A reader asks:

What would you advise as an alternative to getting on the “real estate ladder”?

Saving and waiting for lower interest rates? Or investing in the market until you can put down a larger down payment?

Offering advice on the home buying process is even harder than offering investment advice without more context. Investing is personal but your living situation has even more idiosyncratic risks involved.

Where you live. The local real estate market. The number of houses available for sale. Your tastes and preferences for a house. Your financial situation. Your budget.

So I’m going to answer this question through the lens of what I would do in this situation. What would I do if I was in the market for a house right now?

Everyone knows this is one of the most challenging markets ever for those trying to buy their first home.

It seems like everyone is priced out of the market right now but more than one-third of all buyers over the past year were first-time homebuyers.

Activity in the housing sector is down but there are still millions of houses changing hands this year.

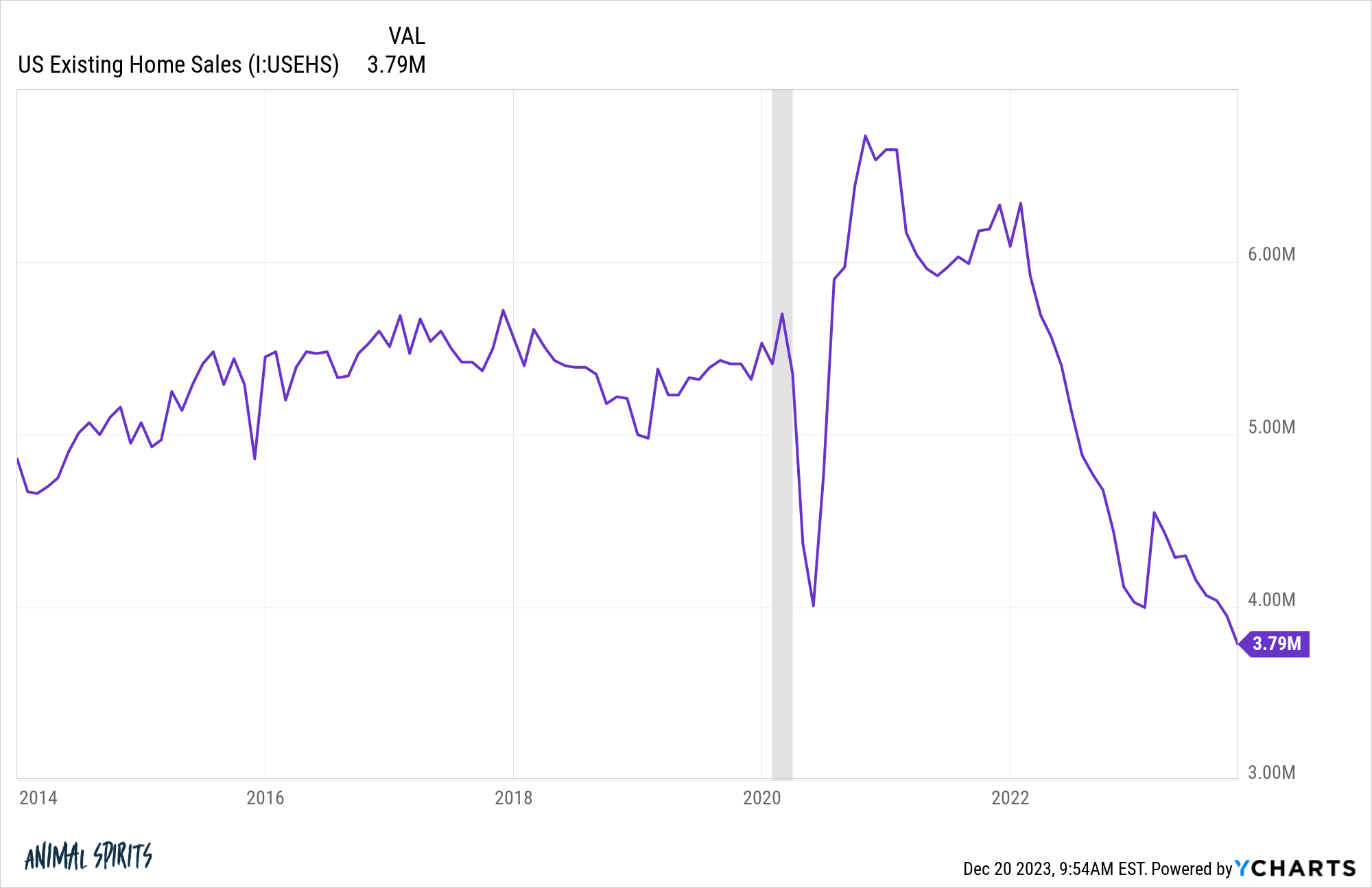

Existing home sales have been crashing:

The only time existing home sales were lower this century was at the depths of the 2008 financial crisis.

