A podcast listener asks:

How do you both manage to produce podcasts every week, handle your jobs, write, read, and raise families without burning out? How do you maintain this balance? What strategies do you use to recharge yourselves? Personally, when I go on vacation, I completely disconnect from work, yet I’ve noticed you guys continue podcasting even during your vacations.

Do you ever dream of leaving everything behind and retiring completely? What are your thoughts on achieving a happy retirement if such a thing exists? I am middle-aged like you too, and retirement has been on my mind lately. I am trying to figure out if I want to retire completely when the time comes or work a little bit for the rest of my life.

As a 40-something, this question is right in my wheelhouse — career, retirement, life satisfaction and middle age.

I’ve always believed work-life balance is a worthy goal…and borderline impossible.

My dad was always great about separating work and home life when I was growing up but it was a different time. It was much easier to leave your work at your office. There was no email, Slack, iPhones, Zoom, texting or wifi back then.

I don’t even know why we have out-of-office replies anymore because the email machine is now attached to your hand. I understand why so many people feel burnout these days.

Personally, it helps to have a job I love. I don’t dread going to the office.

But I know having my finance brain on 24/7 is not feasible. You need to decompress.

For me that’s TV, movies, working out, playing with my kids, coaching and being on the lake in the summer. Sometimes that means completely leaving work behind. But other times I can still get a few things accomplished even when I’m on vacation.

It doesn’t have to be all or nothing. You can mix in leisure time when you’re working and work time when you’re vacationing.

The best you can hope for when it comes to work-life balance is probably 60/40 but the 60 and the 40 go back and forth between work and family/leisure time.

Being in your 40s is strange because you’re an equal distance away from college and retirement. You still feel young but know retirement is getting less abstract by the year. It can be an understandably introspective period in your life.

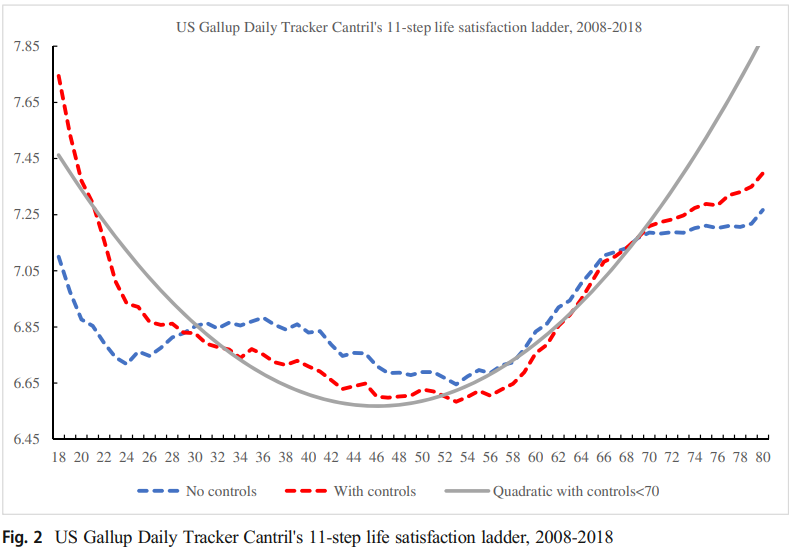

David Blanchflower published a research paper examining 145 countries to determine happiness levels by age.

Across all countries, rich or poor, there was a U-shaped curve in happiness that looks like this:

Happiness is high when you’re young, slowly falls until you reach middle age and then rises later in life. The research shows happiness bottoms out of its bear market at age 48.

Jonathan Rauch has written extensively on this topic and claims a midlife slump is normal:

First, midlife slump (not “crisis”!) is completely normal and natural. Like teething or adolescence, it is a healthy if sometimes painful transition, and it serves a purpose by equipping you for a new stage of life. You may feel dissatisfied, but you don’t need to feel too worried about feeling dissatisfied. Second, the post-midlife upturn is no mere transient change in mood: it is a change in our values and sources of satisfaction, a change in who we are. It often brings unexpected contentment that extends into old age and, yes, even into frailty and illness. Third, by extending our life spans, modern medicine and public health have already added more than a decade to the upturn, and they will add more years in the future.

The bad news is you’ll probably be more anxious and worried about your place in life in your 40s. The good news is you’re basically at the bottom of the happiness bear market.

Valuations are more attractive. The big gains are coming.

We only get one shot at life so it’s not like you get a lot of practice and feedback as you try to navigate these times. I don’t claim to have it all figured out but here are some ways I try to manage the inevitable mid-life crisis stage:

Remember what’s really important. My kids don’t care about my accomplishments at work. They don’t care about how much money I make. They don’t care how many likes I get on Twitter or views on YouTube.

They do care about how much time I spend with them.

If the choices are more time with my family or more income-producing opportunities, family always comes first. There’s no debate.

You can always double down on your career when the kids are older.

I have no idea when I’ll retire. My priorities at age 22 were vastly different than they are now at age 42. They’ll be different at 62 and 82 as well.

I feel like I’ll want to write in some format forever but I have no idea what my motivation to work will look like in 20-30 years. And that’s okay.

You don’t have to wait for retirement. You don’t have to wait to enjoy your time and money until you retire. Enjoy some of it now while you’re still young and healthy.

Bill Perkins says your net worth should peak in your 50s because you should start spending it down early.

I’m always a saver at heart, but the future is guaranteed for no one. Spend some of your money on the stuff you enjoy.

Gratitude helps. These days it’s easy to look at others with better jobs, bigger houses, nicer cars and more money than you and feel inadequate. You’re never going to solve that problem because there will always be richer and more successful people than you.

I prefer to look at jobs in the past where I wasn’t as fulfilled when I was making a lot less money and not happy with the projects I was working on.

It’s much easier to be grateful if you compare the current version of yourself to the past version rather than trying to benchmark to other people.

There are plenty of people doing worse off than you too.

One of the reasons for the uptrend in happiness from middle to old age is that you begin to focus on the positive aspects of your life rather than the regrets and disappointments.

Gratitude gives you a better outlook on life.

Michael and I discussed our jobs, early retirement, mid life crises and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Why Are People Miserable at Work

Now here’s what I’ve been reading lately:

- One of Michael’s best days ever (Irrelevant Investor)

- The problem with 60/40 (Discipline Funds)

- Toward a leisure ethic (The Hedge Hog Review)

- Selling a house is not always easy (Belle Curve)

- 9 surprises about retirement (Retirement Manifesto)

- Purity finance (Money with Katie)

- How much cash should you have in your portfolio? (Oblivious Investor)

- Remembering Richard Lewis (The Ringer)

Books: