America is in a weird place demographically-speaking.

On the one hand, we have 70 million baby boomers reaching retirement age. They control most of the wealth. They control most of the housing market. And they still control the thermostat when you visit their houses.

On the other hand, we have 73 million millennials who are in their prime household formation years. They don’t control nearly as much wealth (but they will someday). They don’t own most of the houses (but they will someday).

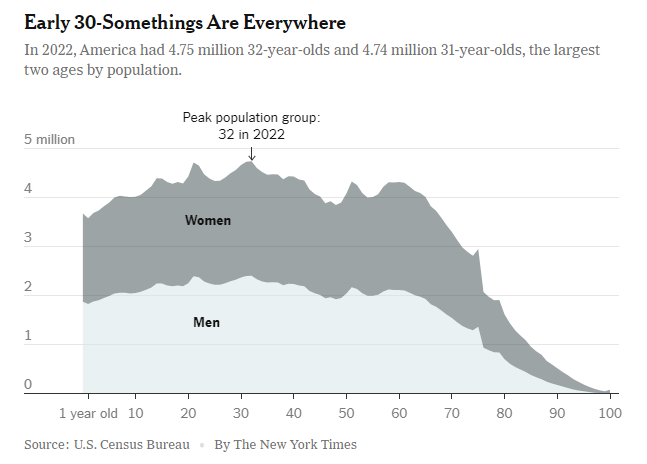

The two largest ages in the United States right now are 31 and 32-year-olds (via The New York Times):

Millennials aren’t kids anymore. They have jobs. They live in the suburbs. They’re buying houses (or want to). They have kids.

And what do you do in your household formation years? You spend money. Moving is expensive. Housing is expensive. Kids are expensive. Filling your house with stuff is expensive.

In America we love to consume and the largest demographic is entering their prime consumption years. This is going to provide a floor under the economy for years to come.

The millennial homeownership rate is roughly 50%. Gen X is more than 70%, and baby boomers are closer to 80%. Plenty of millennials will be looking to buy homes in the years ahead to fill that gap.

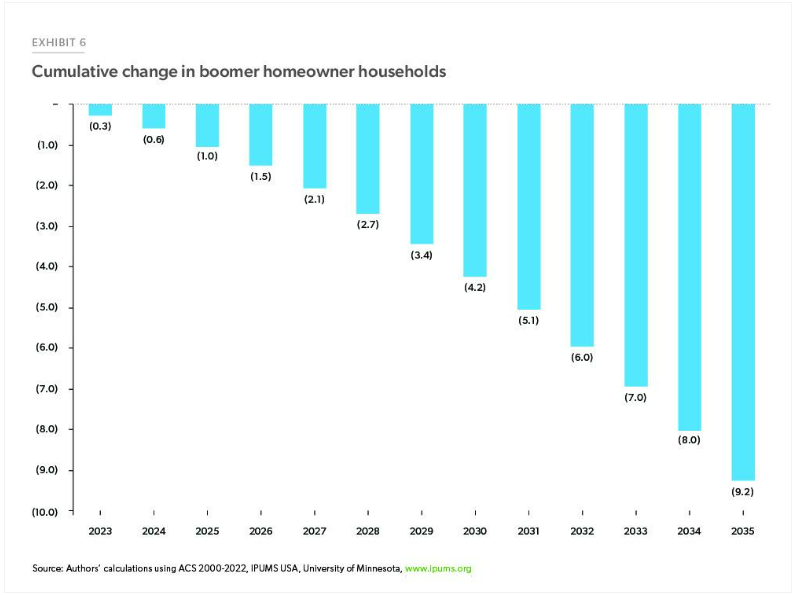

In a supply-constrained market where we simply aren’t building enough homes, the hope is the baby boomers will provide that supply as they retire, downsize, use their home equity to fund retirement or eventually die off.

According to Freddie Mac, don’t count on a wave of baby boomer houses hitting the market. They estimate the total number of baby boomer households will go from 32 million now to around 23 million by 2035 as the oldest boomers turn 90.

Over the next five years that’s roughly 2.7 million homes that will change hands:

That’s more like a small breeze at the beach than a tsunami.

But maybe young people will get lucky. Demographic trends don’t always follow the script.

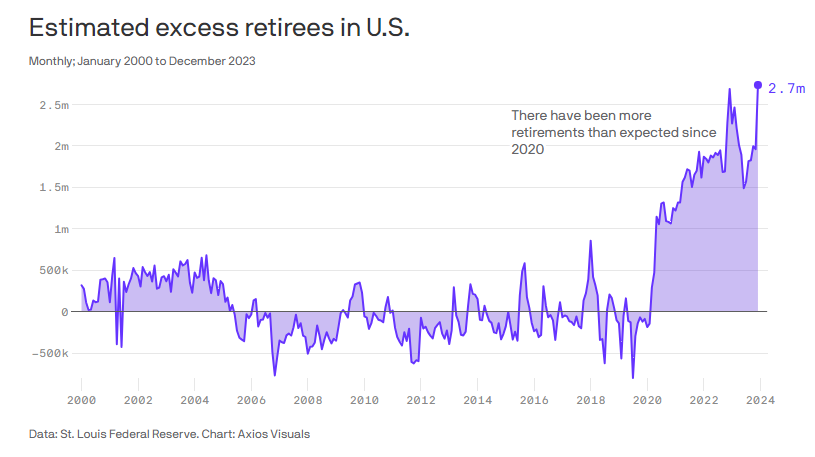

Just look at the number of baby boomers who retired early following the pandemic (via Axios):

A rising stock market, higher housing prices, and some existential stuff from Covid gave us 2.7 million more retirees than expected.

