A reader asks:

Ben in your recent blog post you said $1M investable wealth makes you rich. I would like to provide a counterargument to that. When you retire, $1M basically gives you $40,000 per year to live off of, assuming the 4% rule of thumb is a reasonable starting point to think about retirement income. So is $40k spend a year really rich? I would argue that it is middle class at best; probably lower middle class really. I would argue that if your wealth is buying you a retirement, then it takes at least $3M – $4M to be “rich” (upper middle class). What are your thoughts?

The post in reference here is last week’s $5 Million is Nothing, where I shared some data that many millionaires don’t feel wealthy. Many millionaires consider themselves upper middle class or even regular old middle class.

I received a lot of feedback from people who are members of the dos comma club with seven figures of wealth.

I have some thoughts on what being a millionaire means in retirement, but first, I want to put this level of wealth into perspective.

Credit Suisse Global Wealth Report tallies up the number of rich people worldwide. There aren’t that many of them in the grand scheme of things.

Out of a population of 8.1 billion people, just 62.4 million are millionaires. That’s 0.8% of the population. There are 8.4 million people globally with a net worth of $5 million or more. Having this level of wealth would put you in the top 0.1%.

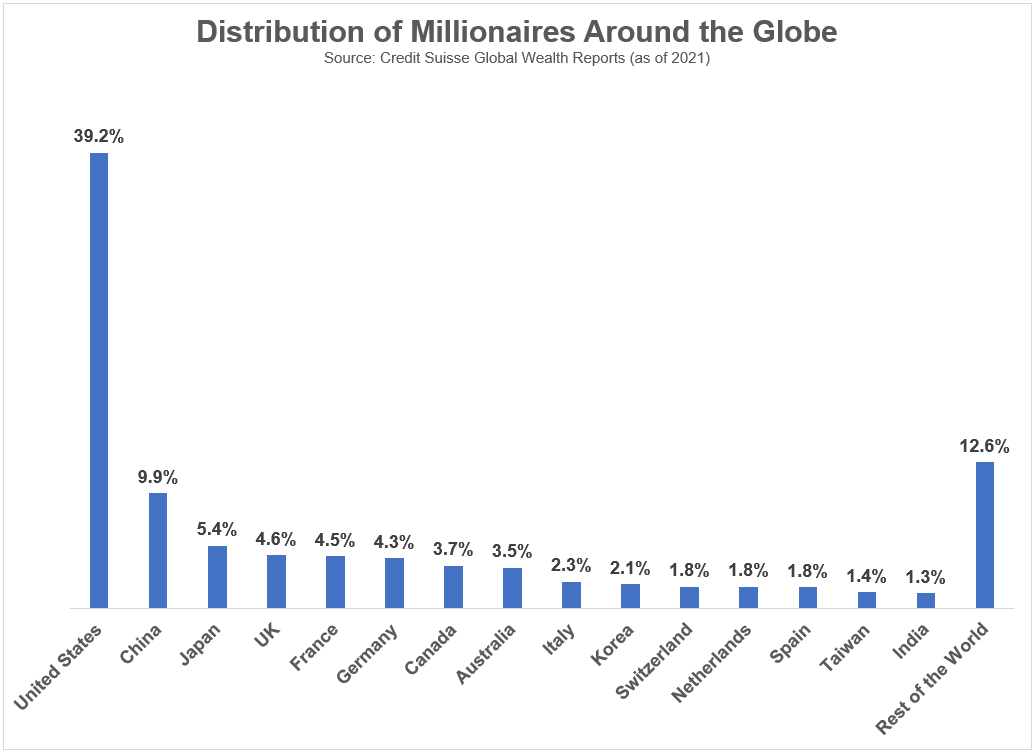

People in the U.S. may not realize how good we have it. Here’s the distribution of millionaires around the globe:

Nearly 40% of all millionaires around the globe reside in the United States. There are more millionaires here than in China, Japan, Great Britain, France, Germany, Canada, Australia, and Italy combined.

I’m not trying to make you feel bad if you’re a millionaire who still feels like you’re middle class at best. But let’s be honest– if you’re a millionaire, you’re wealthy. Maybe that doesn’t change how you feel about your wealth but it’s a fact.

Unfortunately, when it comes to money decisions, feelings override facts.

I do have some good news when it comes to retirement spending though. Your money will probably take you further than you assume.

Yes, retiring means giving up your income stream. That’s a scary proposition and one of the reasons many millionaire retirees don’t feel wealthy enough.

A good rule of thumb from most retirement experts is you’ll have to replace 70-80% of pre-retirement income. For people who are financially literate, this number seems too high.

If you accumulated millions of dollars through diligent saving over the years, you don’t need as much income during retirement. A high savings rate in your working years means less money to replace in retirement.

If you save 20-30% of your income, you’re already living on 70-80%.

Most retirees have their mortgages paid off. That lowers your living expenses considerably.

Those living expenses tend to fall in retirement as well. Studies show spending peaks from age 41 to 56. Average spending from age 57 to 75 is actually lower than what people spend from age 25 to 40. Spending falls by around a third for those 76 and older.

Retirees generally pay less in taxes because they no longer recieve a paycheck. Plus you have Social Security to count on.

Put it all together and you probably need less than money than you think in retirement. Many retirees have a hard time spending money in retirement because they’re worried about running out of money or don’t feel rich enough to enjoy themselves.

It’s also important to remember the 4% rule for retirement withdrawals is a risk management strategy meant to protect against the worst-case scenario (running out of money). Michael Kitces performed a study on a 60/40 portfolio going back to 1870 with a 4% withdrawal rate. The findings might surprise you:

The decision to follow a 4% initial withdrawal rate makes it exceptionally rare that the retiree finishes with less than what they started with at the end of the 30-year time horizon; only a small number of wealth paths finish below the starting principal threshold. In fact, overall, the retiree finishes with more-than-double their starting wealth in a whopping 2/3rds of the scenarios, and is more likely to finish with quintuple their starting wealth than to finish with less than their starting principal!

There are no guarantees this will continue but most retirees end up with even more money than when they started by following this rule of thumb. If you have millions of dollars and 30 years or so in retirement, there’s a good chance your money will keep compounding.

I can’t tell you how to feel about your money. Money is more about emotions than spreadsheets.

Defining “rich” is a tricky situation.

Is it a high income? The amount of money you spend? Your net worth? How money makes you feel? All of these things?

If you spend an inordinate amount of time worrying about money, you aren’t wealthy.

My take is if you have enough money to stop working and keep up your same standard of living, you’re wealthy.

Until the past 100 years or so most people never retired. They worked until they died. If you have the ability to buy your freedom by spending time how you would like without having to work, that’s a rich life.

This is true whether you have a million dollars in the bank or not.

Nick Maggiulli helped me take this question on the latest edition of Ask the Compound:

We also discussed questions about retirement withdrawal strategies, helping your family invest in inheritance, investing in real estate when you can’t afford a house and retirement withdrawal strategies.

Further Reading:

You Probably Need Less Money in Retirement Than You Think

And check out Nick’s new piece on safe withdrawal rates for a 60/40 portfolio:

What is the Safe Withdrawal Rate in Retirement?