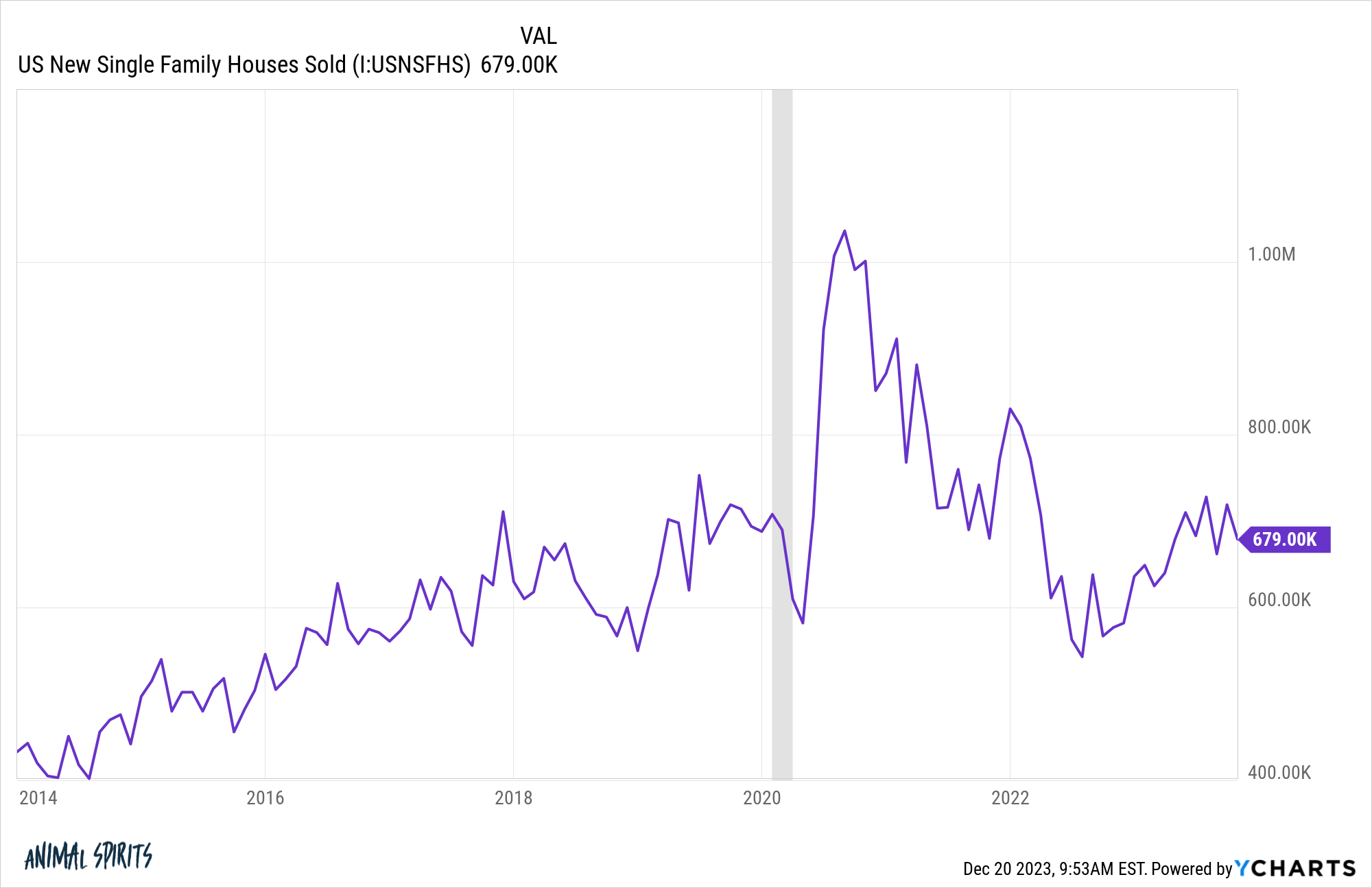

Now look at new home sales:

They’ve been rising over the course of this year despite mortgage rates hitting 8%.