My initial thought here is this could actually help the economy. Younger people can step into the jobs boomers are vacating. The newly retired will be spending some of the money they’ve been hoarding. Good luck finding a deal on a cruise ship for the next 20 years.

Early retirees aren’t the only ones who should feel better about their net worth.

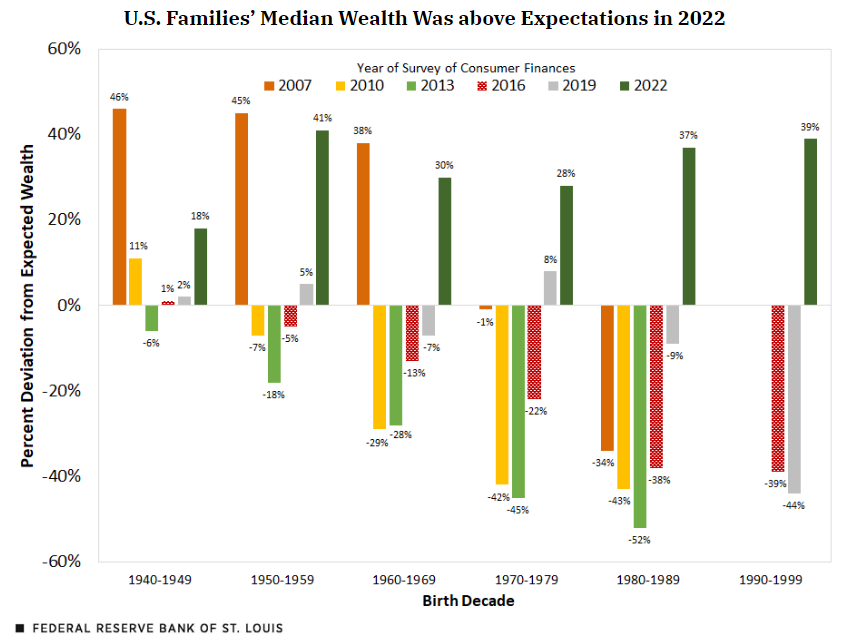

Back in 2019, I wrote a piece about how young people were 34% below their predicted wealth levels based on the experience of earlier generations at the same age. The Great Financial Crisis did a number on millennials.

The pandemic reversed that trend and then some. These are the updated numbers from the St. Louis Fed:

They explain:

We found that the median wealth of older millennials (those born between 1980 and 1989) was 37% above expectations. The wealth of younger millennials and older Gen Zers (those born between 1990 and 1999) was a similar 39% above expectations.

So, in just three years, we went from a situation where older millennials were 34% below expectations to 37% above expectations–a 71% point swing!

Obviously, higher housing prices helped but needless to say we’ve never seen anything like this before.

Regardless of their current place in life, millennials will be the richest generation in history. Knight Frank laid it out in their annual wealth report:

The switch will see $90tn of assets move between generations in the US alone, “making affluent millennials the richest generation in history”, Knight Frank said in its 18th annual wealth report.

That’s a lot of money that will be changing hands from baby boomers to millennials in the decades ahead.

Then there’s the forgotten generation — Gex X.1

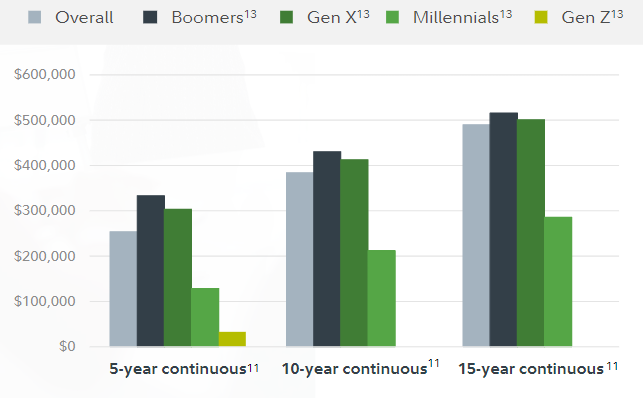

Here’s a great stat about Gen X from the latest annual Fidelity 401k update:

The average balance for Gen X workers who have been in their 401(k) plan for 15 years straight topped half a million dollars ($501,000) at the end of 2023.

A long time horizon wins again!

It’s bizarre to think a disease that spread around the globe and completely upended our lives in numerous ways has somehow made generations of people wealthier than they would have been if it never happened.

Michael and I talked about all things demographics and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

How Demographics Are Shaping the Housing Market

Now here’s what I’ve been reading this week:

- How to graduate college with zero debt (Poor Choices)

- Can anyone become a millionaire? (Of Dollars & Data)

- The fear of missing out (Irrelevant Investor)

- Winning the genetic lottery (A Teachable Moment)

- 9 lessons about death and money (Kindness Financial Planning)

- How the interstate highway system changed America (Fortune Financial)

Books:

1If I’m being honest I’m probably more Gen X than millennials. I was born in 1981 so I have a foot in both camps.