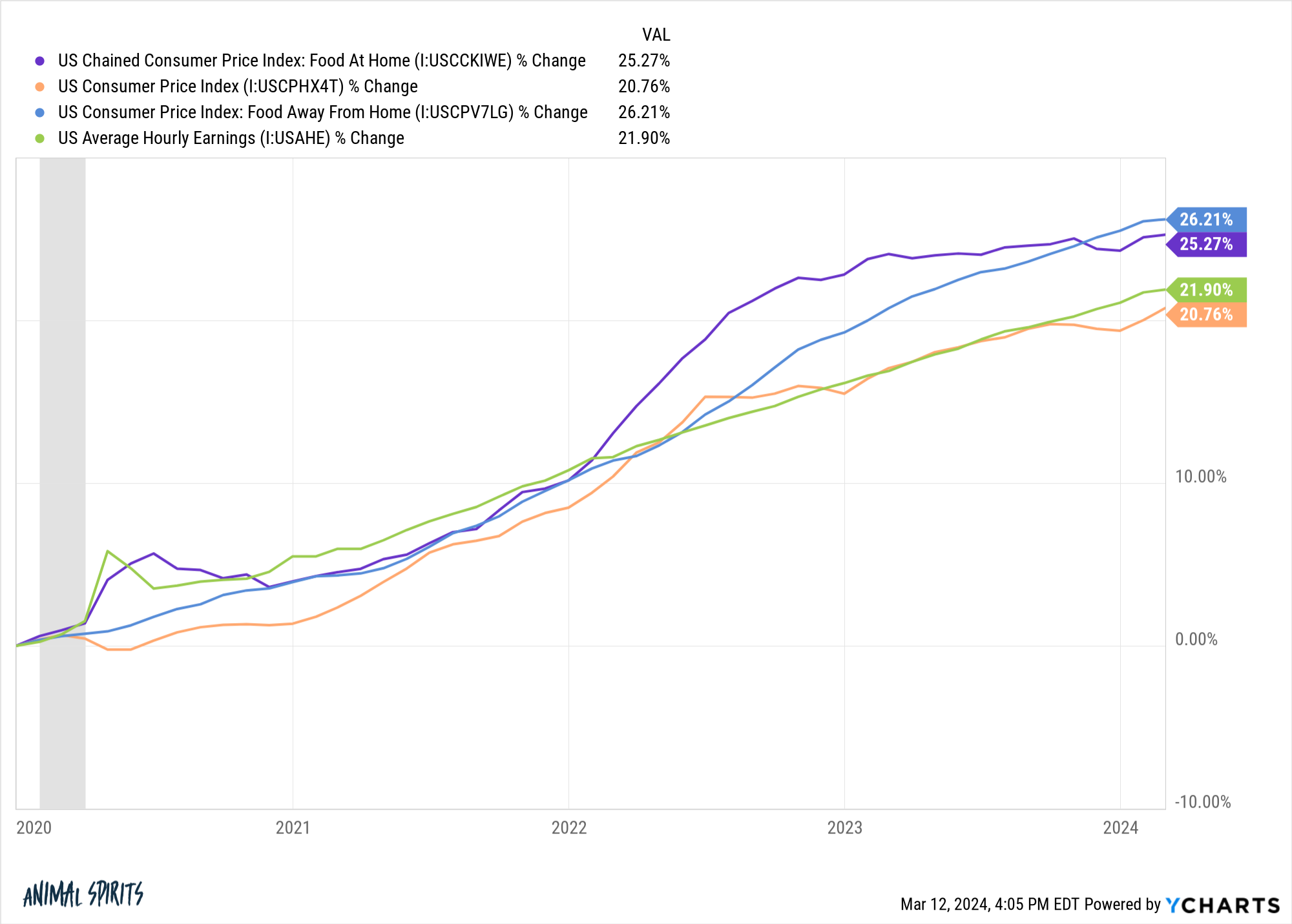

Why everyone is so angry about grocery store prices.

Why everyone is so angry about grocery store prices.

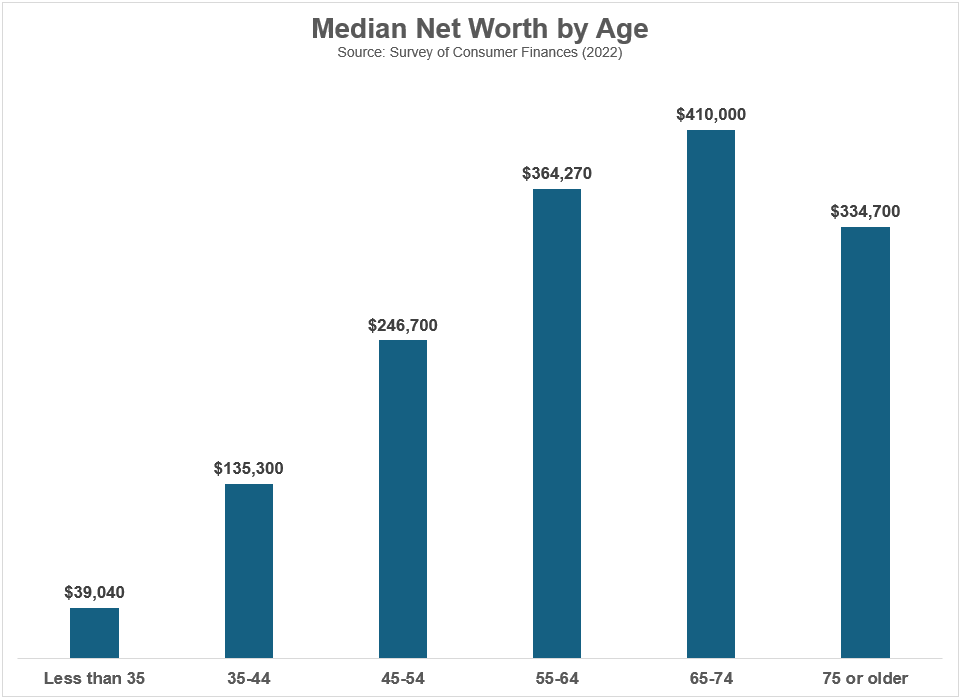

Answering a handful of questions about retirement planning at various stages of life.

On today’s show, we discuss:

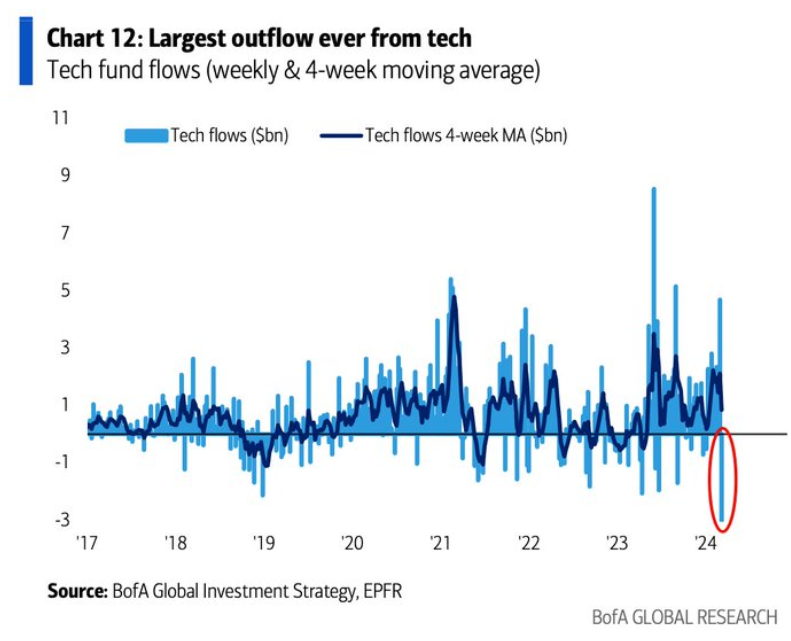

– One of the most resilient stock rallies ever

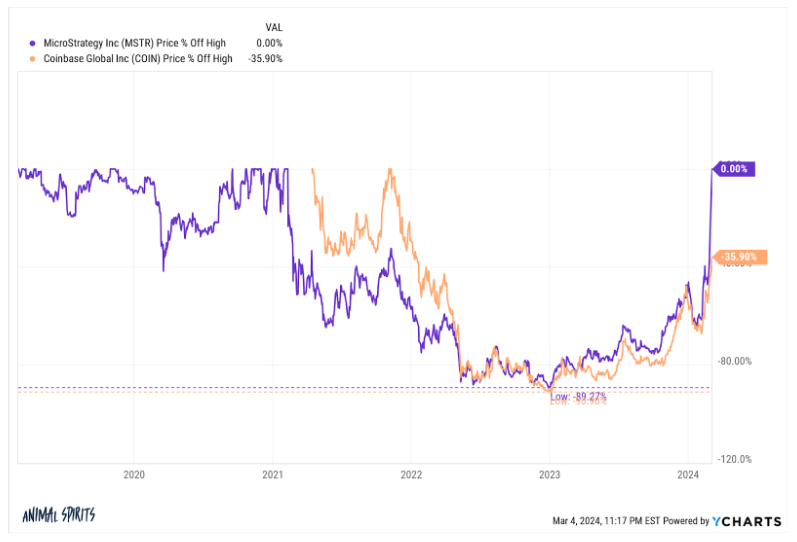

– Money market funds vs. crypto

– Americans are rich

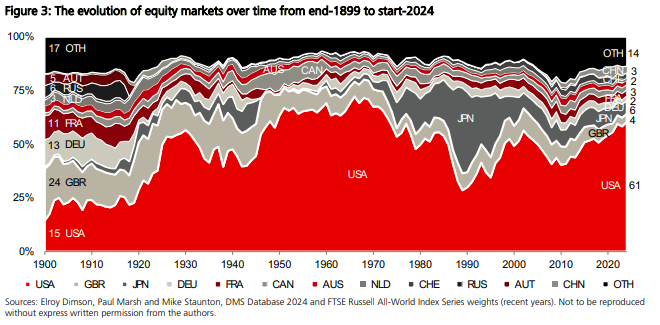

– The stock market has always been concentrated

– Inflation at the grocery store

– The biggest reason the Fed needs to cut rates

– Some good news for first-time homebuyers, and much more.

Some thoughts on owning international stocks (or any strategy that’s underperforming).

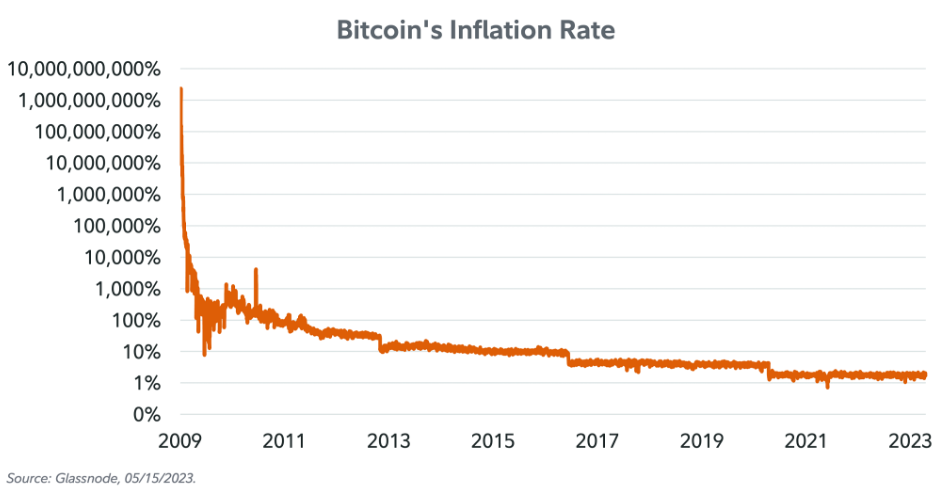

On today’s show, we are joined by Chris Kuiper, Director of Research, and Matt Horne, Head of Business Development for Fidelity Digital Asset Management to discuss:

– The new Bitcoin ETFs

– How much news is priced into Bitcoin price

– What the Bitcoin halving is

– How crypto and macro economics fit together

– Institutional adoption of Bitcoin, and much more!

Some stuff I’ve learned over the years.

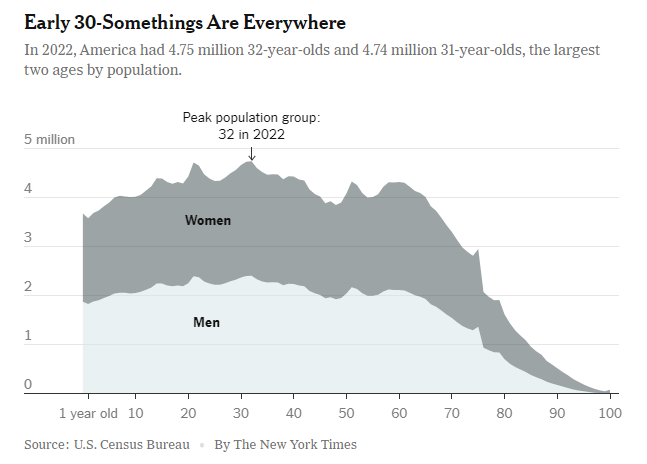

How some of the biggest demographic trends are impacting markets & the economy.

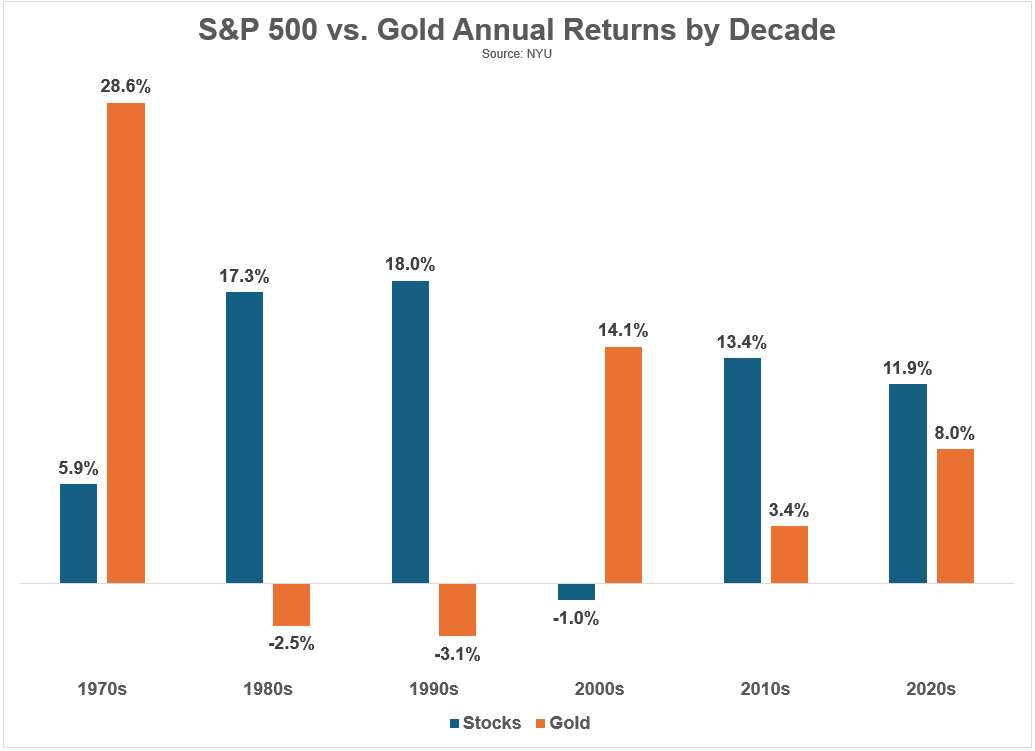

A closer look at the pros and cons of investing in gold.

On today’s show, we talk about:

