Ben Carlson and Michael Batnick discuss how underrated dividends are, Goldman buying an RIA, why true wealth is the absence of stuff and much more.

Ben Carlson and Michael Batnick discuss how underrated dividends are, Goldman buying an RIA, why true wealth is the absence of stuff and much more.

My framework for working through what to do with excess cash that you know needs to be invested but you can’t figure out where to even begin.

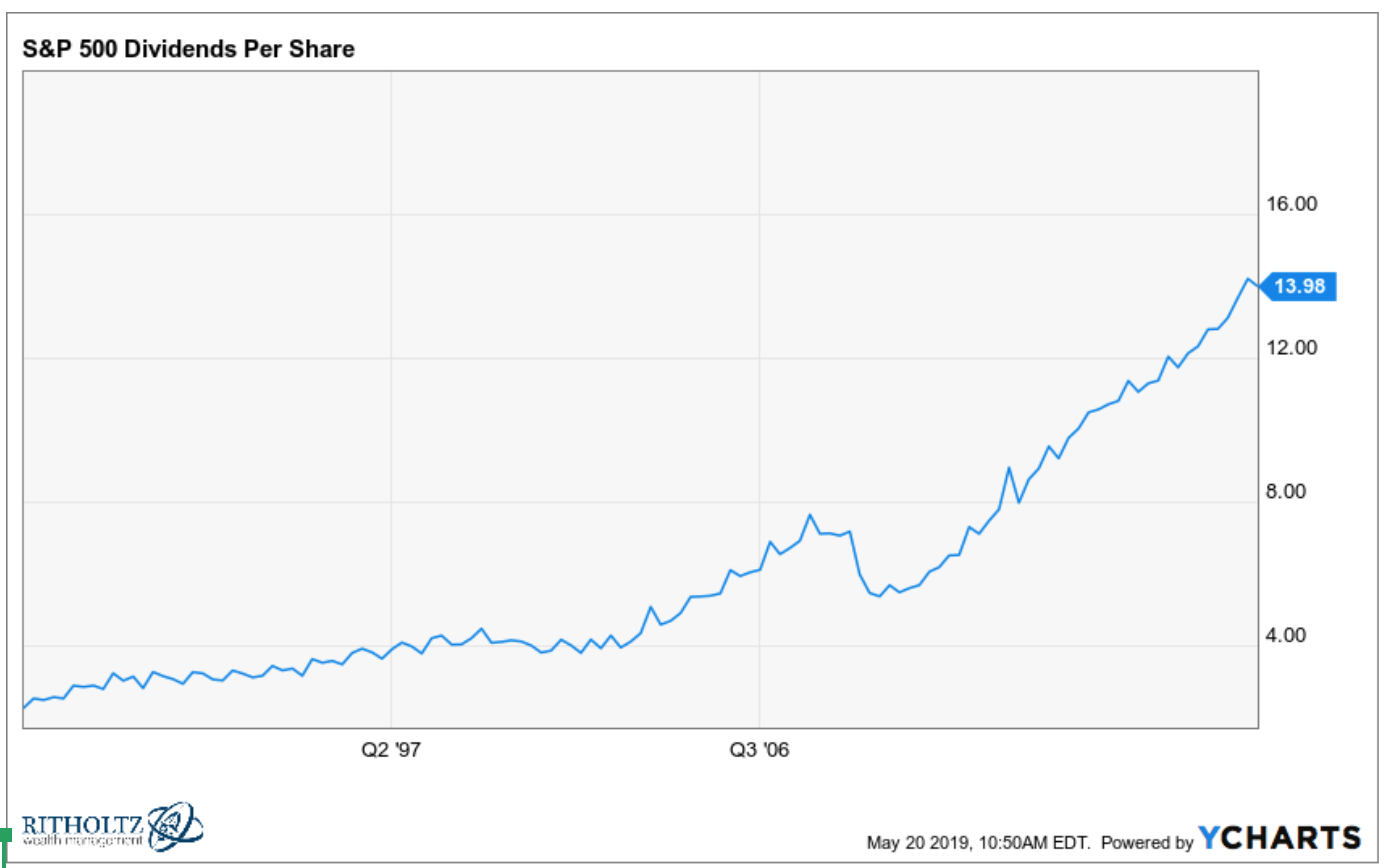

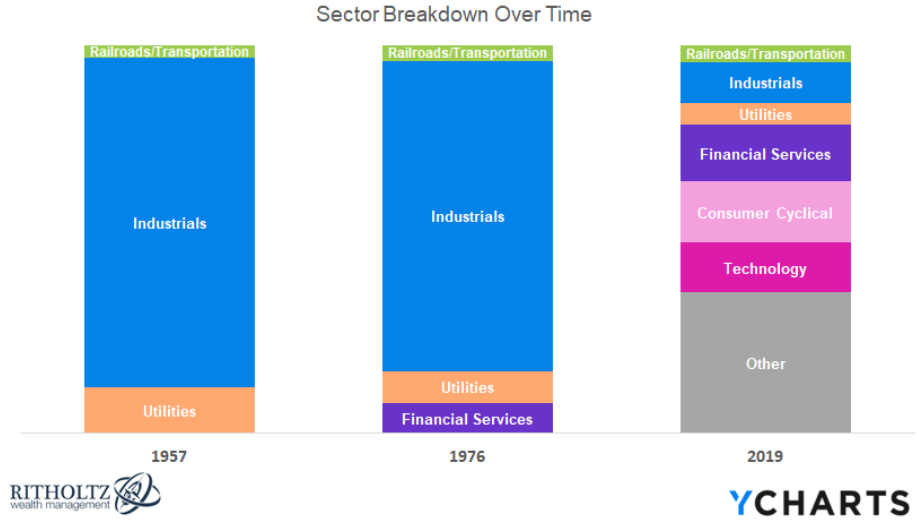

Today’s Animal Spirits: Talk Your Book is presented by WisdomTree: We discuss: Using dividend yield as a factor for picking stocks The rise of tax-deferred accounts Does dividend yield work better overseas? The pros and cons of currency hedging Is currency hedging a factor investment strategy? Does a theory like purchasing power parity work in…

