A reader asks:

I work in the construction industry and I’m always trying to spread a little financial literacy to my coworkers. Whenever I see a young guy getting ready to drop $70k on a new pickup I try to show them what that money could become if they invested in index funds instead. I like to call it “sequence of spending risk”. Of course this rarely works so I thought having the experts comment could help. Maybe you could come up with a chart or graphic that could explain how delaying spending could have a big impact on future wealth.

I was born for this question.

I’ve written a number of posts over the years about excessive spending on trucks and SUVs:

- Is the Ford F-150 Partially Responsible for the Retirement Crisis?

- Why Millennial Parents Won’t Drive a Minivan

- Are SUVs Ruining Retirement Savings?

I am not a fan of spend-shaming…UNLESS you’re spending way too much on something AND not saving any money.

You should enjoy yourself when you’re young but you also need to develop good savings habits because the compounding effects are so strong.

So how much could that $70k truck be costing these young construction workers?

I poked around a little and found new car loan rates at around 6% or higher right now.

Financing a $70,000 truck at 6% over 5 years would be a monthly payment of $1,350 (assuming nothing down).

That’s a ridiculously high monthly payment for most people but especially young people because of the opportunity costs.

Let’s say instead of that Ford F-150 or Dodge Ram you instead got yourself a reasonably priced SUV, maybe something like a Ford Explorer or Chevy Trailblazer.

That probably cuts your price in half to $35,000 or so depending on the amenities.1

You would save $675 a month or more than $8,000 in a year. Over the course of a five-year loan, that’s a total savings of more than $40,000.

Can you imagine the growth of $40,000 over the course of two to three decades for a young person if you invested that money instead of spending it on a souped-up truck?!

We’ll get to those numbers but let’s say you do need a truck because you work in construction and can’t make another vehicle work.

The Ford Maverick has an MSRP of around $25,000. Now we’re looking at a monthly payment of more like $500. I’m not even telling you to get a used car. I’m just saying I don’t get the top-of-the-line, suped-up truck on the market.

That’s a savings of $850 a month. That would give you more than ten grand in annual savings, enough to fill up nearly half of your annual 401k max limit. Over five years we’re looking at $51,000 in savings.

And it’s still a truck!

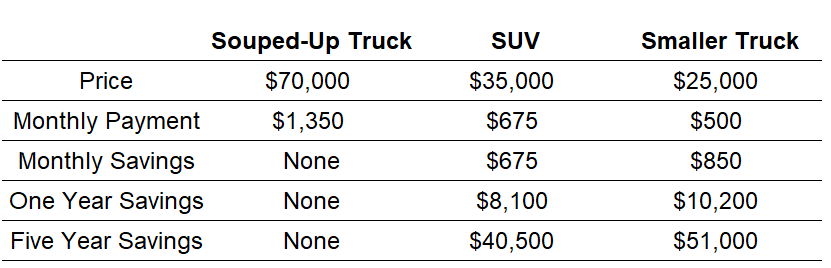

Here’s the breakdown:

Now let’s do the personal finance thing and look at how much these savings could be worth over the long haul.

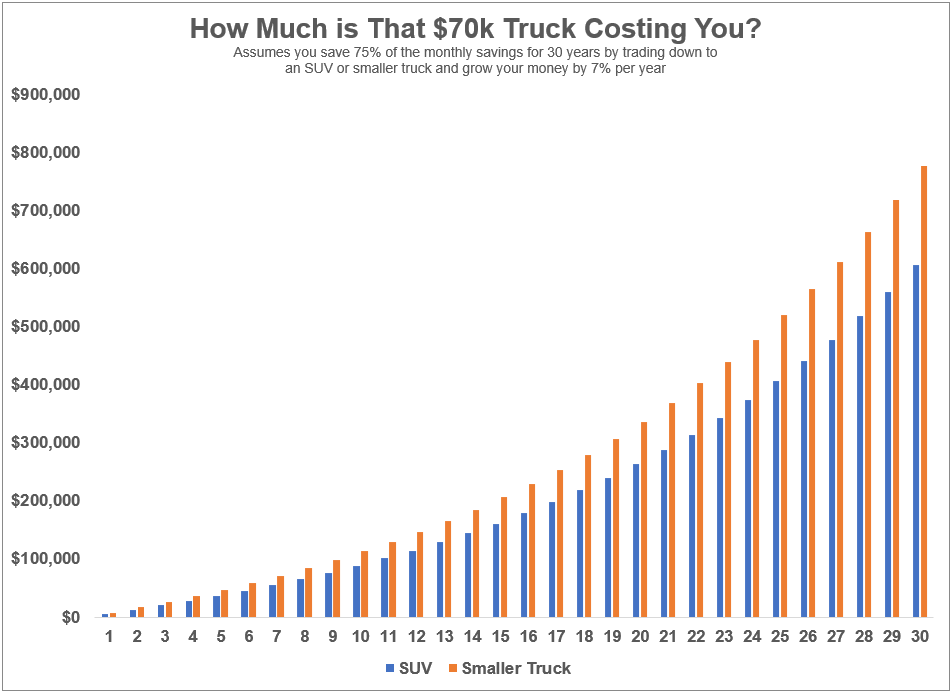

Let’s say you say just 75% of the monthly savings so you can blow the rest of the money on anything else you’d like.

