Today’s Animal Spirits is brought to you by YCharts and Fabric by Gerber Life

See here for YCharts’ 2024 advisor-client communication survey

See here for more information on life insurance from Fabric by Gerber Life

On today’s show, we discuss:

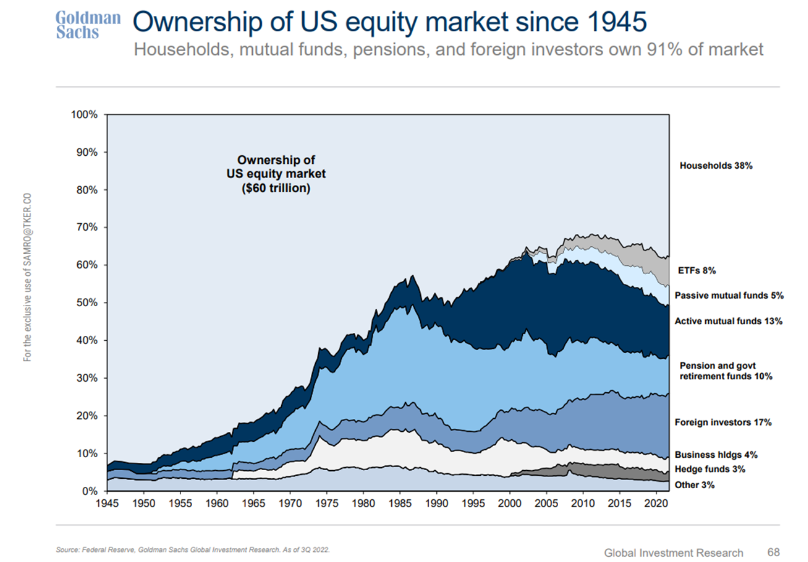

