Today’s Animal Spirits: Talk Your Book is presented by Invesco:

We discuss:

- What is the low volatility anomaly?

- Why financial theory doesn’t always translate into the real world

- The three behavioral and structural reasons for the low vol anomaly

- How often do different factors overlap with one another?

- How the market environment impacts low vol and other factors

- Does low vol work well in mid caps and small caps?

- How important are sectors in factor exposure?

- What is the relationship between interest rates and volatility in stocks?

- How the bear market changed the flows into SPLV

- Why flows follow performance

- Where does the low volatility factor fit within a portfolio?

- How turnover affects performance in factor investing

- The difference between low volatility and minimum volatility

Listen here:

Stories/research mentioned:

- Your Complete Guide to Factor-Based Investing

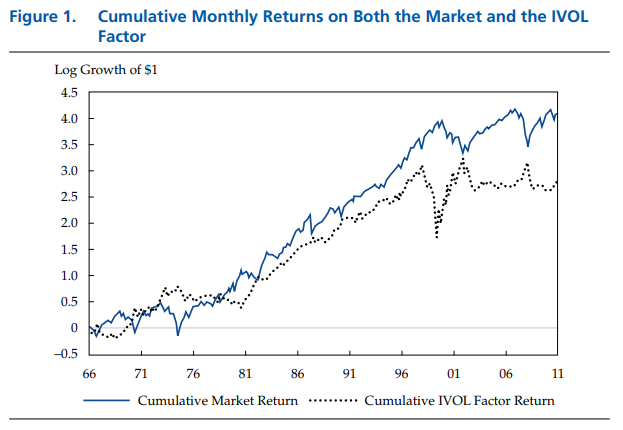

- The Low Volatility Anomaly: Market Evidence on Systemic Risk vs. Mispricing

- Deconstructing the Low Volatility/Low Beta Anomaly

Charts mentioned:

Email us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook.

Subscribe here: