This week’s Animal Spirits with Michael & Ben is sponsored by YCharts:

Mention Animal Spirits and receive 20% off your subscription price when you initially sign up for the service.

We discuss:

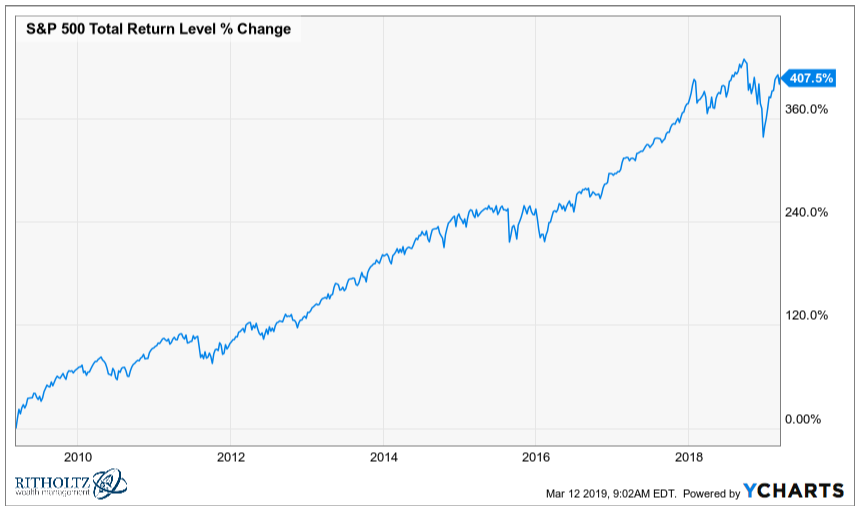

- Where we were in our careers when the market bottomed 10 years ago

- Star fund managers

- Is Bill Gross happy?

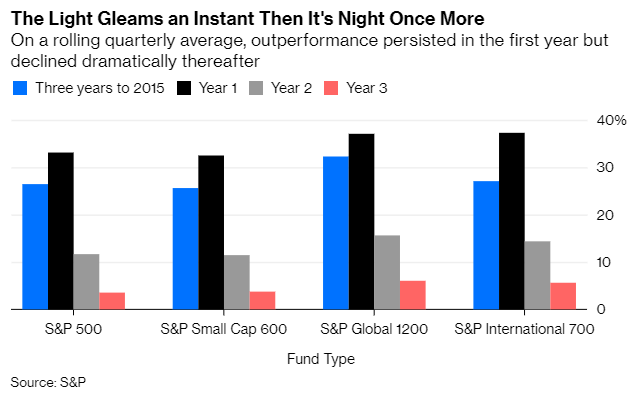

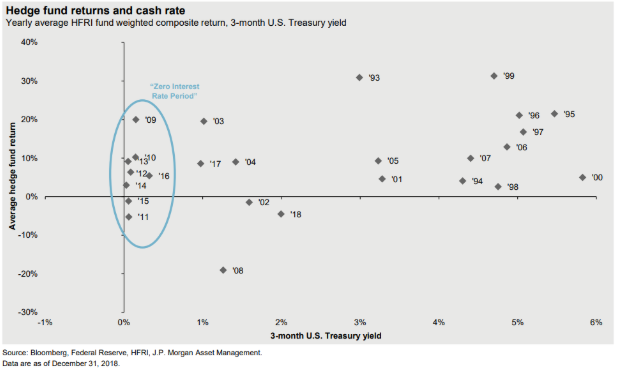

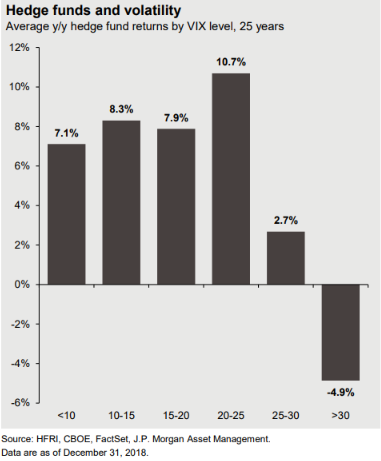

- Persistence in performance may be the hardest thing to find in the markets

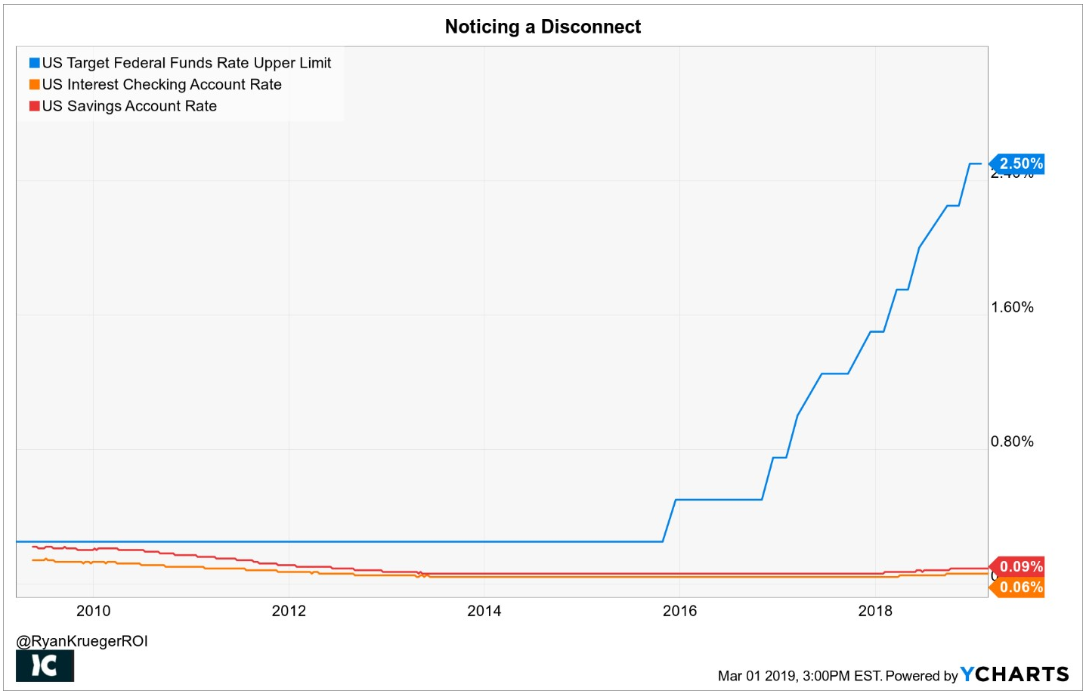

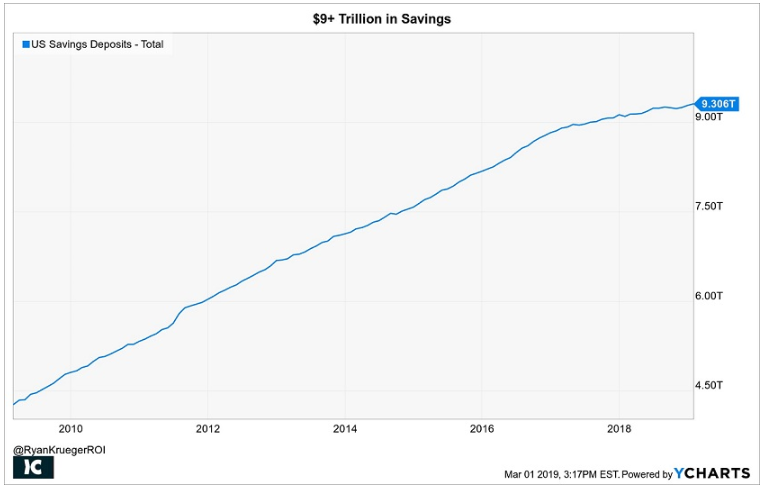

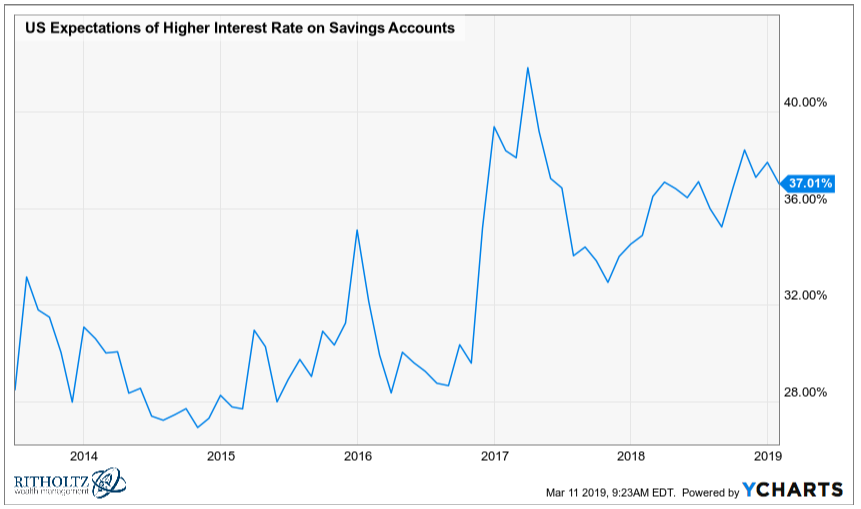

