The markets don’t provide you high returns just because you need them.

The markets don’t provide you high returns just because you need them.

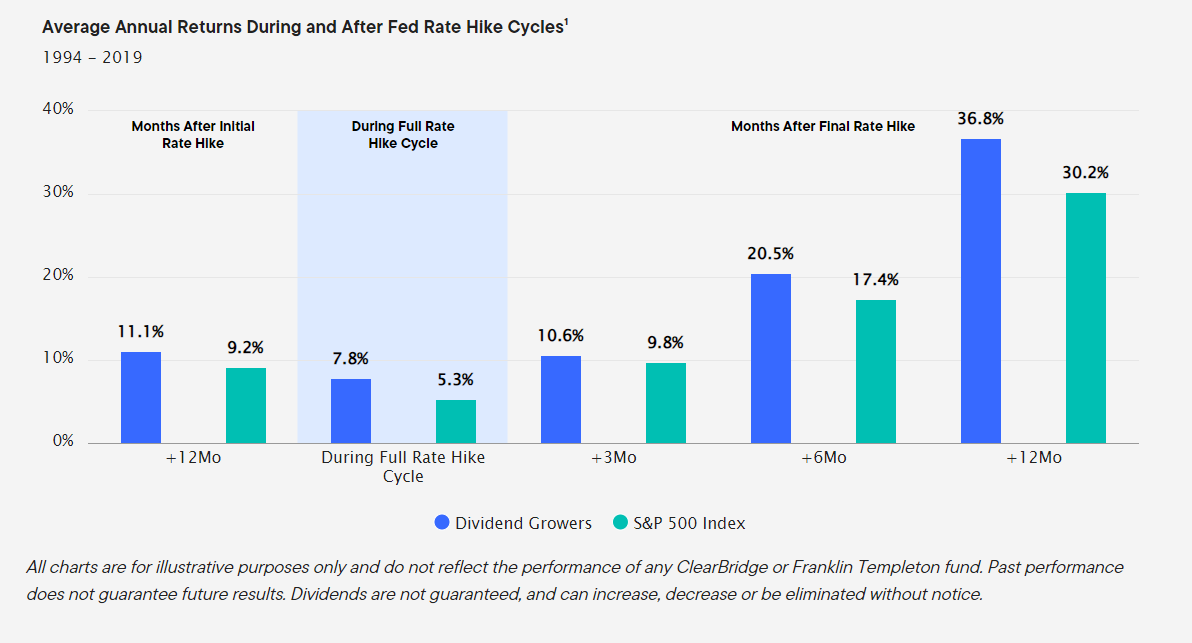

On today’s show, we spoke with Chris Floyd, VP and Portfolio Manager for Franklin Templeton Investment Solutions to discuss:

– How rates affect high-dividend paying companies

– The low volatility aspect of the portfolio

– Utilizing REITs as an income driver

– Systematic approaches to screening out negative factors vs concentrating on positive factors, and much more!

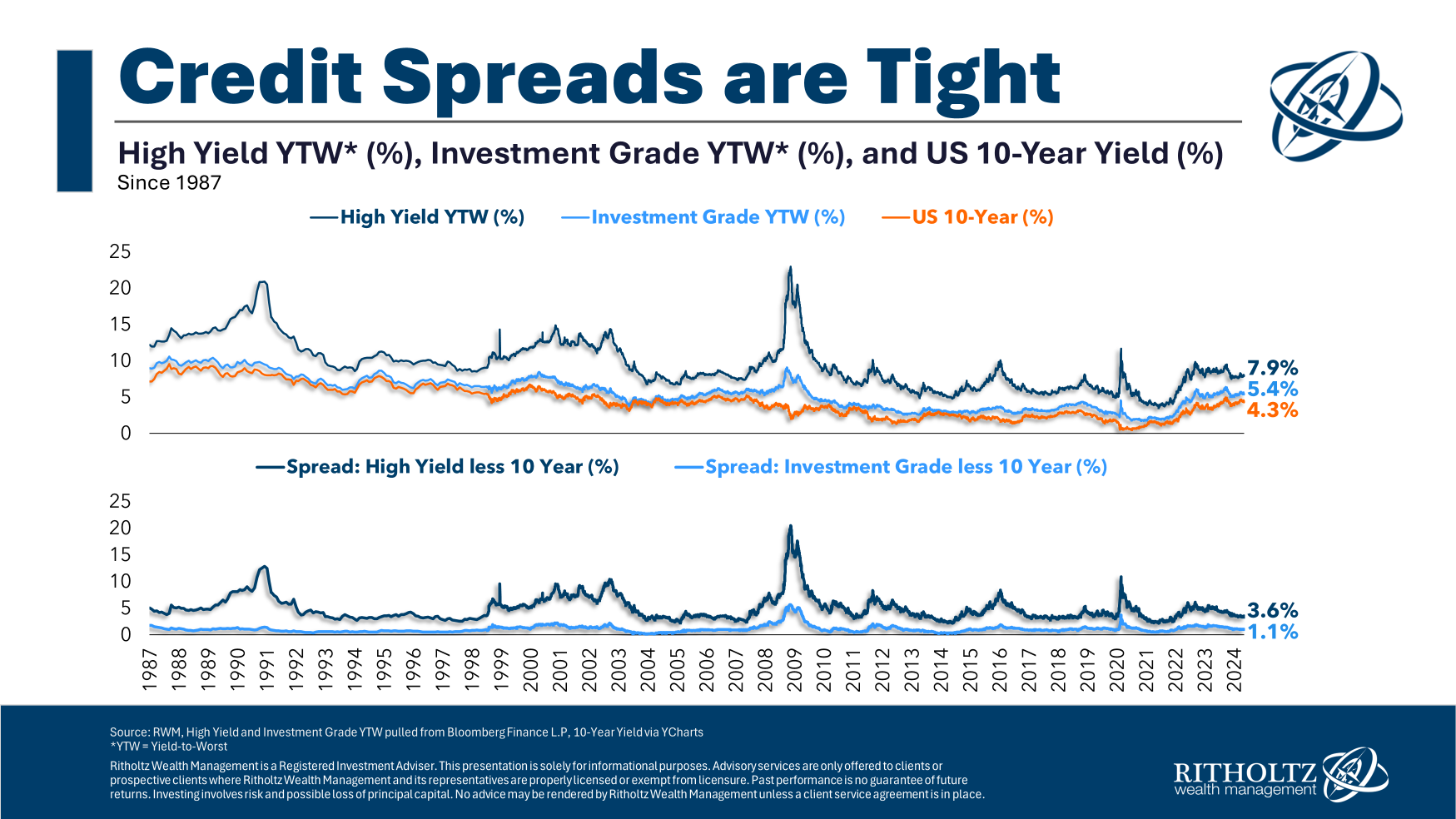

A look at the risks in the bond market.

