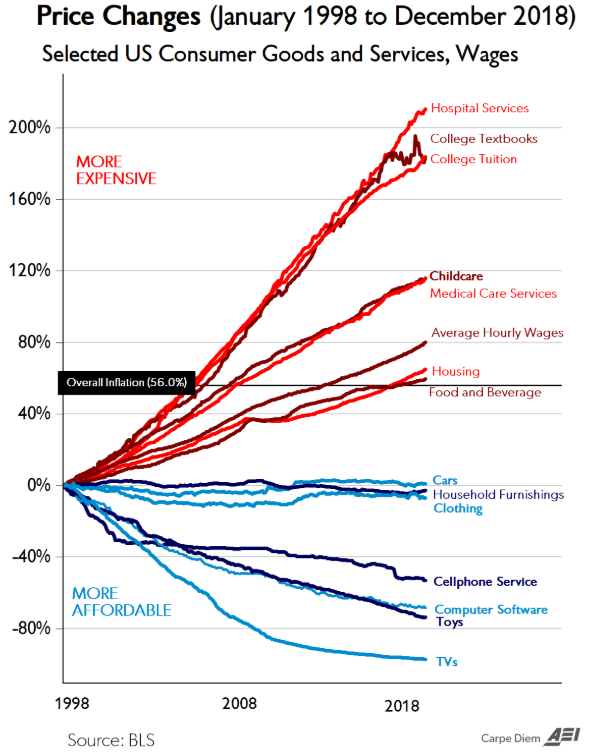

In the wake of the recent college admissions bribery scandal that ensnared Aunt Becky and a whole host of other wealthy people, there were generally two takes from the content/social media apparatus: (1) College is a meritocracy that benefits the rich. It shouldn’t come as a shock to anyone that rich people pull strings to get…