Some stuff I’ve learned over the years.

Some stuff I’ve learned over the years.

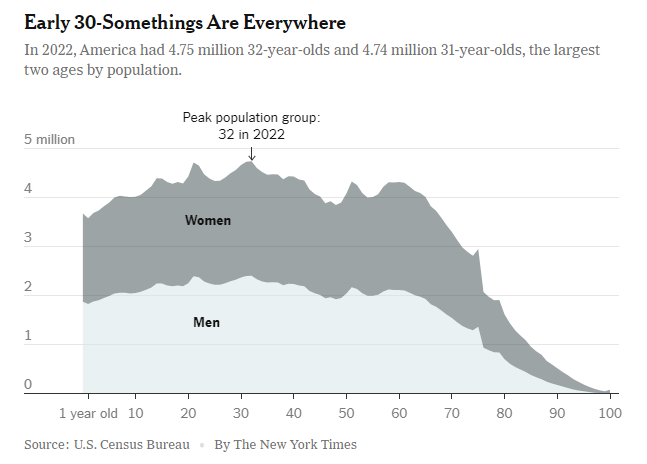

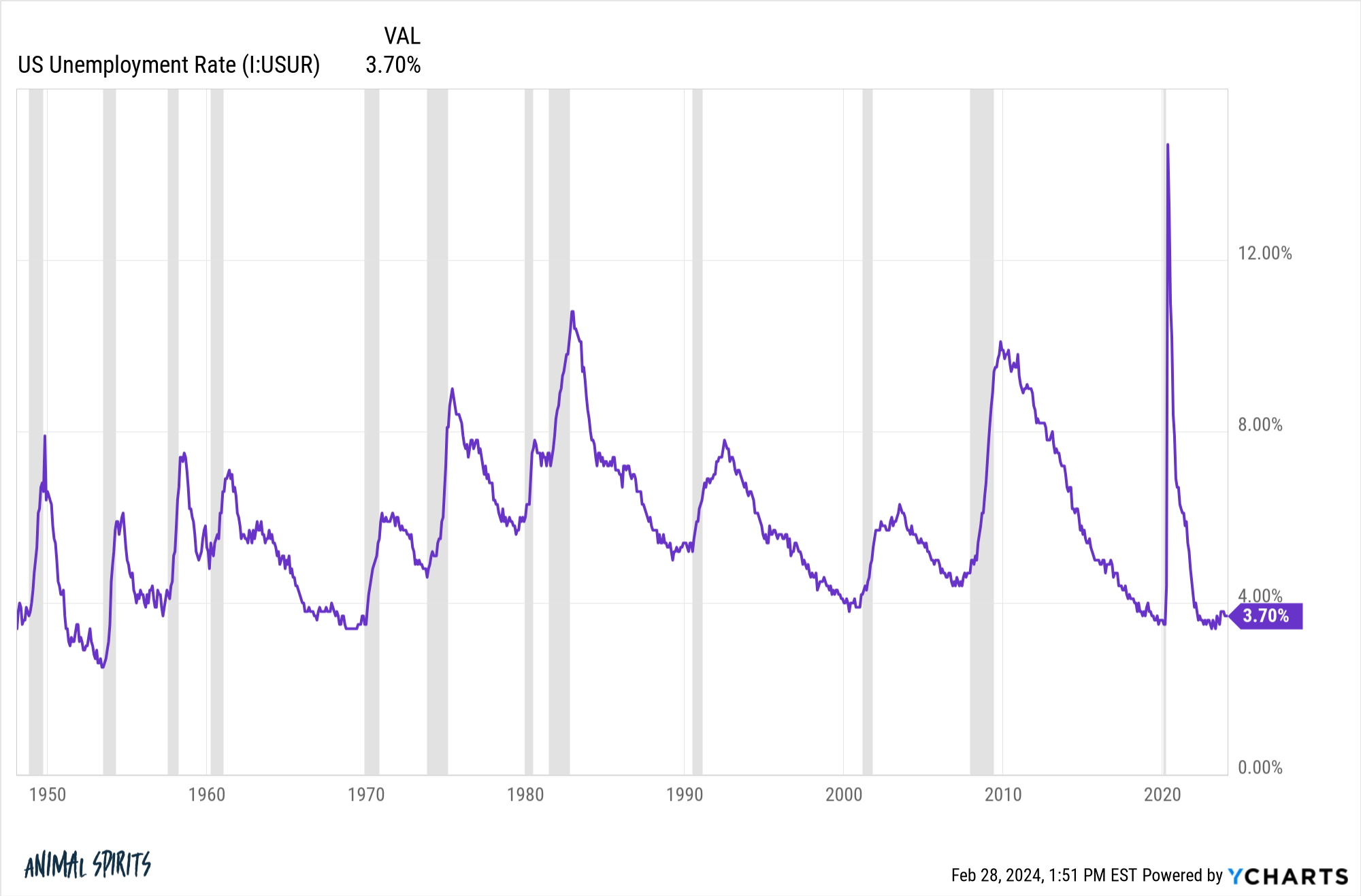