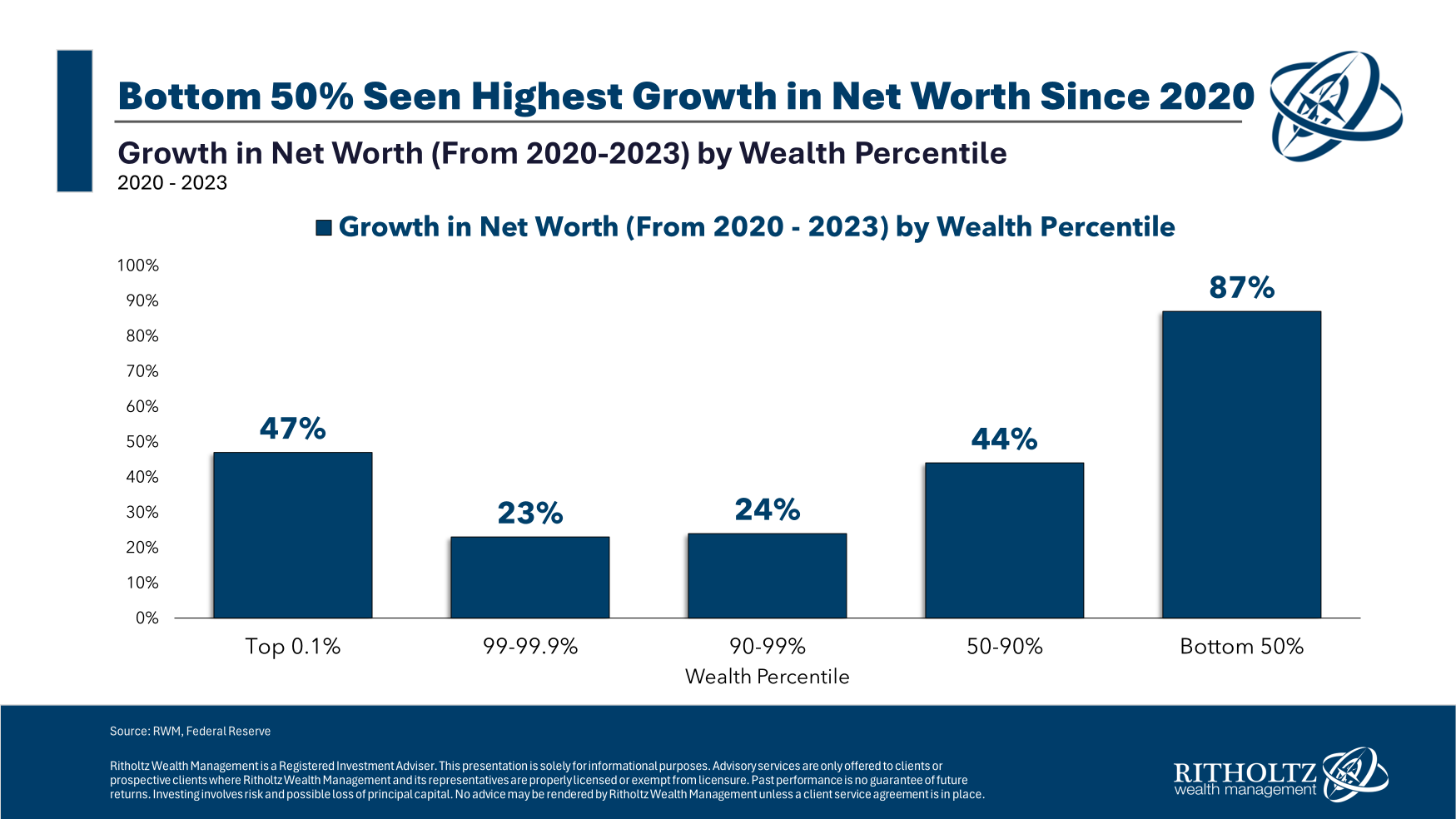

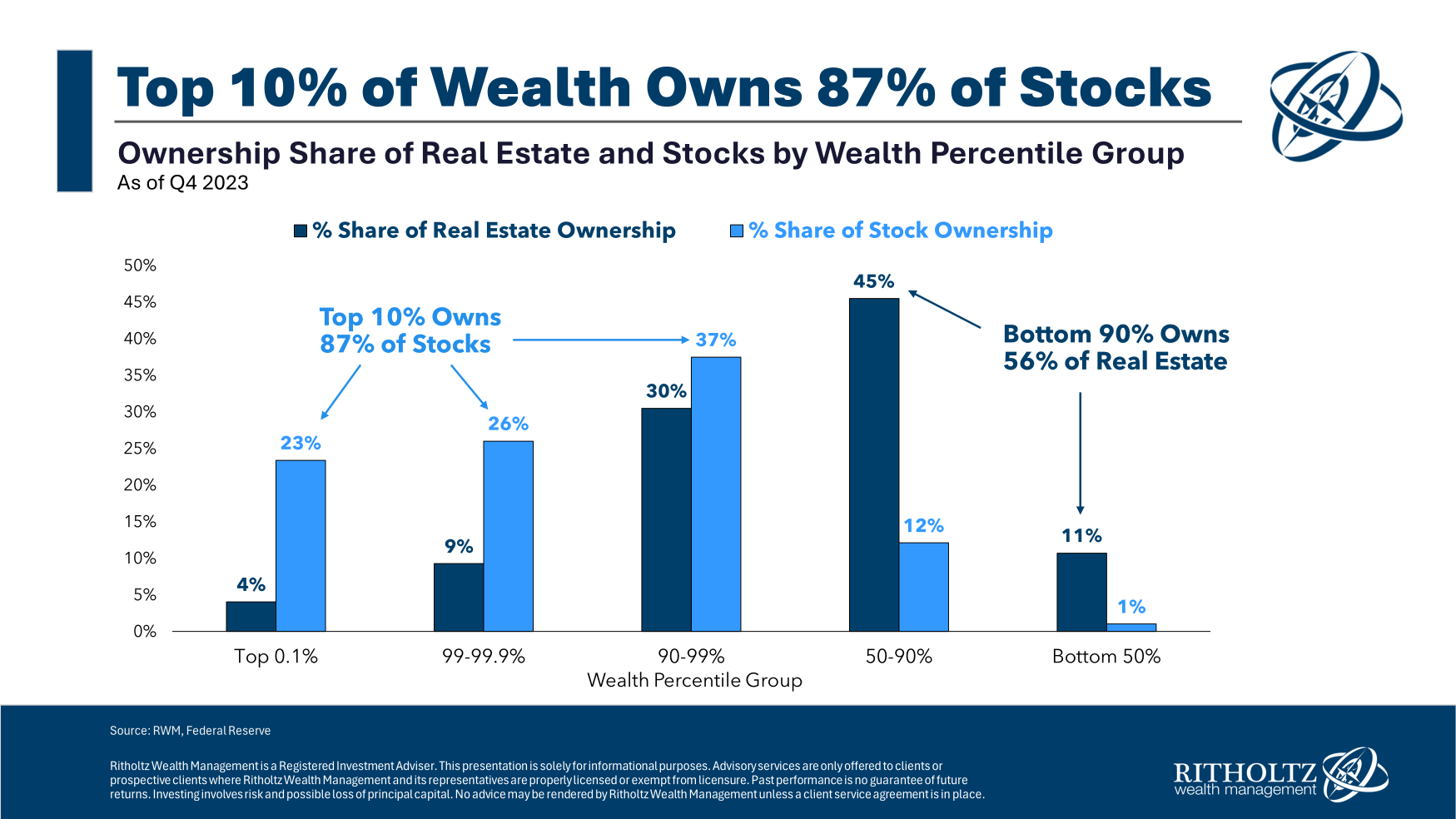

A closer look at the pandemic economic fortunes of the bottom 50%.

What’s the right asset allocation for a $10+ million portfolio?

On today’s show, we discuss:

– What happens if the AI bubble bursts