My friends in New York love to point out there’s a difference between a slice of pizza in the Big Apple and a slice of pizza everywhere else in the world. I’ve always been of the opinion that pizza is almost always good no matter where it’s from but after sampling some pizza in New…

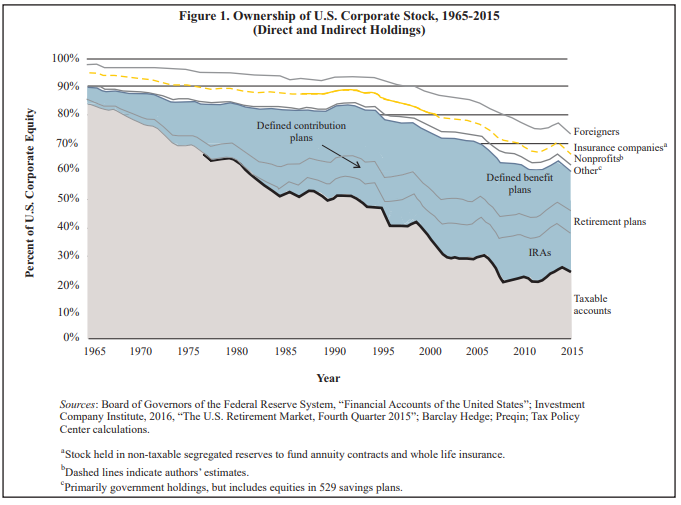

There are a number of periodic research pieces I read whenever they come up — JP Morgan’s Guide to the Markets, the Credit Suisse Yearbook, and the Investment Company Institute’s Fact Book to name a few. The ICI’s annual Fact Book provides a deep dive on past trends and where things currently stand in fund…

When I graduated from college in 2005 or so it took me a while to find a job. This was mostly my own fault because I had no idea what I wanted to do with my life and didn’t put in the time to actually figure out the type of role or company I was…

