Some thoughts on how young people can build wealth.

Some thoughts on how young people can build wealth.

On today’s show we discuss why investors are ignoring scary headlines, war vs. the stock market, a slowdown in the labor market, not every bad thing is a crisis, all stock markets are concentrated, it’s getting more expensive to own a car, Mark Zuckerberg is desperate, the stablecoin opportunity set, baby boomers are never selling their houses and more.

Baby boomers don’t want to sell their homes.

On today’s show, we are joined by Sean O’Hara, Director at Pacer Financial and President at Pacer ETFs to discuss why free cash flow is important, how the index is constructed, how momentum works, valuations within growth stocks, and much more!

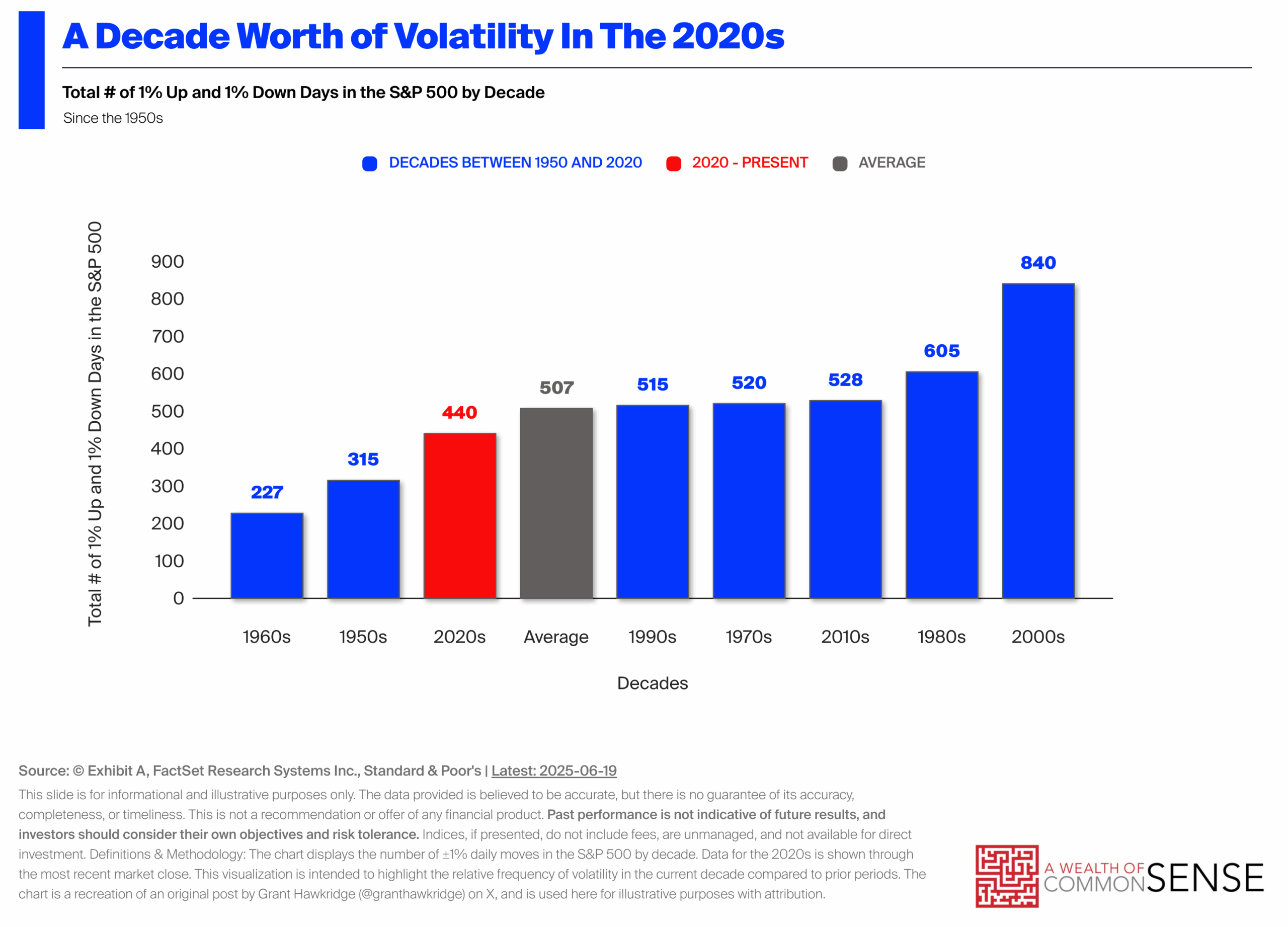

Markets are volatile but just keep going up.

Are rich people immune to the economy?

What the Bogle Expected Return Formula says about today’s stock market returns.

On today’s show we discuss valuations not mattering, volatility is the new normal, all-time highs in rich people, bubble behavior in AI, gambling is off and running, limit orders on crypto trades, the housing market is not fair, the downside of illiquidity, Michael’s email pet peeves and more.

You’ll never be able to keep up with all the Joneses.

On today’s show, we are joined by Steve Hlavin, Portfolio Manager at Nuveen to discuss the muni market structure, the best states for muni bonds, risks around deficits and liquidity, and much more!