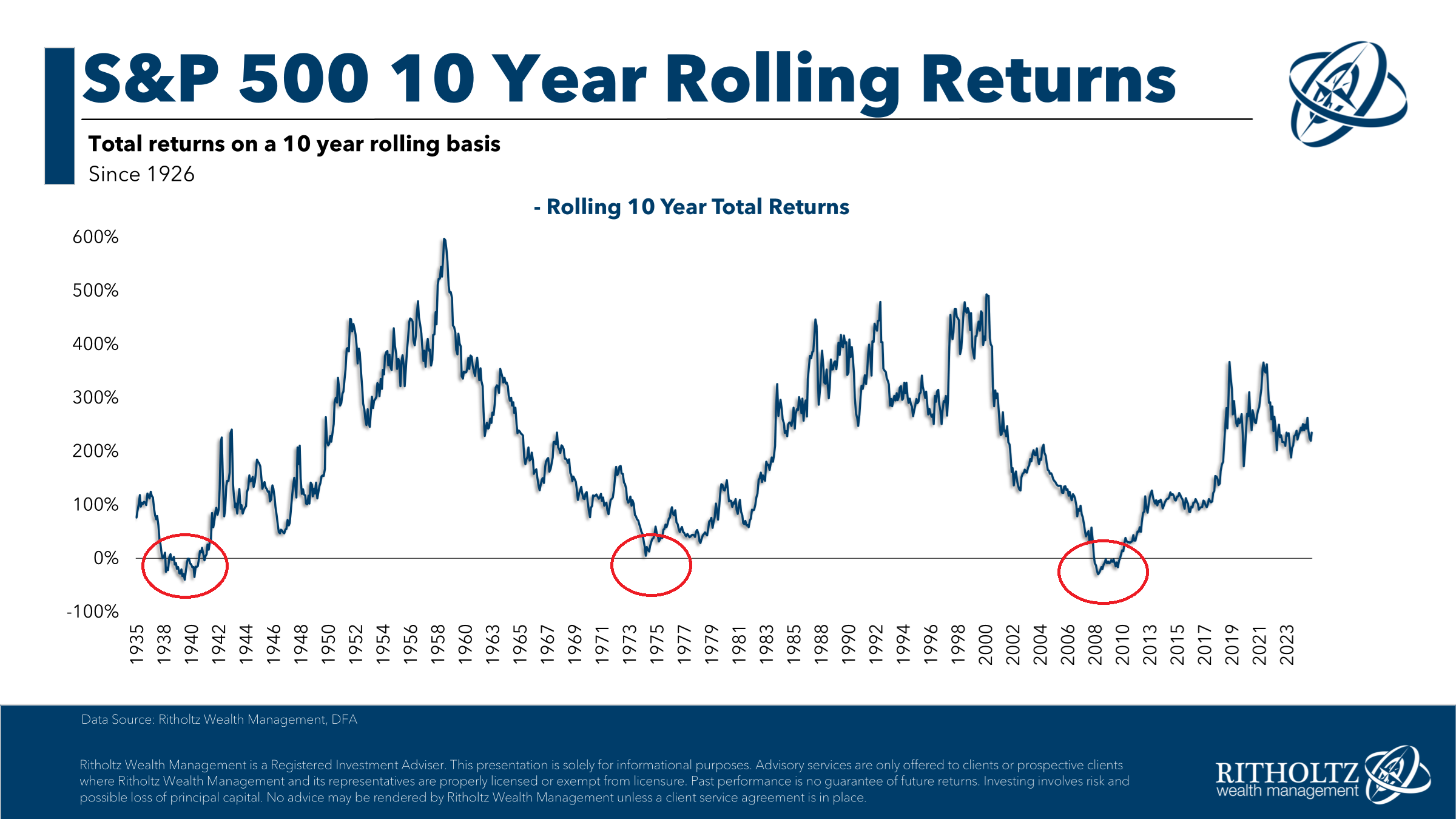

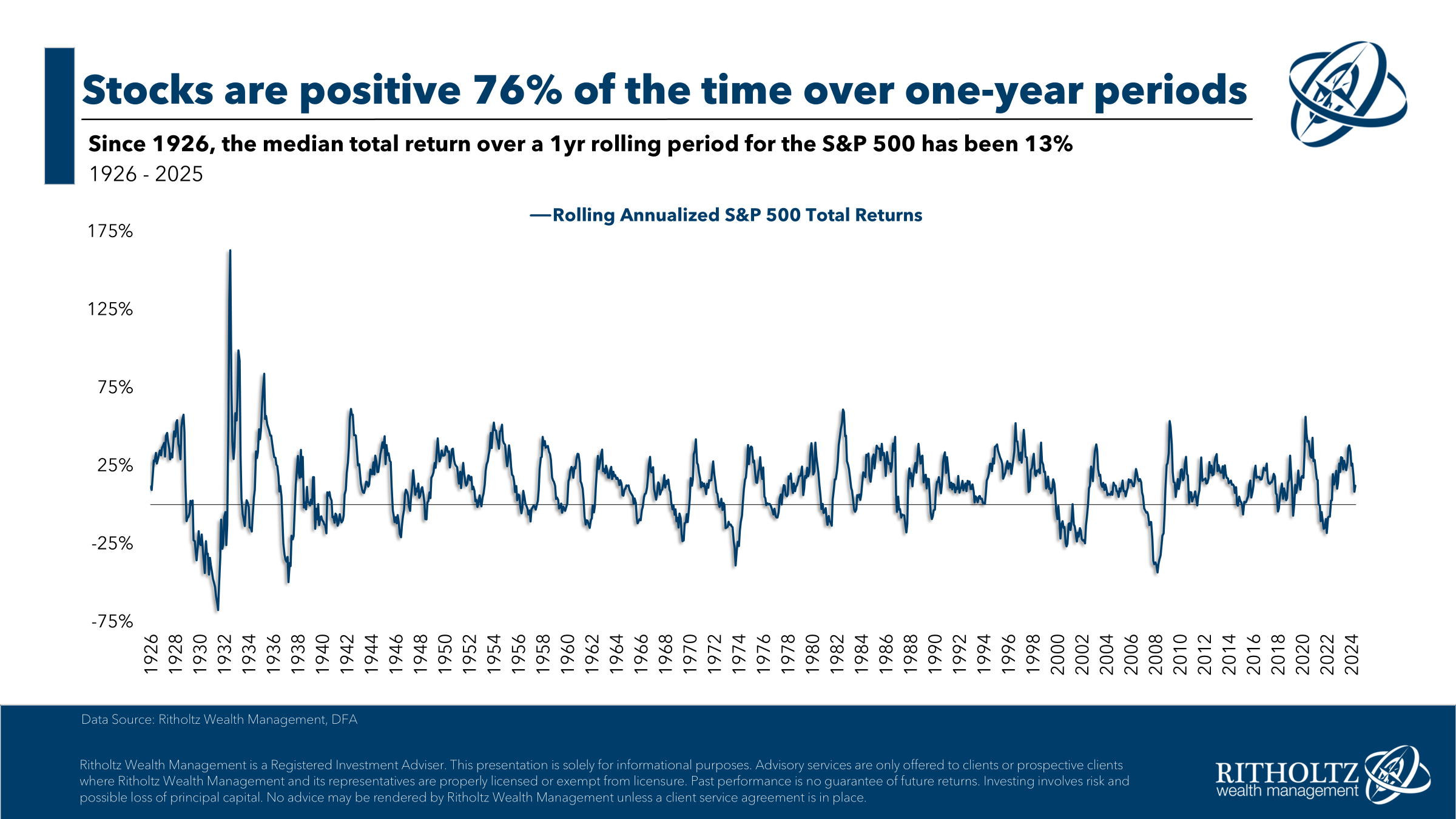

Is the S&P 500 now a risk free asset?

Is the S&P 500 now a risk free asset?

Some thoughts on the risks and opportunities in AI.

On today’s show we discuss why technical analysis matters in a downturn, why stockpicking is so hard, do we need a recession, Jamie Dimon is worried about government bonds, how many millionaires there are, AI deflation vs. government spending inflation, when to worry about government debt, the bull market is self-driving cars, it’s finally a buyer’s market for housing and much more.

It’s time to put in some low-ball offers in housing.

On today’s show, we are joined by Scott Blasdell, Portfolio Manager and Don San Jose, Chief Investment Officer of the U.S. Value Team at J.P. Morgan to discuss what value means today, looking for quality within value, why valuation still matters, why the wine business is in trouble, and much more!

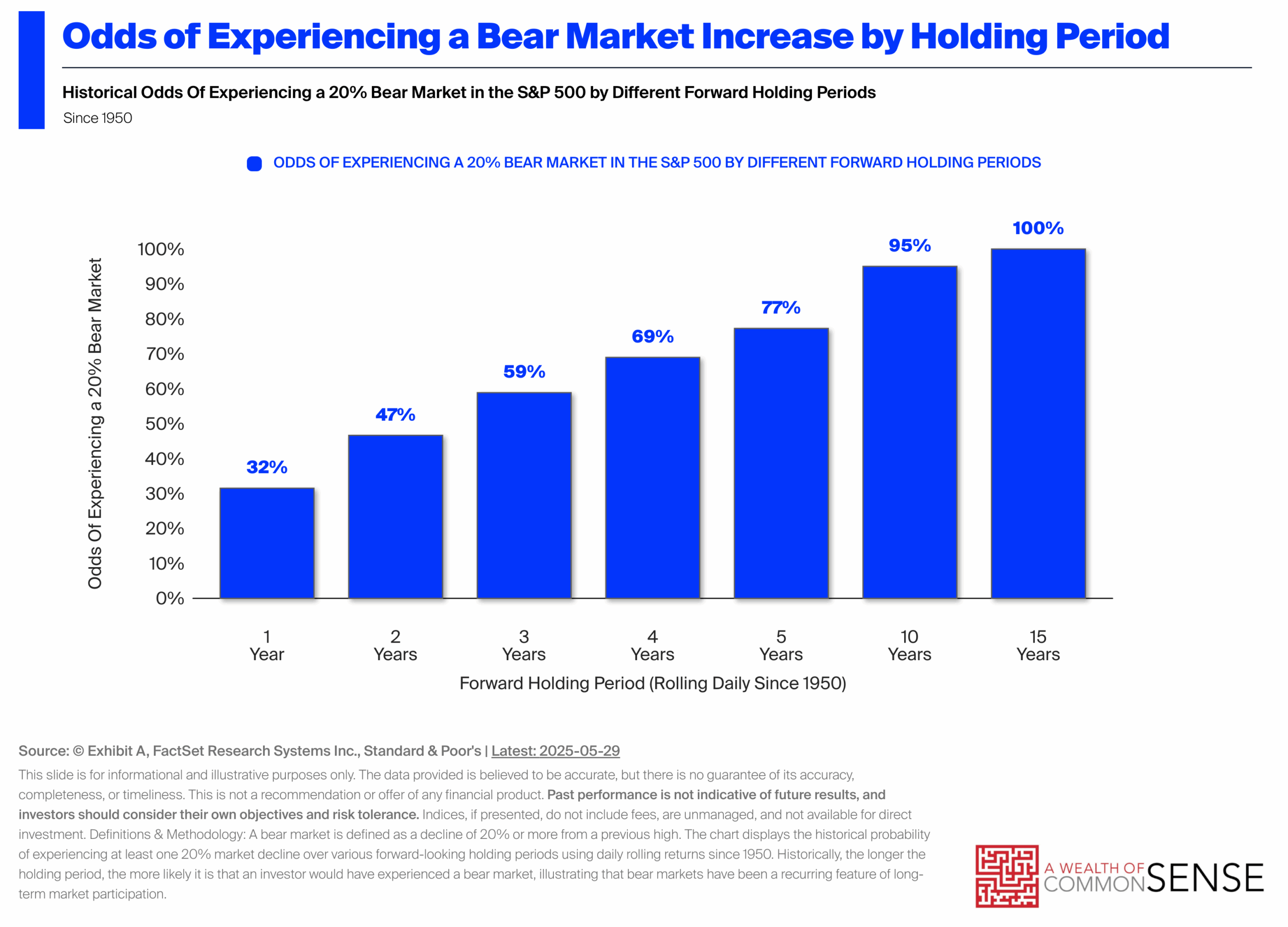

How often do bear markets occur?

A closer look at the drawdown profile of individual stocks.

When should retirees sell stocks for RMDs?

On today’s show we discuss long-term bond yields rising, why government debt won’t fall, where all the dry powder is coming from, how often you should expect bear markets, a weird time to be rich, $97 salads, why starter homes died, retail bagholders, why everyone takes Social Security early, Tom Cruise and more.

Why don’t we build more houses anymore?