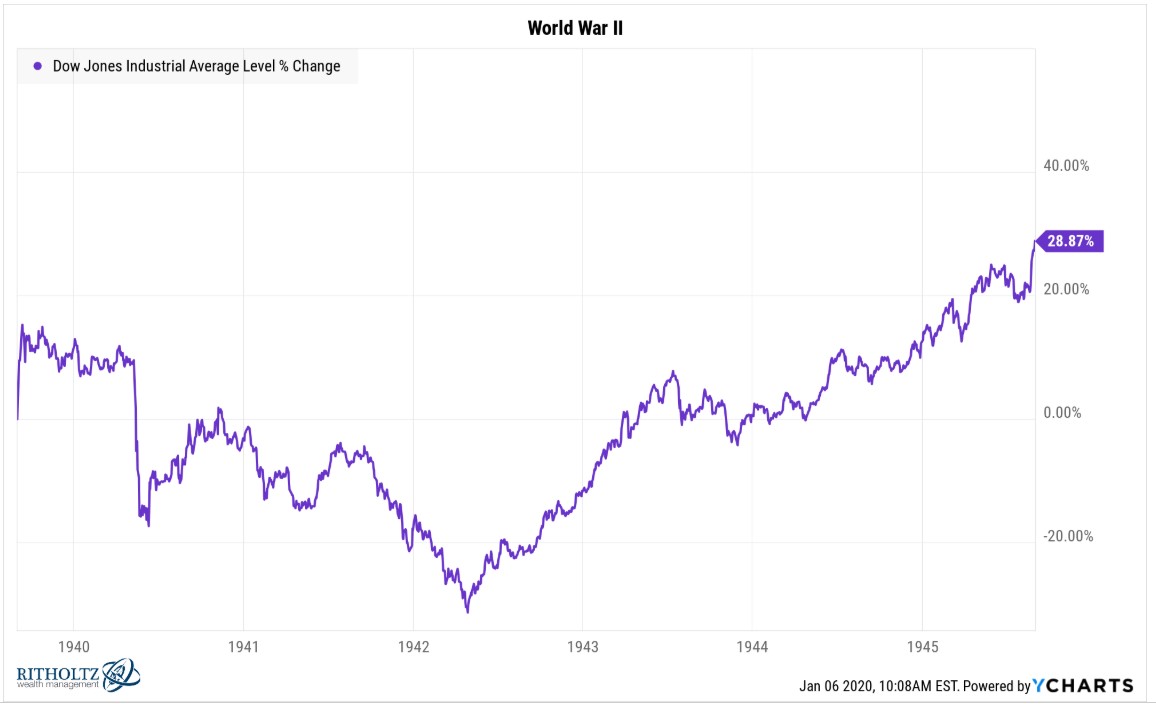

How does the stock market do when the U.S. is at war?

How does the stock market do when the U.S. is at war?

Some lessons I’ve learned about the publishing industry.

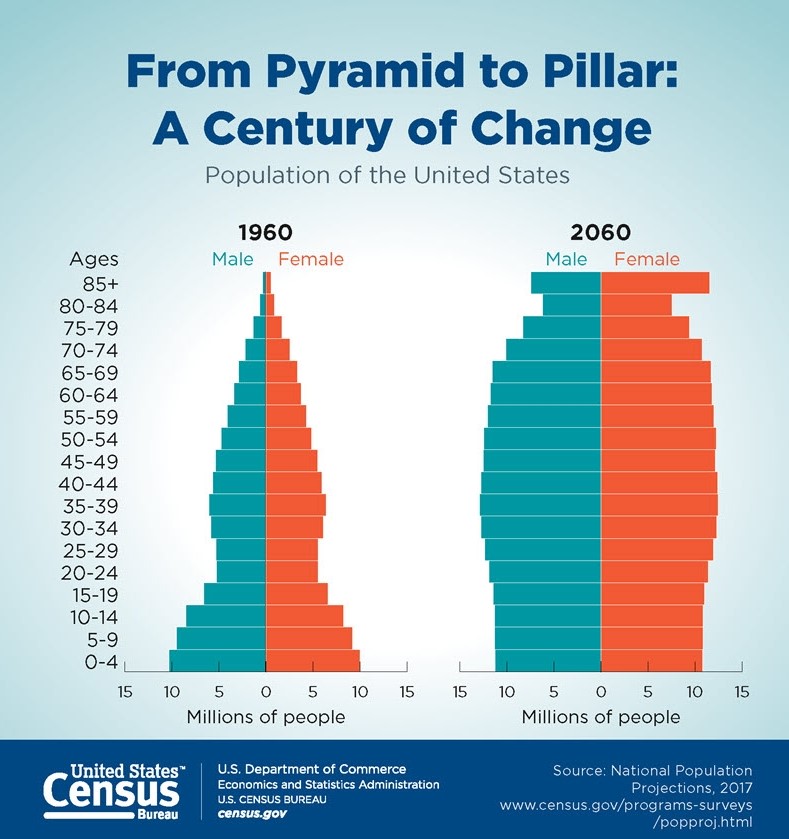

People are living longer. Why this offers both risk and opportunity in the coming years.

