Today’s Animal Spirits is brought to you by AllianceBernstein and The College for Financial Planning:

See here for more information on the AllianceBernstein Conservative Buffer ETF

See here to learn more about the Accredited Behavioral Financial Professional designation and here for a Master in Personal Financial Planning

On today’s show, we discuss:

- This season’s hottest pricing trend: Falling prices

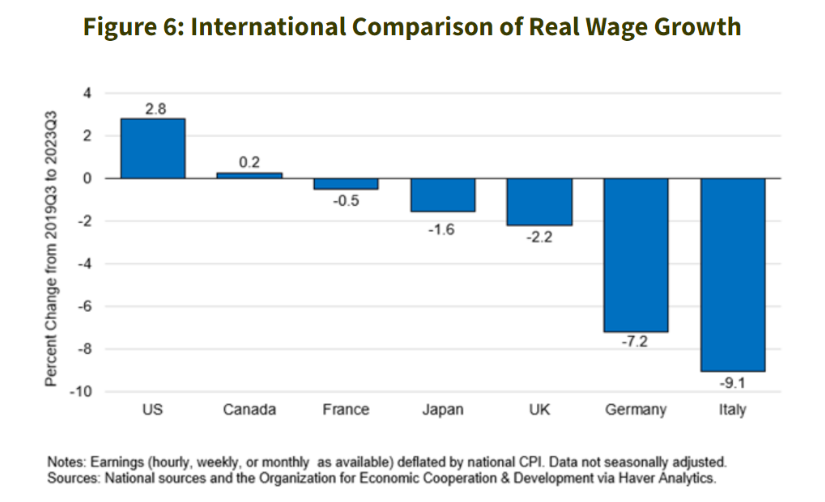

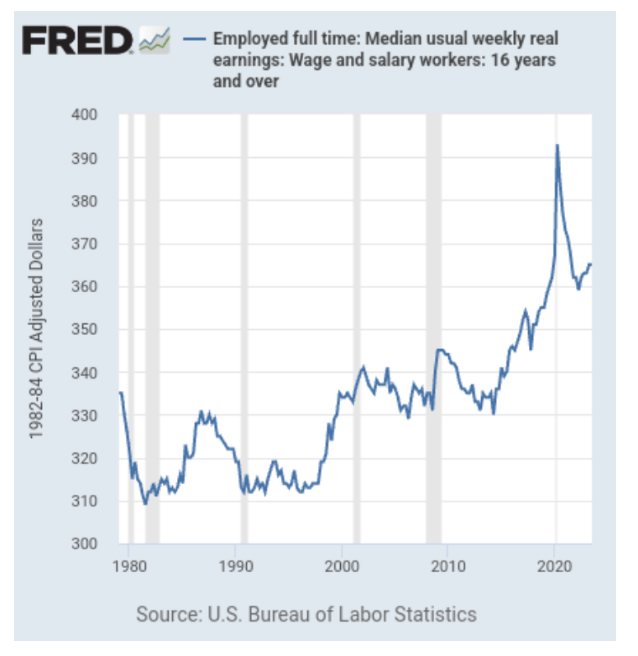

- The purchasing power of American households

- This is a wonderful market for dollar cost averaging (AWOCS, Nov 2023)

- What to make of today’s twice-in-history S&P 500 valuations (AWOCS, 2017)