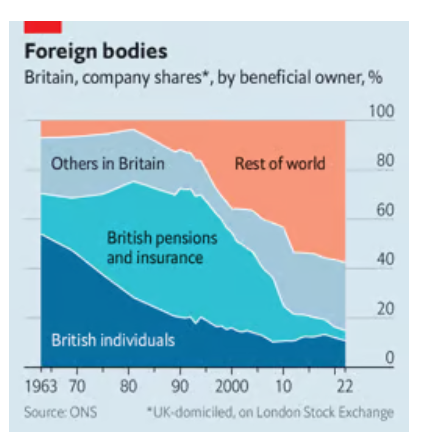

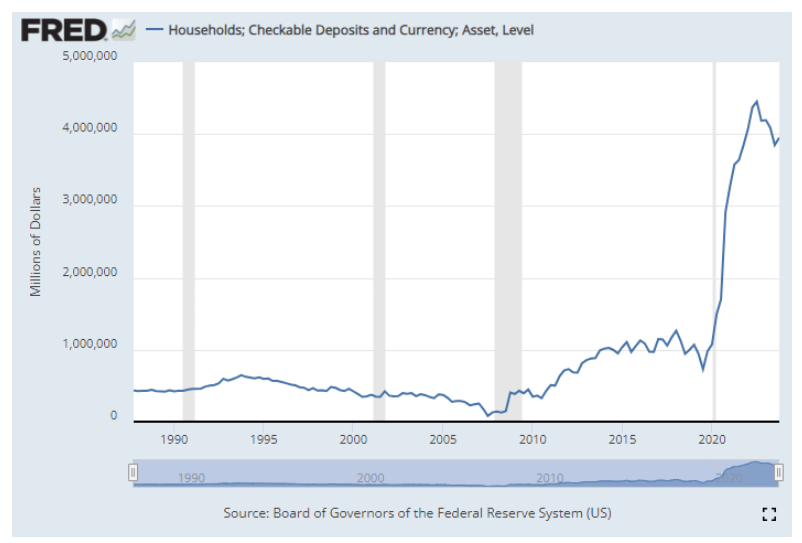

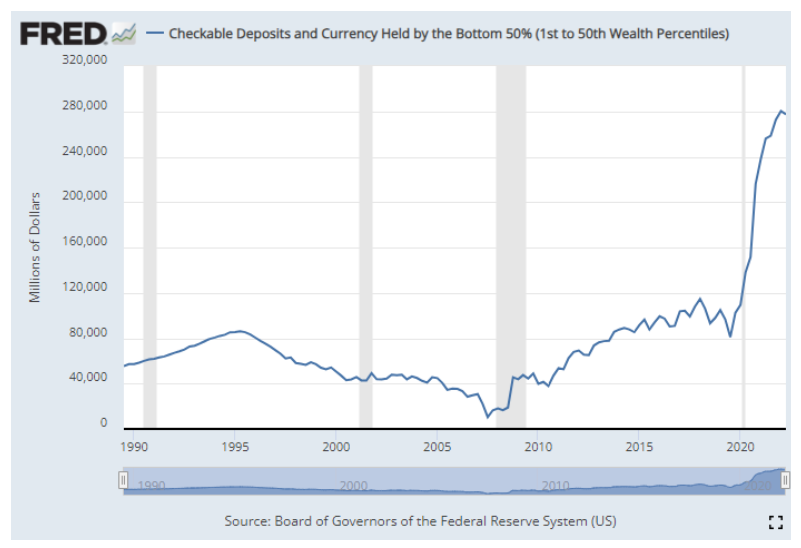

- Sorry stock bulls, the ‘Wall of Cash’ isn’t all headed your way

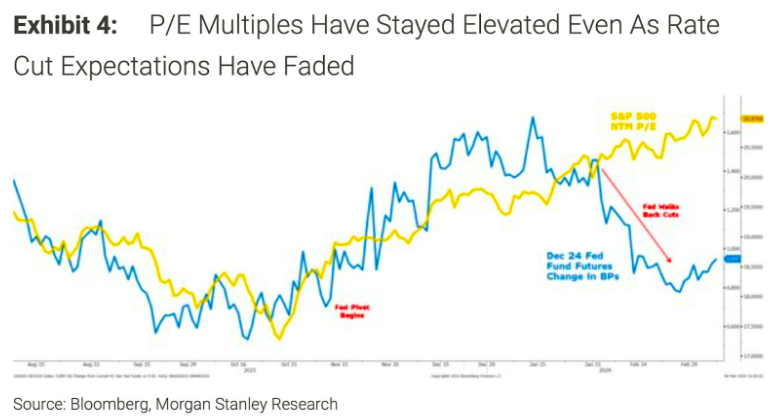

- A chart market skeptics will find frustrating

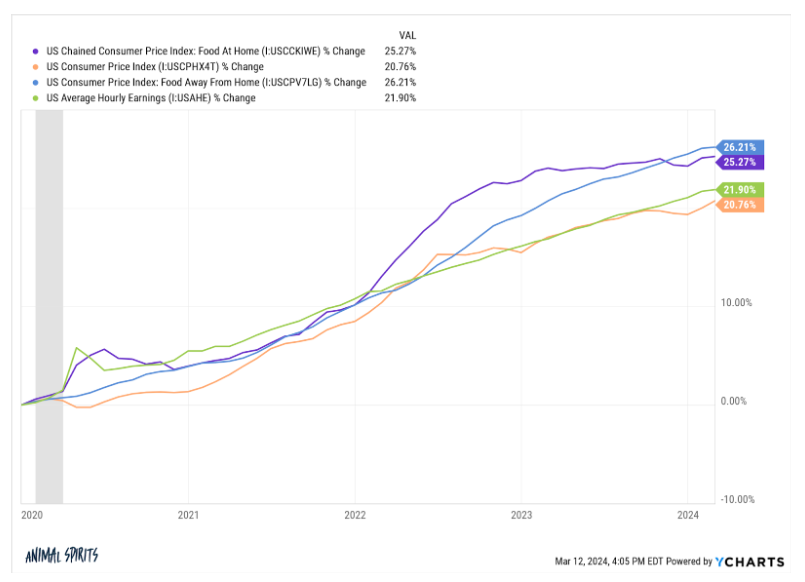

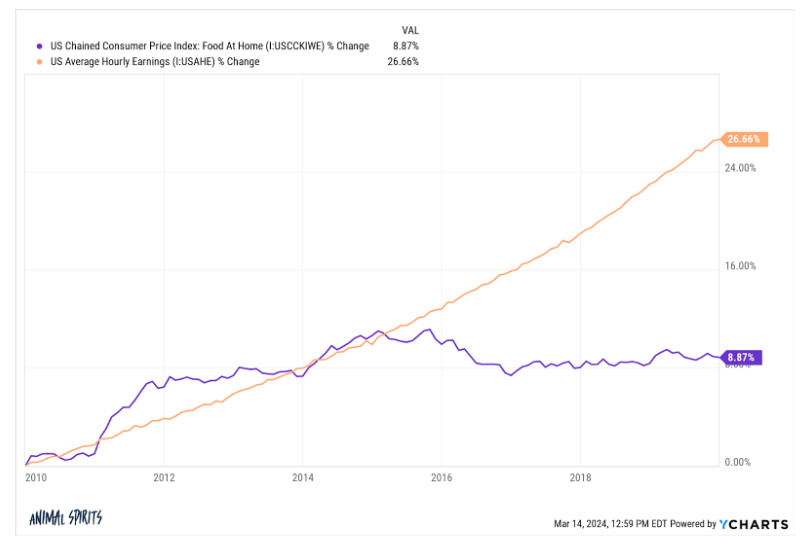

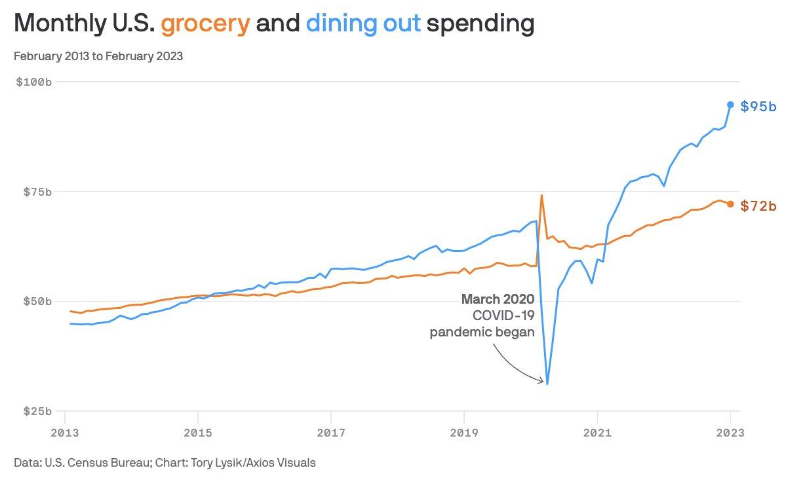

- Inflation at the grocery store

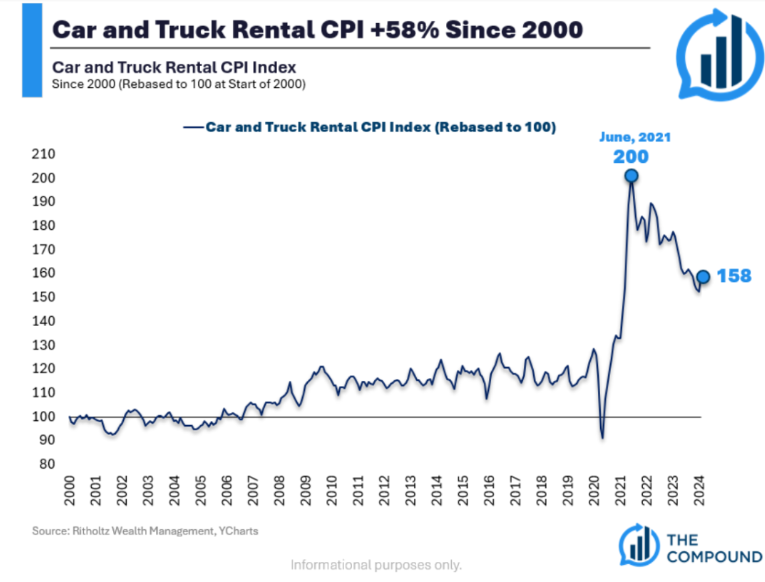

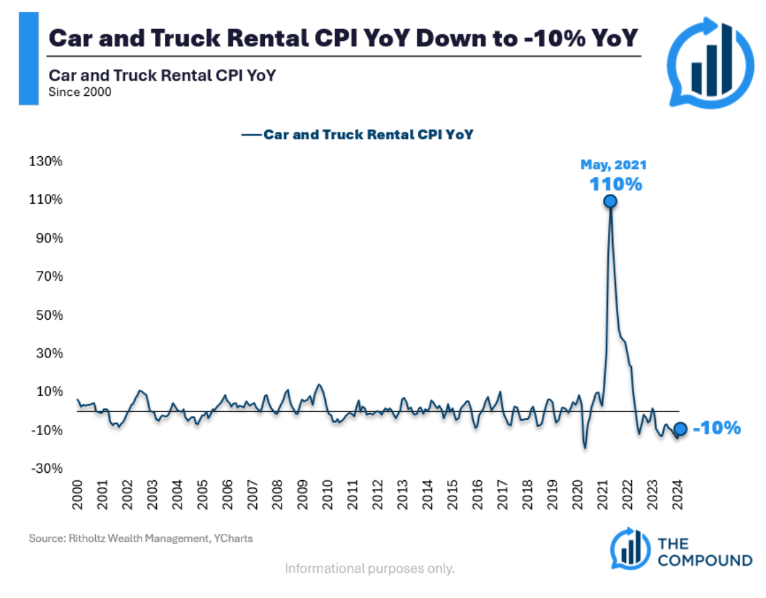

- Rental car prices are far lower. Here’s where you can save money.