How some of the biggest demographic trends are impacting markets & the economy.

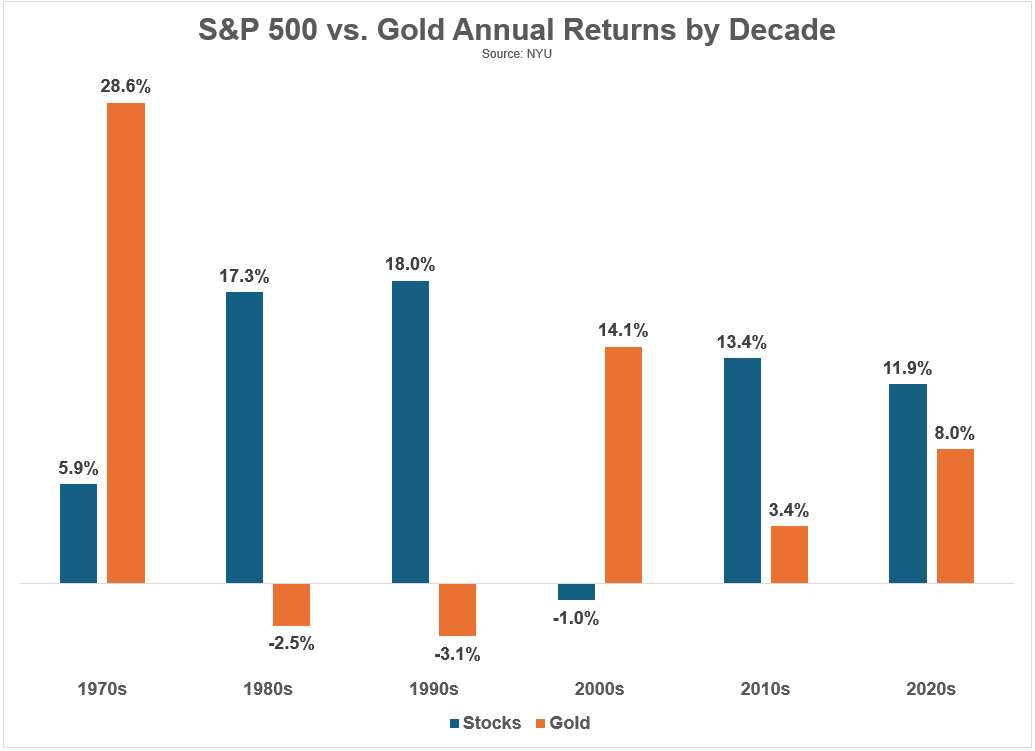

A closer look at the pros and cons of investing in gold.

On today’s show, we talk about:

