Today’s Animal Spirits is brought to you by YCharts:

See here for YCharts Top 10 Visuals for Prospect & Client Meetings

On today’s show, we discuss:

- Stock pickers failed to take part in first-quarter rally

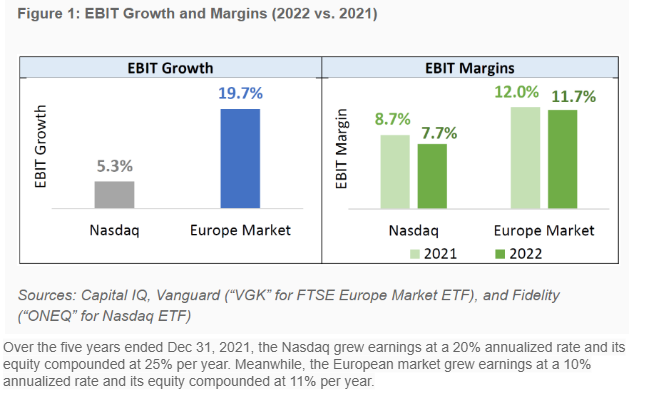

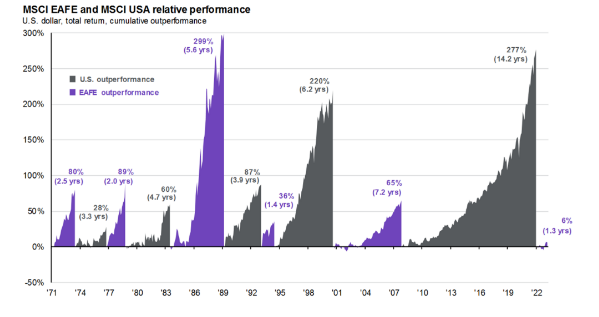

- Tech investing via Verdad

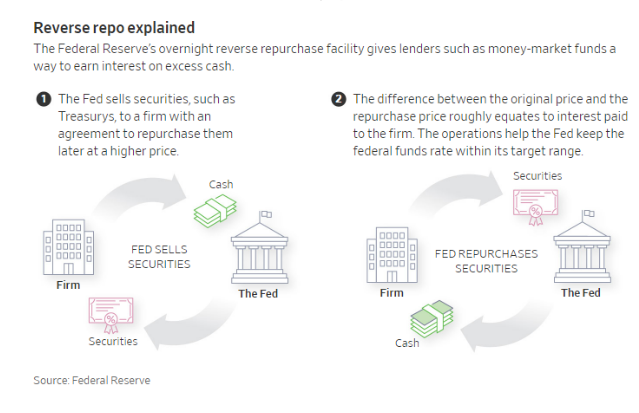

- Deposit outflows shine light on Fed program that pays money-market funds

- Why one firm’s 3,612% return is drawing the ire of hedge funds

- A historic labor market recovery

- Wages may not be inflations cause, but they’re in focus of the cure

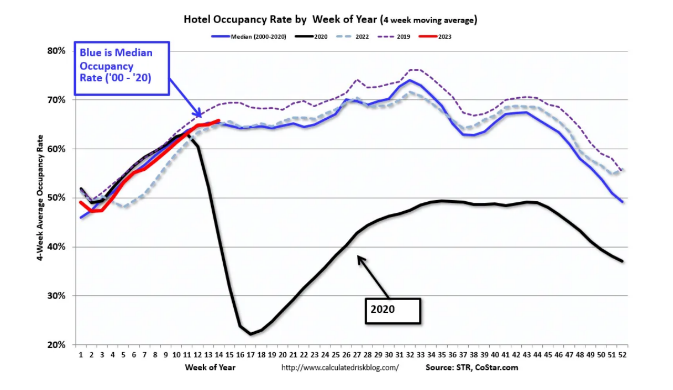

- A few comments on commercial real estate via CalculatedRisk

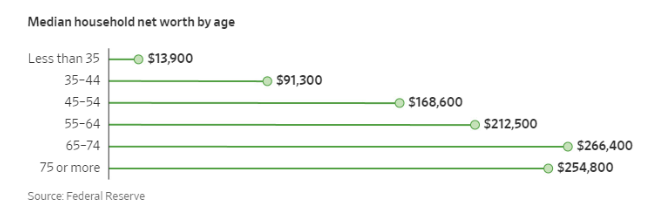

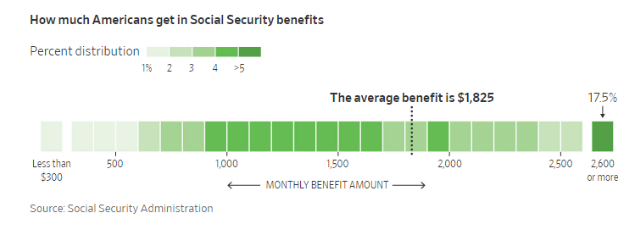

- Here’s what retirement looks like in America in six charts

- Buying or selling a home? Welcome to the year of disappointment

- Demand outpaces limited supply, making some markets feel hot despite few sales

- Lenders lost $301 for each mortgage they made last year

Future Proof:

Listen Here:

Recommendations:

Charts:

Tweets:

Every time the S&P 500 had a 20%+ decline or more in Midterm Election year, 1-year later the market rallied ~30% or more. pic.twitter.com/Imc2o05J6u

— Tom Dunleavy (@dunleavy89) April 7, 2023

Next few days:

