This past week, I received three questions about retirement, all of which concern long-term planning at different stages of life.

A reader asks:

Chatting with the friends, we all seemed to be relatively close to one another in terms of cash on hand, investments in the market and current incomes. I would love to get your perspective as a professional to understand if we are behind, on par or ahead of the curve for a 28 year old. My father is also in wealth management, however the majority of his clients are much older and have much different financial goals than a 28 year old, so an insight would be much appreciated.

Averages below:

-

- Cash in checking acct: ~$8,000

- Investments in the market: ~$35,000

- 401k: ~$60,000

- Annual salary: $135,000

Would love to get your thoughts!

Another reader asks:

What kind of 401k return should a 35-40-year-old guy be happy with, assuming he was more diversified and, therefore, didn’t match the returns of the S&P 500? I was at 10.9%, which is close to the Vanguard Total World Index (since 2015).

And another reader asks:

As a long term investor, how do you decide to take profits if you are mid-40’s and investing for retirement? I struggle with this because I know I will probably never get the prices I got in the past if I sell, but scared of the roundtrip as well.

The basic summary of these questions looks like this:

- How are my finances doing?

- How is my portfolio doing?

- How do I preserve my wealth?

Let’s go through them one by one:

How are my finances doing?

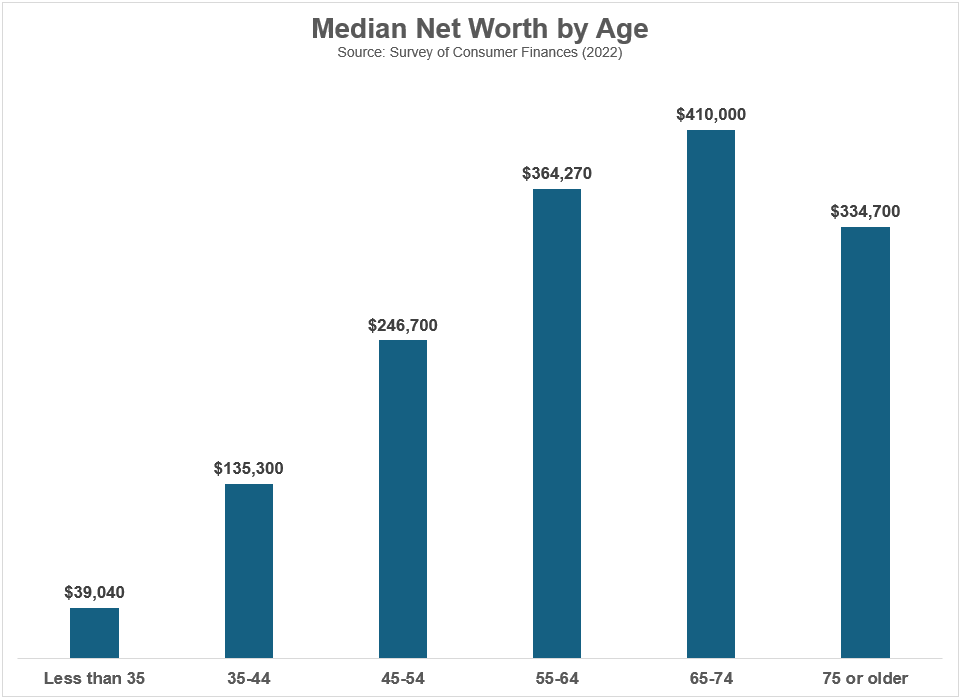

The Federal Reserve breaks out the data for median net worth by age groups:

You fall in the under 35 crowd so it looks like you’re doing better than most.

My colleague Nick Maggiulli built a handy calculator on his website that allows you to drill down even further. You can enter your age and net worth to see where you rank with your specific peer group:

This person ranks in the top quartile of 28-year-olds.1

Peer rankings can help you understand your place in the world but I’m always more concerned about how you’re doing relative to your past self. The most important aspect of retirement planning when you’re young is slowly but surely making improvements:

- Are you making more money over time?

- Are you saving more of that money over time?

- Are you increasing your savings rate over time?

- Are you improving your personal finances over time?

No matter your age, there will always be people richer and poorer than you. Your net worth matters less at age 28 than the habits you’re creating.

You’re on the right path as long as you have a double-digit savings rate and boost your earnings by making the most of your career.

How is my portfolio doing?

Portfolio performance can be tricky if you don’t know how to benchmark it correctly.

It really depends on what you invest in. Are you invested in index funds or actively managed funds? Are you in all stocks or do you have a more diversified portfolio?

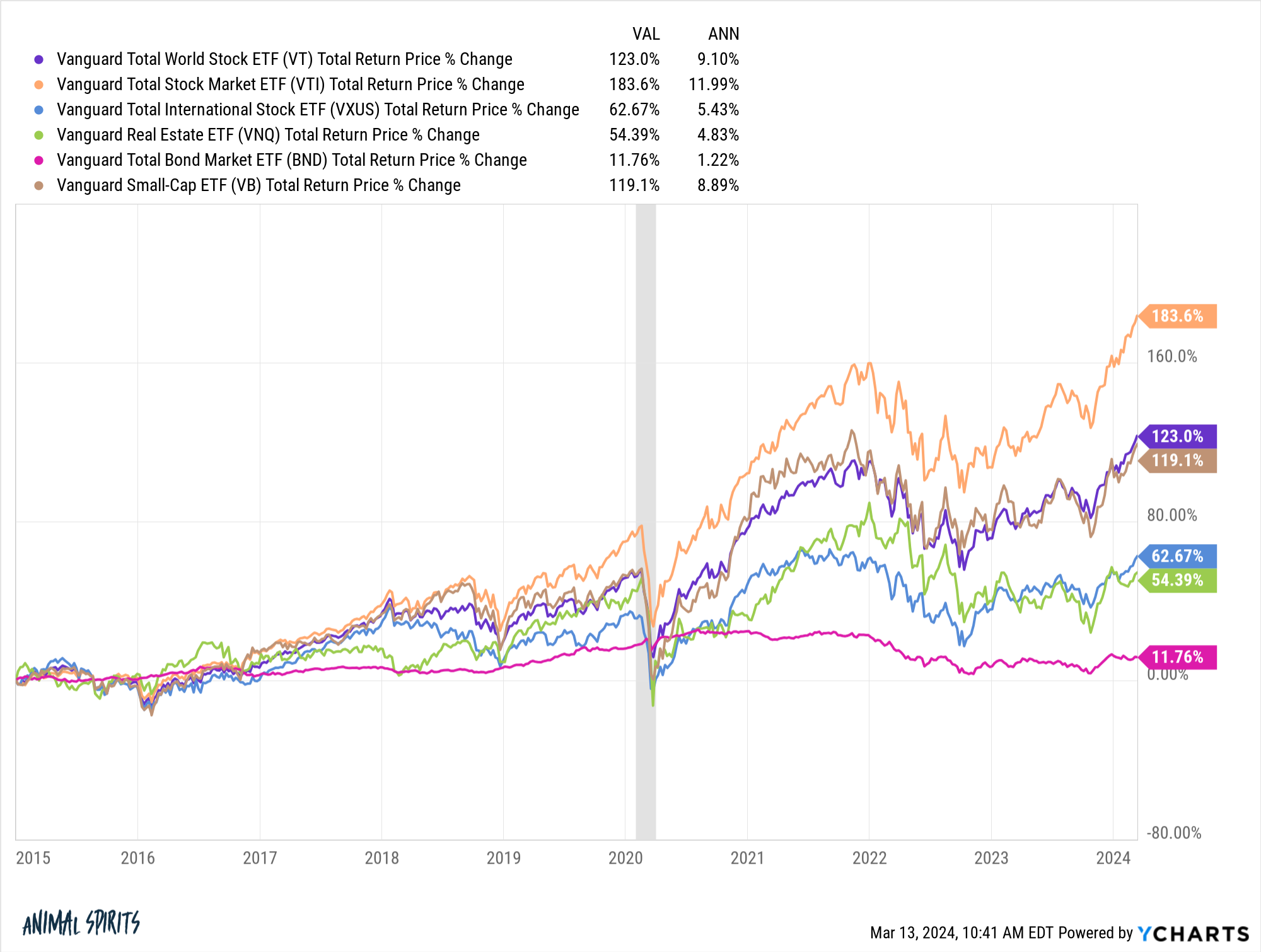

Just look at the annual returns for various asset classes and regions since 2015:

If you hold a diversified portfolio but compare it to a total U.S. stock market index or the S&P 500, you will be disappointed.

However, the U.S. stock market is not the right benchmark for a diversified portfolio. You can compare your U.S. large cap funds or holdings to the total U.S. stock market but everything else should be benchmarked against index funds with similar exposures.

If you hold a 60/40 portfolio, the S&P 500 is not your benchmark. If you hold a globally diversified portfolio, the S&P 500 is not your benchmark.

One of the reasons I love investing in index funds is because they’re literally the benchmark. If you hold a total U.S, total international and total bond market index fund, those are your benchmarks.

If you own a globally diversified portfolio of all stocks a total world index fund is a good benchmark.

You just have to make sure you’re comparing apples to apples when benchmarking.

How do I preserve my wealth?

Investing in middle age can be tricky because you’re straddling two camps. I wrote about this a few weeks ago:

You should own some financial assets at this stage of life so it’s nice to see prices rise.

But you should also be entering your prime earning years so bear markets should be welcomed.

One of the hardest parts about actually building wealth is the losses tend to sting more because there’s more money at stake.

A 10% loss on a $100,000 portfolio means you’re down $10,000. If you lose 10% on a $1,000,000 portfolio, that’s a loss of $100,000. This seems like an obvious point but dollar signs matter even more than percentages as your nest egg grows.

I understand this idea of locking in profits. Considering the market environment we’ve lived through, if you’ve been saving and investing for 15-25 years, you should be sitting on some healthy gains.

Let’s say you sell some stocks to lighten up a bit — then what?

Are you timing the market or changing your asset allocation? There’s a big difference.

Reducing your equity risk as you age can make sense, but you need to be explicit when making this kind of move. Don’t just sell stocks because you feel like you should. Have a plan of attack.

Some people make sweeping allocation changes, say, immediately going from 100% in stocks to a 90/10 or 80/20 portfolio. Others prefer more of a glide path where you slowly but surely diversify your portfolio as you age. That could mean selling 1-2% of your stocks each year until you hit your new allocation target.

Or you could build up a new allocation with future contributions. Some people like to over-rebalance when the stock market is up a lot. Others prefer a systematic rebalancing process that’s done automatically at prespecified times.

There really are no right or wrong answers since no one knows the future.

The biggest thing is creating a plan and then sticking with it.

You don’t want to let high (or low) stock prices turn you into an amateur market timer.

We spoke about all of these questions on the latest edition of Ask the Compound:

My colleague and RWM financial advisor, Ben Coulthard, joined me on the show to discuss these questions and more.

Further Reading:

The Evolution of Retirement

1The question didn’t list any debts so I’m just using assets here to calculate net worth.