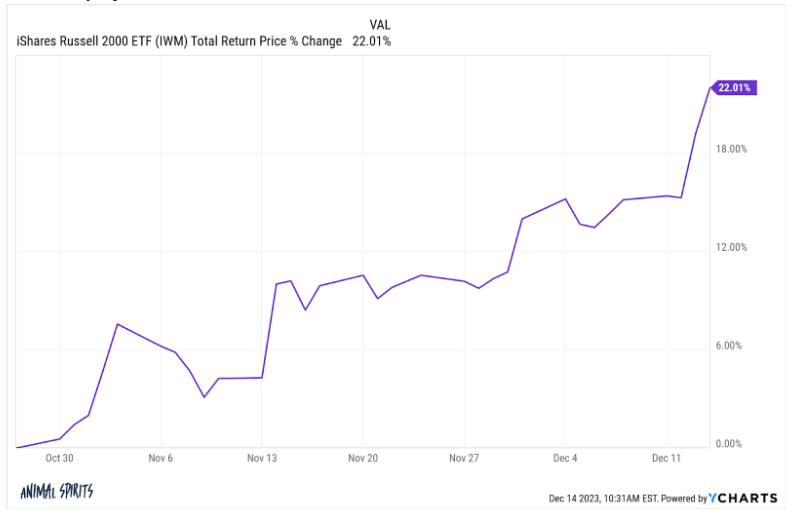

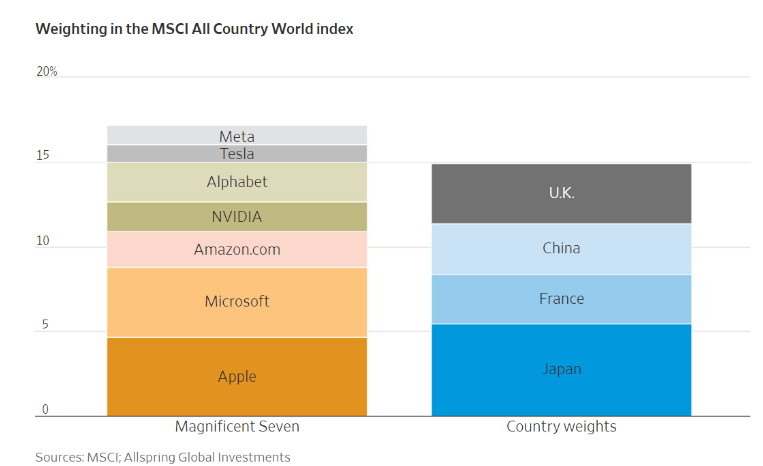

- It’s the magnificent seven’s market. The other stocks are just living in it

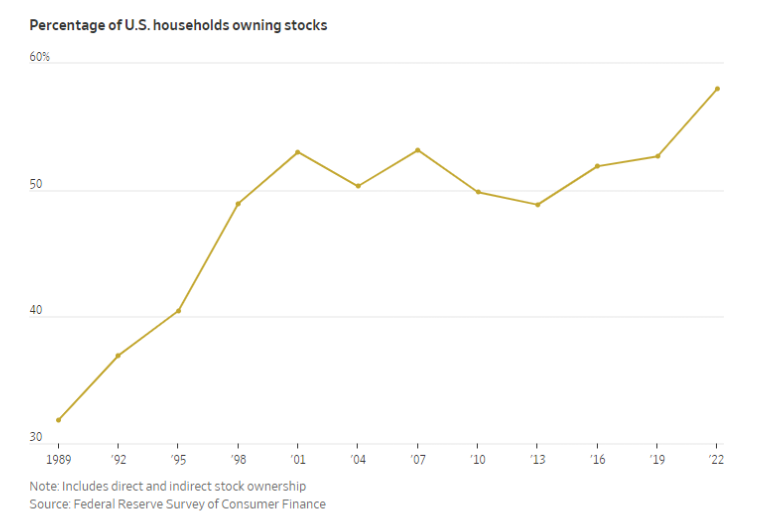

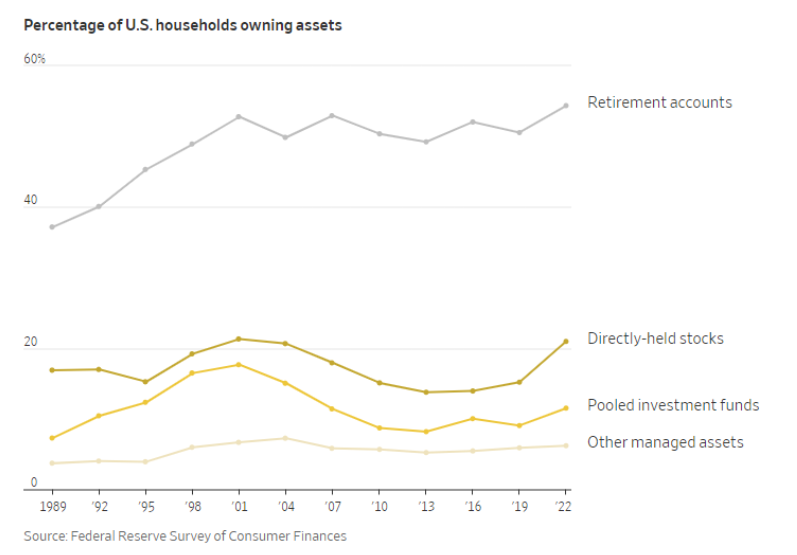

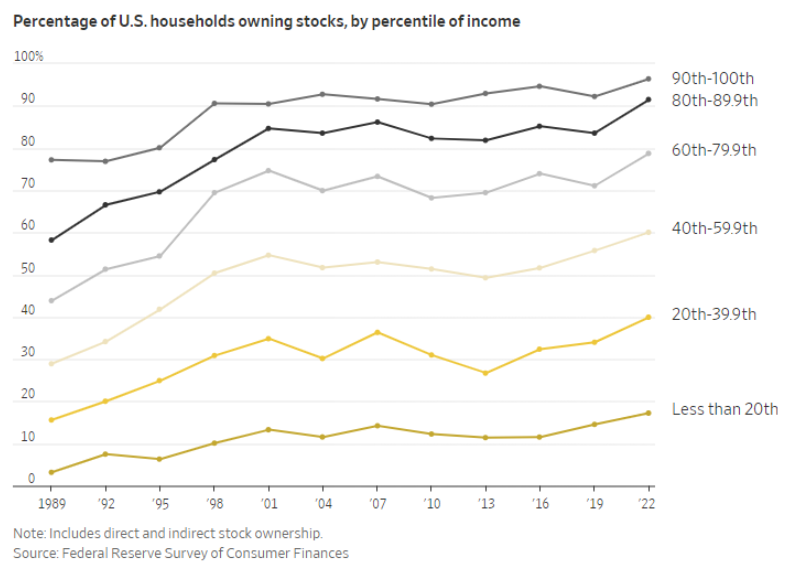

- More Americans than ever own stocks

- Beware the most crowded trade on Wall Street: Next year’s soft landing

- Goldman strategists lift S&P 500 forecast a month after setting it

- TKer’s 2023 chart of the year

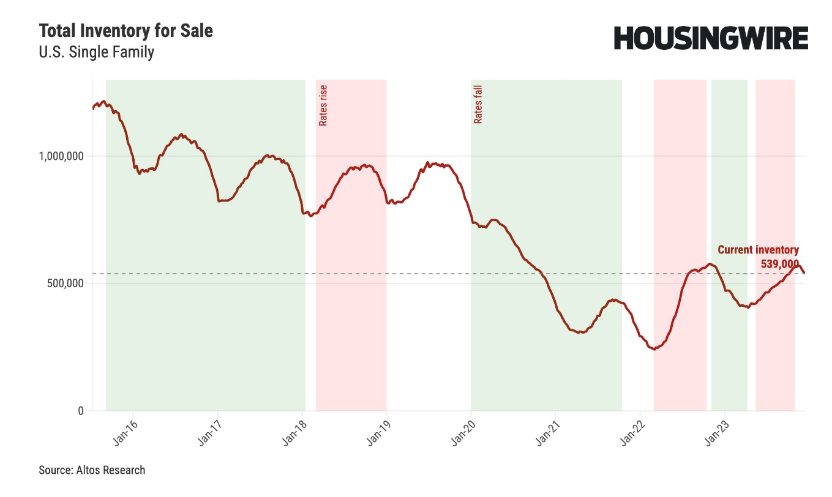

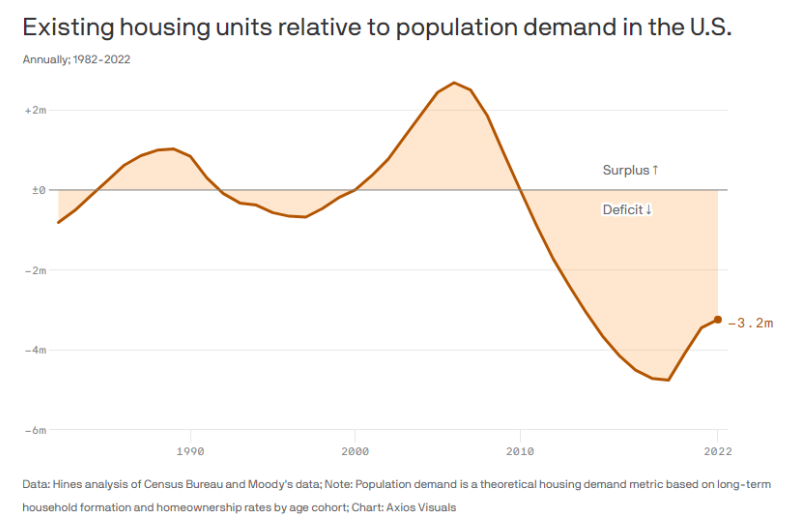

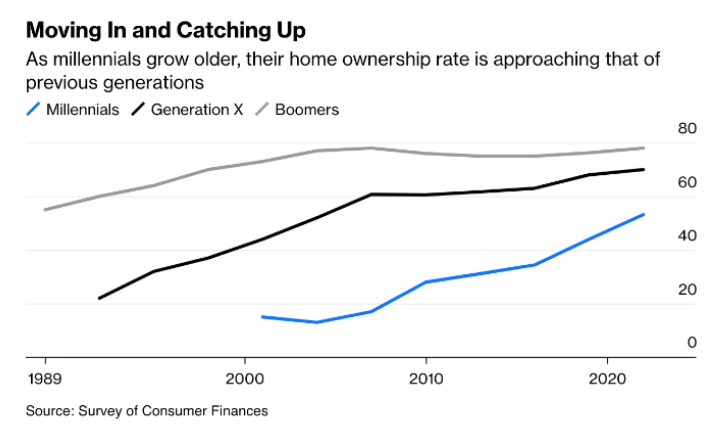

- America’s housing shortage explained in one chart

- Allison Schrager on a soft landing

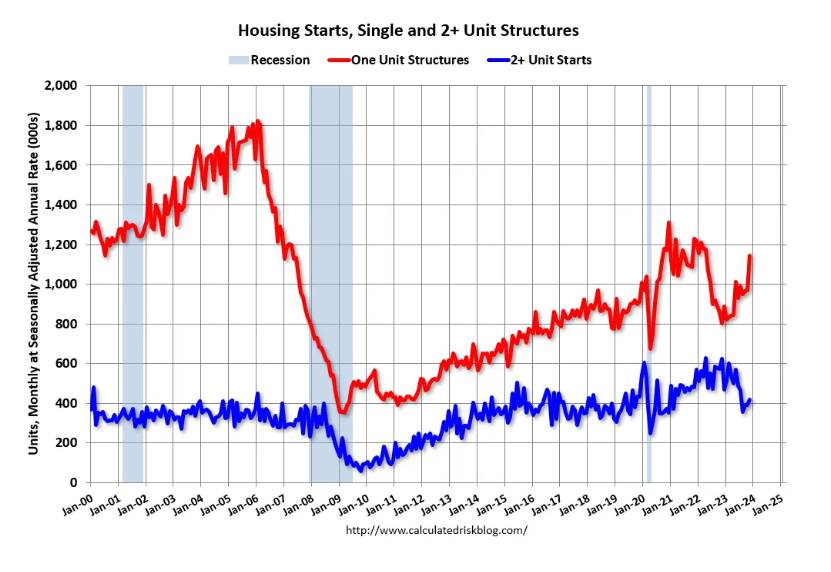

- Single-family starts increase sharply in November, near record number of multi-family housing units under construction

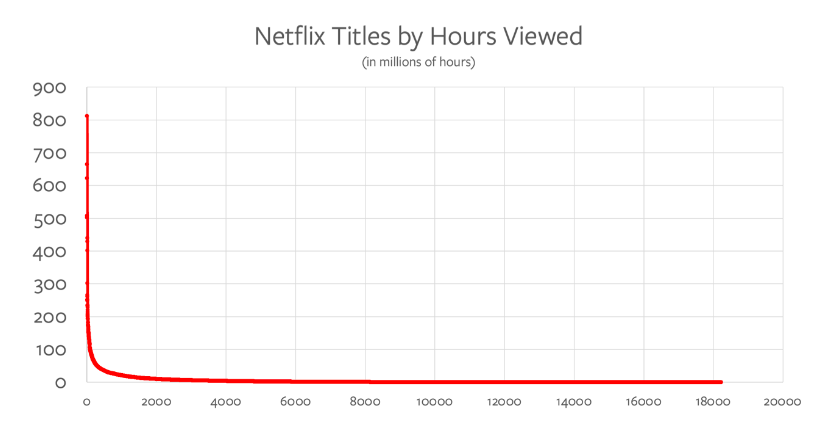

- What we watched: A Netflix engagement report

- Barbie, Elf and the $500m right to entertain you on a plane

Listen here:

Recommendations:

- Beckham

- Past Lives

- Mark Zuckerberg building $100M Hawaii compound with a massive underground bunker

- Mint Comedy

Charts:

Tweets:

Contact us at animalspirits@thecompoundnews.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Wealthcast Media, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.