-US CPI

-BOC decision

-Fed minutes

-Major US banks report

-Policymakers from major central banks speak

-IMF/World Bank spring meetingsMeanwhile the VIX is near 1 year lows (Bloomberg chart). pic.twitter.com/lbWhmdOMPm

— Jeffrey Kleintop (@JeffreyKleintop) April 11, 2023

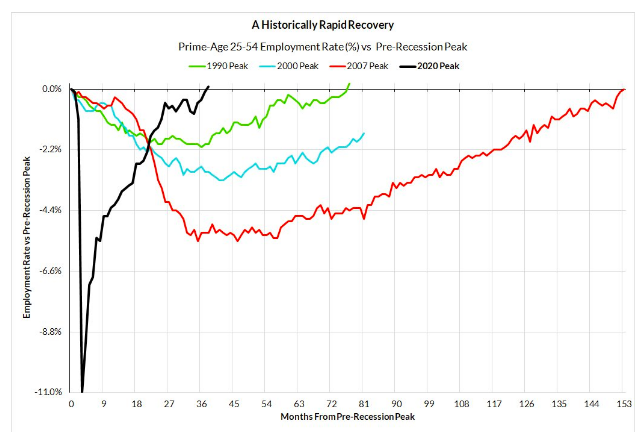

The prime-age employment rate is now higher than the pre-recession peak.

And it did so in record time, despite starting from a lower base.

It's been a historically rapid and complete recovery. Took over 12yrs to get back to pre-recession peak following the Great Recession pic.twitter.com/RK6EvwHuUb

— Skanda Amarnath (@IrvingSwisher) April 7, 2023

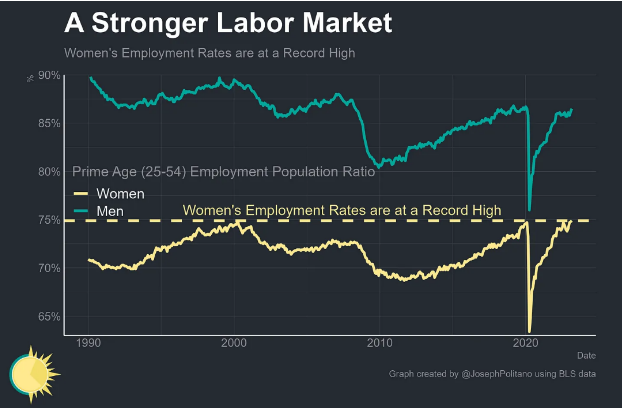

So much for "nobody wants to work anymore": 80.7% of prime-age (25-54) Americans were working in March, the highest rate since May 2001. pic.twitter.com/W858TSe2G0

— Ben Casselman (@bencasselman) April 7, 2023

Wages continue to slow down. Wage growth is now running at 3.2% on a three-month annualized bias. Production workers running at 4.2% pic.twitter.com/7ejY2CzMi9

— Nick Bunker (@nick_bunker) April 7, 2023

We're starting to see 2 economies for jobs: Still hiring in restaurants/health/gov but not in retail/real estate

Hospitality: +72,000

Gov't +47,000

Biz: +39,000

Healthcare +34,000

Social aid +17,000Retail -14,600

Warehousing -11,800

Construction -9,000

Real estate/leasing…— Heather Long (@byHeatherLong) April 7, 2023

Services spending continues to outpace total spending pic.twitter.com/uWBBMAzfJQ

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) April 11, 2023

30-year fixed mortgage rates down to 6.39% today, lowest in about two months, as investor fears about growth once again serve to boost the housing market: pic.twitter.com/GAEXP3NYlg

— Conor Sen (@conorsen) April 4, 2023

Big investors have virtually disappeared from the market – down almost 80%.

We reviewed 581,000 transactions in the largest U.S. markets in Q4 2022 and Q4 2021.

Surprisingly, investors who own 10-999 homes have slowed less. We know many of them, who are not "market timers." pic.twitter.com/3Pkako6jCX— John Burns (@johnburnsjbrec) April 8, 2023

Wild stat…

17% of people financing a new vehicle purchase are paying > $1,000/mo

That percentage in Q1 2021? 6%

Avg car payment = $730/mo

via @DowJonesAl

— Nate Geraci (@NateGeraci) April 11, 2023

Wholesale used vehicle prices (mix, mileage & seasonally adjusted) based on @Manheim_US Index increased 1.5% in March leaving the index down 2.4% y/y https://t.co/Tt0RVbz0FJ… NSA ave price increased 3.5% leaving unadjusted ave price down 2.9% y/y pic.twitter.com/wS10x9iDW8

— Jonathan Smoke (@SmokeonCars) April 7, 2023

This is big. Capital One is pulling inventory lines of credit (aka ‘floorplans’) on dealers 😳

Basically means its dealers have 90 days to refi their inventory.

From source: “Cap one is completely getting out of the inventory lending game”

[Reposted for added confidentiality]

— Car Dealership Guy (@GuyDealership) April 9, 2023

Let's test something out. Can you retweet this? https://t.co/BXbMq9dCxZ

— Timothy B. Lee (@binarybits) April 7, 2023

BOX OFFICE: #SuperMarioMovie Makes History!

– Biggest global debut ever for an animated film ($377M)

– Biggest 5-day opening ever ($204M)

– Biggest opening ever for a video game adaptation

– 3rd biggest 3-day opening for an animated film ($146M)

– Biggest opening of 2023 pic.twitter.com/zXLcaeUljS— Erik Davis (@ErikDavis) April 9, 2023

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Wealthcast Media, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.