Here’s what it looks like if you bank those savings in the stock market every year for 30 years and earn 7% on your investments:

You’re looking at somewhere in the $600k to $800k range in total from just driving a lower-priced vehicle over time. That’s pretty eye-opening.

But let’s be honest, this example probably isn’t all that realistic. If you’re a big truck person you’re going to want a big truck eventually, regardless of what the spreadsheets say.

OK fine, but what if you just wait until you’re a little older to buy a truck that can pull a 747?

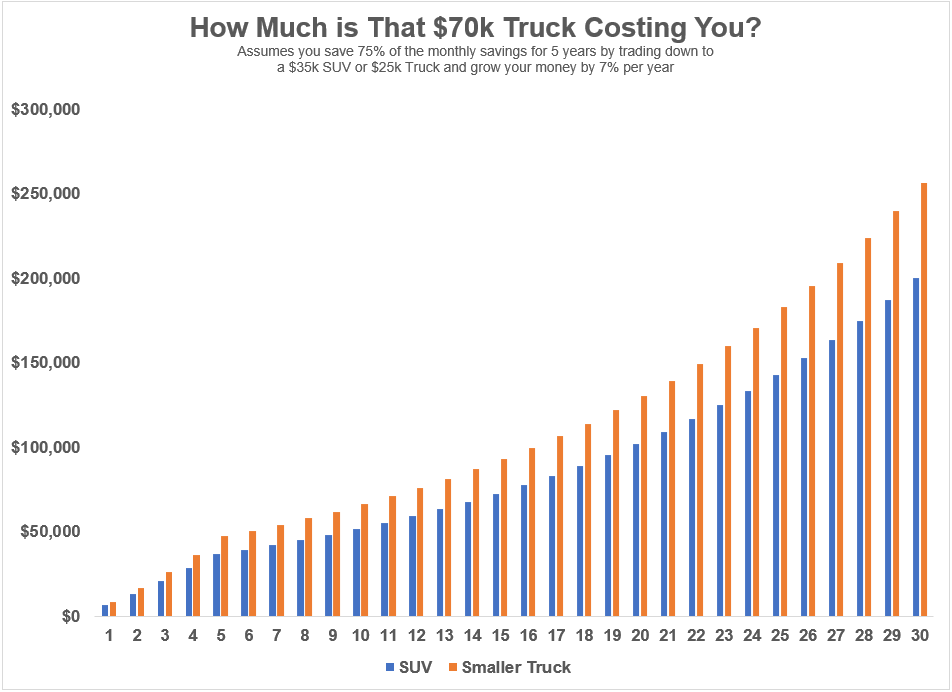

Let’s say you’re a 25-year-old construction worker who drives a smaller truck or an SUV for one loan cycle. All you have to do is wait until you’re 30 to buy a tank on wheels.

Here’s a look at what just five years’ worth of savings would grow into over 30 years in total:

This assumes you bank 75% of the monthly savings from an SUV or smaller truck into the stock market and then let it compound from there. Now we’re talking more like a quarter of a million dollars after 30 years from just 5 years of driving a lower-priced vehicle.

Maybe it’s not realistic to assume you can keep saving that difference year after year for so long. Eventually you’re probably going to want to splurge on that huge truck.

I’m not one of those personal finance experts who likes to do this with every purchase. You should be able to enjoy your money.

But it can be hard for young people to save. And it’s not appetizers or drinks with friends that will shoot a hole in your budget; it’s the large fixed expenses. For most people your largest fixed costs are housing and transportation.

If you lock in high housing and transportation costs it doesn’t matter how many lattes you skip from Starbucks.

I have no problem with spending money on trucks or cars or boats or jet skis or whatever as long as you’re saving money. Prioritization is the hallmark of any good financial plan.

But locking in a four-figure monthly payment when you’re young is a poor choice especially if you’re not saving much for retirement. You should spend some of your hard-earned money but that doesn’t mean you should feel entitled to a $70k vehicle so early in your career.

Of course, it’s not enough to simply buy a lower-cost vehicle. You also have to save the difference.

Automate those savings just like you would for the monthly car payment and you’ll be set.

A six-figure Roth IRA account will do more heavy lifting for you than a Ford F-150.

We covered this question on the latest edition of Ask the Compound:

My own financial advisor Bill Sweet joined the show again this week to help me tackle questions about college savings, the tax implications of investing in bonds, max contribution limits for retirement accounts and how many 529 plans you need for your children.

1And let’s be honest — if you’re a young person you don’t need all the bells and whistles when it comes to amenities. Once you get them they’re going to become a necessity, not a desire.