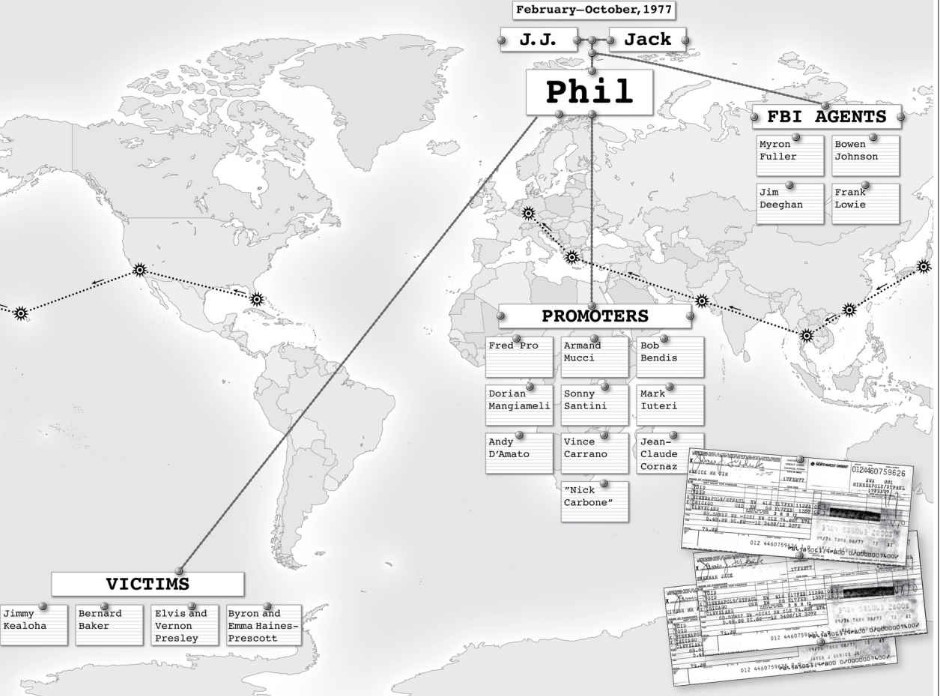

One of the hardest parts about writing my book on financial scams, frauds, charlatans, and hucksters was figuring out what to include and what to leave out. Every time I read a book or story about a ridiculous financial scheme it would be topped by the next one I read. Here are some straight from…

My new book, Don’t Fall For It, is out now!

This week’s Animal Spirits with Michael & Ben is supported by YCharts: Mention Animal Spirits and receive 20% off your subscription price when you initially sign up for the service. We discuss: The future of books Why the future of publishing is all Amazon Why the relationship between markets and geopolitics isn’t as simple as you’d think Why…

Something I never would have imagined when I started writing about finance.

My non-prediction predictions for the year ahead.

