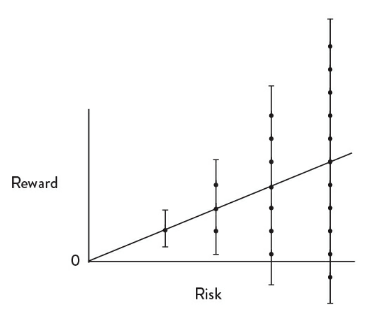

The late-Peter Bernstein once wrote, “The market’s not a very accommodating machine; it won’t provide high returns just because you need them.” When you do need higher investment returns because of a perceived shortfall in assets for a specific goal you generally have 3 options to remedy the situation: (1) Adjust your expectations, and therefore,…