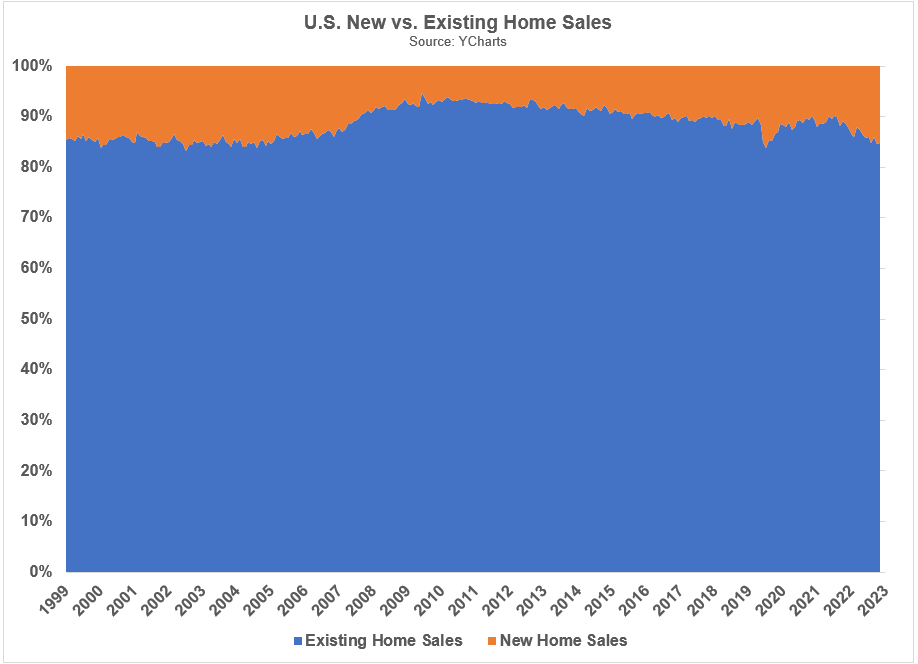

Here is the breakdown of new versus existing home sales on a relative basis since the start of the 21st century:

During the housing boom of the 2000s, 15-16% of all sales were new homes. After the housing bubble popped and the 2008 financial crisis set in, new home sales crashed to a low of just 5% of total sales by 2010.

New home sales slowly but surely gained market share throughout the 2010s, but we’ve seen a breakout in the past 2-3 years back up to 15% of total sales.

Why is this the case in a world of higher inflation and mortgage rates?

Homebuilders own the land. They’re not just going to sit on it like a homeowner with a 3% mortgage rate locked in. They are incentivized to sell.

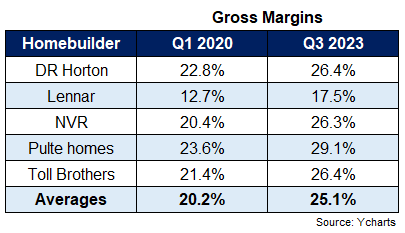

Surprisingly, margins for homebuilders have improved this cycle. Look at the gross margins for the biggest publicly traded homebuilder stocks from the start of the pandemic to now:

Margins increased 25% across the board, on average, during the highest inflation we’ve seen in four decades.

Supply chain problems caused input costs to rise, so builders countered that by raising prices. But now that input costs like the price of lumber have come back to earth, homebuilders aren’t lowering prices.

But they are helping buyers by buying down mortgage rates for them.

Here’s a deal I found on the Pulte Homes website:

And an even better one for Lennar:

And an even better one for Lennar:

Homebuilders don’t like to lower prices because it could anger buyers who are already locked in a higher price. But they can pass along savings by buying down mortgage rates to more reasonable levels.

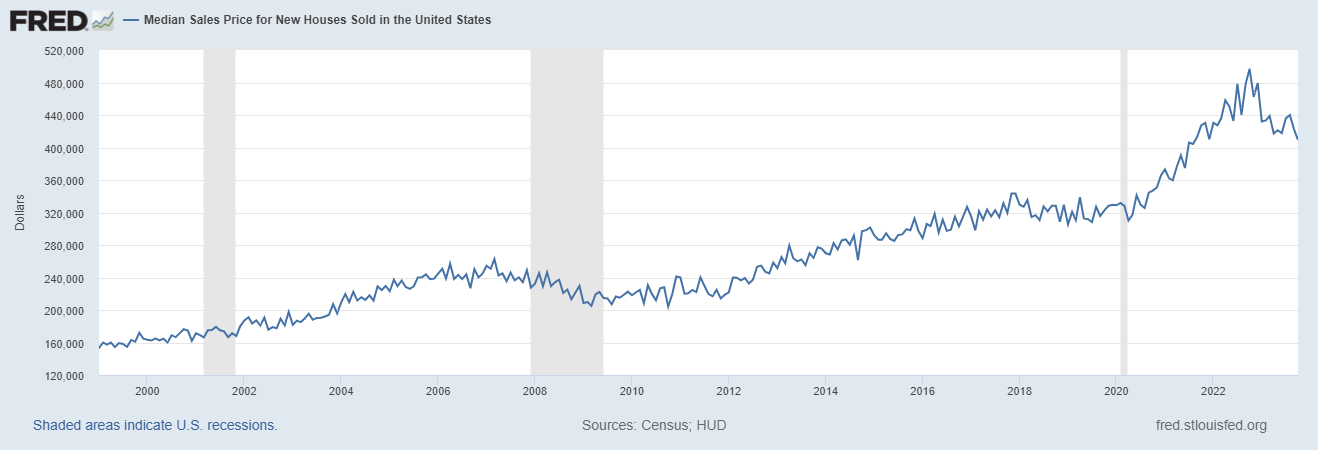

There is another benefit to the increase in new home sales. Look at the median price of new homes sold:

It’s fallen from a high of nearly $500,000 to $409,000. How is that possible if housing prices are at all-time highs?

