In my last piece, I looked at generational wealth inequality.

The charts in that post make it obvious baby boomers control vast sums of wealth in this country.

In some ways, this makes sense since they’ve had more time to save and compound their capital. In other ways, it doesn’t make sense because boomers had more wealth when they were younger than millennials do at the same age.

But even within the boomer cohort itself, there is a huge disparity between the haves and have nots.

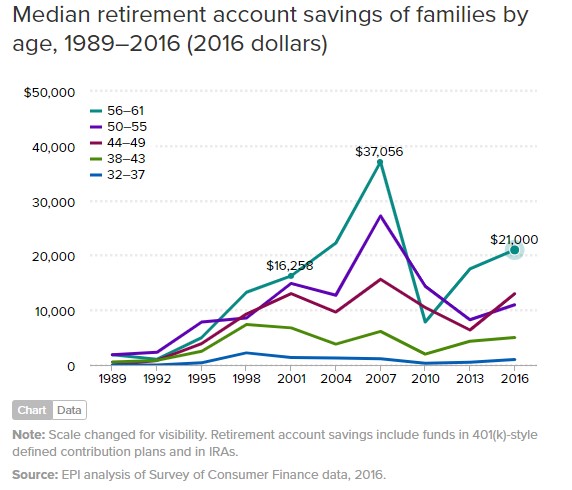

According to the Economic Policy Institute, as of 2016 half of all people aged 56-61 had less than $21,000 saved for retirement.

Half of all senior citizens get at least 50% of their retirement income from social security. Around 25% of seniors rely almost exclusively on social security to fund their retirement.

So even though baby boomers benefitted from solid economic growth and high returns in the capital markets, not everyone was able to take advantage (for a plethora of reasons).

Which brings us to the natural follow-up to my piece on generational wealth inequality — what can millennials do about it?

Boomers will either spend or pass down much of their wealth. Unfortunately, when it comes to inequality, this won’t help much as the money will mostly pass within wealthy families.

The rich will stay rich.

Millennials could complain about their lot in life or they can do something about it. Here are some ideas on the latter approach:

Take control of your finances. No one will care more about your own personal finances than you.

Young people have so many more tools at their disposal to improve their finances than previous generations — budgeting software, automated savings platforms, credit card reward systems, blogs and old fashioned personal finance books.

Personal finance touches so many aspects of your life that it’s imperative you spend some time putting the right financial systems in place. If you don’t get your financial house in order your life will always be more stressful than the alternative.

Take advantage of the markets. Returns were much higher for the baby boomers but so were the costs. Back then you had to pay higher commissions, expense ratios, bid-ask spreads and minimums to make an investment.

And you had to either send someone a check, go to an office or call someone on a landline phone (remember those?) to transact in the markets. All of those frictions are now gone.

Fees are basically nil. It’s never been easier to invest in a wide range of products and securities with the push of a button. You can buy fractional shares of companies or ETFs and index funds that charge little-to-no management fees.

You can invest with commission-free brokerages or tax-efficient robo-advisors. Markets are as liquid as they’ve ever been and the investment options are nearly endless.

There’s never been a better time to be an individual investor and things will only get better from here. And if markets perform poorly in the coming decades, young people get to buy in at lower prices.

Take control of your career. Getting your spending under control is necessary if you ever hope to save but the way you really supercharge your ability to invest is by increasing your earning potential.