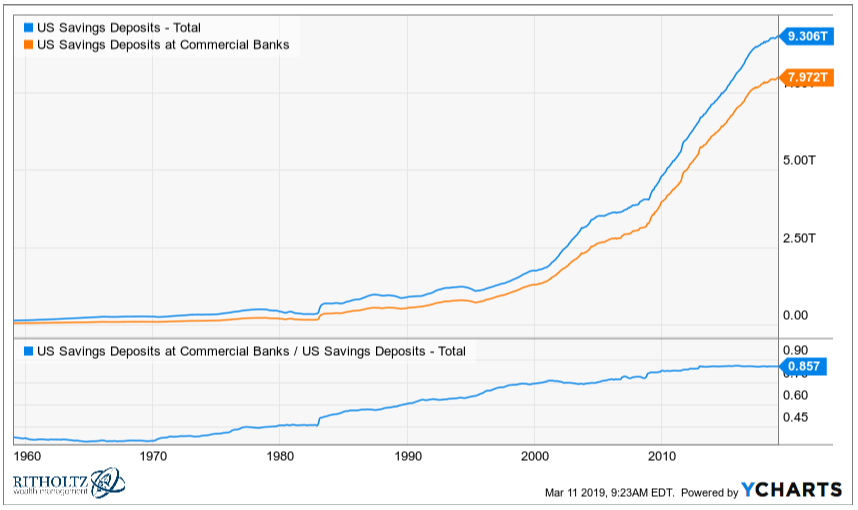

- The biggest mistake savers are making right now

- Where to find yield on your liquid savings accounts

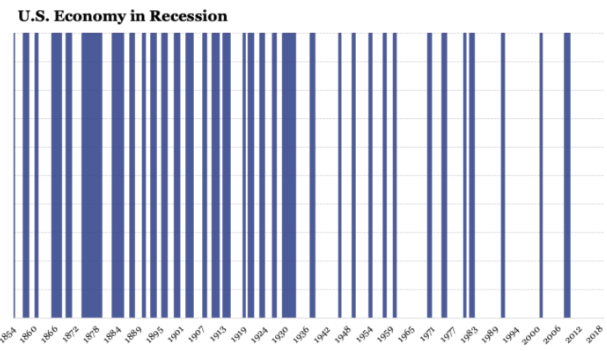

- It’s been a while since the last recession

- ETF PR wars

- How many workers max out their 401k?

