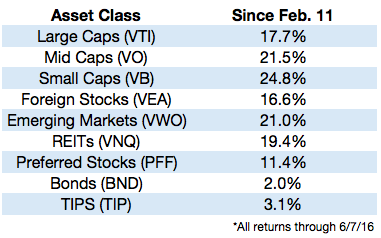

Markets got off to a terrible start to the year. Small caps, emerging markets and international stocks were all in bear market territory. Here’s what happened next:

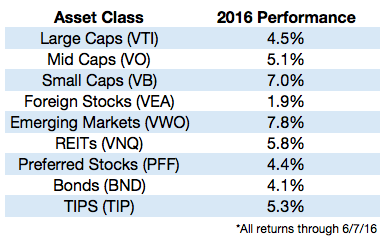

Investors have spent an inordinate amount of time worrying about pretty much everything — real estate, oil prices (being too high or too low), interest rates, economic growth, China’s hard landing, student loans, tech bubbles, future returns and the list could go on. The assumption is that it’s now impossible to make money in markets with low rates and higher-than-average valuations. While people have been prepping for the end of the financial system as we know it, the returns have been good in pretty much everything so far in 2016:

Even commodities are up after a dismal stretch of performance over the past few years. Don’t get me wrong — there’s no guarantee that these returns will last. Markets have a way of frustrating investors just when they think they have it all figured out. I’m under no illusion that these returns will last forever. My general feelings about the markets are as follows:

Yes, we will have bear markets and crashes in the future.

Yes, we will have periods of low returns in the future.

Yes, we will have recessions in the future.

Yes, risk management is important, but risk avoidance means return avoidance.

No, spending all of your time worrying about these types of events is not a good way to manage your portfolio or live your life.

The problem is that investors are now inundated with people saying smart-sounding phrases like, ‘I’ve seen this movie before and it doesn’t end well’ or ‘So you’re telling me this time is different?’. The people who say these things are not going to help you make money. All they do is prey on your worst instincts and fears to make themselves feel better for missing out on one of the biggest bull markets in history.

Investors now spend 90% of their time planning for events that happen 5% of the time.

While preparing for lower returns in the future, many investors have earned lower returns in the recent past.

Investors are being told they need to hedge out their exposure and then hedge those hedges with even more hedges to the point that they’re paying a lot of money to basically sit in cash. And I know, cash can be helpful when things do take a turn for the worst. But I’m skeptical that the charlatans who have kept people out of the markets for the past 7 years or so are going to have the fortitude to get back in when things do fall apart in the future. These people are always able to point to a new and depressing dark cloud.

It always makes sense to hope for the best and plan for the worst. But it seems that many investors these days plan for the worst and hope for the worst, as well.

Good luck with that.

Further Reading:

10 Bear Market Truths