“It is high time for costs to be recognized as a crucial factor in determining the future returns that funds earn.” – John Bogle

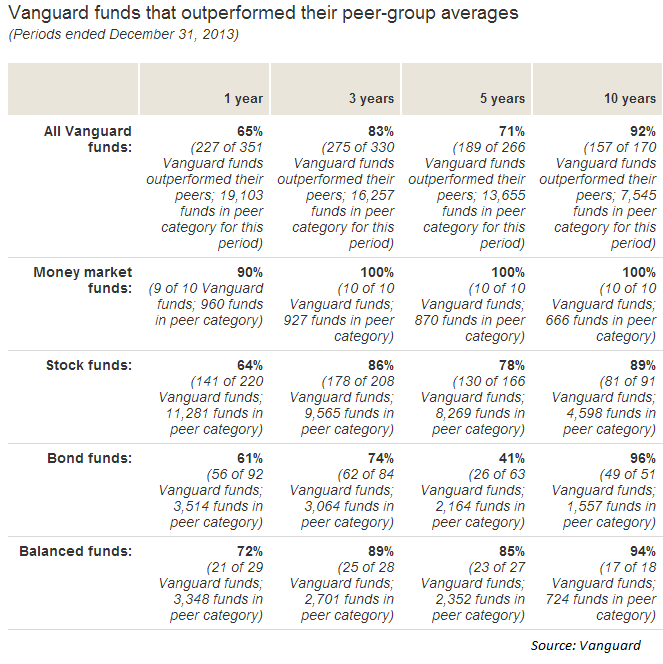

These are the Vanguard fund performance results against their peer group by category through December 31, 2013 over various time frames:

You can see that Vanguard funds outperform the majority of their peers in the fund industry in nearly every category over almost every period listed.

There’s no perfect answer for finding the best investment strategy. It really comes down to finding a process you can stick with emotionally that gives you the highest probability for success.

While you could do better than investing all of your money with Vanguard, you could also do much, much worse.

My unofficial tally from the Vanguard mutual fund screener on the company’s website shows that they have 126 mutual funds. Of that 126, there are 65 actively managed funds and 61 index funds (these numbers don’t include the different share classes that are offered for some funds).

This means that less than 50% of Vanguard’s funds are technically index funds, which might surprise some people.

Because of John Bogle and the rise of the index fund investor, most investors assume that Vanguard is strictly an index fund shop.

In reality, they are a low cost shop. There’s a difference.

The average expense ratio for all Vanguard funds is 0.19% compared to the industry average of 1.11%.

Research has shown that fund expenses are the only factor you can use to predict the success of mutual fund performance. This is from Russell Kinnel of Morningstar:

“If there’s anything in the whole world of mutual funds that you can take to the bank, it’s that expense ratios help you make a better decision. In every single time period and data point tested, low-cost funds beat high-cost funds. Expense ratios are strong predictors of performance. In every asset class over every time period, the cheapest quintile produced higher total returns than the most expensive quintile.”

And here’s one of my favorite Bogle quotes of all-time:

“Investors in aggregate will earn the gross return of the total stock market before costs, but share only in the amount of that return that remains after costs.”

The beauty of this statement resides in its simplicity.

The financial markets can so seem complex and overwhelming to many outside observers. Bogle’s greatest gift to investors is his ability drill things down into the three or four main points that will get you 90% of the way there, even if you don’t completely understand all of the nuances of the markets.

Bogle’s quote from an interview in Men’s Health last year sums up the most important steps individual investors should take to shape a reasonable investment plan:

“Everyone is looking for the Answer, and there really isn’t an answer except save. Save more. Invest for the long term, get cost out of the equation, and get diversified to the nth degree.”

Of course, once you get these factors right you still have to control your behavior, but you have to start somewhere.

I think most individual investors could do much worse than investing with Vanguard and following Bogle’s simple approach.

Sources:

Performance report: How Vanguard funds stacked up (Vanguard)

This man will make you rich (Men’s Health)

AWOCS,

Thanks for the reminder. We always need these. I’m in the process of moving my retirement accounts to index ETFs, mostly Vanguard. Its a slow move, but over time I think its the right choice base on the data.

-RBD

Nice. I agree. It’s a less stressful way to manage your investments, plus if you would like to venture out with a smaller piece of your portfolio there are enough ETFs available that you can get into basically any market you want in a diversified way.

Haha, nice timing. I wrote a blog post today about replacing my retirement portfolio with 5 Vanguard ETFs. I am a huge believer in Vanguard’s products and have owned some of them for years. The article is also available on Seeking Alpha at http://seekingalpha.com/article/2015241-my-retirement-portfolio-could-be-replaced-with-these-5-etfs?source=kizur_seekingalpha.

-Bryan

Nice, great minds and all that. Vanguard is the type of company that really shouldn’t even exist in today’s world. Bogle left so much money on the table by making it a shareholder run company instead of taking it public. The rest of the industry had no choice but to follow their lead and lower fees. But this is a great thing for investors like you and me.