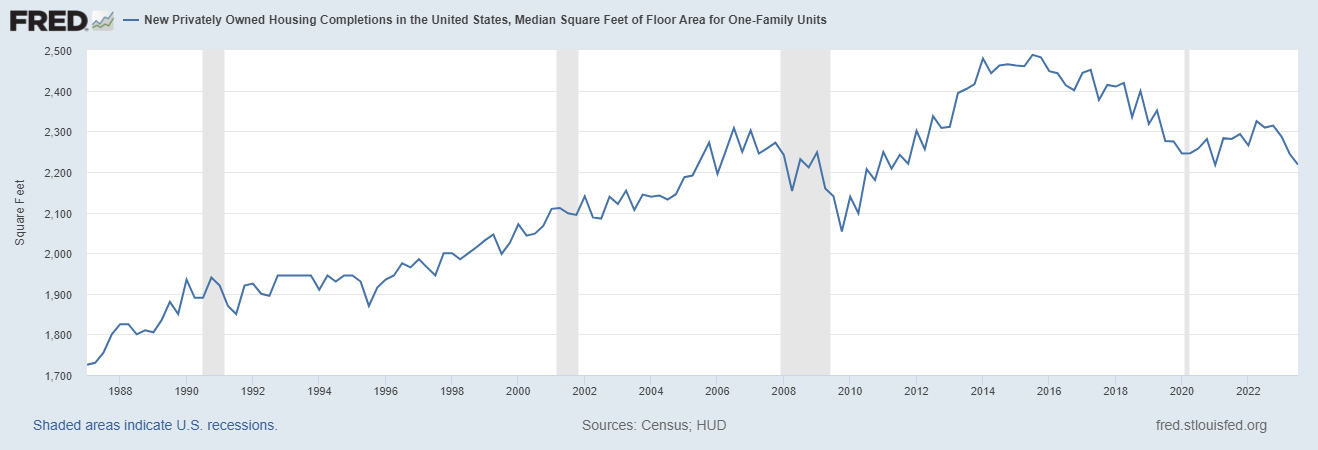

Well, it’s not that new home prices are crashing; it’s that builders are constructing smaller houses:

This is a good thing!

Builders are actually making more new starter homes.

The low supply in the existing housing market means it’s going to be difficult to find what you are looking for. Demand still exceeds supply in the housing market. If mortgage rates fall further from here, my guess is demand will come in even stronger than supply. That could mean more bidding wars in certain areas.

If I were in the market for a house I would skip the existing home market altogether and build.

You can get a lower mortgage rate and build a house to fit your needs and desires.

Anecdotally, I’m seeing new homes go up in every nook and cranny they can find land where I live. That wasn’t the case last decade.

I’ve gone through the building process multiple times. There are pros and cons to going through a builder as opposed to buying an existing home.

Pros include:

- You get a new house where you get to pick everything out. That means new everything so lower maintenance costs going forward.

- No bidding wars. No back-and-forth haggling with realtors and home sellers who have an inflated view of their home’s value.

- You could get a lower mortgage rate (this is probably more true with the national builders rather than the local builders).

- You get some time to figure everything out while the house is being built. There’s no rush to move right away.

Cons include:

- The cost will likely be higher than you think with add-ons and such.

- The number of decisions you have to make can be overwhelming. Cabinets and countertops are fun but how about grout color? Trim? Doorknobs? Cabinet handles? It’s a lot if you’ve never been through the process.

- It can take longer than you think. You’re bound to get delays because of supplies, inspections, labor shortages, etc. This is not a fast process. You have to be patient.

- You can’t get into a house right away.

- There might not be land available where you want to live.

Like most financial decisions, this one involves trade-offs.

My biggest lesson from these past few years of craziness in housing is don’t to try to time this market.

There were people who were worried about prices going up 20% in 2020 or 2021 who wanted to wait for a 10% pullback that never happened. Then they missed 3% mortgage rates.

If you can’t afford it, you can always save for a bigger down payment or keep renting.

But if you want to buy a house and you can afford it, go for it.

Don’t try to time the housing market.

And maybe look to build if you want to avoid competition on such a large purchase.

We covered this question on the latest edition of Ask the Compound:

Taylor Hollis joined me again this week to discuss questions about bond losses, diversifying your stock market exposure, the right questions to ask your financial advisor, and how to think about municipal bonds in a portfolio.

Further Reading:

How Demographics Are Shaping the Housing Market