On today’s show, we are joined by Todd Morris, International Growth Portfolio Manager and Analyst for Polen Capital to discuss:

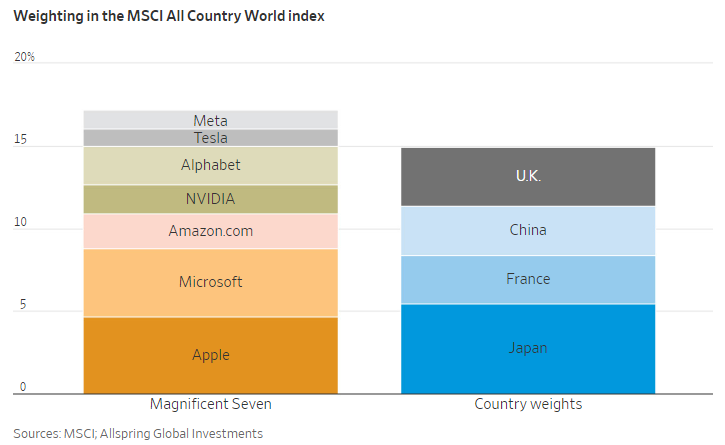

– Reasons for the valuation discrepancies between international stocks and US stocks

– How the dollar affects international investments

– Understanding cultural differences when investing outside the US

– Position sizing within a concentrated portfolio, and much more!