All eyes are on the Fed this week as everyone is focused on whether or not they’ll finally raise short-term interest rates. The game of will they/won’t they has been playing out for some time now as it’s been nearly a decade since the Fed last raised their benchmark Fed Funds Rate.

Forecasting the direction of interest rates is extremely difficult, mainly because there are so many factors and expectations to consider when making your forecast. But beyond predicting where rates will go in the future, most people don’t even realize how much of an over-generalization “interest rates” really is.

The rates most people pay attention to are the 10 Year Treasury yield, the Fed Funds Rate and maybe the 30 year fixed rate mortgage. But the debt markets have a fairly deep bench when you really start drilling down into the different maturities, sectors, structures and bond issuers.

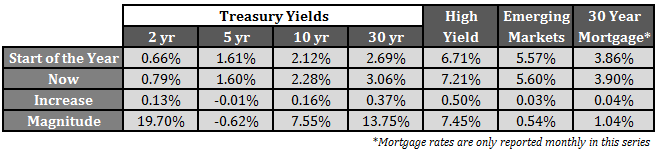

When people talk about rates rising or falling, they’re usually not taking into consideration the fact that there’s never going to be a parallel shift in all interest rates across the board with the same exact magnitude at the same exact time. The markets only work like that in textbooks or scenario analysis software. Just take a look at yield changes this year alone in some of the different treasury yields, bond sectors and mortgage rates:

By no means has there been an equal shift in either the amount of the increase in rates this year or the magnitude. For example, 2 year yields have screamed higher lately, while the 5 year is basically unchanged since the start of 2015. You could come up with plenty of narratives to fit your current viewpoint depending on which particular yields you’re focusing on.