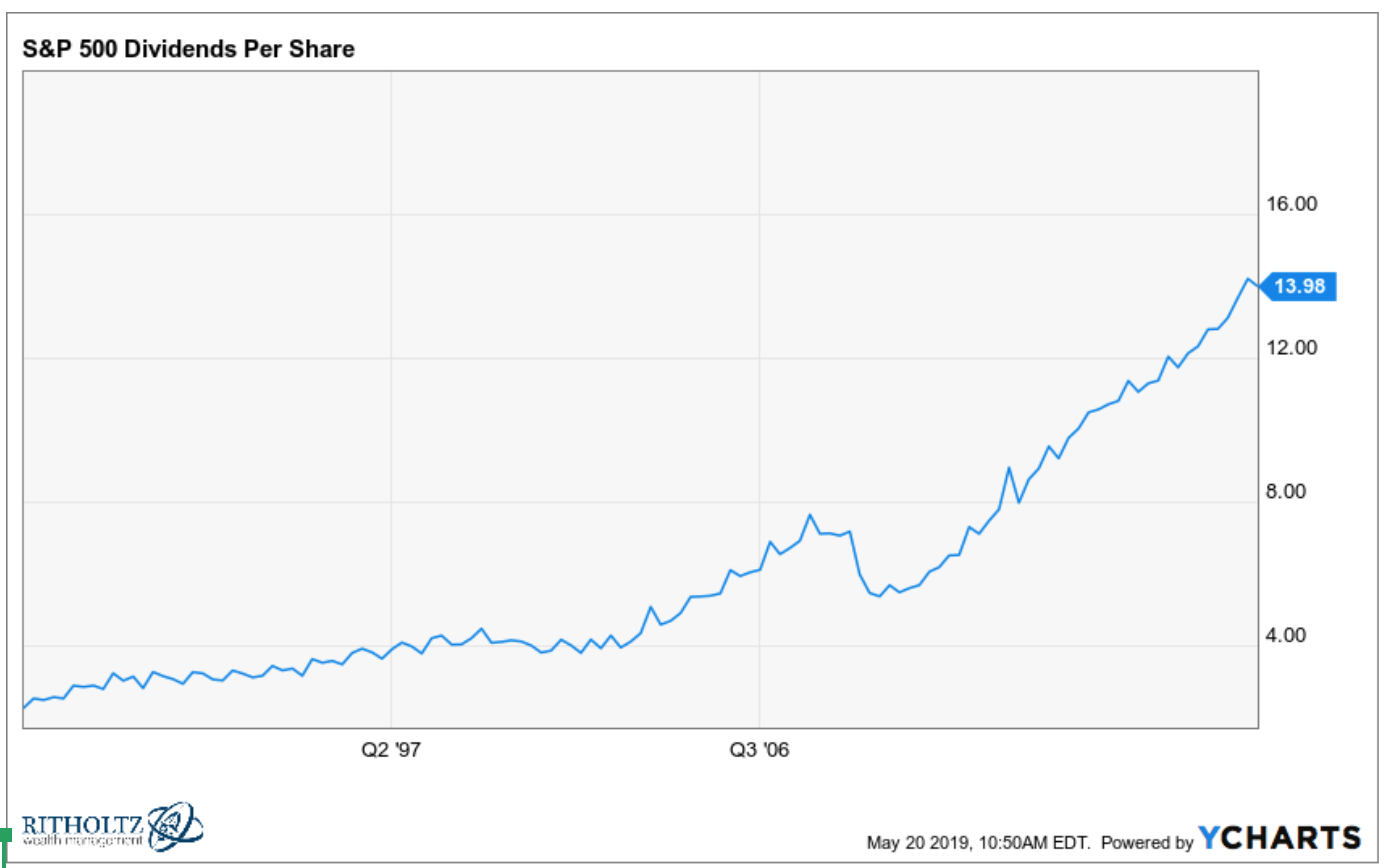

This week’s Animal Spirits with Michael & Ben is sponsored by YCharts: Mention Animal Spirits and receive 20% off your subscription price when you initially sign up for the service. We discuss: Are the tech companies going to make us all fat and lazy? Some good news for once in retirement saving data The huge growth in tax-deferred…

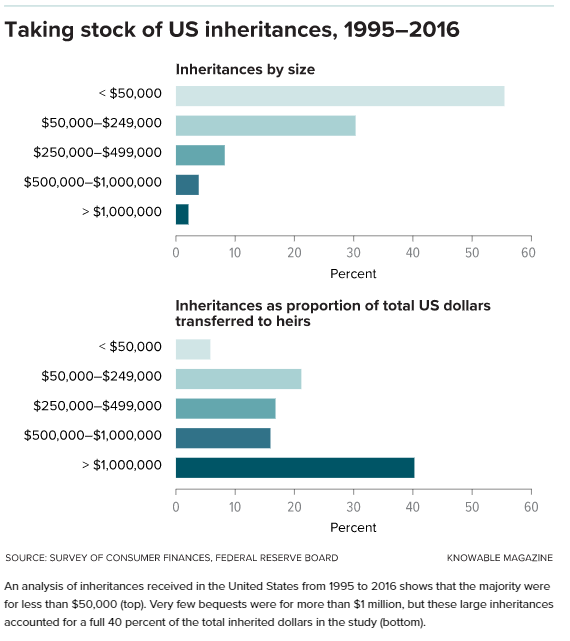

A reader asks: My wife and I recently had a retirement and inheritance discussion with her parents. During our conversation it was mentioned how much they plan to leave for inheritance. We’re already on track to retire in our early 60s. However, I’m curious if I should try to incorporate the additional inheritance, it’s a…

When people find out you’re having a baby people are more than happy to tell you everything you need to buy (and exactly how to be a parent). Despite getting plenty of advice from pretty much every other parent I know before I had kids, there are some things that slipped through the cracks. Here’s…

A podcast listener asks: What inning are we in? This question was asked tongue-in-cheek but it’s still worthy of a serious answer because so much time and energy are devoted to figuring out where we stand in the market or economic cycle. Here’s what I had to say about this one on Instagram: I ran…