– Why the markets continue moving higher

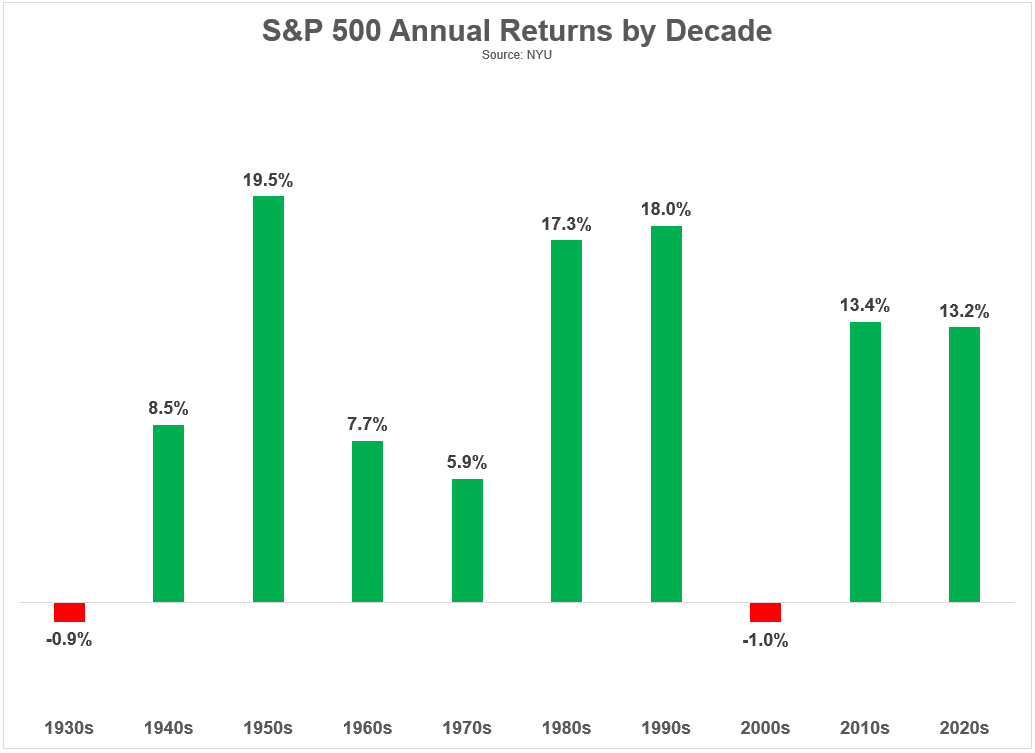

– Why buy and hold is the best (and worst) strategy

– How 401ks impact the stock market

– Billionaires can’t complain about inflation

– Consumers keep consuming

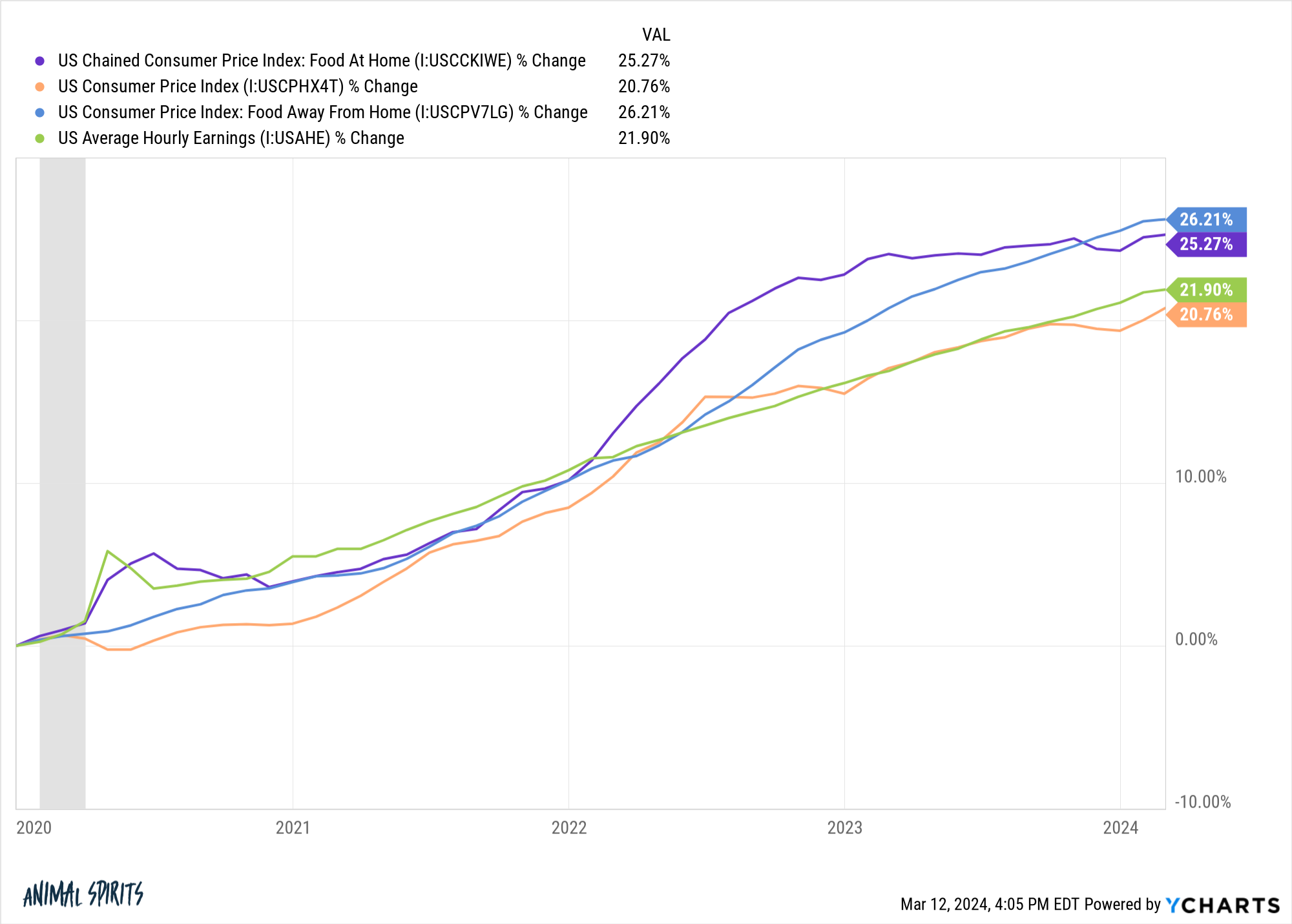

– Th richest generation in history

– Crypto just won’t die

– Why we keep seeing so many booms & busts

– The best new shows of 2024, and much more.

Some thoughts about being a long-term buy & hold investor.