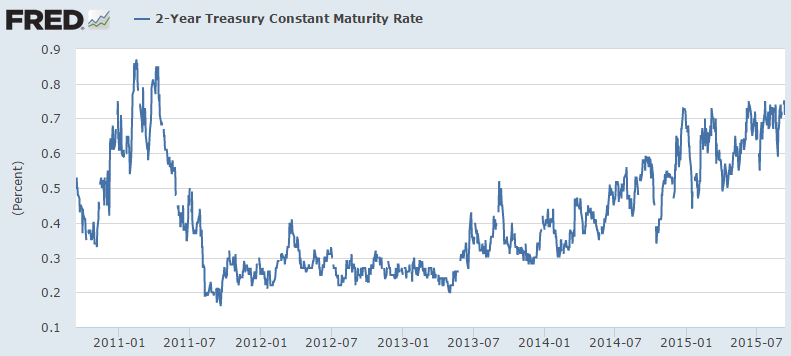

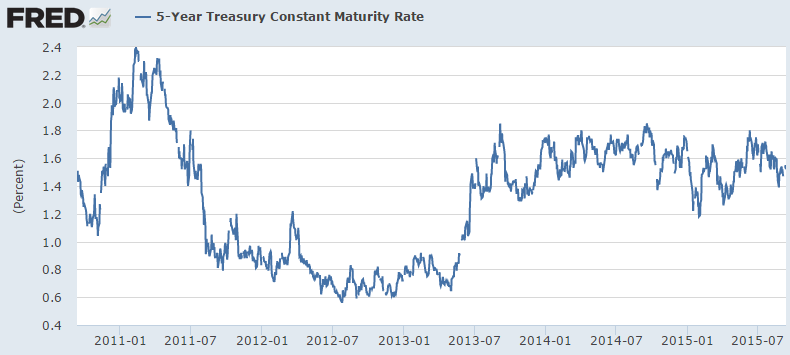

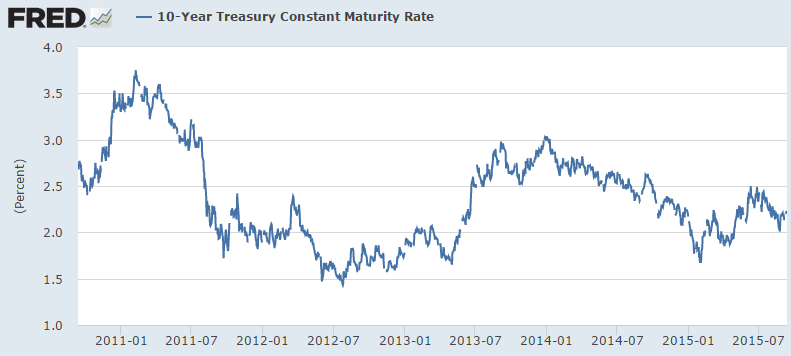

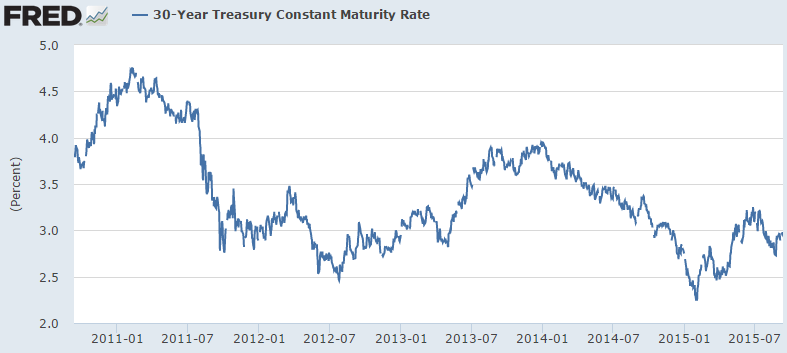

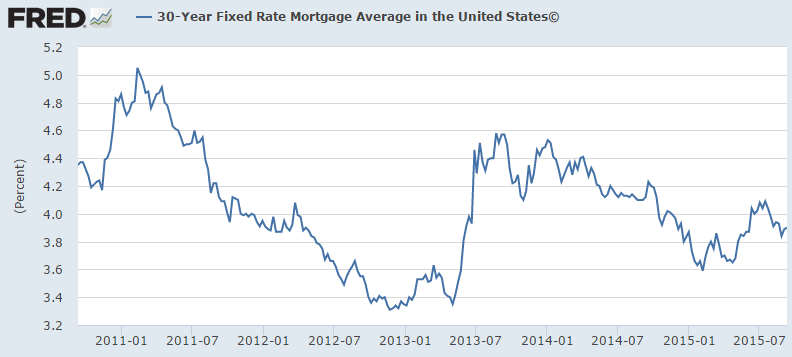

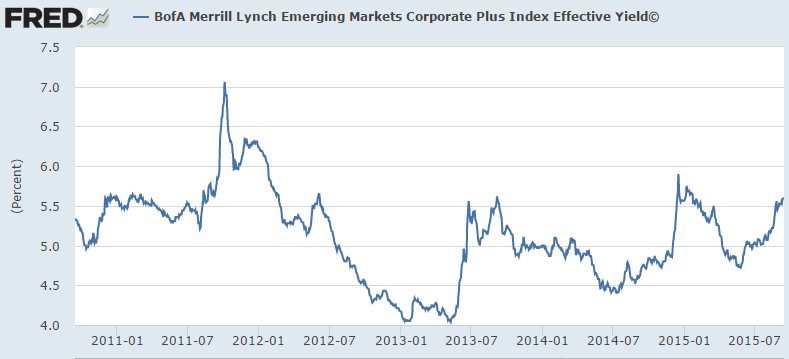

Now take a look at the path of each yield over the past 5 years:

The general direction in many of these yields is highly correlated, but it’s never going to be as easy as saying “rates will rise” or “rates will fall.” Not only do you have to get the direction of the move right when making these predictions (something most economists and forecasters fail miserably at), but you also have to get the magnitude and the change in the yield curve correct.

To do that you have to figure out not only the current economic conditions, but also the market’s expecations over various time frames along with good old supply and demand factors such as central bank pruchases or sales and investor allocation preferences. This also entails taking into account different risk appetites in terms of the spreads between the different yields.

There is a small group of brilliant people who can do this well. Everyone else should probably refrain from trying to make specific, binary interest rate bets one way or another.

Further Reading:

The Most Interesting Asset Class Over the Coming Decade

Subscribe to receive email updates and my quarterly newsletter by clicking here.