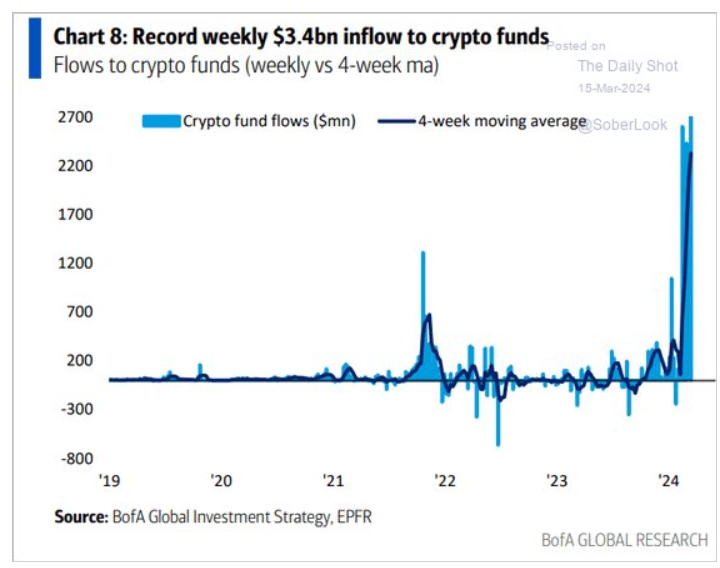

- Bitcoin endgames & the new hyperagents

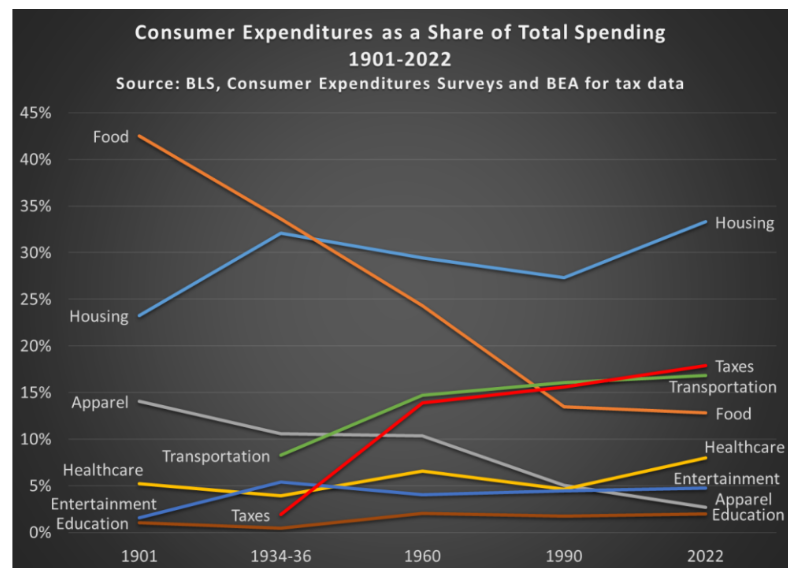

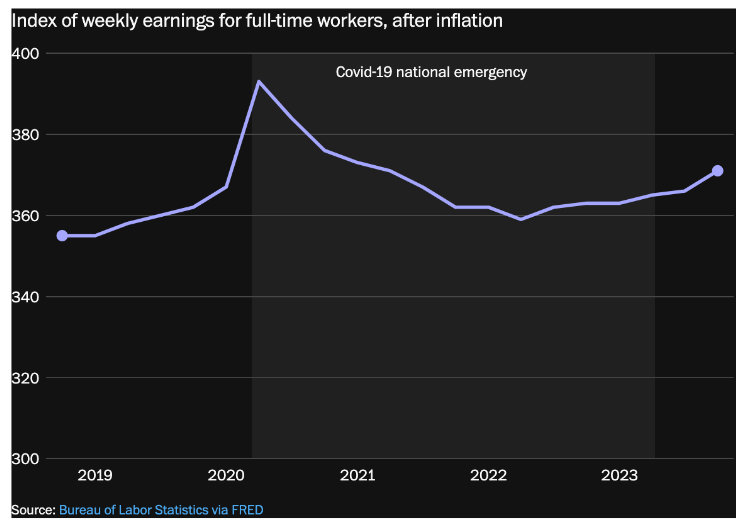

- 11 charts that show how Covid changed the U.S. economy

- Powerful realtor group agrees to slash commissions to settle lawsuits

- A look into the future of home buyers’ agent commissions

- Zillow stock sinks after realtor settlement paves way for lower commissions

- Once America’s hottest housing market, Austin is running in reverse

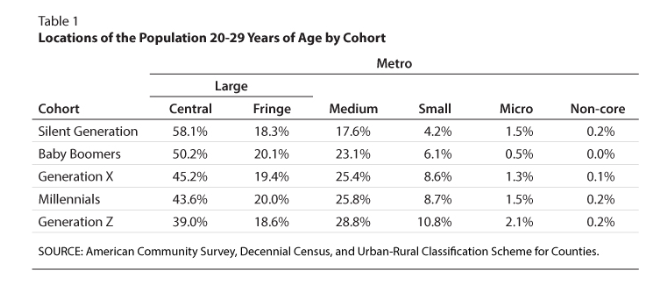

- By the generations: Location pattern of different cohorts

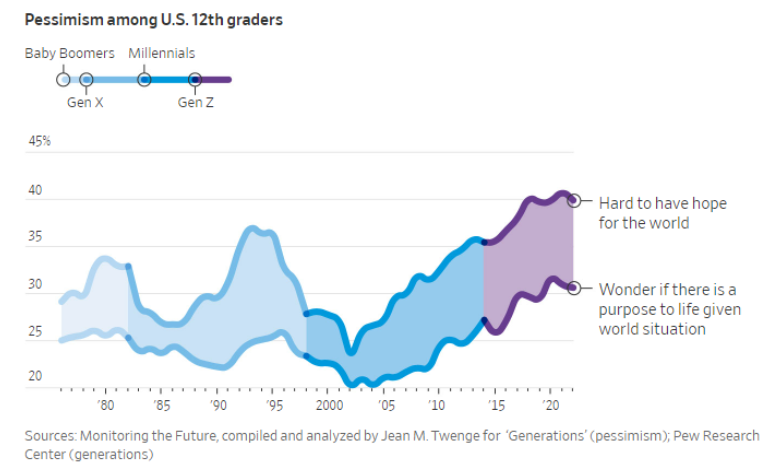

- The rough years that turned Gen Z into America’s most disillusioned voters

Listen here:

Recommendations:

Charts:

Tweets:

Goldman's Sentiment Indicator just went nuts pic.twitter.com/giefi3hciP

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) March 15, 2024

I think you asking why ARKK hasn't popped more along with the tech stocks. This attribution (which I ran against QQQ from 10/22 to 2/24) yields a sense. Tldr: They owned less tech than the Nasdaq and had bad selection within it + owned a lot more HC and had bad selection there. pic.twitter.com/kTBKeNVhoJ

— Jeffrey Ptak (@syouth1) March 13, 2024

ARKK's shareholder base has been remarkably resilient all things considered. Assets that poured in largely stayed put. However, starting to see some sustained redemption activity for the first time. Nothing big on daily basis, typically, but sharecount is down ~25% from the peak. pic.twitter.com/jAcpqbyH6V