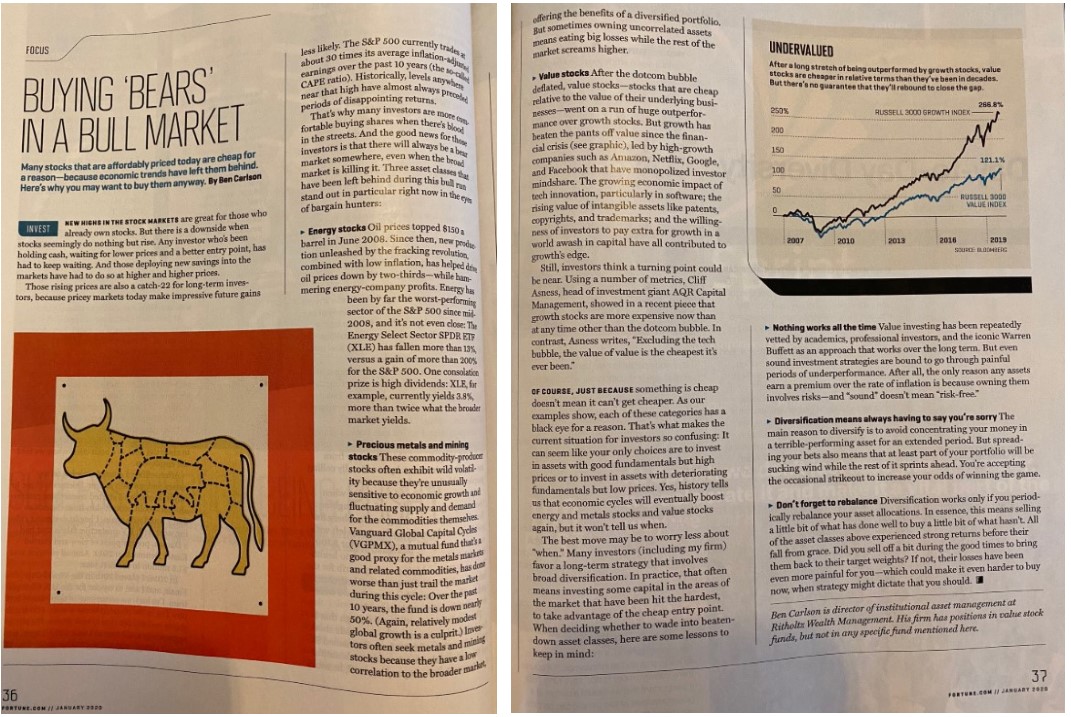

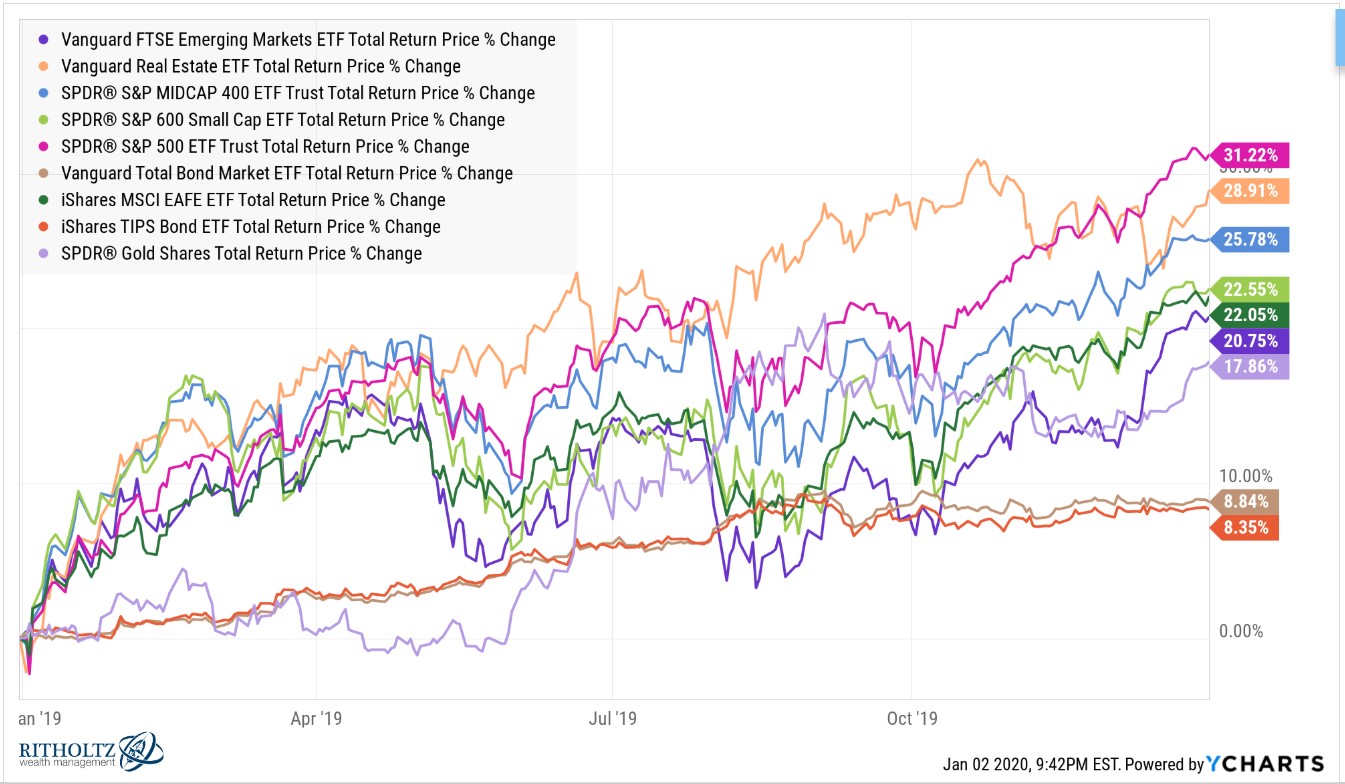

2019 was a good year for risk assets. Basically everything worked this past year: Large caps, mid caps, small caps, foreign stocks, emerging markets, REITs, bonds, TIPS, and gold were all much higher in 2019. If you couldn’t make money last year you were extremely unlucky, concentrated in the wrong securities or betting against the…

Why leaders have to be optimistic about the future.