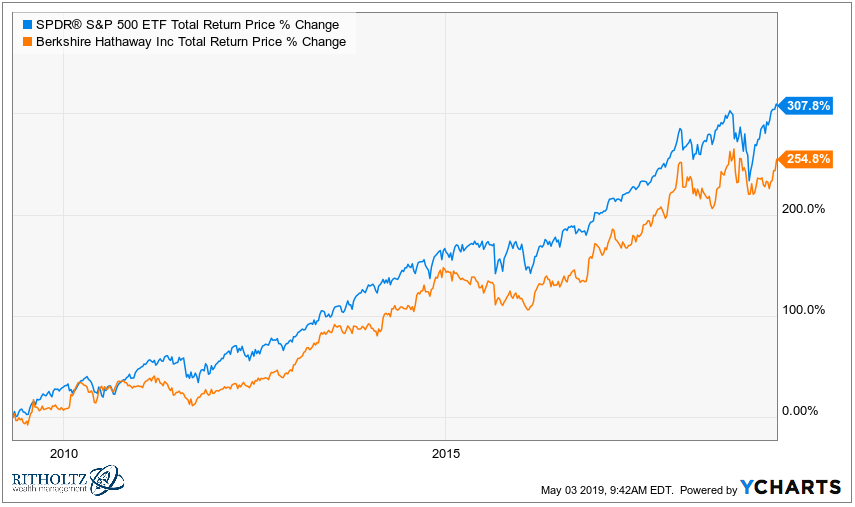

While trying to boil down the many reasons for Warren Buffett’s long-term success, Alan Greenspan once told the Oracle, “Warren, it strikes me that if you did nothing else you never sell. That is, if you can grit your teeth through and just disregard short-term declines in the market or even long-term declines in the…