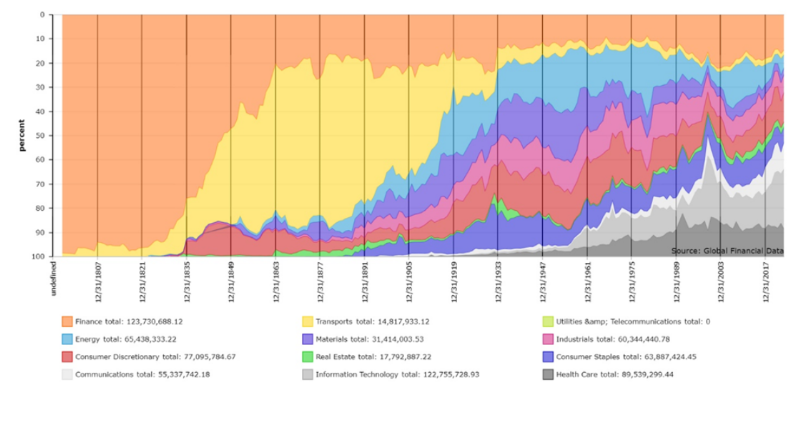

– 200 years of stock market concentration

– How to find lower insurance premiums

– The bottom 50%

– The fentanyl of private markets

– Assets and debts across generations

– Middle age conversation starters, and more.

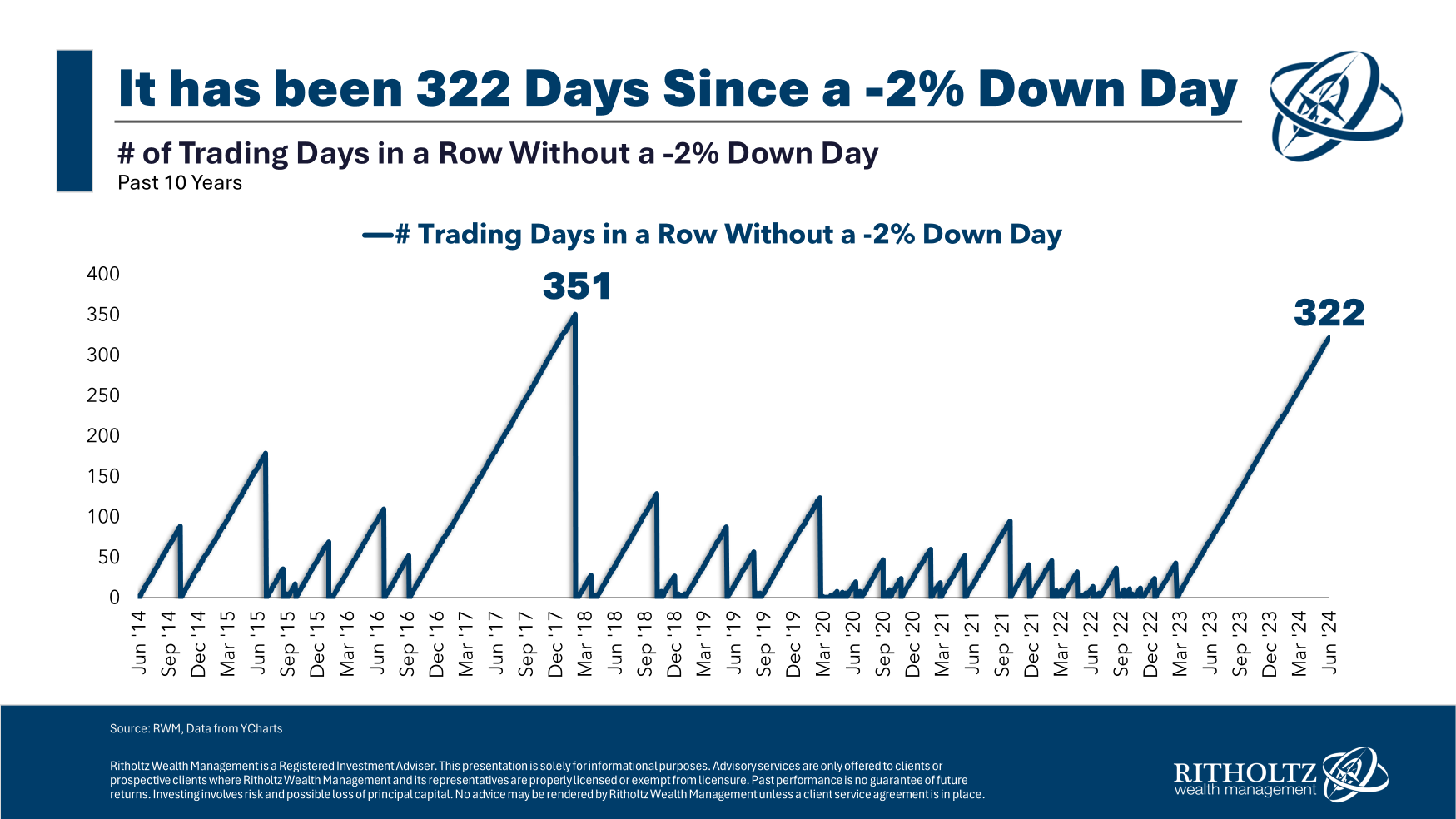

Preparing for a downturn in the stock market.

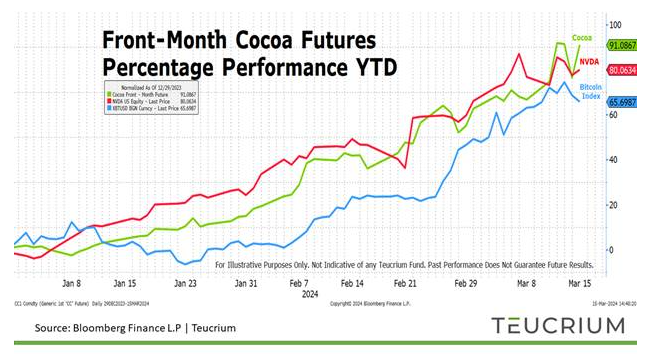

On today’s show we are joined by Sal Gilbertie, CEO of Teucrium to discuss:

– The cost of production and commodities

– How inflation affects the cost of production

– How investors are utilizing Teucrium products

– What’s going on in cocoa, and much more!

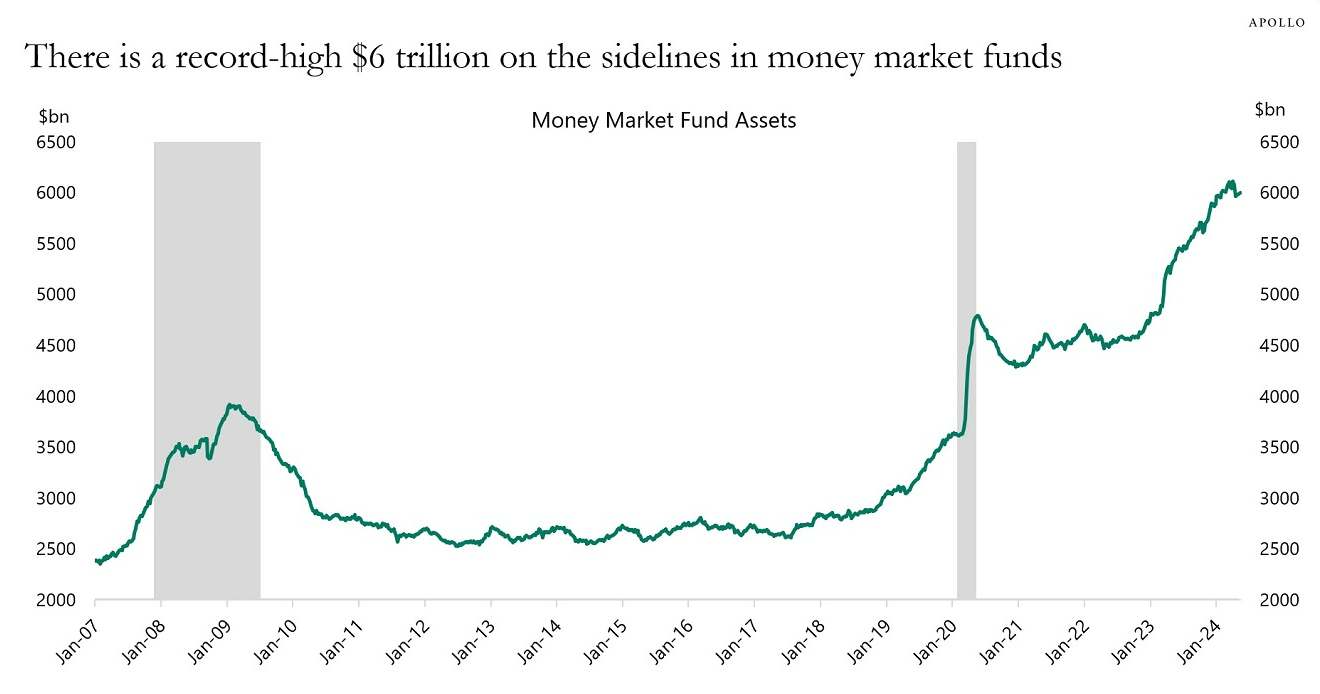

Some thoughts on home equity, money market funds, CDs, T-bills and cash in checking accounts.

It’s never been easier to buy stocks or harder to buy a house.