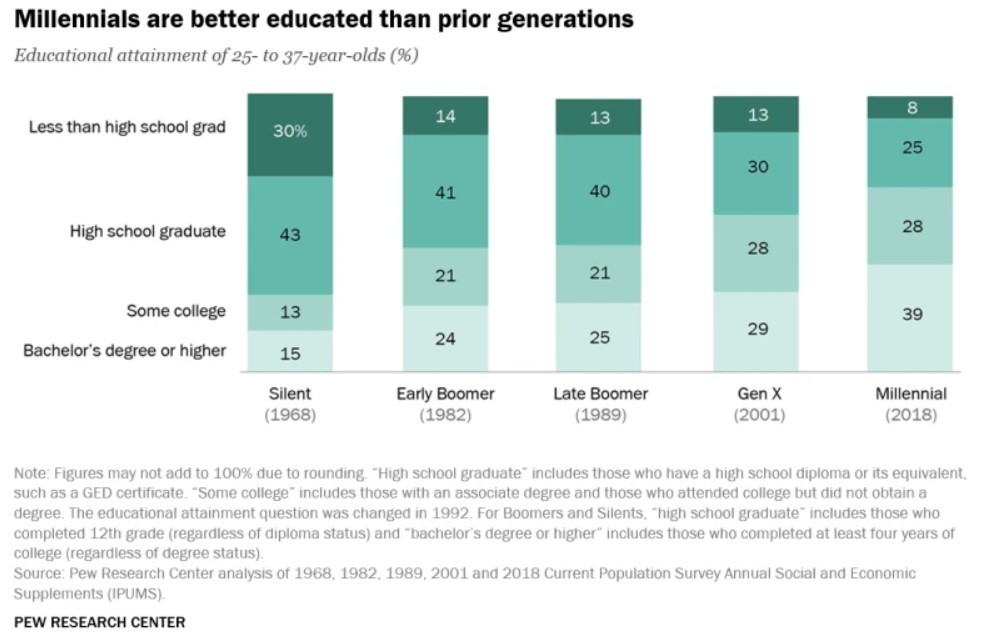

Millennials came into a tough job market but we’re more educated than any generation in history:

This additional education has pushed back typical adult moves such as getting married and buying a house but it has set up millennials to increase their income potential over the course of their working life.

Few people find their dream job early in their career but millennials will likely be working longer than prior generations since we’re living longer so there is still plenty of time to figure it out.

If you’re stuck career-wise I’ve always loved the Theo Epstein 20% rule for getting ahead. The Red Sox and Cubs savior once told David Axelrod:

Whoever your boss is, or your bosses are, they have 20 percent of their job that they just don’t like. So if you can ask them or figure out what that 20 percent is, and figure out a way to do it for them, you’ll make them really happy, improve their quality of life and their work experience.

You also must become comfortable negotiating (with current and prospective employers), having uncomfortable conversations and building a network of people who will look out for your career prospects.

Give yourself a diversification of opportunity. Technology is a wonderful thing because it has made it easier than ever to start your own blog, business, newsletter or network of intelligent people.

These endeavors all take hard work to pull off but diversifying your life can open you up to the possibility of getting lucky that something sticks.

Avoid shortcuts. There are no life hacks or top 10 lists or get rich quick schemes that will consistently help you get ahead in life.

The secret to getting ahead is that there is no secret. Success for most people comes from some combination of hard work, luck, persistence and lifelong learning.

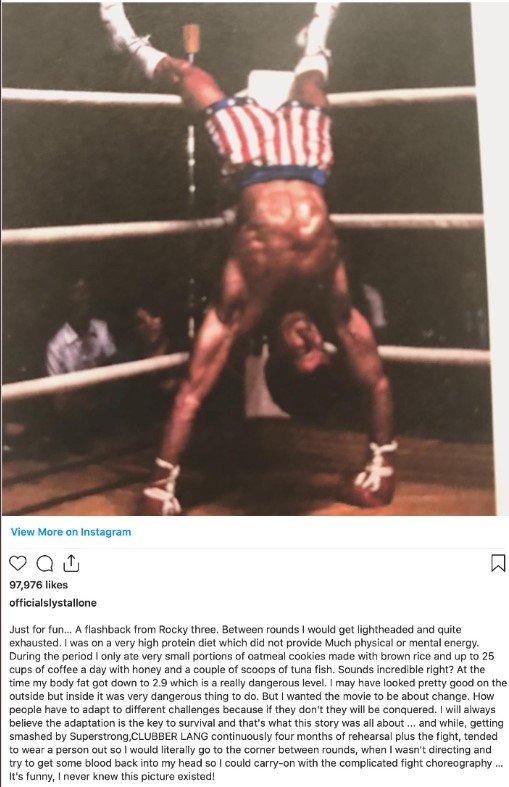

Don’t worry about other people. In Rocky III, Sly Stallone looked like a Greek god. In a recent Instagram post he shared how he was able to get so chiseled:

He may have looked great but his insane diet created an unhappy existence.

Stallone looking amazing on the outside but being somewhat miserable on the inside is a wonderful analogy to the perfect lives you see portrayed on Instagram.

Keeping up with the Joneses back in the day consisted of people in your neighborhood, peer group or family.

Now we can compare ourselves to pretty much everyone through social media and the Internet.

Judging yourself based on the lives of other people portray on social media is a sure path to unnecessary pain and poor financial habits.

Take advantage of your human capital. Young people have far fewer financial assets than their parent’s generation but have the wind at their back in terms of time and future earnings power.

Millennials have decades to allow compound interest to work in their favor and I’m not just talking about their savings.

Knowledge, new skills, career advancements and networking can all snowball if you’re willing to put in the time.

My generation is behind when it comes to financial assets than prior generations because we were dealt a bad hand but there is still plenty of time to fix this.

You just have to start now.

Further Reading:

Making It Look Easy is Hard Work