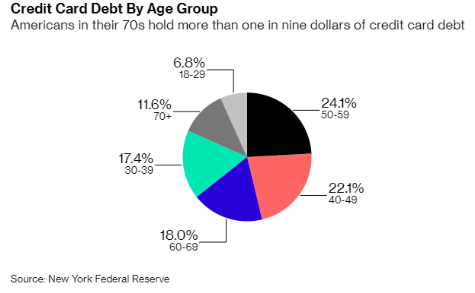

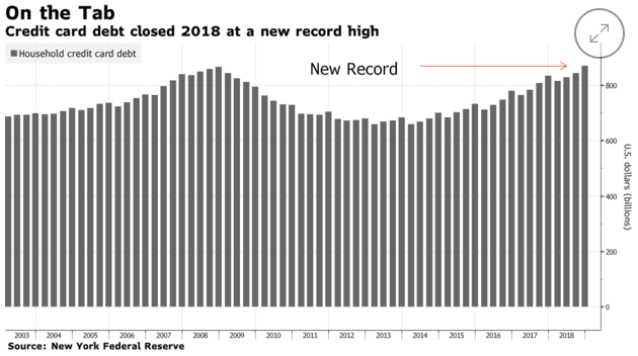

- How much credit card debt is out there?

- What would you be willing to give up to get out of debt?

- How to cut your mortgage payments

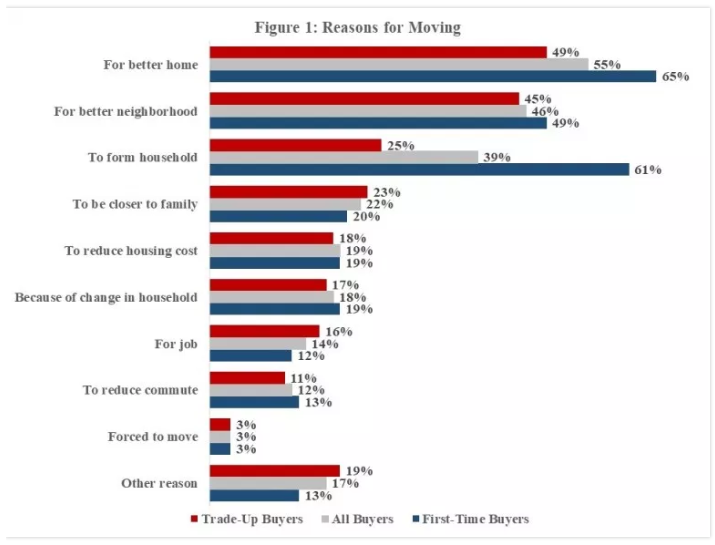

- Why do people move?

- My review of A Star is Born and much more

Listen here:

Stories mentioned:

- Bill Gross: “We were looking for every penny we could get”

- We’re still fooled by randomness

- Solving a bank heist: Follow the money

- Where to find yield on your savings

- It’s been a while

- Maxing out your 401k is rare

- The first ride-sharing IPO!

- ETF fee war reignites

- 2018 credit card debt closed at a record high

- What would Americans be willing to give up to get out of debt?

- A little known strategy to cut your mortgage payments

- Homebuyers don’t move out of necessity anymore

Books mentioned:

- Extreme Ownership by Jocko Willink and Leif Babin

- Super Sad True Love Story by Gary Shteyngart

- Beneath a Scarlet Sky by Mark Sullivan

Charts mentioned:

TV Shows/Movies/Podcasts Mentioned:

- A Star is Born – I liked it but think it was a tad over-hyped. Lady Gaga was as good as advertised and might have an underrated voice for being one of the biggest pop stars on the planet. And I’m still not sure how Bradley Cooper just decided to become a good singer. Solid movie with a few corny parts. 7.1 out of 10.

- Crashing (HBO) – A must watch if you’re into stand-up comedy. Season 3 was the best one yet.

- John Mulaney (Netflix) – Michael’s pick for the stand-up special of the week. I’ve seen this one before too. It’s intelligent humor.

Email us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook.

Subscribe here: