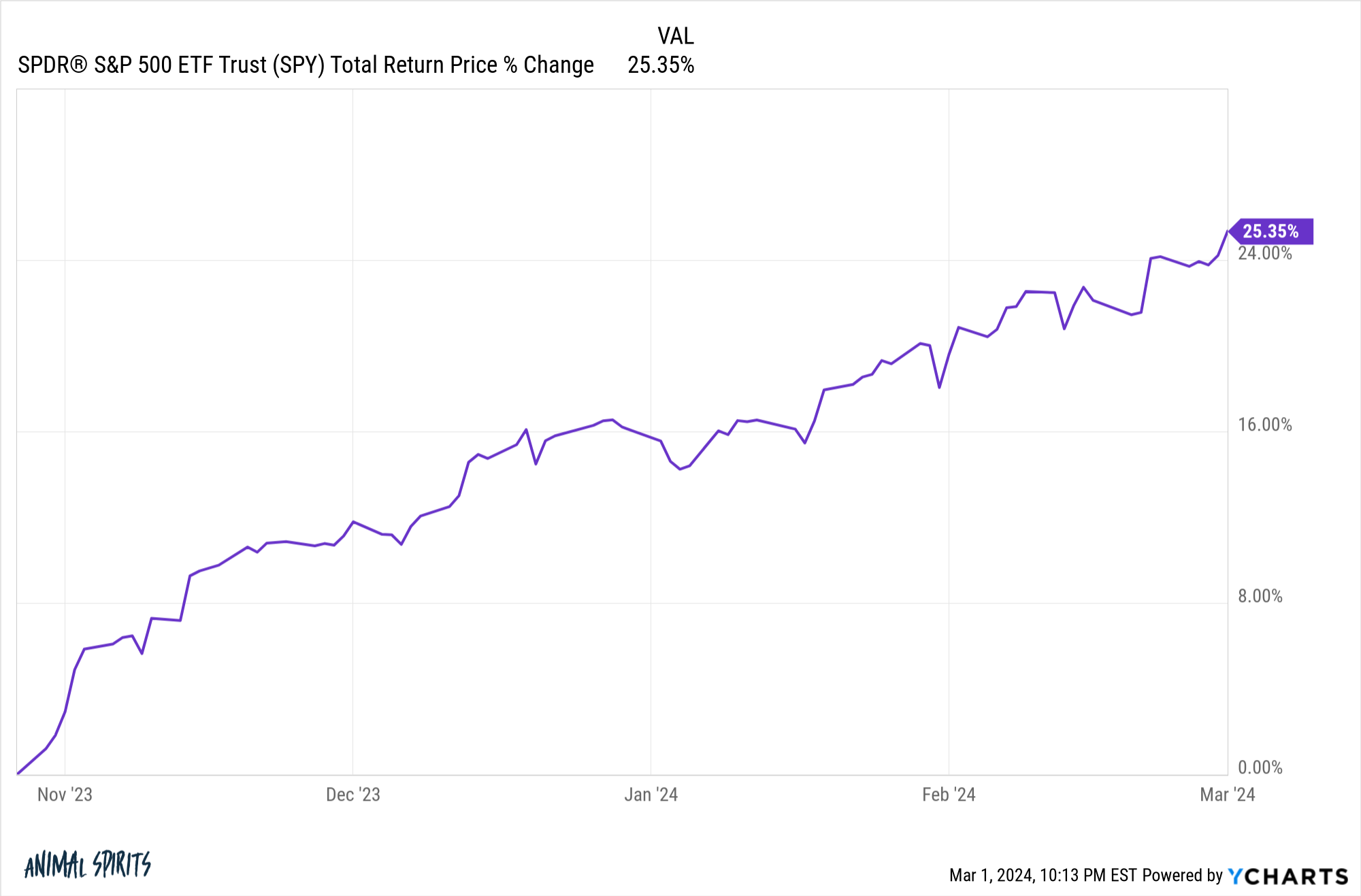

From the bottom of the quick 10% correction in late-October of last year, the S&P 500 is up more than 25%:

Markets often move fast which is why timing them can be so tricky. The market obviously can’t keep up this pace forever.

New highs in the stock market tend to lead to more new highs but sometimes the stock market needs a breather, even in a bull market.

No one can predict the timing or magnitude of corrections in the stock market. It’s far too unpredictable for that.

But it does feel like a correction would be healthy at some point. I know corrections never feel healthy in the heat of the battle but they can be helpful to avoid complacency and give investors a better entry point.

Investors focus on the crashes and bear markets for good reason — they’re painful to live through.

But what if we take out the huge downturns and focus on the corrections instead? You know, the healthy ones.

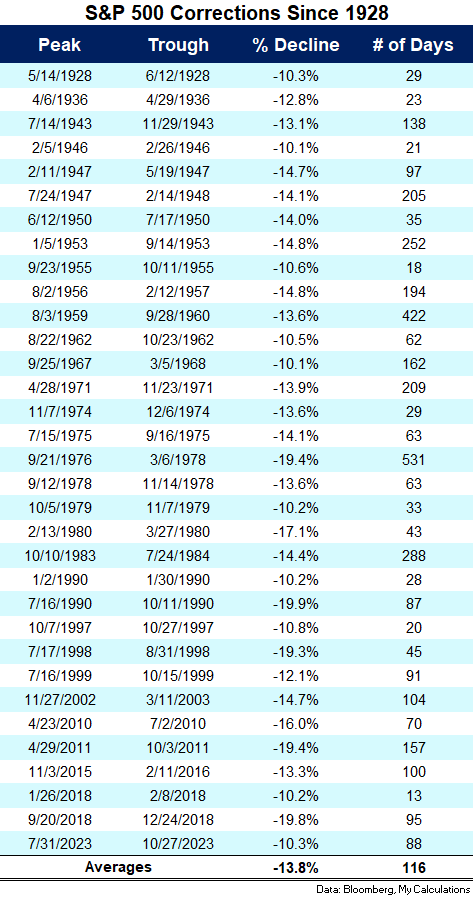

Here’s a look at the double-digit corrections that never got to the bear market level (down 20% or worse) since 1928:

By my count we’re looking at 33 corrections over the past 97 years. The average healthy correction was a loss of 13.8%, lasting 116 days from peak-to-trough, on average.

I’m sure most of these corrections felt like they were going to turn into a bear market at the time but a healthy correction is more likely than a crash most of the time.

Bad markets occur during bad times but shorter-term downtrends can also occur during longer-term uptrends.

The 2010s was an excellent run for the S&P 500, yet you still had four double-digit corrections.

The late-1990s is one of the best stretches of gains in history:

- 1995: +37%

- 1996: +23%

- 1997: +33%

- 1998: +28%

- 1999: +21%

Despite those insane returns, three separate double-digit corrections were sprinkled into this five-year period.

The 1950s is the most underappreciated bull market of all-time.1 The U.S. stock market was up nearly 20% annually on the decade. There were four corrections during those gains along with a minor bear market near the end of the decade.

The S&P 500 is up around 70% in total (13.5% annualized) in the 2020s so far despite the fact that we’ve experienced two bear markets.

Two steps forward, one step back.

I’m never going to try to predict a stock market downturn because I don’t have the ability to do that.

However, it is important to prepare yourself for the fact that corrections are a natural part of the stock market, in good times and bad.

A healthy correction in the coming months might be a good thing if it helps stave off an unhealthy correction down the line.

Further Reading:

How Often Do Bear Markets Occur?

1Mainly because no one was really invested in stocks at the time. The Great Depression crash was too scary.