My plan to get more people saving for retirement and investing in the stock market.

My plan to get more people saving for retirement and investing in the stock market.

Investors love buying the dip.

Why risk and reward is more important than bullish or bearish.

On today’s show we discuss some 1929 and 1932 comparisons, the impact of tariffs on small businesses, supply chain problems are coming, putting the dollar’s move into perspective, jumping into a recession, why a recession might feel worse than it actually is, the correction is still relatively mild, retail keeps buying the dip, Bitcoin is decoupling, $145,000 mud rooms and much more.

Buffett’s 4th law of motion.

On today’s show, we speak with Jason Greenblath of American Century Investments about short duration fixed income, remaining active during recessions, inflationary spikes and fixed income and then we speak to Christian Hoffmann of Thornburg Investment Management to discuss opportunities in global credit markets, recession risk, heightened volatility, the Fed and inflation, and much more!

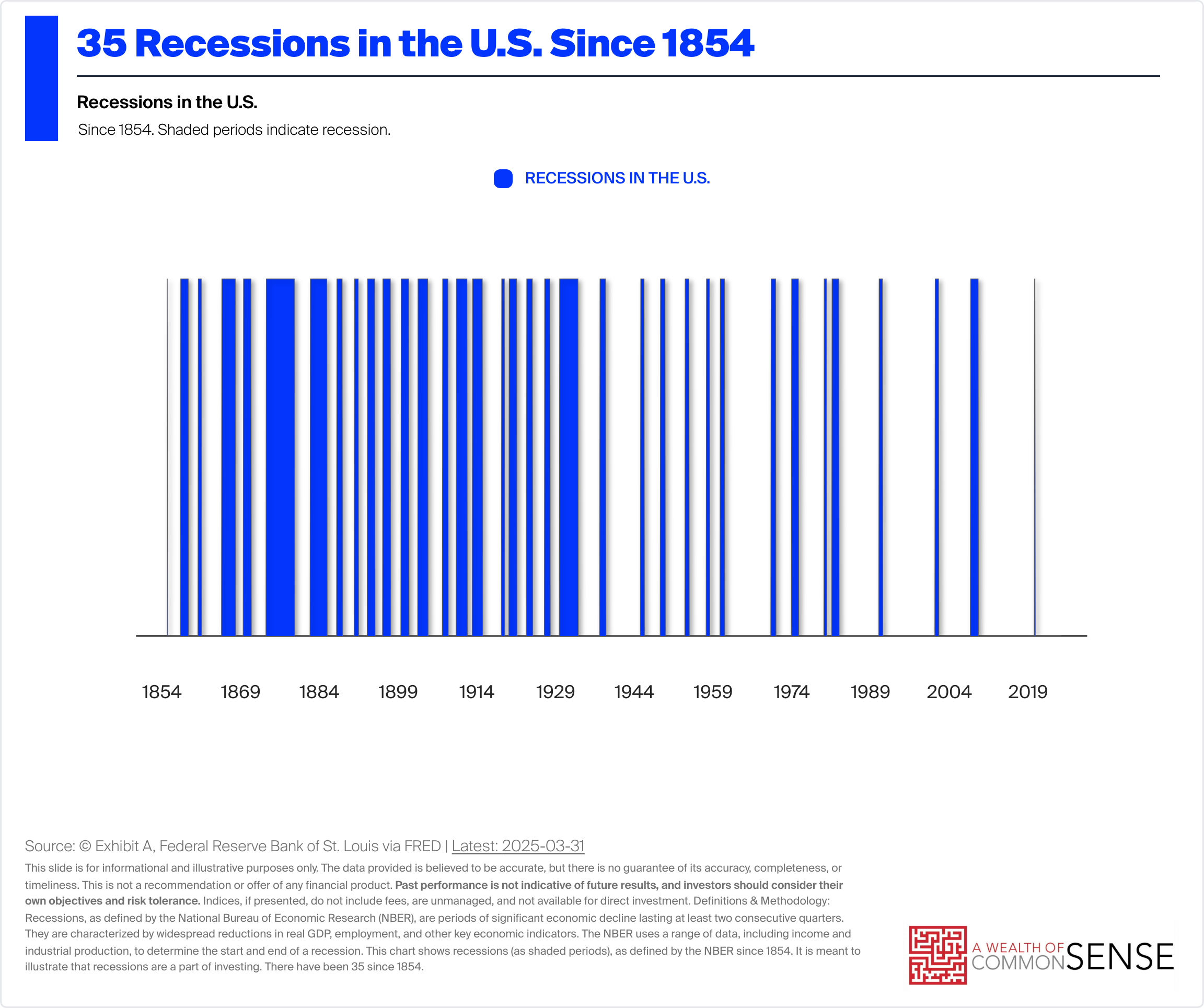

Some thoughts on the timing of the next recession.

Economic dynamism requires a safety net.

Some questions about how to invest in a new regime.

On today’s show we discuss the tariff tantrum, why a falling dollar matters, yields are rising, betting markets on recession predictions, sentiment is falling off a cliff, buying stocks when they’re down 15%, the unintended consequences of Trump’s trade policies, panic in the stock market, when you should sell some stocks and much more.