– Why the markets continue moving higher

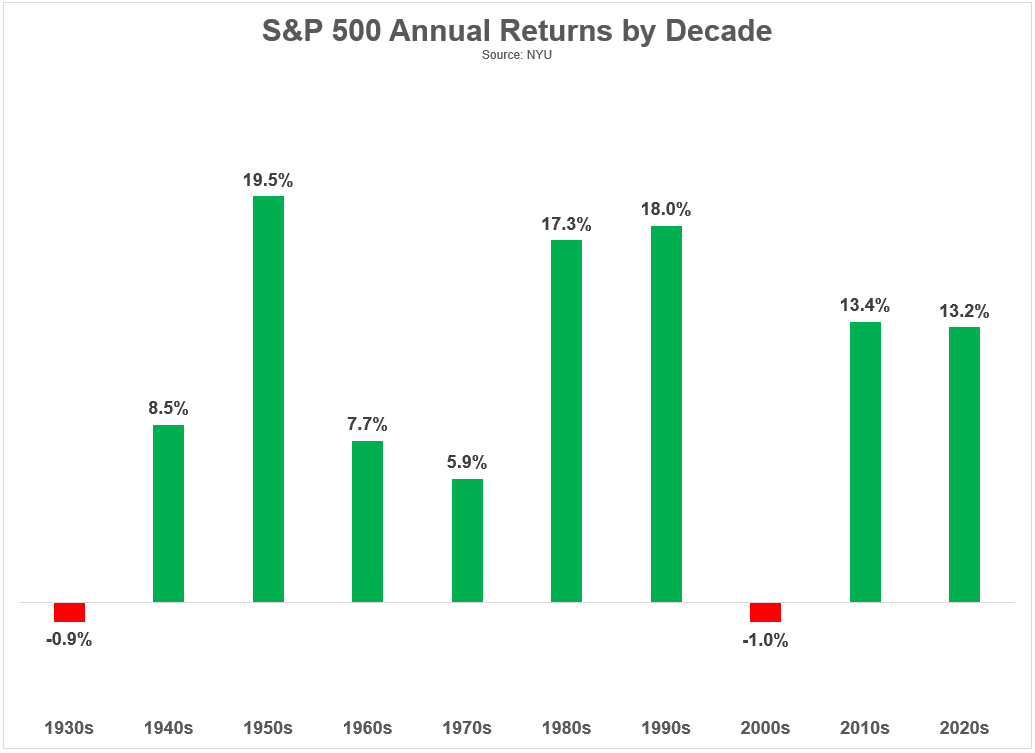

– Why buy and hold is the best (and worst) strategy

– How 401ks impact the stock market

– Billionaires can’t complain about inflation

– Consumers keep consuming

– Th richest generation in history

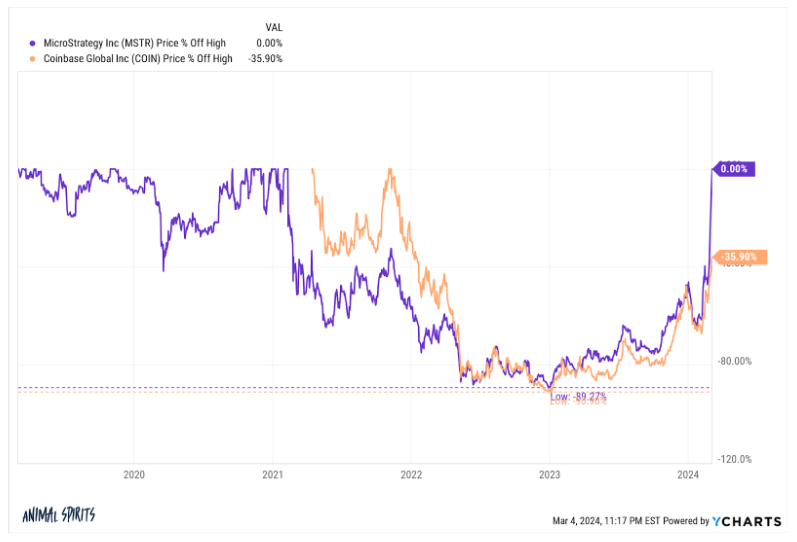

– Crypto just won’t die

– Why we keep seeing so many booms & busts

– The best new shows of 2024, and much more.

Some thoughts about being a long-term buy & hold investor.

