A reader asks:

I ran across this blog post by Econ blogger Noah Smith, “Americans are still not worried enough about the risk of world war.” He makes the case that we could well be in what he calls “the foothills” of another conflict on the scale of World War II, arguing that right now feels a lot like the mid-late 1930s must have felt as conflicts broke out across the world and gradually merged into what we now call World War II. I briefly tried to research personal finance approaches for this kind of scenario, but everything seems to be in the category of preparing for total civilizational breakdown and strikes me as ridiculous. Are there any thoughts you guys have on what individuals could do to hedge this kind of risk from a personal finance perspective? Shouldn’t someone in 1938 have taken concrete steps to prepare for the possible outbreak of a major conflict?

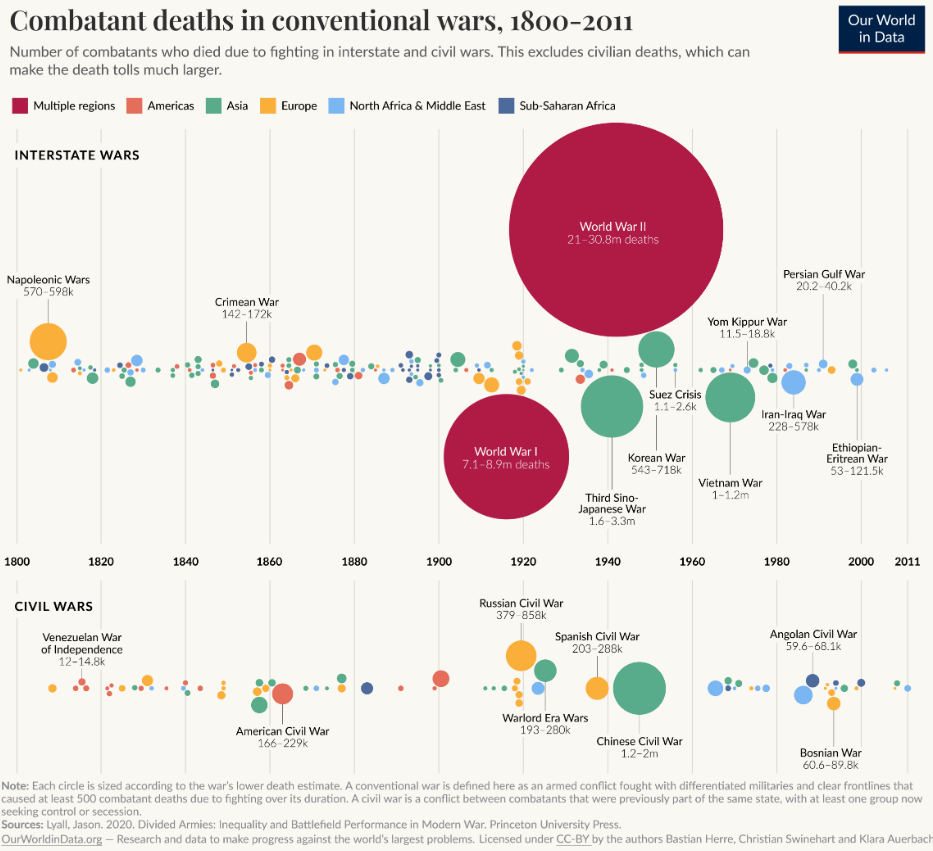

Our history as a species is littered with war.

Our World in Data estimates more than 37 million combatants have died fighting in wars worldwide since 1800 (that number is a lot larger if you include civilian casualties):

The two world wars stand out from all the others.

I would like to think cooler heads will prevail but I don’t know if the U.S. and China will go to war in the years ahead. Geopolitics are fickle. Who knows how certain politicians will react or what the various leaders of countries around the globe are thinking?

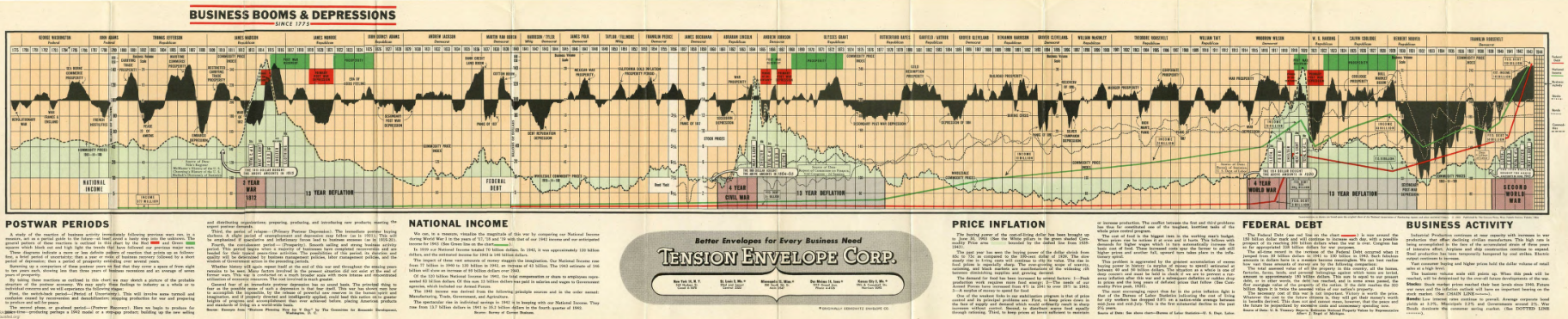

There actually used to be a playbook for investing during wartime because that was the way of the world back then:

This is hard to read so allow me to summarize the typical post-war economic reaction in the pre-WWII era:

- There would be a downturn at the outset of the war.

- Then there would be a boom from all the war-time spending.

- This was followed by a period of uncertainty as nations shifted from war-time to peace-time production.

- The post-war economic recovery included speculation, an inflationary spike from all the spending and overheating from all the excesses.

- Those excesses would inevitably lead to a post-war depression which included a deflationary bust. There were 13-year periods of deflation following the War of 1812, the Civil War, and World War I.

- Finally, a period of prosperity would kick in as things got back to normal.

This playbook worked until it didn’t. Everything changed after World War II, which was followed by boom times without the deflationary bust in the economy because the government offered all of the soldiers returning home so many incentives to get their lives back on track through the GI Bill.

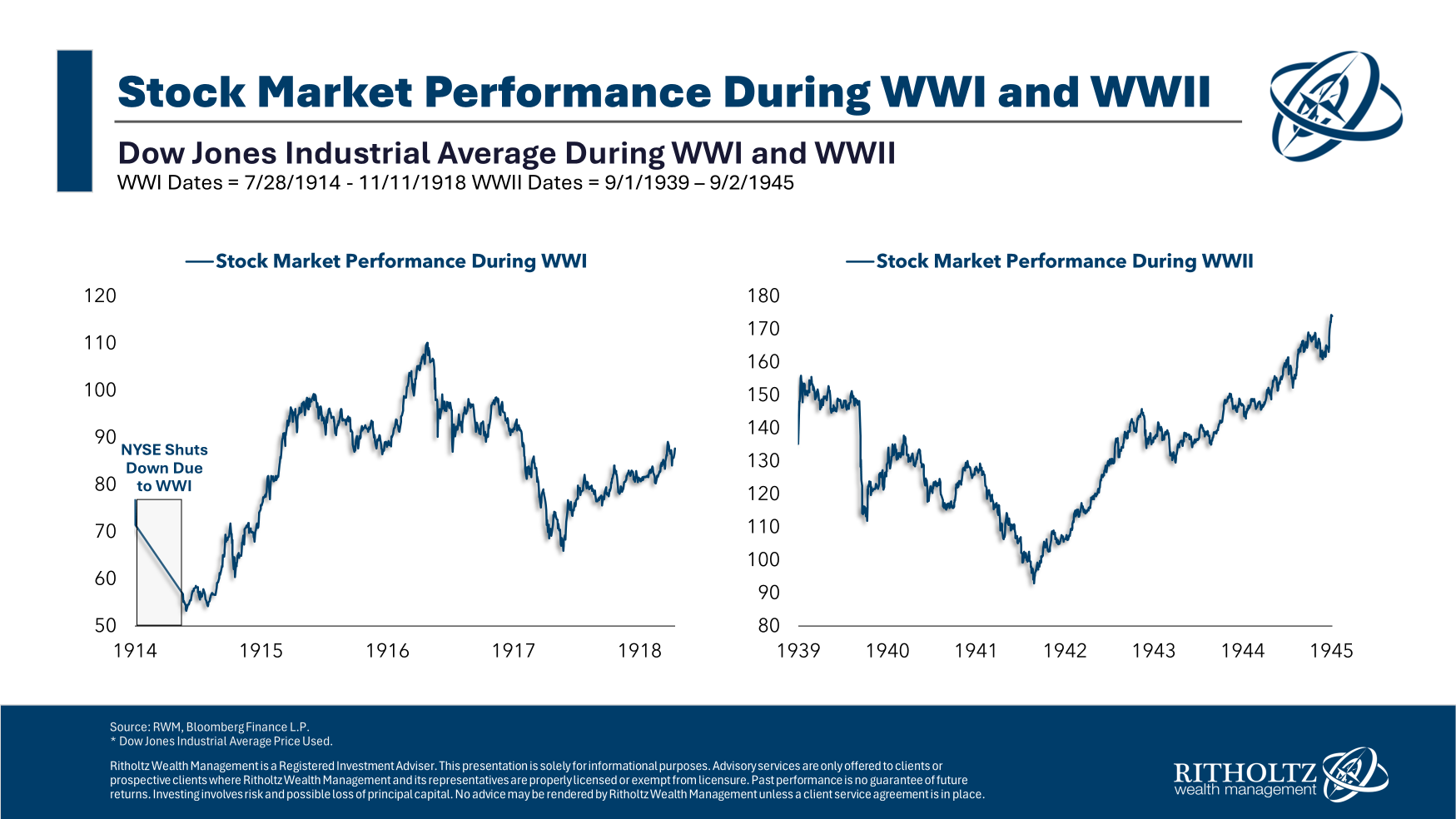

There are no guarantees for any scenario but volatility would seem to be the most logical outcome if world powers came to blows. Here’s a look at the performance of the Dow in World War I and World War II:

There were a handful of crazy market outcomes in World War I. At the war’s outset in 1914, the stock market shut down for six months. Liquidity simply dried up since so many people went to fight. It opened much lower, but then a funny thing happened–stocks took off like rocketships in 1915.

1915 remains the best year ever for the Dow, up more than 80% on the year.

From the start of the Great War in the summer of 1914 through the end of the war at the tail end of 1918, the Dow showed a total return of more than 43% or nearly 9% per year.

There was a downturn at the outset of World War II as well. U.S. stocks were down double-digits in 1940 and 1941.

By 1942, things looked bleak for the Allied nations. Germany controlled most of Europe and had yet to suffer any defeats in battle. Yet that’s the same time the stock market bottomed and was off to the races.

From the start of the war in 1939, when Hitler invaded Poland, through the fall of 1945, when the war ended, the Dow gained a total of 50%, good enough for an annualized return of more than 7% per year.

Even with some volatility as war broke out, the stock market performed admirably during the two world wars.

The stock market can be counterintuitive and heartless during periods of conflict. And there is obviously no guarantee we’ll see a similar outcome if something flares up between global superpowers in the years ahead.

So how would you hedge your portfolio against the possibility of World War III?

I’m not sure there are any big secrets involved here.

You match your risk profile and time horizon so you’re able to balance long-term goals with short-term needs.

You invest in risk assets that have expected returns above the rate of inflation so you don’t fall behind from rising prices.

You build downturns into your investment plan with the understanding that stocks can get crushed from time-to-time.

You don’t try to predict the future because predicting the future is impossible but you do prepare yourself for a wide range of outcomes.

I’m sure there are certain industries, companies or assets that would do better or worse if the United States went to war with China.

But the best way to hedge the risk of World War III is the same way you hedge against any other future unknown.

We got into this question on the latest episode of Ask the Compound:

Ritholtz Wealth Management financial advisor Michelle Katzen joined me on the show this week to discuss questions about how to account for home equity in your financial plan, borrowing against your portfolio, what constitutes a last will and testament and how retirement planning actually works.

Further Reading:

Pandemics vs. Post-War Recoveries