The late-Peter Bernstein once wrote, “The market’s not a very accommodating machine; it won’t provide high returns just because you need them.”

When you do need higher investment returns because of a perceived shortfall in assets for a specific goal you generally have 3 options to remedy the situation:

(1) Adjust your expectations, and therefore, your lifestyle or goals.

(2) Increase your savings rate.

(3) Take more risk.

The first two options are for the realists while the third option is for the optimists.

It appears CalPERS is an optimist.

The Wall Street Journal reported this week that the behemoth public pension plan for the state of California would like to double down on risk by placing an additional $20 billion in private investments:

Board members are expected to vote on Monday to indicate whether they support the plan, which represents a dramatic new bet for the $356 billion retirement system known as Calpers. Chief Investment Officer Ben Meng has said the expansion will help the system meet its 7% future return targets. Calpers currently has $28 billion devoted to private-equity bets.

The transcript for the CalPERS board meeting, which took place last month, highlights their desire to make these changes. This was one of their consultants:

You know, private equity really is the one asset class that has a significantly higher return that can drive the CalPERS expected returns and hopefully realized returns higher.

And here is the chief investment officer:

So the very first question is why private — why — why do we need private equity? And the answer is very simple. So if I could give you a one-line exact summary of this entire presentation would be we need private equity, we need more of it, and we need it now. So let’s talk about the first question, why do we need private equity? And the answer is very simple, to increase our chance of achieving the seven percent rate of return, and to stabilize employer contribution, and to help us to secure the health and retirement benefit of our members.

…if you are trying to achieve seven percent return, and there’s only one asset class that is forecasted to deliver more than seven percent of the return, you need that asset class in the portfolio and you need more of it.

He actually repeated the phrase “we need it now” four times over the course of this one meeting in reference to PE. There’s just a hint of desperation hidden inside the optimism.

It’s possible private investments have a higher expected return but there are a host of risks involved in this strategy.

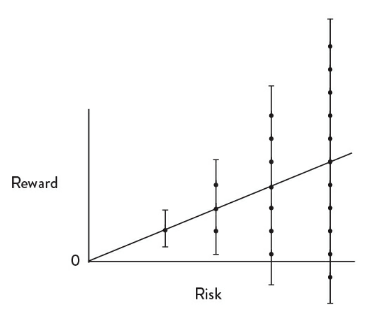

Brian Portnoy shared this graph in his book The Geometry of Wealth to show how the relationship between risk and reward tends to work:

Increasing risk in a portfolio can increase returns but it also increases your range of potential outcomes. There are no guarantees that taking more risk automatically increases returns.

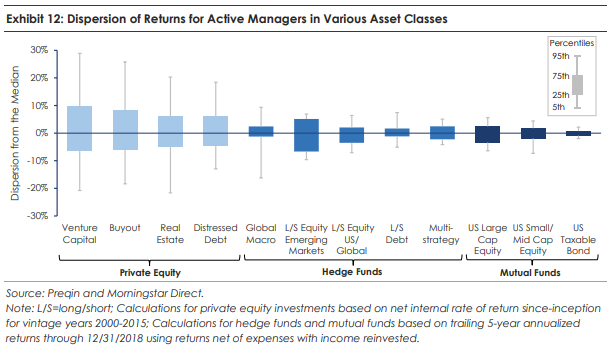

Brian’s illustration can be seen in real-world results when we look at the dispersion of returns from money managers in the various asset classes (courtesy of Michael Mauboussin):

Going from right to left, dispersion among the managers increases drastically from liquid public markets to illiquid hedge funds to really illiquid private markets. This dispersion has two distinct outcomes:

(1) There is the possibility for higher returns in the illiquid space

(2) There is the possibility for much lower returns in the illiquid space

Basically, if you’re able to consistently choose top quartile private money managers, you can earn pretty nice returns on your capital. If you’re unable to choose top quartile managers, watch out below.

There’s the potential to do better but also much worse, so doubling down on risk works in both directions.

When investors are disappointed with their results, ground zero for their source of frustration almost always comes down to expectations.

The old saying is that stress is the gap between expectations and reality. In the investment world, irrational investor behavior is the gap between expectations and reality.

It’s also worth mentioning that while CalPERS is looking to add $20 billion to their private equity book, they manage more than $350 billion in total. That’s an increase in the allocation of around 6% of the total portfolio.

To put this number into perspective, let’s assume public markets achieve a 7% annual return from here over the long haul. Now let’s further assume CalPERS picks private investments that knock the cover off the ball and outperform public markets by 50%, for an annual return of 10.5%.

With a 6% increased allocation to PE, that additional 3.5% in excess return would add a whopping 0.21% to the overall portfolio return.

That’s 21 basis points and they need it now.

When you get into multi-billion dollar portfolios it’s important to remember investment principles are often trumped by politics. My guess is this Hail Mary attempt is more political posturing than anything. It’s a way to show that the investment office is trying to do something, anything, to right the ship and improve the funded status of the pension.

CalPERS is attempting to take more risk to fix their potential shortfall in assets for future beneficiaries. It may increase their returns or it could hurt performance.

But they would probably be much better off if lawmakers began putting more money into the fund or adjusted everyone’s expectations by lowering future payouts. That’s not an optimistic assessment but it is probably closer to the reality they will one day face.

Further Reading:

Does Private Equity Deserve More Scrutiny?