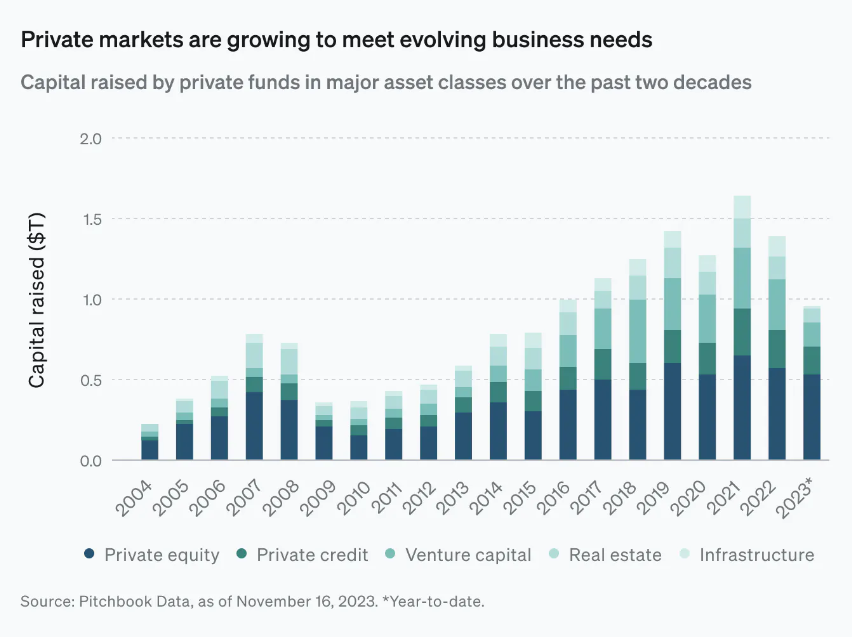

On today’s show, we are joined by Jacob Miller, Co-Founder of Opto Investments to discuss:

– How difficult it is for RIAs to get private market exposure

– The growth of private credit, and why that may be an issue

– Opto’s screening process for private investments, and much more!

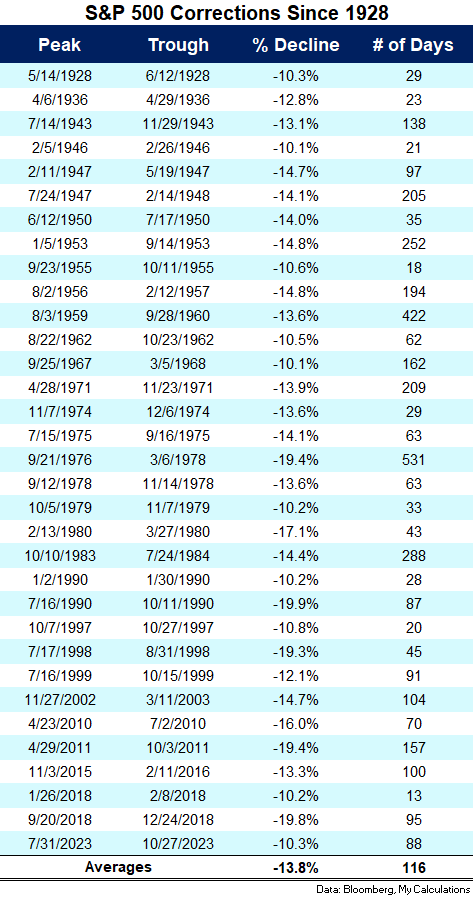

How often do we get a stock market correction?

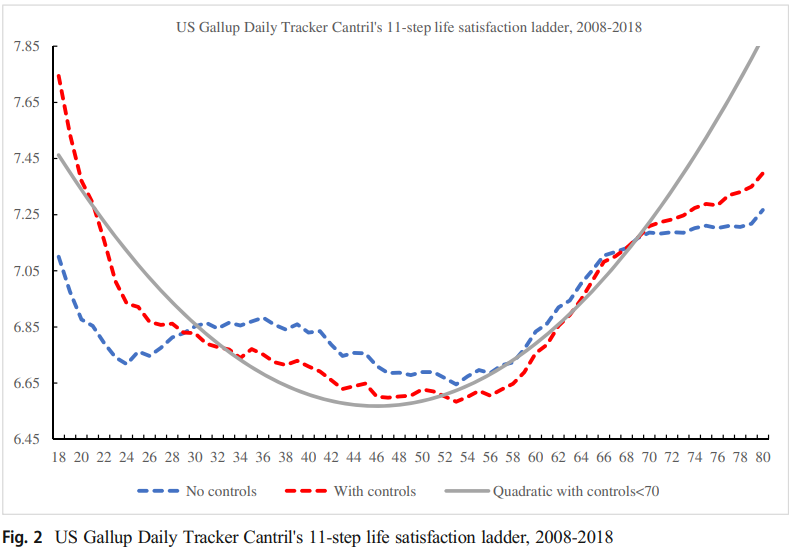

How can you avoid a mid-life crisis?

A list of risks to the financial markets along with the biggest one.

On today’s show, we discuss:

– Where to stay in the Florida Keys

– The Eli Manning podcast

– The market needs a healthy correction

– Japanese equities making a come back

– Good news for homebuyers

– The new Costner trailer, and much more!