— Jeffrey Ptak (@syouth1) March 14, 2024

Surprise: shelter strikes again.

Real world headlines read out much cooler.

When we put in Apartment List rent (which declined -1% last 12m) vs the +5.7% BLS, we see both core and headline CPI printing both <1%!

Hearing much more commentary the Fed 'gets it' now. pic.twitter.com/kAbhuY0f7d

— Jeremy Schwartz (@JeremyDSchwartz) March 12, 2024

This is underappreciated but perhaps the greatest accomplishment of modern-day economists.

graph via @leecoppock pic.twitter.com/bepnJBYnuq— John Arnold (@JohnArnoldFndtn) March 14, 2024

https://twitter.com/HODL15Capital/status/1769040553423806785

Nice look at 2024 YTD ETF flows by category.. US growth stocks and bitcoin are stories of year so far.. corp bonds up there as well.. Notable Japan and EM both making rare appearance. Gold ETFs in the gutter (despite seeing ATHs) is also interesting. Via @Todd_Sohn pic.twitter.com/VfFYvnWRKk

— Eric Balchunas (@EricBalchunas) March 15, 2024

At least 23.98% of your wealth has been invisibly seized by the government since Jan 2020. https://t.co/s97GLpvV0X pic.twitter.com/BjIji6Iuwt

— Balaji (@balajis) March 16, 2024

2/3 of U.S. adults prefer watching movies on streaming rather than theaters, according to a new poll.

(Source: https://t.co/Fwt9KLVO3K) pic.twitter.com/8GJ6CeKeLP

— DiscussingFilm (@DiscussingFilm) March 15, 2024

Contact us at animalspirits@thecompoundnews.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound, Inc., an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.