Follow me on Twitter: @awealthofcs

My new book, A Wealth of Common Sense: Why Simplicity Trumps Complexity in Any Investment Plan, is out now.

Good Perspective but there is Way too much attention droning on about “what the Fed will do…”

They are pretty impotent – as they are battling the hurricane headwind of the White House that pours battery acid into the lap of the American Economy with Policies, Regulation and Division.

And the White House expects the Fed to create jobs and turn the economy around? Right….

We need leadership change – and it is coming… Americans are fed up.

see: http://www.investors.com/editorial-cartoons/michael-ramirez/771179

I think we’ve gone way too far down the interest rate rabbit hole in predicting what the consequences will be if the Fed does/does not increase rates at the latest OMC meeting. As the article via the following link suggests, little is likely to happen either way.

http://fivethirtyeight.com/features/dont-worry-too-much-about-a-fed-interest-rate-hike/

The US economy is undeniably in better shape today as evidenced by the twin FED goals of employment and inflation. However, it is fair to question whether these historic measures of economic health work as well today in a world that is very different from when they were first adopted.

While the traditional measure of unemployment portends near term inflationary pressures, the broader U-6 unemployment rate remains well above its previous cyclical low. The retirement of Boomers is given as one contributing factor, but the increasing use of part time and contract employees to better manage labor costs, as well as the increasing disconnect between productivity and wage gains may tell us more about the future health of the US economy and labor markets.

I am likewise suspicious of the notion that eliminating regulation, governmental agencies, expelling illegal immigrants and/or raising/lowering taxes will somehow magically generate the kind of GDP growth claimed by an ever increasing number of presidential candidates. Certainly, some measure of tax and benefit reform would help, but so would a significant investment in our aging infrastructure. However, as the responsibility for fiscal reform rests with Congress, which seems unable to do more than generate meaningless promises and soundbites, the prospect of real change anytime soon seems remote.

Also troubling is the notion that closing our borders will somehow solve our societal and economic woes. We tend to conveniently forget that America is fundamentally an immigrant nation and that our families (save for native Americans) all came from someplace else: poor, hungry, uneducated and often speaking a different language. What some also fail to understand are the consequences of our declining birth rate and the continued aging of our population. To avoid a Japan-like implosion, we must continue to accept immigrants and, more importantly, assimilate them into the beliefs of mutually shared freedom, fairness, tolerance and opportunity that have made this country great.

Lastly, the economic, political and military dominance that America enjoyed following WWII is gone. Like it or not, we now live in a world in which our social, political and economic fortunes are inextricably intertwined with other developed and emerging nations, which will increasingly shape our nation in years to come.

This is why central planning an economy invariably fails.

To my understanding, it’s the ON RRP (Overnight Reverse Repo) rate which, after a rate hike, will become … The Most Interesting Rate in the World.

Since the Fed no longer can raise the Fed Funds rate by withdrawing reserves (there being some $2.7 trillion in excess reserves thanks to QE), ON RRP will be the new mechanism to peg the overnight policy rate directly. As the old saying goes, you can control the price or the quantity, but not both.

Supposedly this change will revolutionize money market funds, which can then invest in RRPs instead of commercial paper and such. But tampering with the plumbing of the money markets could have unforeseen consequences.

Wish the central planners luck!

[…] also Too Many Maybes (Irrelevant Investor) • Not All Interest Rates Are Created Equal (A Wealth of Common Sense) • The proper response to a sovereign downgrade by a major credit rater is: “Who cares?” […]

[…] Not All Interest Rates Are Created Equal (awealthofcommonsense) […]

Emerging Markets are on the cusp of imploding… Fed can delay rate hike, but another 6 months on life support is not going to help Emerging Markets that are already on the cusp of imploding… the mess in EM economies is palpable, and they’re haemorraging as money is flowing out of them at a record pace, leaving all their crappy building projects/corrupt officials out in the cold…

[…] Inequality between interest rates […]

[…] colleague and fellow “Wealth of Common Sense” blogger Ben Carlson weighs in as well: “Forecasting the direction of interest rates is extremely difficult, mainly because there are so […]